4 Loan Drawdown Application

This topic describes the process flow of Loan Drawdown Application.

Loan drawdown application goes through various stages of the business process flow, commencing from request initiation till loan account creation and loan disbursement based on the type of loan.

On submission of loan drawdown application from Oracle Banking Digital Experience (OBDX), the request gets assigned to the bank for further processing. Bank staff can view and process the application using back office or mid office systems integrated with Oracle Banking Digital Experience. Corporate Loan Origination module is currently integrated with Oracle Banking Corporate Lending Process Management (OBCLPM) for initiation of a new loan drawdown request and to track its status.

Corporates can track the status of the loan applications using Application Tracker available within Oracle Banking Digital Experience. Once the loan account is open, the integrated Oracle Banking Corporate Lending (OBCL) application enables the servicing of the account.Note:

If approver wants to modify the Loan Drawdown Request, then Send to Modify option can be used instead of rejecting the request. Later, maker can make necessary changes to Loan Drawdown Request and send for approval.Pre-requisites:

- The corporate user should be a registered Oracle Banking Digital Experience user.

- The corporate user must have at least one existing facility. The facility limit available should be sufficient for drawdown.

- The application must be integrated with the Oracle FLEXCUBE Enterprise Limits and Collateral Management (ELCM) or any other facility application to fetch the facilities of the customer.

- The application must be integrated with Oracle Banking Corporate Lending Process Management to initiate Drawdown request flow and for tracking status of the request.

- The application must be integrated Oracle Banking Corporate Lending to check with the newly opened loan account.

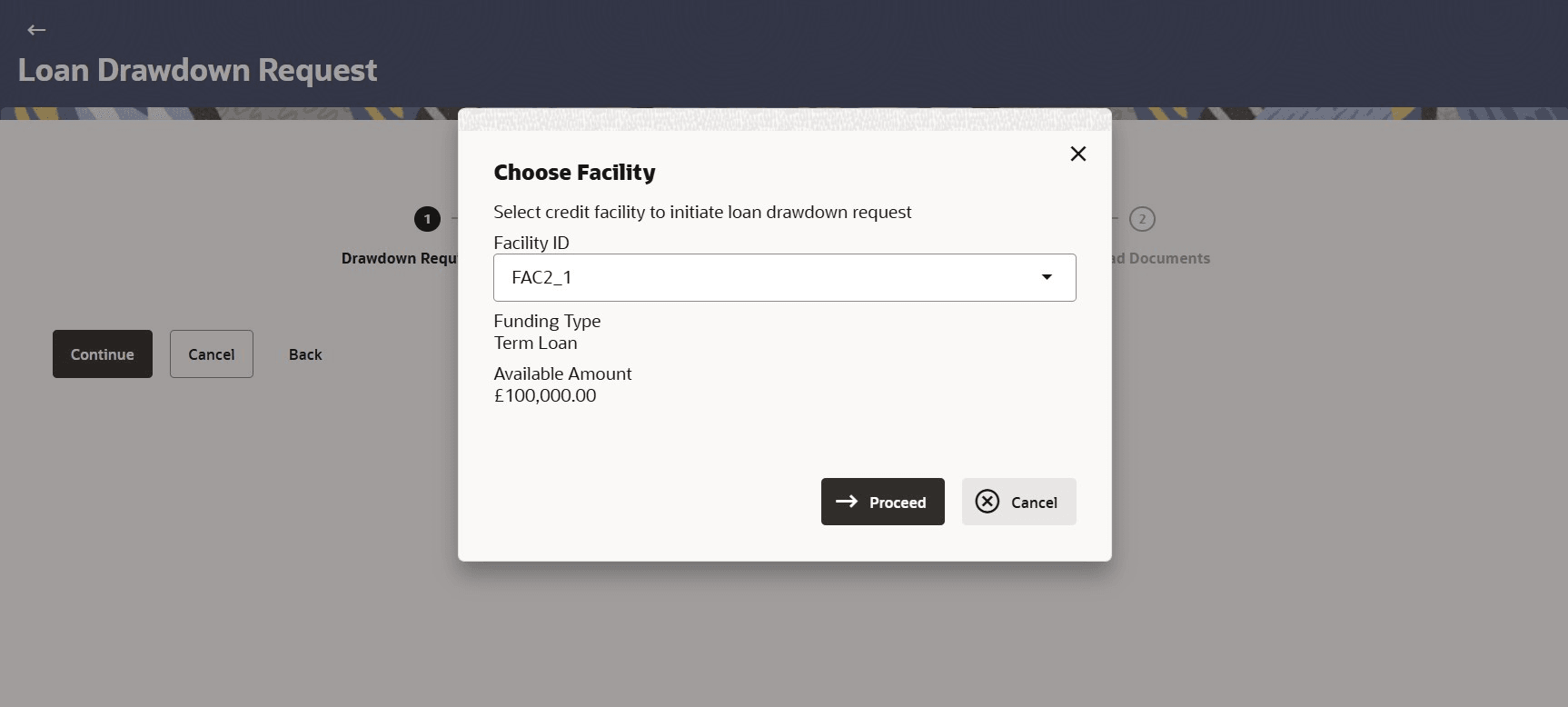

To apply for a corporate loan drawdown:

- Loan Drawdown Request

This topic provides the information initiate an application for loan drawdown request. - Save as Draft

This topic provides systematic instructions to save the document as draft and allow user to edit it later prior to submit.