4.2 Instalment Repayment

This topic provides the systematic instructions to repay loan for upcoming instalments or overdue instalments.

Instalment repayment differs from ad hoc repayment as it involves paying the scheduled instalment amount on its due date as per the amortization schedule. Late fees may apply if the instalment is paid after the due date.

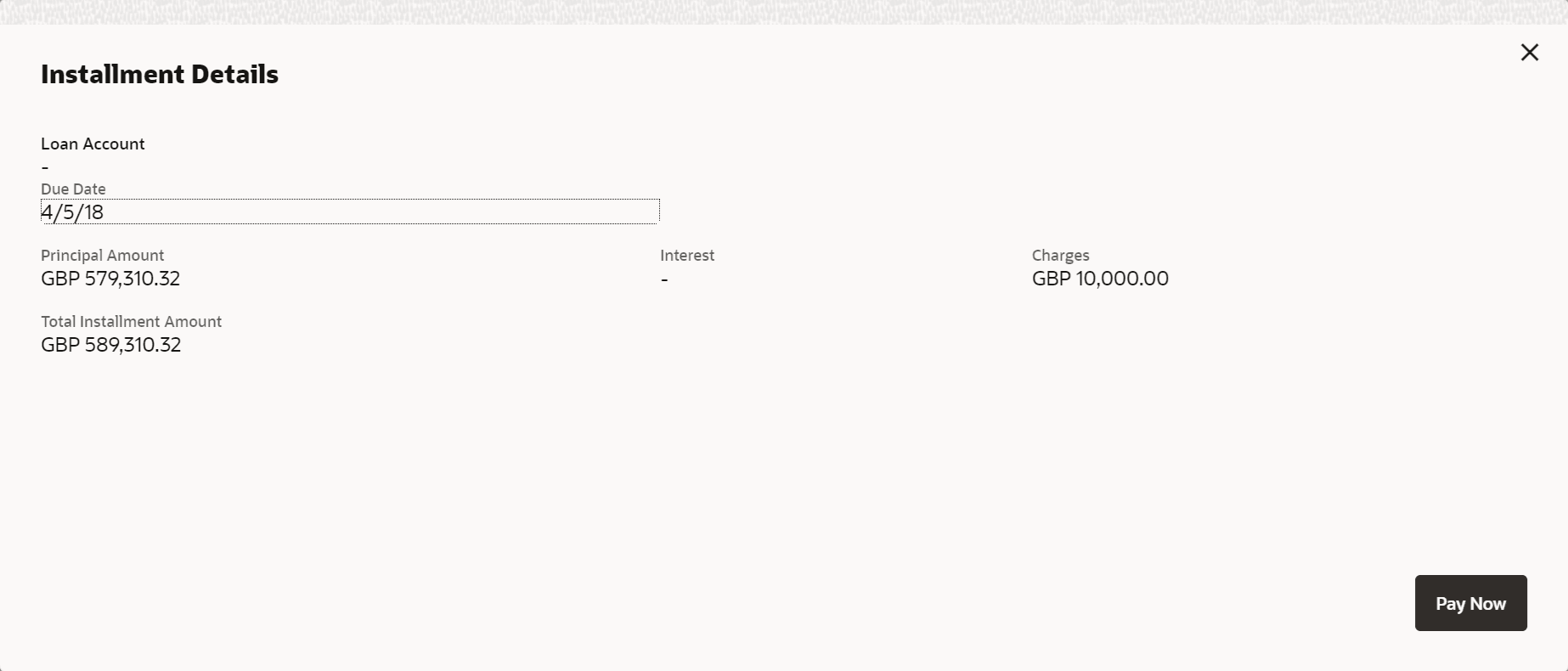

The user can access this screen from the Instalment Due widget in the Overview screen. The fields display in this screen are common for both upcoming and overdue instalment repayments.

To repay an upcoming instalment or an overdue instalment of the loan:

- Perform one of the following navigation to repay the Upcoming or Overdue Instalments on the Loan and Finance Repayments screen.

- Upcoming Instalments

From the Dashboard, click Menu, click Accounts, then click Corporate Loans . Under Corporate Loans, click Overview, then select Upcoming tab in the Corporate Loans Instalments Due widget, and then click on the Instalment Details link against the Loan Account, then click Pay Now, and then click Loan Repayment.

- Overdue Instalments

From the Dashboard, click Menu, click Accounts, then click Corporate Loans. Under Corporate Loans, click Overview, then select Overdue tab in the Corporate Loans Instalments Due widget, and then click on the Instalment Details link against the Loan Account, then click Pay Now, and then click Loan Repayment.

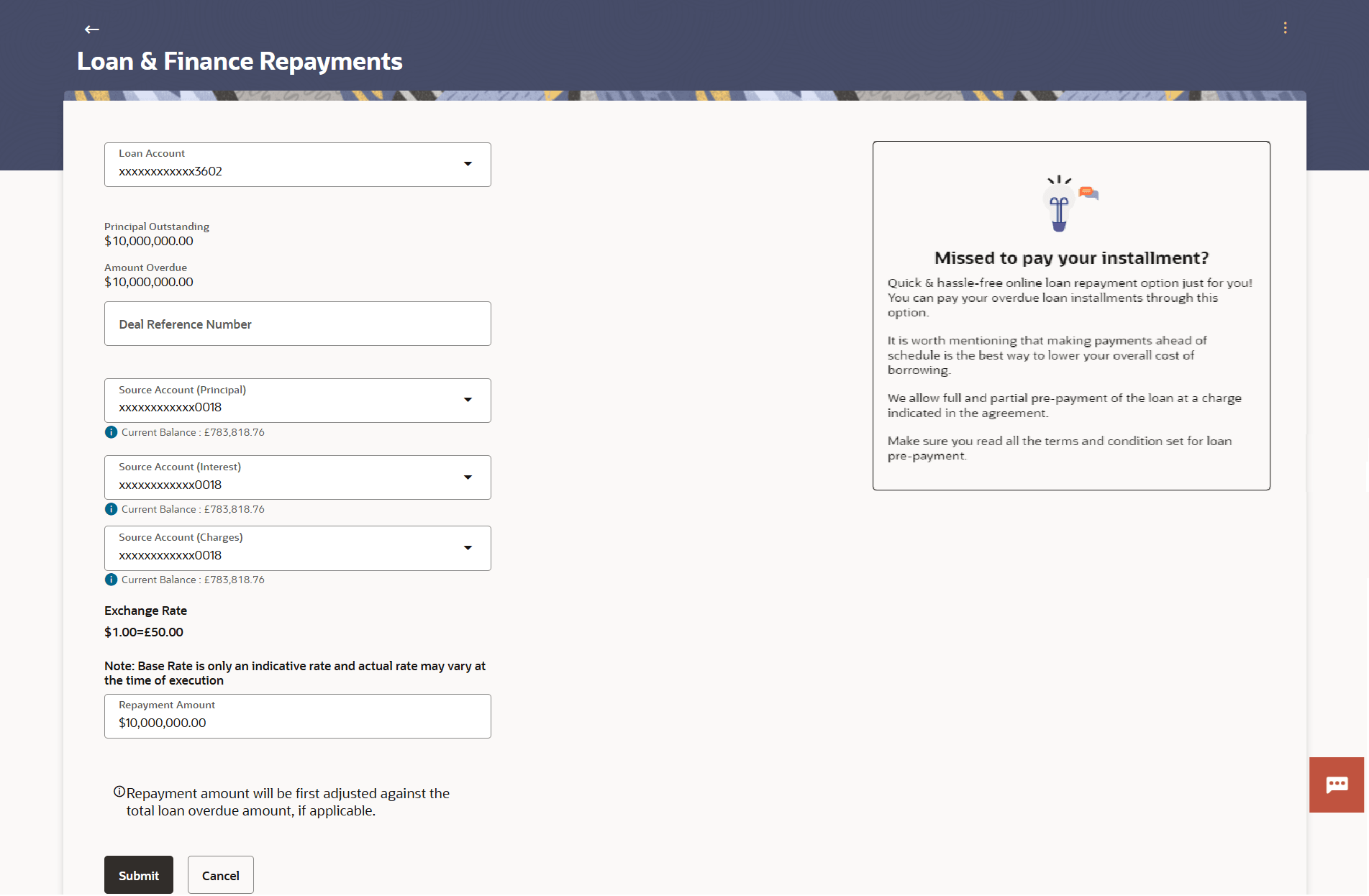

The Loan and Finance Repayments screen displays.Figure 4-4 Instalment Repayment (for upcoming or overdue instalments)

For more information on fields, refer to field description table below:

Table 4-2 Field Description

Field Description Loan Account Number Displays the loan account number in masked format along with the account nickname (if set). Amount Financed Displays the total loan amount in local currency that has been lent by the bank to the corporate party. Principal Outstanding Displays the outstanding principal amount, which is yet to be repaid. Amount Overdue Displays the overdue amount. This amount is the summation of the principal, interest and charges (if any). Deal Reference Number Displays the field is a free text to specify the deal reference number. The system does not have any validations on this field. Exchange Rate Displays the exchange rate if the account currency and loan currency are different. It is an information field. Source Account Select the source account from the drop-down. A list of current and savings accounts (in masked format). The account nickname (if set by the user) is also displayed.

Note: Displays the list of all active accounts of corporate users.

For making loan repayments for Principal and Interest components, you can either select two different accounts, that is, Source Account (Principal)/ Source Account (Interest) or use the same account.- Source Account (Principal) – Select the source account for Principal payment.

- Source Account (Interest) - Select the source account for Interest payment.

Balance Displays the balance amount in the selected source account. Instalment Details This section displays the following fields are related to the instalment Details. Principal Amount Displays the outstanding principal amount due on the instalment date. This amount does not include any interest or charges. Interest Displays the interest on the amount due on the instalment date. Charges Displays the charge or penalty (if applicable) due on the instalment date. Due Date Displays the date on which the instalment is due. Repayment Amount Displays the total instalment amount to be paid. This amount is the sum of the principal amount, the interest and the charges.

Note: The Source Account should have sufficient balance to cover the repayment amount.

- Upcoming Instalments

- On the Loans and Finance Repayment screen, select the appropriate CASA account number, to make the repayment from the Source Account list.The balance in the account displays.

- Perform the one of the following actions:

- Click Repay.

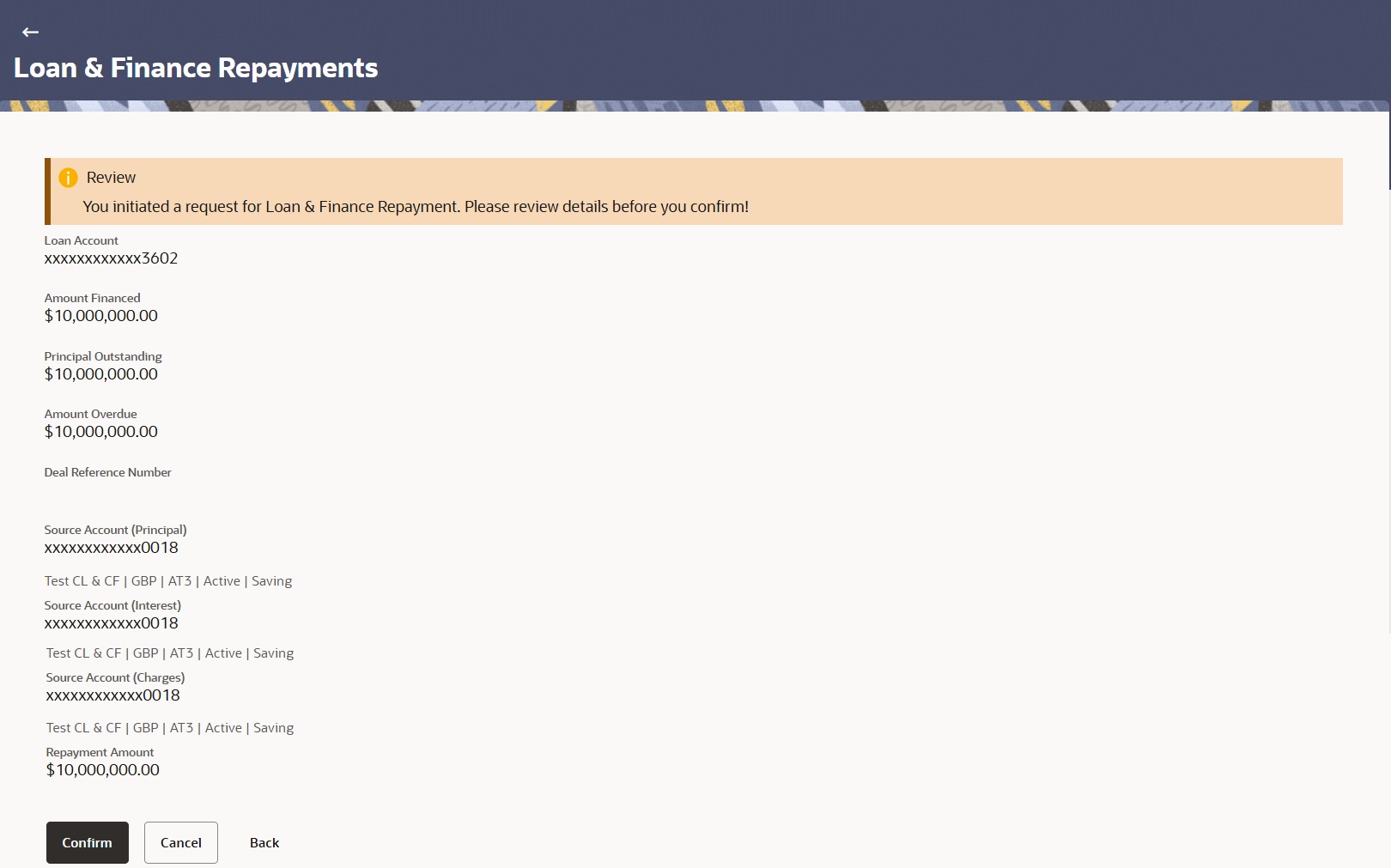

The Review screen displays.

Figure 4-5 Loan and Finance Repayments - Review page

- Click Cancel to cancel the transaction.

- Click Repay.

- On the Review screen, verify the details and perform one of the following actions:

- Click Confirm.

A confirmation message displays the repayment along with the transaction reference number.

- Click Cancel to cancel the operation and navigate back to the dashboard.

- Click Back to make changes if any. The user is directed back to the Loan Repayment screen with values in editable form.

- Click Confirm.

- On the confirmation message screen, perform one of the following actions:

- Click Go to Dashboard link to go to the dashboard screen.

- Click Go to Account Details to visit the loan details on the Loan Account Details screen.

This topic contains the following sub-topic:

- Installment Repayment Simulation

This topic provides the systematic instructions to simulate the loan repayment for an account.

Parent topic: Loans Repayments