15.2 Remittance Information Enhancement

This topic describes the information about Remittance Information Enhancement workflow.

Users can now enter remittance information as unstructured remittance information of length 140 characters.

As supported by MX, when making international payments across all types, including saved and adhoc payees, low value payments, and standing instructions (SI).

Note:

- Existing Payment Details input is retained for MT-type payments.

- Banks can configure whether to use MT-type or MX-type remittance.

- Transfers – Existing Payee

- Transfers – Adhoc Payee

- Repeat Transfers – Existing Payee

- International Low Value Payment

- Multiple Transfers

Navigation Path

- Toggle menu > Payments >Transfers > Transfers – Existing / Adhoc Payee

- Maker Dashboard > Quick Links > Transfers - Transfers – Existing / Adhoc Payee

- Toggle menu > Payments >Transfers > Repeat Transfers – Existing Payee

- Maker Dashboard > Quick Links > Transfers - Repeat Transfers – Existing Payee

- Toggle menu > Payments >Transfers > Multiple Transfers

- Maker Dashboard > Quick Links > Transfers - Multiple Transfers

- Toggle menu > Payments >Transfers > International Low Value Payment

- Maker Dashboard > Quick Links > Transfers - International Low Value Payment

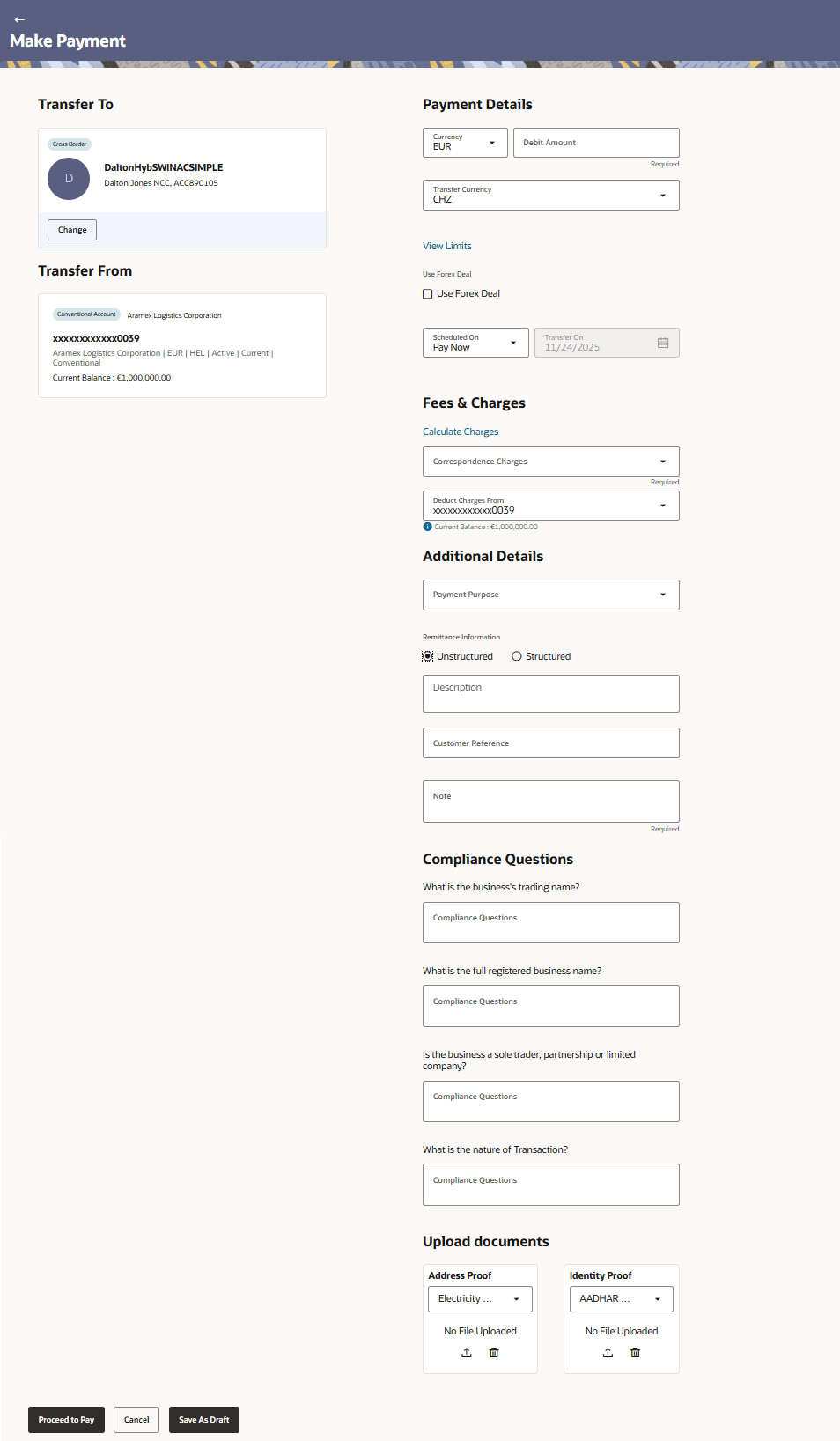

Figure 15-13 Remittance Information – Unstructured

Users can add the information as normal text.

Users can now enter unstructured remittance information while making the international fund transfer. It will be a Free-text input with length of 140 characters. Allowed characters under this field are -

a-z A-Z 0-9 / - ? : ( ) . , ' + ! # & % * = ^ _ ` { | } ~ " ; @ [ \ ]

Remittance Information - Structured

- The user can select the Structured option from the Remittance Information and

Click the hyperlink Add Structured Remittance Information.

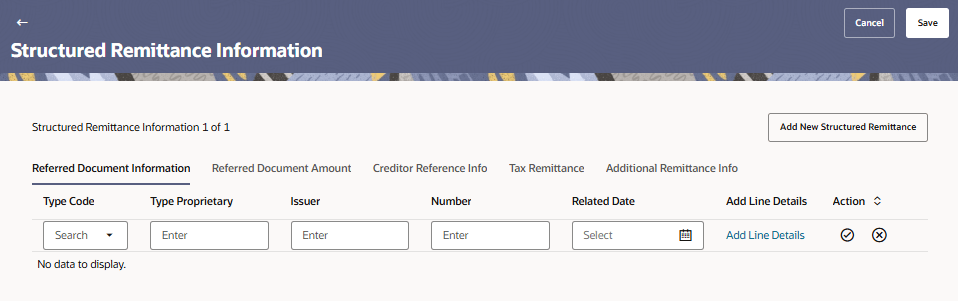

Figure 15-14 Reference Document Information

Table 15-10 Reference Document Information

Field Description Type Code Select the code from the list. Type Proprietary Specify the type proprietary. Issuer Specify the issuer. Number Specify the number. Related Date Select the related date. - Click Save to save the details.

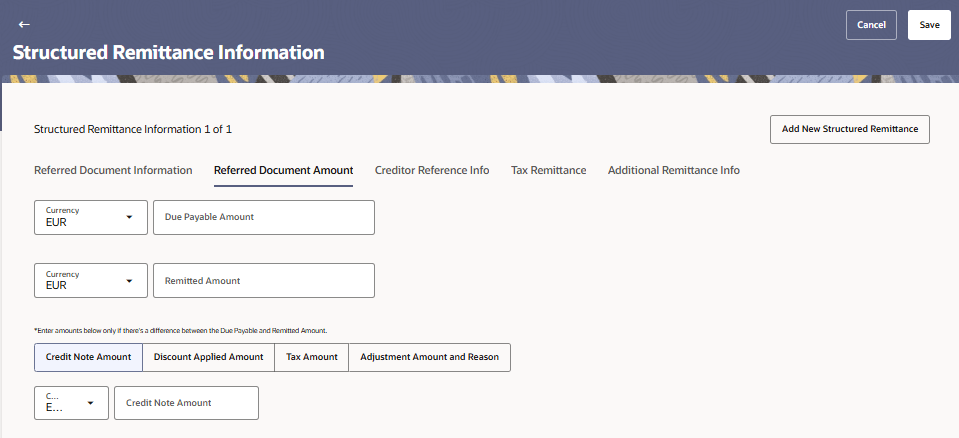

- Click Reference Document Amount from Structure Remittance

Information screen.

The Reference Document Amount screen appears.

Table 15-11 Reference Document Amount

Field Description Due Payable Amount Select the currency from the list and specify the payable amount. Remitted Amount Select the currency from the list and specify the remitted amount. Credit Note Amount The following fields are displayed for Credit Note Amount tab. Credit Note Amount Select the currency from the list and specify the credit amount. Related Date Select the related date. Discount Applied Amount The following fields are displayed for Discount Applied Amount tab. Discount Applied Code Specify the discount code. Discount Applied Proprietary Specify the discount applied proprietary. Discount Applied Amount Select the currency and specify the discount amount. Tax Amount The following fields are displayed for Tax Amount tab. Tax Amount Code Specify the tax code. Tax Amount Proprietary Specify the tax amount proprietary. Tax Amount Select the currency and specify the tax amount. Adjustment Amount and Reason The following fields are displayed for Adjustment Amount and Reason tab. Adjustment Amount Select the currency and specify the adjustment amount. Credit Debit Indicator Specify the credit and debit indicator. Adjustment Reason Specify the reason for adjustment. Adjustment Additional Information Specify the additional information of the adjustment. - Click Save to save the details.

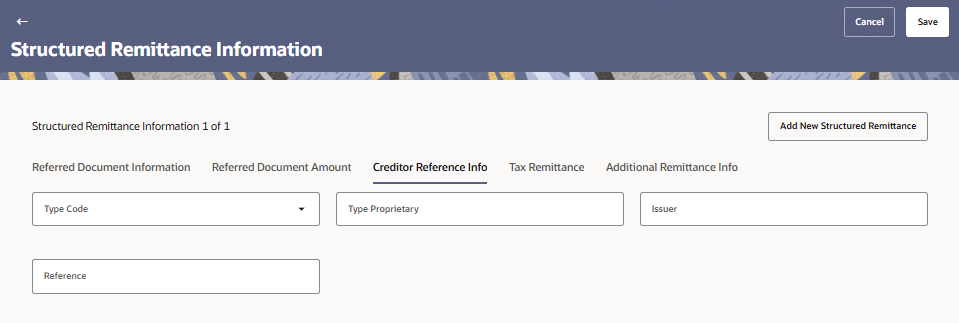

- Click Creditor Reference Info from Structure Remittance

Information screen.

The Creditor Reference Info screen appears.

Figure 15-16 Creditor Reference Info

Table 15-12 Creditor Reference Info

Field Description Type Code Select the code from the list. Type Proprietary Specify the type proprietary. Issuer Specify the issuer. Reference Specify the reference number. - Click Save to save the details.

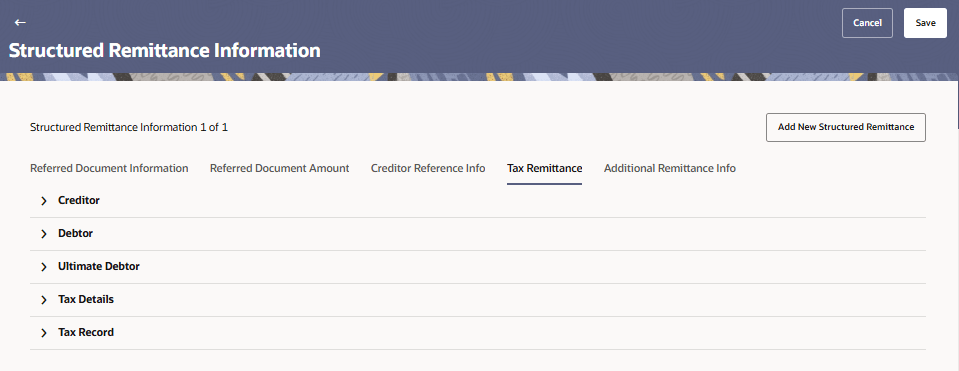

- Click Tax Remittance from Structure Remittance Information

screen.

The Tax Remittance screen appears.

Table 15-13 Tax Remittance

Field Description Creditor The following fields are displayed for Creditor. Tax Identification Specify the tax identification number. Registration Identification Specify the identification of registration. Tax Type Specify the tax type. Debtor The following fields are displayed for Debtor. Tax Identification Specify the tax identification number. Registration Identification Specify the identification of registration. Tax Type Specify the tax type. Authorization Title Specify the authorization title. Authorization Name Specify the authorization name. Ultimate Debtor The following fields are displayed for Ultimate Debtor. Tax Identification Specify the tax identification number. Registration Identification Specify the identification of registration. Tax Type Specify the tax type. Authorization Title Specify the authorization title. Authorization Name Specify the authorization name. Tax Details The following fields are displayed for Tax Details. Administration Zone Specify the administration zone. Reference Number Specify the reference number. Method Specify the method. Total Taxable Base Amount Select the currency and specify the total taxable base amount. Total Tax Amount Select the currency and specify the total tax amount. Date Specify the date. Sequence Number Specify the sequence number. - Click Save to save the details.

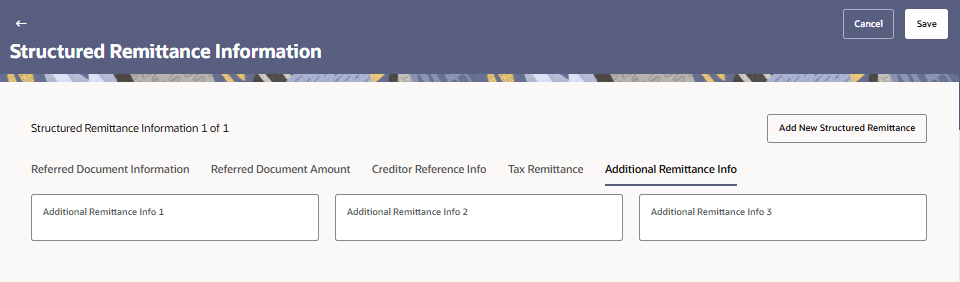

- Click Additional Remittance Info from Structure Remittance

Information screen.

The Additional Remittance Info screen appears.

Table 15-14 Additional Remittance Info

Field Description Additional Remittance Info 1 - 3 Specify the additional remittance info. - Click Save to save the details.

Note:

Allowed characters for the structured remittance text fields are as per the below regex –a-z A-Z 0-9 / - ? : ( ) . , ' + ! # & % * = ^ _ ` { | } ~ " ; @ [ \ ]