1 Introduction

Virtual Accounts Management platform is a solution to reduce the complexity of money management for corporates. Virtual accounts help the large corporates to reduce the number of real accounts needed and its associated costs, provides ease of reconciliation and gives better collection, visibility and deployment of money.

Using this module, a corporate can create and manage multiple virtual entities, accounts and structures via self-service channel. The user gets the benefit of an exclusive dashboard view of account information and an option to create Virtual Accounts structure to get better visibility of his cash positions.

- Virtual Entities – Notional entities representing the real entities

- Virtual Accounts – Notional accounts that are either linked to a real account directly or via a Virtual Accounts Structure

- Remittance ID List – Short Identifier/ Corporate Identifier based Virtual Accounts

Pre-requisites

The user must be having a valid corporate account.

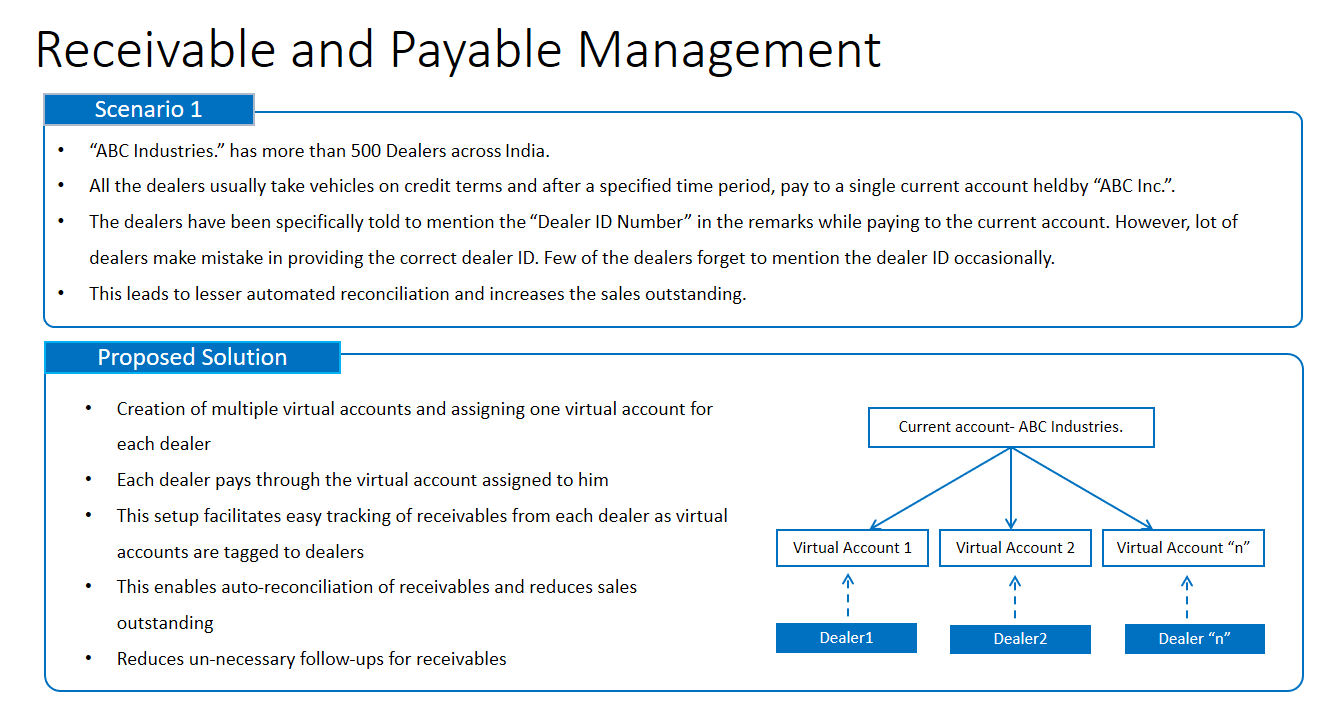

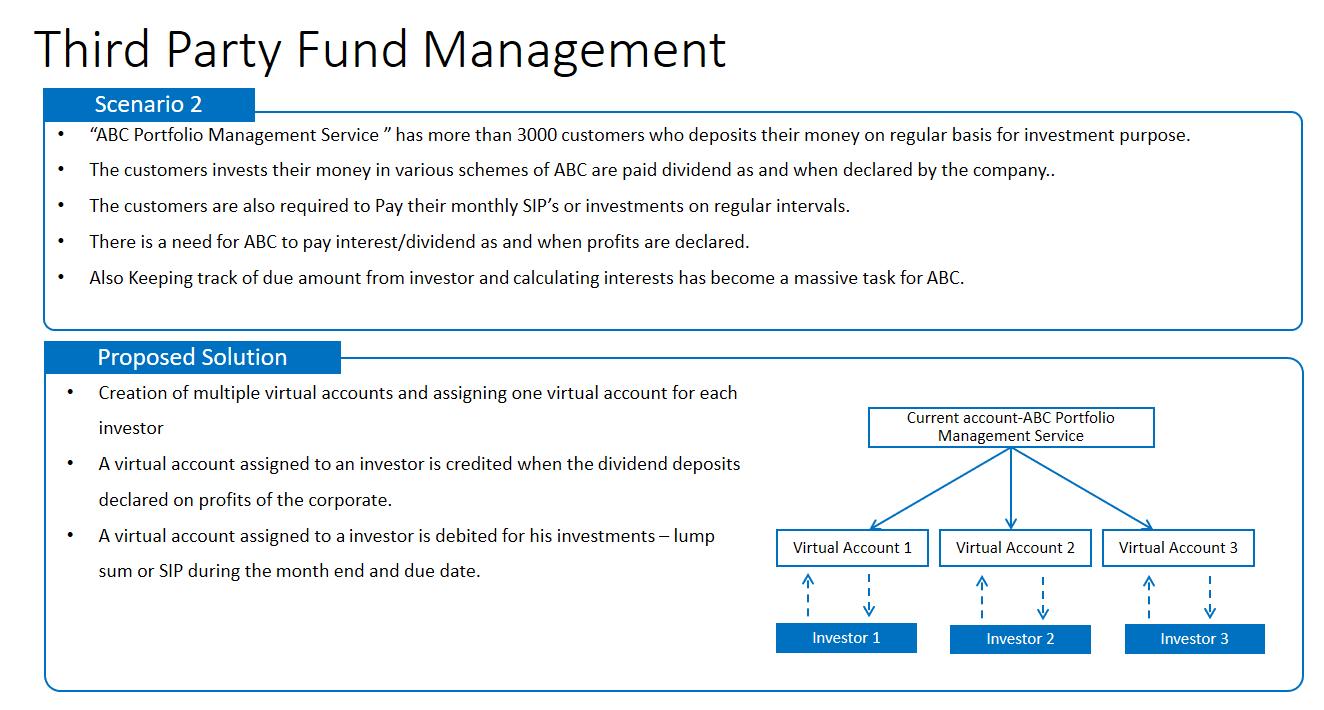

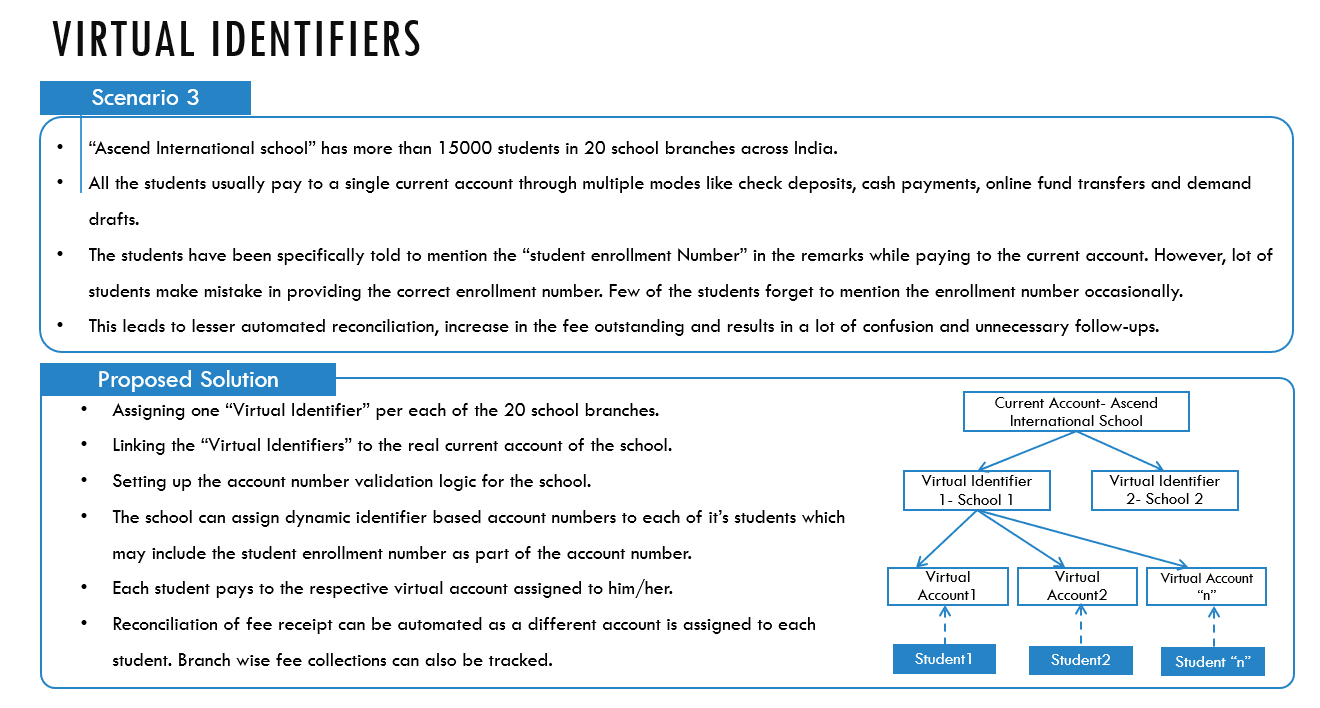

Given below are different scenarios / use cases in which Virtual Account management plays a crucial role, minimizing the various overheads.

Note:

These are the generic use cases where Virtual Accounts management is applied. Refer the section (Features Supported in Application) to understand OBDX product offeringsScenario 1

Figure 1-1 Receivable and Payable Management

Scenario 2

Scenario 3

Features Supported In the Application

Virtual Account Management module supports the following features:

- Overview

- Virtual Entity

- Virtual Account

- Virtual Accounts Structure

- Remittance ID

- Virtual Multi-Currency Account

- Payments Using Virtual Accounts

- Move Money

- Internal Credit Line

- Transaction Inquiry

- Pre-Generated Statement

- Adhoc Statement

- Charges Inquiry

- Special Rate Maintenance

- General Rate Maintenance