1.3 EMI Calculator

This topic describes the tool which enables customers to gain an estimate of their regular loan repayments (EMIs).

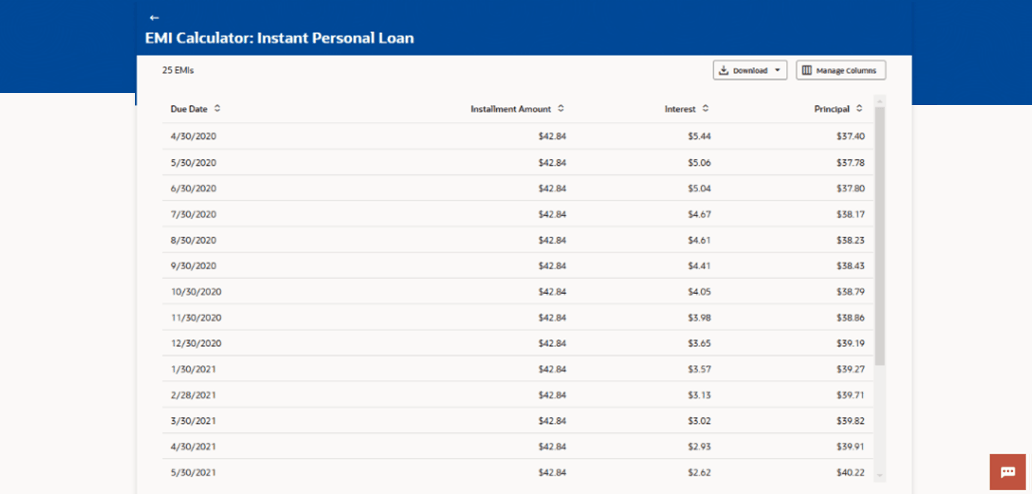

The EMI Calculator, available only to existing customers of the bank. Customers can also view the loan repayment schedule.

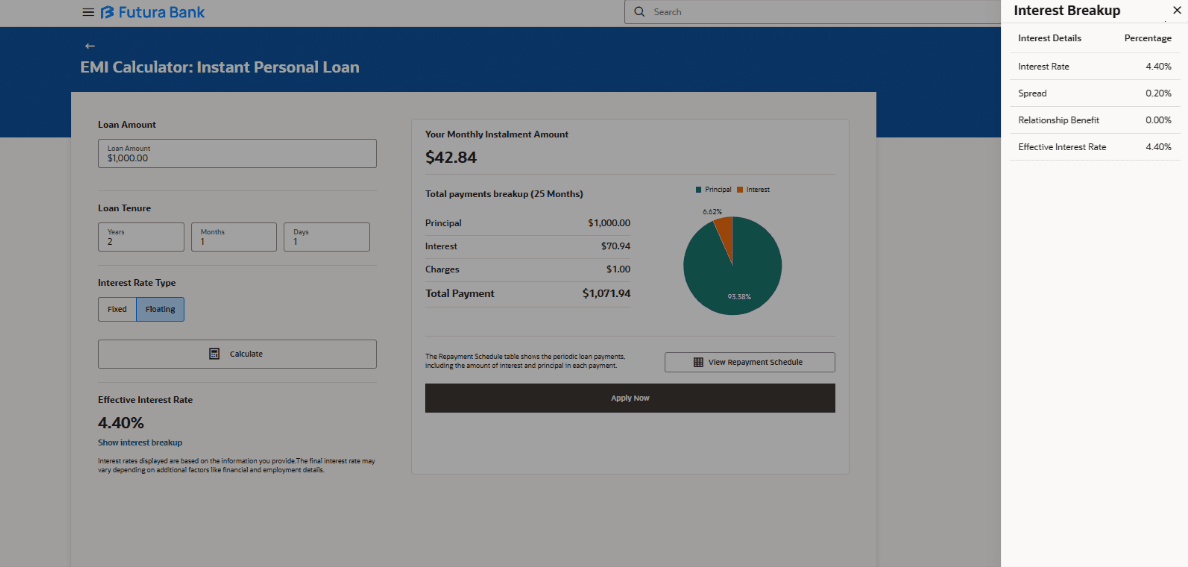

If the loan product, for which the customer is accessing the EMI calculator, supports preferential interest rates, then on entering the loan amount, tenure and on selecting a preferred interest rate type (if applicable), the customer can view the relationship benefit percentage along with the break up of the effective interest rate that will be applicable on the loan, if the customer decides to apply for it. This interest rate will be lower than the regular interest rate applicable on the loan. A preferential interest rate is generally available to customers who have existing accounts, investments, or a strong history with the bank and is offered as a reward for the customer’s engagement with the bank. This exclusive benefit ensures that the financial trust in the bank translates into more affordable borrowing options.

If the bank customer is not eligible for the special interest rate, then the rate of interest provided to them will not be preferential and the regular interest rates will apply.

The Relationship-Based Pricing feature is configurable for specific Personal Loan products from the backend.

This feature is only supported with Oracle Baking Retail Lending (OBRL) as the Loan Host System.

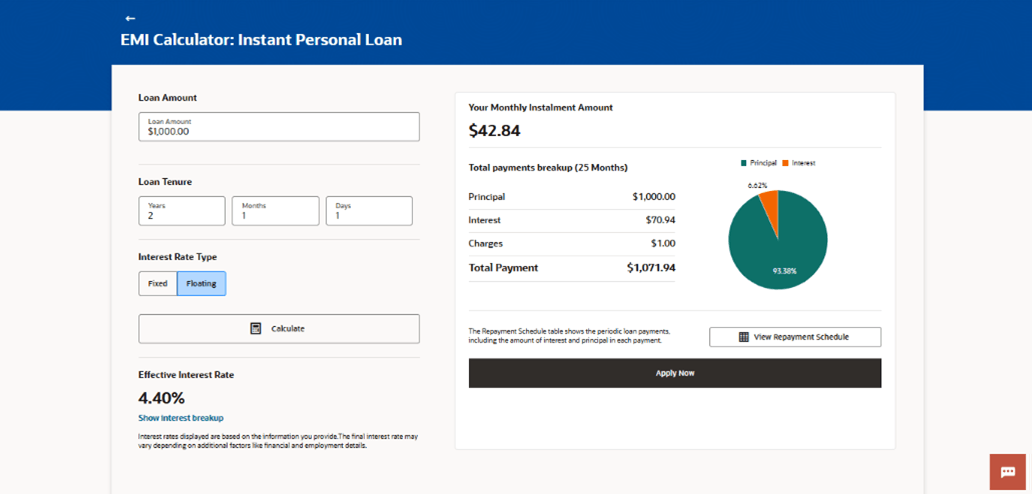

Figure 1-3 EMI Calculator

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-3 EMI Calculator - Field Description

| Field Name | Description |

|---|---|

| Loan Amount | The amount of loan that the customer wishes to avail. |

| Loan Tenure | The tenure of the loan. |

| Interest Rate Type | The type of interest rate to be applied on the loan i.e. fixed or floating.

Note: In case only one type of interest rate is defined for the loan product, then this field will be a read only field and the interest rate type applicable will be displayed against it. |

Parent topic: Unsecured Personal Loan Application