4.1.1 Purchase Funds - New

This topic describes the systematic instruction to Purchase Funds - New screen. This option allows user to place purchase orders either one time or Systematic Investment Plan (SIP) or Standing Instruction (SI) type .

This option allows the retail investor/ user to place purchase orders either one time or Systematic Investment Plan (SIP) or Standing Instruction (SI) type for buying one or more mutual fund schemes. In SIP the dates of investment and frequencies are pre-decided by the fund house therefore an SIP is a one-time instruction to the fund house to place recurring orders. SI on the other hand is a feature provided by the bank to mimic the SIP but with dates & frequency chosen by the investor. Here the order is not a one-time instruction/order but multiple orders placed one time by investor.

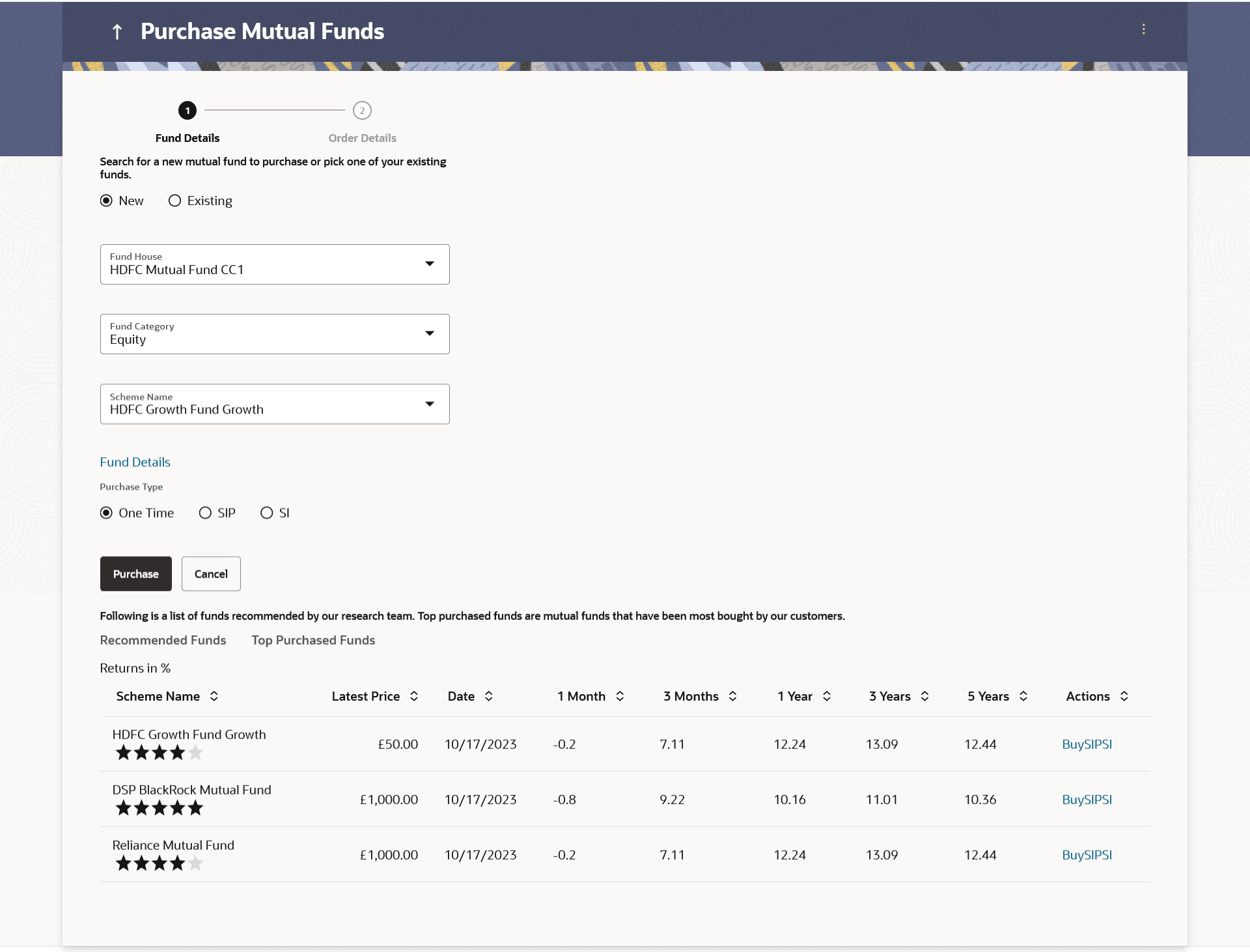

To purchase the new mutual funds:

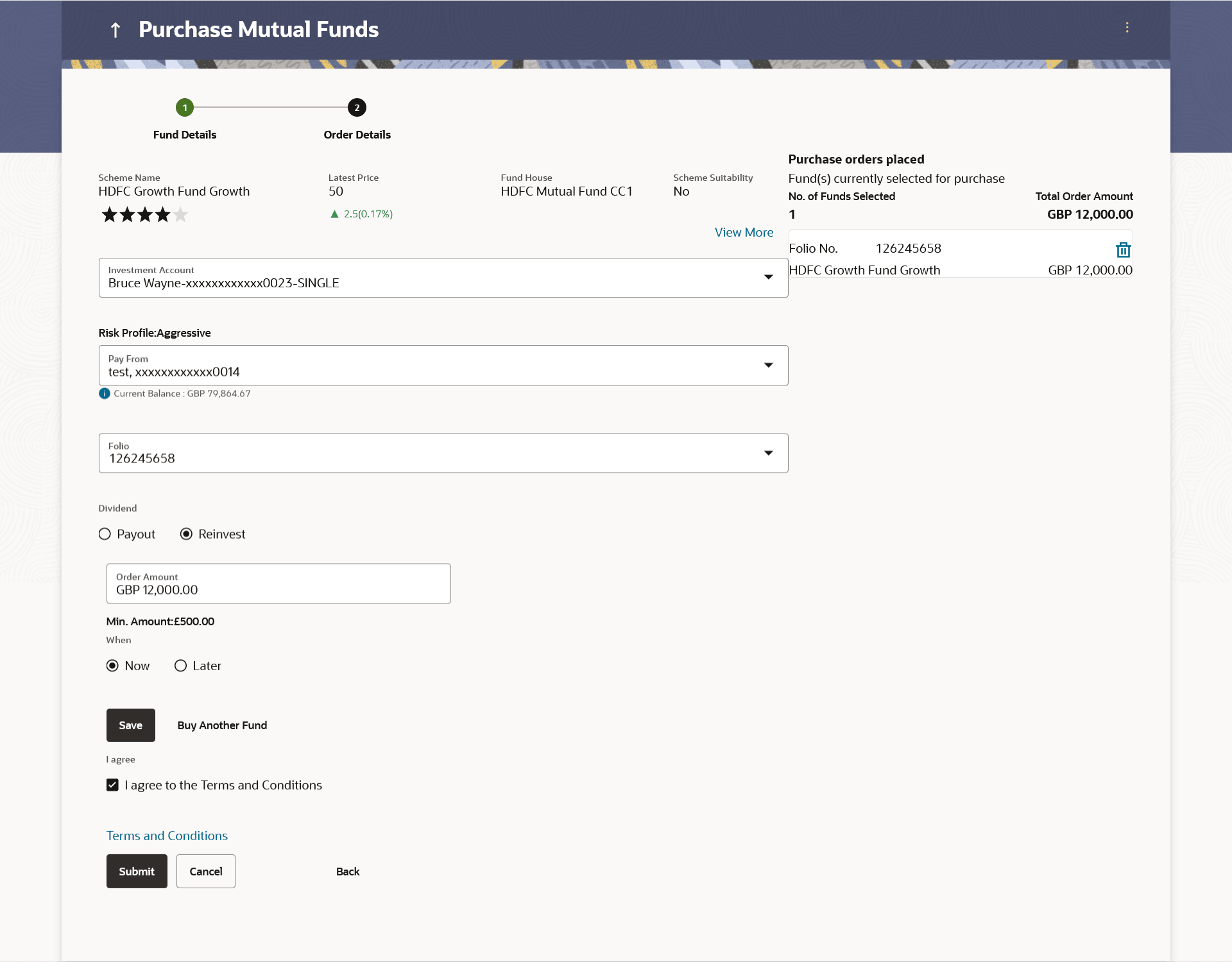

If you have selected Onetime option in the Purchase Type field, or clicked the Buy link in the Recommended Funds/ Top Purchased Funds section, following screen appears.

Figure 4-2 Purchase Mutual Funds - Order Details - Onetime Note:

For more information on fields, refer to the field description table.

Table 4-2 Purchase Mutual Funds - Order Details - Onetime - Field Description

| Field Name | Description |

|---|---|

| Scheme Name | Name of the scheme selected for current purchase order. |

| Scheme Rating | Rating of the scheme selected for current purchase order, as provided by MF processor. |

| Latest Price |

The latest NAV/ Price per unit the scheme chosen for current purchase order as provided by MF processor. The value below the Latest Price field is the Amount % % change over previous value of the NAV/ Price per unit the scheme chosen for current purchase order as provided by MF processor. |

| Fund House | The Fund house to which the fund house in context belongs. |

| Scheme Suitability | Displays whether the scheme is suitable for user to invest in provided by MF processor. The system displays 'Yes' if it is suitable and 'No', if the scheme is not suitable. |

| Investment Account | The investment account to which the current purchase order belongs. |

| Risk Profile | The risk profile of the selected investment account.

For more information on Risk Profile, refer Risk Profiling section. |

| Pay From | The current and savings account from which user can pay for the purchase order. |

| Folio | The option to select whether the current purchase order will go under new folio number or an existing one. |

| Dividend | The dividend for the current purchase order.

The options are:

The options will appear only if the selected scheme has dividend option. |

| Order Amount | The order amount of the current one-time purchase order. |

| Minimum Amount | The minimum order amount as set by the fund house for the scheme. |

| When | Select the option by which to specify when the orders are to be submitted for execution.

The options are:

|

| Order Date | The future date on which the orders are to be submitted for execution.

This field appears if you select Later option in the When field. |

| Cut Off Period | Cut off time and date for the order as provided by the MF processor. |

| Purchase Order Details |

Fund(s) Currently selected for purchase |

| No. of Funds Currently selected | Displays the number of purchase orders that have been placed till then ( in the context of multiple buy orders - maximum 3 purchase orders can be placed in one go). |

| Total Order Amount | Sum of all the order amounts. |

| Folio Number | Folio number of the selected order or "New" is displayed in the case new folio option has been selected. |

| Scheme Name | Name of the scheme selected for current purchase order. |

| Order Amount | Order amount keyed in by user. |

- From the Investment Account list, select the investment account to which the current purchase order belongs.

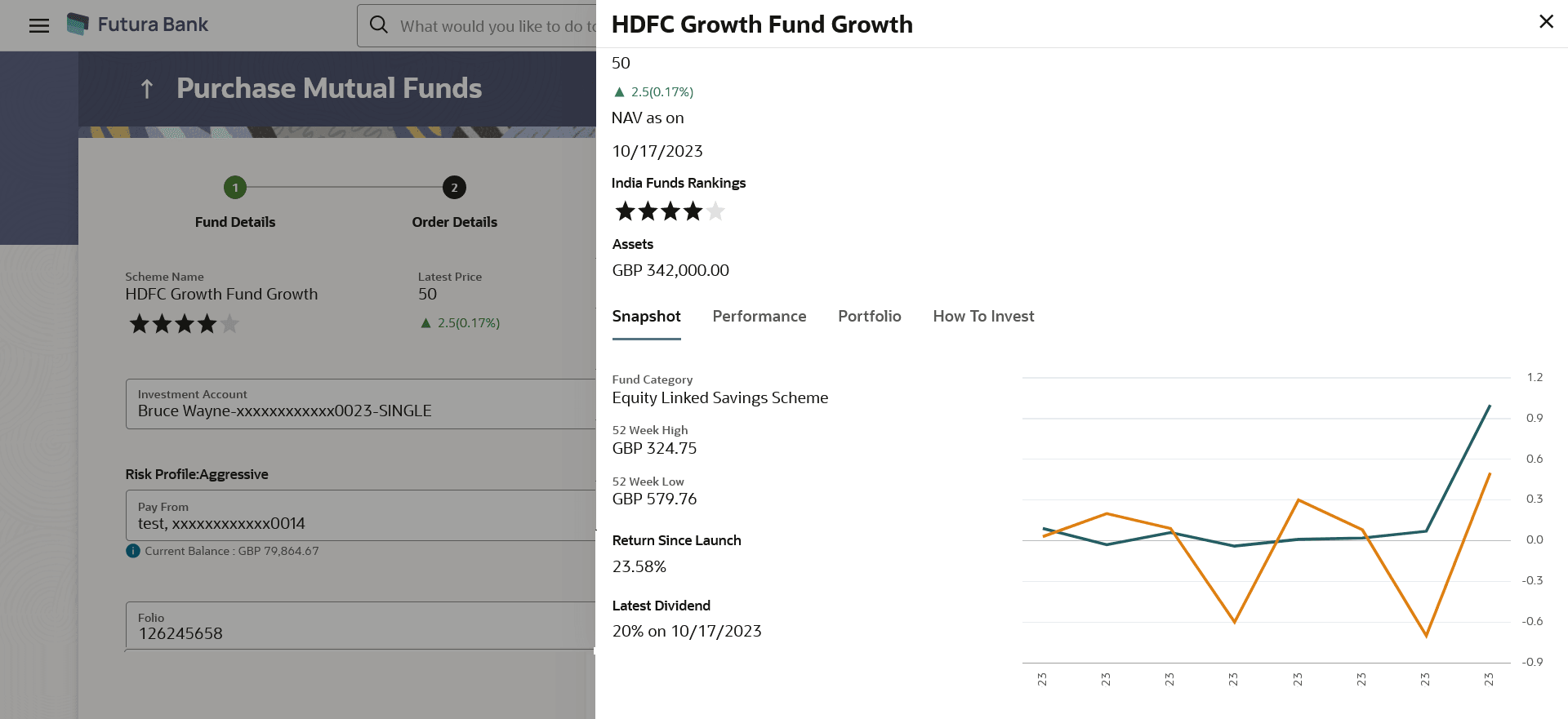

- In the Scheme Details section, click the View More link, if you want to view more details of the scheme selected for current purchase order.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 4-3 View More - Field Description

Field Name Description NAV as on Date The net asset value (NAV) per share/ NAVPS, is the fund's current market value of the fund's investment portfolio as on the current date. Funds Rating Rating of the scheme selected for current purchase order, as provided by MF processor. Assets as on Date The value of the total assets of the selected scheme on a particular date. Fund Manager Name of the fund manager who manages the fund. Subscription Status Subscription status i.e. whether the fund is open or closed currently for subscription. Snapshot This tab displays the overall snapshot of the selected fund/ scheme. Fund Category The fund category from which user has selected the fund for purchase. 52 Week High Highest price of selected scheme over the period of past 52 weeks. 52 Week Low Lowest price of selected scheme over the period of past 52 weeks. Return Since Launch Amount of money earned by the scheme since it is launched. Latest Dividend and Date Date and amount of recent most dividend declared by the fund. The amount of dividend here refers to the dividend earner by customer in the fund. Graph The graph displaying the value of the fund on a a particular day of month. Performance This tab displays the overall performance of the selected fund/ scheme. Fund Return The rate of return in percentage, the selected fund/ scheme has earned for a week, month, three months, six months, One year, three years, or five years.

Benchmark Return This represents the rate of return earned by the benchmark index of the fund. Difference Between Fund and Benchmark Return This represents the difference in rate of return earned between the fund and the benchmark index. Category Average Return The average rate of return in percentage for the category to which the scheme in context belongs, over multiple periods like a week, month, three months, six months, One year, three years, or five years. Difference Between Fund and Category Average Return This represents the difference in rate of return earned between the fund and the average of rates of return of a peer group of funds. Rank in Category Represents the rank of the fund in its peer group based on rate of return earned for a specific period. Percentage of Growth This represents the rate of return the 10,000 invested in the fund (mentioned above) has achieved over different periods of time. Note: Growth of 10,000 This figure represents how an investment of 10,000 (in fund currency) would have grown over a period of time.

Portfolio Represents the current portfolio – the top sectors and top holdings along with % exposure to them respectively. Top 5 Sectors Top five sectors where funds can be invested. For example: Financial, Technology, Construction, etc.

Top 10 Holdings: Equity Fund-Growth Top 10 holdings provides the information of the fund portfolio on which the user invests. The rank of the Holding is calculated by their total market value and expressed as a percentage of the fund's total assets. How to Invest Information specified in below fields are related to How to Invest. Lump sum Investment This type of investment allows the retail investor to place order for one time lump sum purchase. Minimum Initial Investment The minimum initial investment as allowed by the fund house. Minimum Subsequent Investment The minimum amount allowed for the next investment after the first initial investment. Minimum Withdrawal The minimum amount allowed to be withdrawal from the investment. Minimum Balance The minimum balance to be maintained. Repurchase Displays whether repurchasing of funds are allowed or not. Resell Displays whether reselling of funds are allowed or not. Repurchase Start Date The start date of repurchase. Repurchase End Date The end date of repurchase. Purchase Pricing Method The method to determine the purchase price of the funds. Purchase Cutoff Time The cut off time for the fund purchase order as provided by the MF processor. Redemption Time Redemption time of the purchased funds. Systematic Investment Plan Information specified in below fields are related to Systematic Investment. Minimum Installments Minimum number of installments for the SIP specified by fund house. Minimum Investment Minimum investment allowed by the fund house. Date Allowed The date on which SIP is allowed. Other Details Information specified in below fields are related to other details. Recurring Withdrawal Allowed Displays whether recurring withdrawal is allowed or not. Recurring Transfer Allowed Displays whether recurring transfer is allowed or not. - From the Pay From list, select the account to pay for the purchase order.

- From the Folio list, select the appropriate option.

- In the Dividend field, select the appropriate dividend type.

- In the Transaction section, enter the order amount of the purchase order in the Order Amount field.

- In the When field; select the appropriate date for order execution.

Select the future date from the Purchase Date list, if you select Later option.

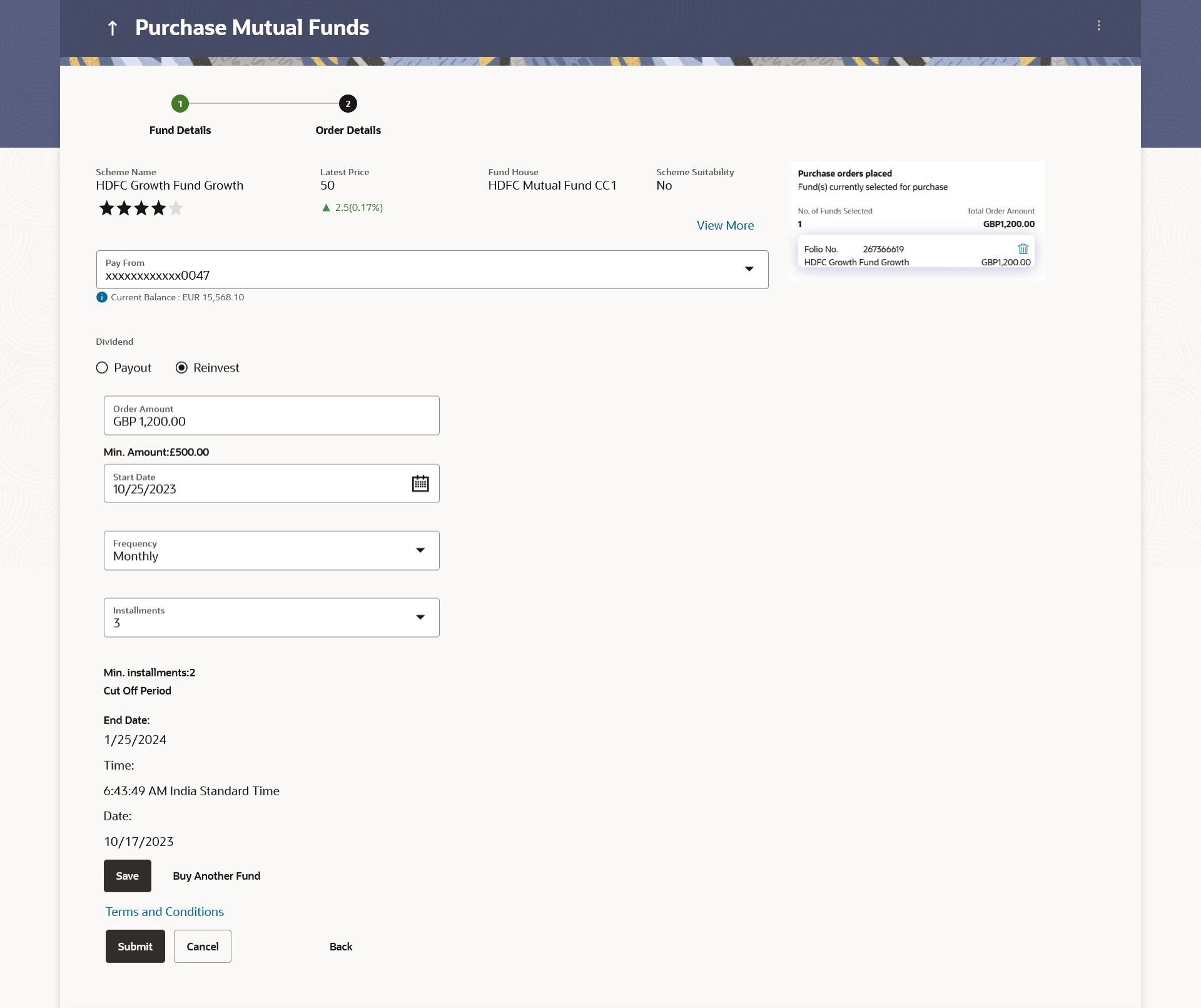

Figure 4-4 Purchase Order - Order Details - SIP/ SI

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 4-4 Purchase Order - Order Details - SIP/ SI - Field Description

Field Name Description Scheme Name Name of the scheme selected for current purchase order. Scheme Rating Rating of the scheme selected for current purchase order, as provided by MF processor. Latest Price The latest NAV/ Price per unit the scheme chosen for current purchase order as provided by MF processor. The value below the Latest Price field is the Amount change over previous value of the NAV/ Price per unit the scheme chosen for current purchase order as provided by MF processor and the Percentage change over previous value of the NAV/ Price per unit the scheme chosen for current purchase order as provided by MF processor.

Fund House The Fund house to which the fund house in context belongs. Scheme Suitability Displays whether the scheme is suitable for user to invest in provided by MF processor. The system displays 'Yes' if it is suitable and 'No', if the scheme is not suitable. Investment Account The investment account to which the current purchase order belongs. Pay From The current and savings account from which user can pay for the purchase order. Balance The current balance in the current and savings account from which user can pay for the purchase order. Dividend The dividend for the current purchase order. The options are:

- Payout

- Reinvest

The options will appear only if the selected scheme has dividend option.

Transaction (Installments) Information specified in below fields are related to transaction (installments). Order Amount The order amount of the current one-time purchase order. Minimum Amount The minimum order amount as set by the fund house for the scheme. Start Date List of SIP (Systematic Investment Plan) date specified by fund house. In case of SI (Standing Instructions) the user has to select the start date to set up standing instructions. Frequency List of SIP / SI frequencies specified by fund house. The options are:

- Daily

- Weekly

- Monthly

Installments List of SIP (Systematic Investment Plan)/ SI installments specified by MF processor. Min. Installments Minimum number of installments for the SIP/ SI specified by fund house. End Date End date of SIP/ SI based on start date, frequency & installment number. Cut Off Period Cut off time and date for the order as provided by the MF processor. Purchase Order Placed Fund(s) Currently selected for purchase No. of Funds Currently selected Displays the number of purchase orders that have been placed till then ( in the context of multiple buy orders - maximum 3 purchase orders can be placed in one go). Total Order Amount Sum of all the order amounts, in case of SIP or SI - sum will consider individual per installment amount and not the (installment number * per installment amount). Folio Number Folio number of the selected order or "New" is displayed in the case new folio option has been selected. Scheme Name Name of the scheme selected for current purchase order. Order Amount Per installment amount keyed in by user. - From the Investment Account list, select the investment account to which the current purchase order belongs.

OR

In the Scheme Details section, click the View More link, if you want to view more details of the scheme selected for current purchase order.

- From the Pay From list, select the account to pay for the purchase order.

- In the Dividend field, select the appropriate dividend type.

- In the Transaction section, enter the order amount of the purchase order in the Order Amount field.

- In the Start Date field, select the appropriate start date for SIP/ SI.

- From the Frequency list, select the SIP/ SI frequency.

- From the Installments list, select the SIP/ SI installments.

- In the End Date field, select the appropriate end date for SIP/ SI.

Parent topic: Purchase Mutual Funds