5.1 New Conventional Term Deposit

The Small & Medium Business user can open new conventional term deposit account based on the CASA accounts. In case of premature withdrawal from conventional term deposit, the maturity amount goes to CASA account with same local currency.

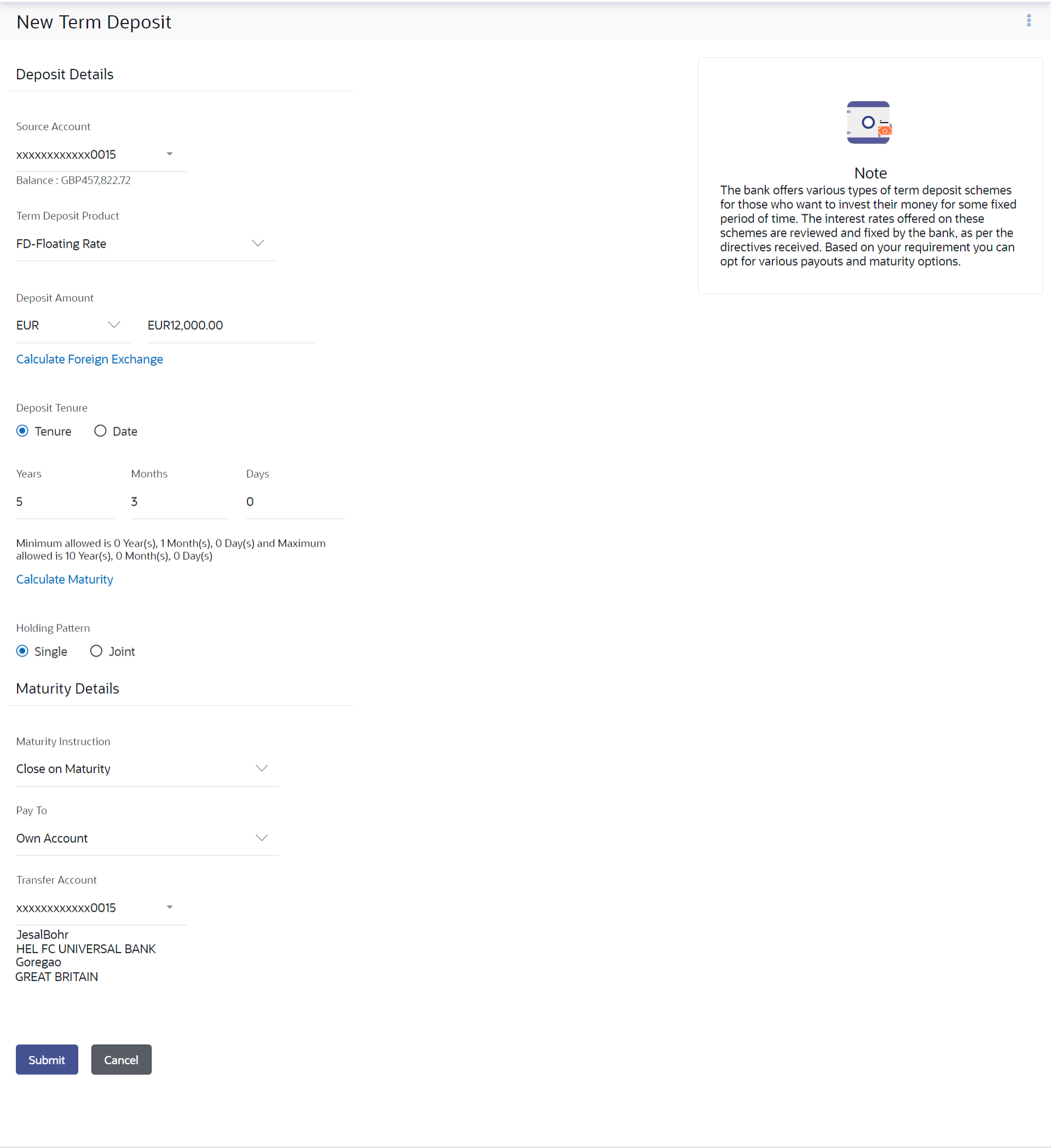

Figure 5-1 New Conventional Term Deposit

Table 5-1 Field Description

| Field Name | Description |

|---|---|

| Source Account |

The customer is required to select the current or savings account to be debited with the deposit amount. All the active current and savings accounts of the customer are displayed along with nicknames, if defined. For more information on Account Nickname, click Account Name |

| Balance | On selection of a current or savings account in the Select Account field, the current balance of the specific account is displayed against the field. |

| Term Deposit Product | All the term deposit products available for application will be listed down. |

| View Interest Rates | Click on the View Interest Rates link to view the interest rates that will be applicable on the deposit account based on the deposit product selected. This link will be displayed against the Select Product field once a product is selected. |

| Currency |

Currency in which the deposit is to be held. If the deposit product supports only a single currency this field is displayed as a label (instead of a list for selection). |

| Deposit Amount | The customer is required to specify the amount for which the deposit is to be opened. |

| Amount Range | The minimum and maximum amounts for which a deposit can be opened are displayed against the amount field once the customer selects a particular deposit product in the Select Product field. |

|

Calculate Foreign Exchange Below fields are displayed when you click on the Calculate Foreign Exchange link. |

|

| Current Exchange Rate |

Displays the per unit currency exchange rate for the chosen currency combination. Note: This field is displayed if the source account currency is different from the TD opening currency. |

| Current Amount | Displays the current exchange amount after currency exchange. |

| Exchange Amount |

Displays the exchanged amount in the chosen currency after currency exchange. Note: This field is displayed if the source account currency is different from the TD opening currency. |

| Current Exchange Rate | Displays the buy or sell per unit rate for the chosen currency combination. |

| Deposit Tenure |

The customer can specify the tenure of the deposit in terms of a period i.e. years/ months/ days or by selecting a specific date on which the deposit should mature. The options are:

|

| Years |

The customer can identify the deposit tenure in years. This field is enabled if the customer selects the Tenure option in the Deposit Tenure field. |

| Months |

The customer can identify the deposit tenure in months. This field is displayed if the customer selects the Tenure option in the Deposit Tenure field. |

| Days |

The customer can identify the deposit tenure in days. This field is displayed if the customer selects the Tenure option from the Deposit Tenure field. |

| Date |

The customer can define the deposit tenure by selecting a date on which the deposit should mature. This field is displayed if the customer selects the Date option from the Deposit Tenure field. |

| Deposit Period Range | The minimum and maximum period within which the deposit account can be opened is displayed against the deposit tenure field once the customer selects a deposit product in the Select Product field. |

|

Calculate Maturity The customer can click on the Calculate Maturity link in order to be displayed the maturity amount and interest rate applicable on the deposit account based on the information defined. |

|

| Maturity Amount | The system will calculate and display the estimated maturity amount based on the parameters defined by the customer. |

| Interest Rate | The rate of interest applicable on deposit account. |

| Holding Pattern |

The holding pattern that will be applied to the deposit being opened is displayed. This field will be displayed only if the current or savings account selected as the Source Account has a joint holding pattern. The options are:

Note:

|

| Maturity Details | |

| Maturity Instructions |

Maturity instructions to be set by the customer for the deposit account. The options available are dependent on the deposit product selected. The options can be:

|

| Rollover Amount |

The amount to be rolled over. This field is displayed if the customer selects Renew Special Amount and Payout the Remaining Amount option from the Maturity Instructions list. |

| Transfer Principal and Interest to |

This field is displayed only if the customer selects the option Close on Maturity from the Maturity Instructions list. The customer can identify if the entire maturity amount is to be transferred to a single CASA account or if the principal and interest amounts are to be split and transferred to two separate CASA accounts. The options are:

|

| Pay To |

This field is displayed if the customer has selected any maturity instruction that involves any part of the deposit amount to be paid out at the time of maturity. In case the maturity instruction Close on Maturity has been selected, this field will be displayed only if the user has selected the option Single Account from the Transfer Principal and Interest to field. The customer is required to select the mode through which the amount to be paid out is transferred. The options are:

This field is not displayed, if the customer has selected Renew Principal and Interest option from the Maturity Instructions list. |

| Pay Principal To |

This field is displayed only if the customer has selected the option Close on Maturity from the Maturity Instructions list and proceeds to select the option Separate Accounts from the Transfer Principal and Interest to field. The customer is required to select the mode through which the principal amount to be paid out is transferred. The options are:

Note: This option will be provided only if it is supported for the term deposit product selected from the Term Deposit Product list. |

| Pay Interest To |

This field is displayed only if the customer has selected the option Close on Maturity from the Maturity Instructions list and proceeds to select the option Separate Accounts from the Transfer Principal and Interest to field. The customer is required to select the mode through which the interest amount out of the total maturity amount to be paid out is transferred. The options are:

Note: This option will be provided only if it is supported for the term deposit product selected from the Term Deposit Product list. |

|

Own Account This section is displayed if the customer has selected the option Own Account in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Transfer Account | The customer can select a current or savings account to which the funds will be transferred when the deposit matures. All the customer’s current and savings accounts held with the bank will be listed down and available for selection. |

| The following fields are displayed once the customer has selected an account in the Transfer Account field. | |

| Beneficiary Name | The name of the holder of the account selected in Transfer Account. |

| Bank Name | Name of the beneficiary bank. |

| Bank Address | Address of the beneficiary bank. |

| City | City of the beneficiary bank. |

|

Internal Bank Account This section is displayed if the customer has selected the option Internal Account in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Account Number | The customer can identify a current or savings account of the bank to which the funds are to be transferred once the deposit matures. |

| Confirm Account Number | The customer must re-enter the account number in this field so as to confirm the account number entered in the above field is correct. |

|

Domestic Bank Account This section is displayed if the customer has selected the option Domestic Bank Account in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Account Number | The customer can identify a current or savings account to which the funds are to be transferred once the deposit matures. |

| Account Name | Enter the name of the account holder who will be the beneficiary to whom funds will be transferred once the deposit matures. |

| Bank Code | The customer is required to identify the bank code in which the beneficiary account is held. |

| Look Up Bank Code | Search option to look for bank code of the destination account. |

| The following fields and values will be displayed once the customer has specified a bank code. | |

| Bank Name | Name of the beneficiary bank. |

| Bank Address | Address of the beneficiary bank. |

| City | City of the beneficiary bank. |

To open a new conventional term deposit:

Parent topic: New Term Deposit under Oracle FLEXCUBE Universal Banking