5 Multiple Loan Repayments

This topic provides systematic instructions to repay the loan for multiple accounts at once.

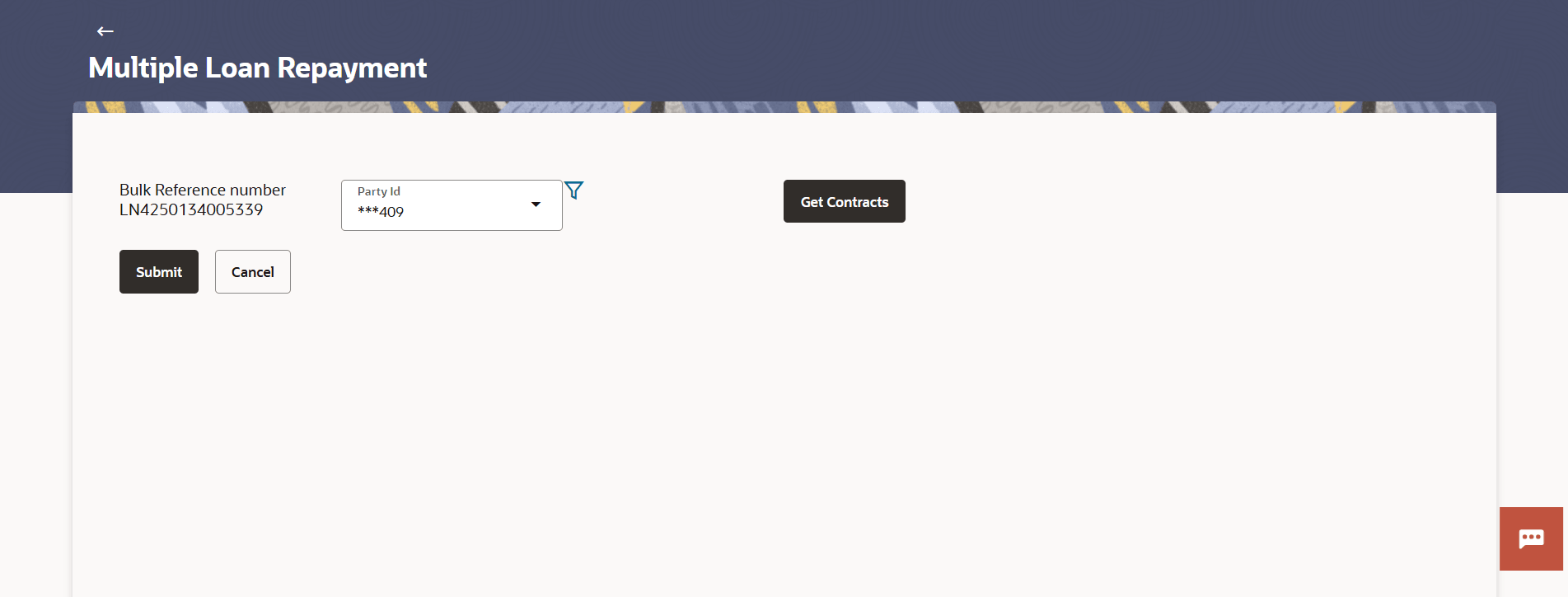

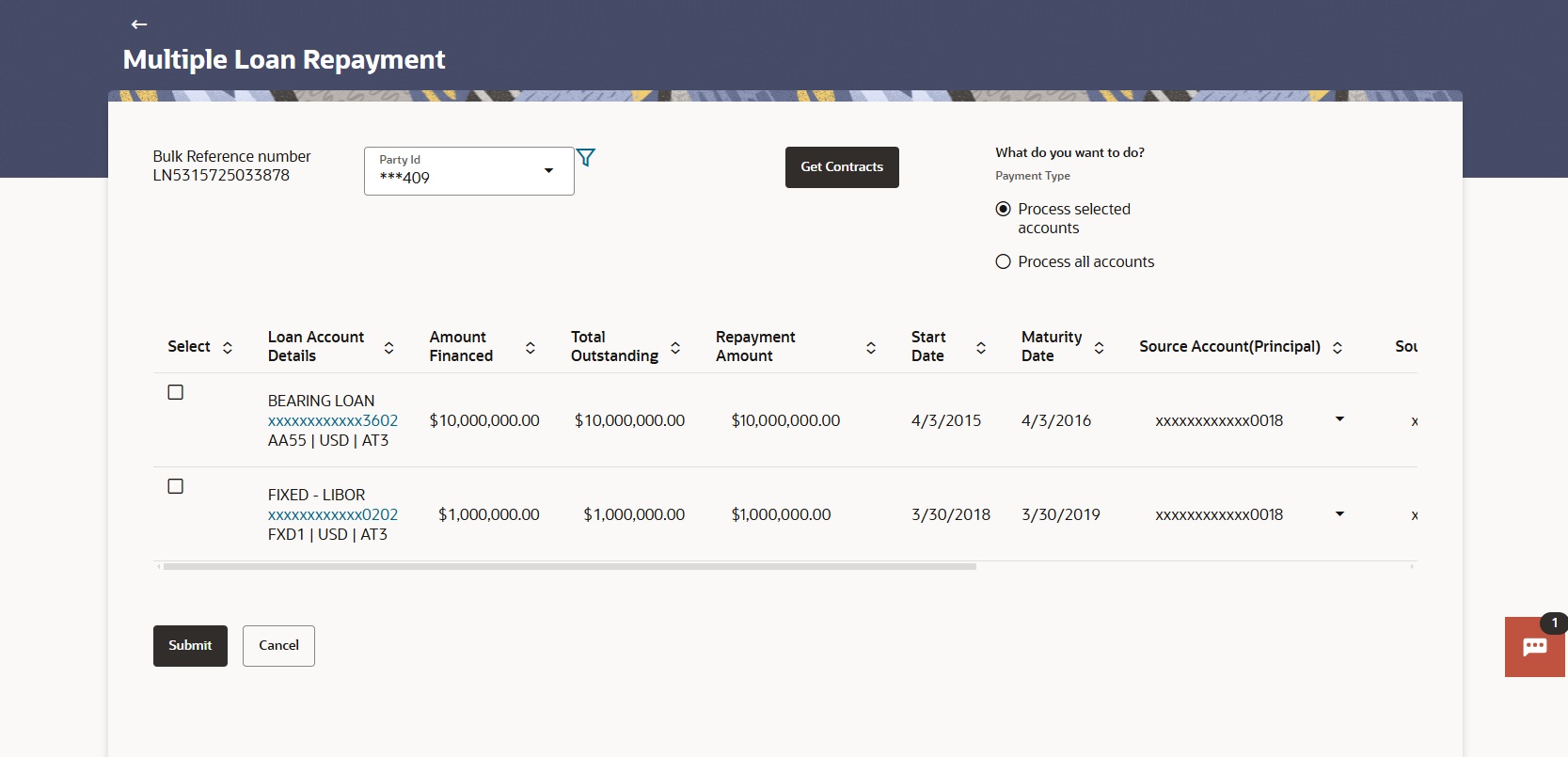

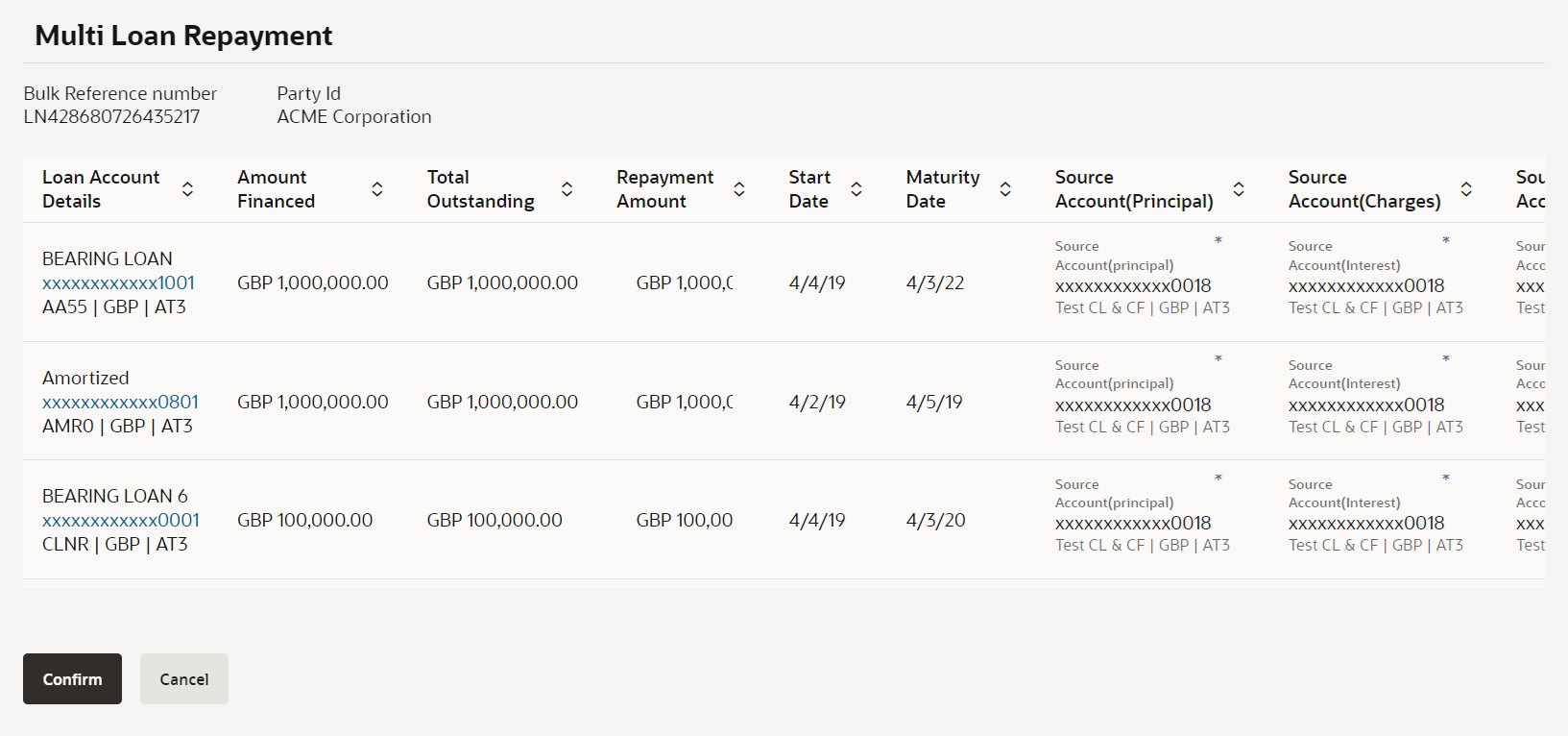

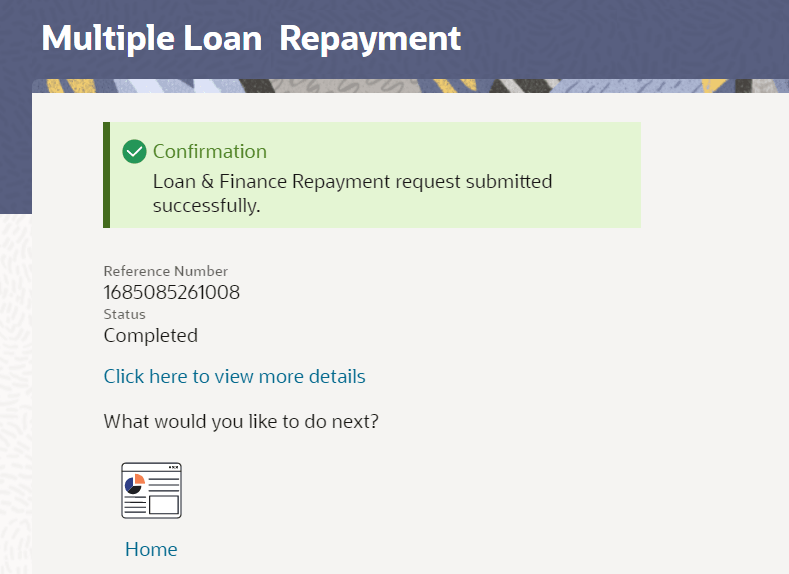

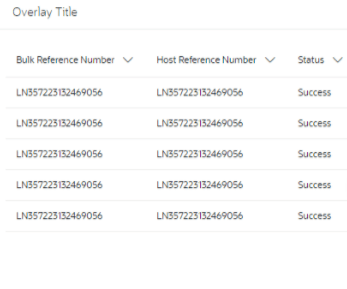

The user can initiate multiple loan settlements using Multiple Loan Repayments screen. The user can search for required loan account(s) based on standard search criteria. The user can delete one or more contracts from the search result. Once user clicks Confirm, the pending accounts listed are initiated for payment.

The user can view the payment due details for the selected loan accounts. The user can debit the account separately for principal, interest and charge components. Debit account for charges component can be captured in the Loan Repayment screen.

In addition, tax component is also applied on the actual payment amount.

To repay the loan for multiple loan accounts:

Following example explains the amount allocation for Principal, Interest, Charges component for the repayment amount entered of a loan contract.

During liquidation of installment payment, the charge component is given priority.

Example for Installment Payment

Application Date = Installment date = 15th February 2022

Total Principal Outstanding = USD 25,000.00

Table 5-3 Example 1

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $10,000.00 |

| Interest | $1,200.00 |

| Charges | $100.00 |

The user can input USD 11,300.00 in the Repayment Amount. The entire amount due is paid off after the transaction is approved in OBCL mid-office.

The user can input USD 10,000.00 in the Repayment Amount, the amount due after successful payment is as follows:

Table 5-4 Example 2

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $8,700.00 |

| Interest | $0.00 |

| Charges | $0.00 |

Liquidation order defined at the product: Interest and Principal

Partial pre-payment

Application Date = 15th February 2022

Total Principal Outstanding = USD 25,000.00

Table 5-5 Example 3

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $0.00 |

| Interest | $1,200.00 |

| Charges | $100.00 |

Once the user specifies USD 5,000.00 in the Repayment Amount, the amount due after successful payment is as follows:

Table 5-6 Example 4

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $0.00 |

| Interest | $0.00 |

| Charges | $0.00 |

Liquidation order defined at the product: Interest and Principal

The residual excess amount of USD 3,700.00 is liquidated against the Principal component. The repayment schedule adjustments take place based on the product configurations in OBCL.

Full pre-payment

Application Date = 15th February 2022

Total Principal Outstanding = USD 25,000.00

Table 5-7 Example 5

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $10,000.00 |

| Interest | $1200.00 |

| Charges | $100.00 |

The user can specify USD 25,000.00 in the Repayment Amount, the amount due after successful payment is as follows:

Table 5-8 Example 6

| Component | Amount Due (15th February 2022) |

|---|---|

| Principal | $0.00 |

| Interest | $0.00 |

| Charges | $0.00 |

Liquidation order defined at the product: Interest and Principal

The residual excess amount of USD 13,700.00 is liquidated against the Principal component.