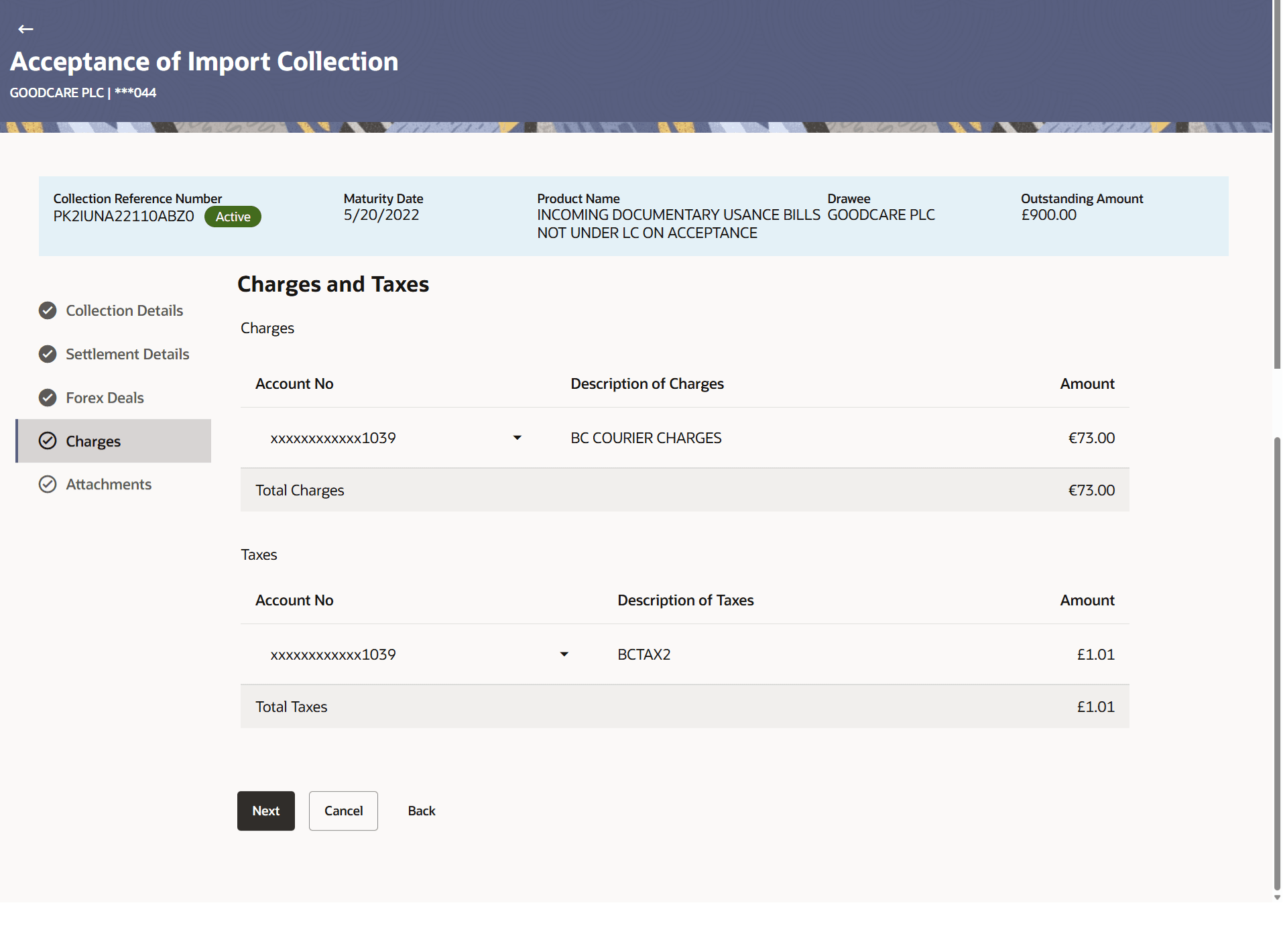

17.4 Acceptance of Import Collection - Charges and Taxes

This topic provides the systematic instructions to view the Charges and Taxes details in the application.

This tab allows the user to view the charges and taxes if any applicable on the collection. User should also be able to select an account to be used for debit of the charges.

Parent topic: Acceptance of Import Collection