35 Trade Finance Application Tracker

This topic provides the systematic instructions to track the applications.

The Application Tracker enables you to view the progress of submitted applications and also to retrieve and complete applications that have been saved as Draft. You can search for the required application using the application number or draft name. The Trade Finance Application tracker currently supports Initiate Import LC and Initiate Outward Guarantee, Initiate LC Amendment and Customer Acceptance – Bills & LC which are going to be processed through Trade Finance mid office.

Through the application tracker, you can perform the following actions:

- View and update application in draft: While filling out an application form, if you opt to save the application instead of submitting it, the application is saved in the app tracker as an ‘In Draft application’. You can select any of the applications available under this widgets in order to complete not yet started stages and submit that application.

- View submitted application: The application tracker enables you to view details of submitted applications, which includes viewing status history, application summary and uploaded documents.

- View applications with Pending Clarifications: the application tracker enables you to look into the applications which has received certain clarifications from bank. User can choose to respond from there,

- View application in progress: The application form that are picked up by the mid-office user and are under processing, comes under "In progress" state.

- View approved application: The application tracker enables you to view details of applications that are approved by the approver.

- View rejected application: The application tracker enables you to view details of applications that are rejected by the approver.

To track the applications:

- From the Dashboard, click Menu, then click Trade Finance, and then

click Application Tracker. Under Maintenance, click Clause

Maintenance. The Trade Finance Application Tracker screen is displayed with all the Letter of Credit and guarantees applications.

Figure 35-1 Trade Finance Application Tracker

For more information refer to the field description table below:

Table 35-1 Trade Finance Application Tracker - Field Description

Field Name Description Party Select the party of the product for which you want to track the application. Search Specify the Application Number or Beneficiary Name of the application to search and view its details. In case of draft applications you can search by name of the draft.

Application Cards The Application card displays the following application details. Application Number Displays the application reference number as generated by the bank at the time the application was submitted. Application Type Displays the type of trade finance application that is Letter of Credit or Bill Guarantee. Beneficiary Name Displays the beneficiary’s name against whom LC is to be created. Application Date Displays the date and time on which the application was submitted. This is applicable for all application status except “Drafts”. Amount Displays the amount for the Letter of Credit or Bill Guarantee is applied for. Draft Name Displays the name of Draft which was used to save the application. This is applicable when application status is “Drafts”. - Select the Party of the product for which you want to track the application.

- Select and click the Application card whose details you want to view.

- Specify the name of the specific Application card in the Search field whose

details you want to view.The specific Application card record appears.

- Perform any one of the following actions:

- Click

or

or  to view the Application card as Summarized or Tabular view

to view the Application card as Summarized or Tabular view

- Click on the "Draft" tab, it opens the all applications cards with Draft

status.

Click on an application card, details screen with pre-populated details that you have already entered and saved as draft will appear, you can update those details and fill any other details required in the application form and submit it.

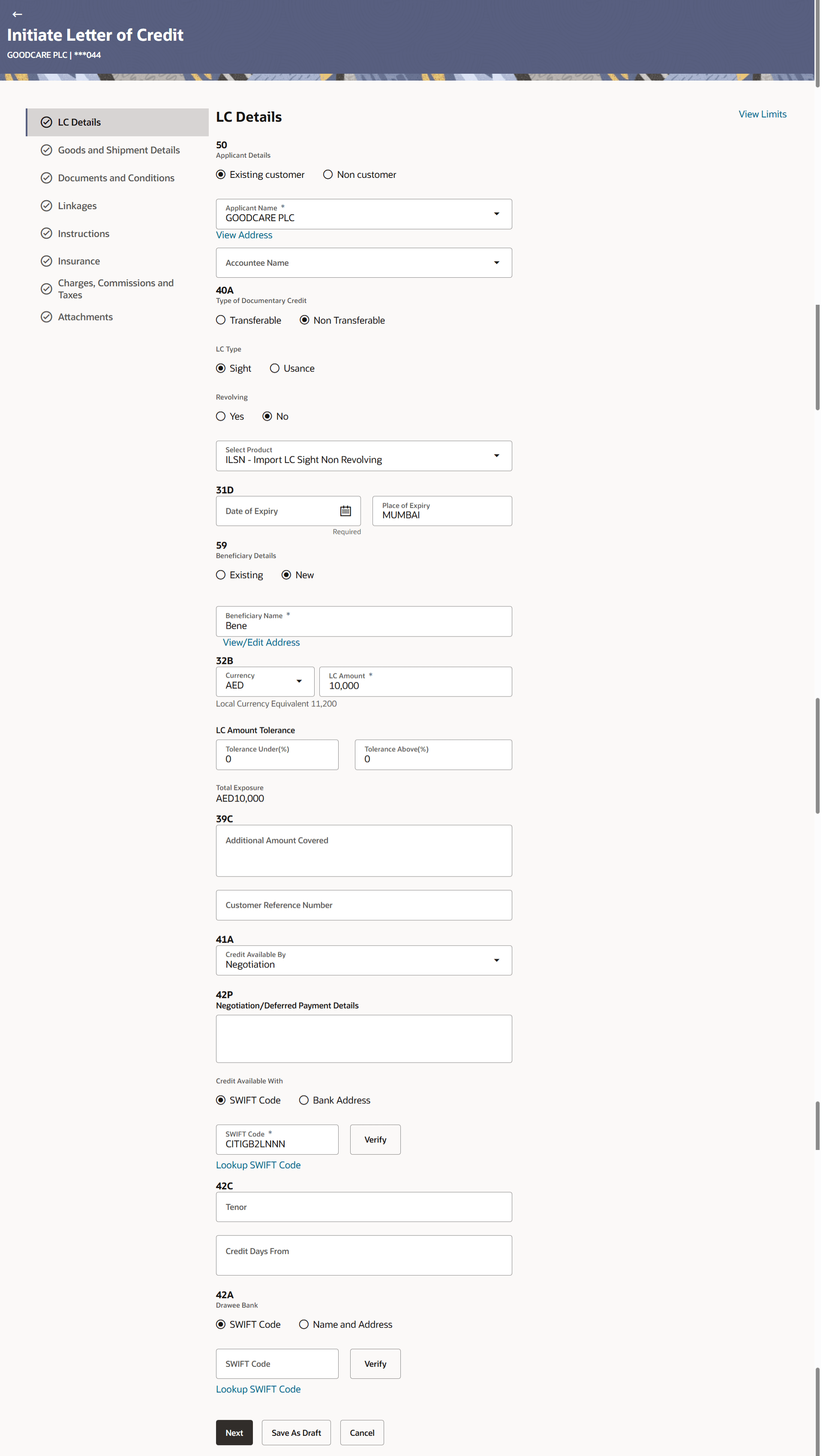

Figure 35-2 Initiate Letter of Credit - Draft

- Click Submit tab, it opens the all applications widgets with Submit status.

- Click

- Click on an application card, it opens the application details screen as "submitted" by the customer.

- Perform any one of the following actions:

- Click the Documents (View/ Download Your Documents) icon to view and download the documents that are submitted.

- Click the Application Details (View Your Application) icon to view your submitted application. Refer Initiate LC or Initiate Guarantee transactions for more details.

- Click Close to cancel the operation and to navigate back to Dashboard.

- Click Back to navigate back to the previous screen.

Figure 35-3 View Application Details - Submitted

For more information refer to the field description table below:

Table 35-2 Field Description

Field Name Description Application Number Displays the application reference number as generated by the bank at the time the application was submitted. Status Displays the current application's progress as submitted. Amount Displays the amount for the Letter of Credit or Bill Guarantee is applied for. Created Date Displays the date and time on which the application was submitted. Country Indicates the country of the applicant. This field is input field, if Non customer option is selected in Applicant Details field.

Limits Indicates the available limits for applicant under the selected Line. The limit details are also represented in a graphical manner with available, sanctioned and utilized limit details for the users.

View Limit Details Click the link to open the Facility Summary screen. Country Displays the country of the LC applicant. Accountee Name Select from the list of all accountees mapped to a party. Address Displays the accountee's address. Country Displays the country of the accountee. Type of Documentary Credit Move the slider to select the type of documentary credit. The type of documentary credit are:

- Transferable

- Non Transferable

LC Type Indicates the type of LC. The options are:

- Sight

- Usance

Revolving Indicates whether the product is revolving or not. The options are:

- Yes

- No

Select Product Select the LC product. Auto Reinstatement This option indicates that reinstatement will happen automatically, if not chosen it has to be done manually if required. The options are:

- Yes

- No

Revolving Type The option to select the revolving type. The options are:

- Value: LC revolves in value.

- Time : LC revolves in time

This field is enabled if Yes option is selected in the Revolving field.

Cumulative Displays whether the frequency is cumulative for the LC. If it is cumulative then unused amount of previous LC would be added and available for the new LCs. The options are:

- Yes

- No

This field is enabled if Time option is selected in the RevolvingType field.

Repeat Frequency Select the time duration of revolving frequency. Specify the values for:

- Days

- Month

This field is enabled if Time option is selected in the RevolvingType field.

Date of Expiry Specify or select the expiry date of the LC. The expiry date must be later than the application date.

Place of Expiry Specify the place where LC would expire. Beneficiary Details The option to select the beneficiary type. The options are:

- Existing

- New

Beneficiary Name The name of the LC beneficiary. This field allows the user to select the beneficiary name from drop-down, if Existing option is selected in the Beneficiary Details field.

This field allows the user to specify the beneficiary name, if New option is selected in the Beneficiary Details field.

Address Specify the address of the LC beneficiary. This field is enabled to enter the address details, if New option is selected in the Beneficiary Details field.

Country Specify the country of the LC beneficiary. This field is enabled to enter the country name, if New option is selected in the Beneficiary Details field.

Currency Specify the currency under which the LC can be issued. LC Amount Specify the amount for the Letter of Credit. The user can see the equivalent amount in the local currency, if the application is in foreign currency.

LC Amount Tolerance Specify the tolerance relative to the documentary credit amount as a percentage plus and/or minus that amount. Specify the values for:

- Under (-) %

- Above (+) %

Total Exposure Displays the total LC amount including the positive tolerance, with the currency. Additional Amounts Covered Specify any additional amounts available to the beneficiary under the terms of the credit, such as insurance, freight, interest, etc. Customer Reference Number Specify the customer reference number. Credit Available By Select the value credit available by. Indicates the manner in which credit is available when the bank is authorized to pay, accept, negotiate or incur a deferred payment undertaking for the credit.

The options are:

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

- Sight Payment

Negotiation/ Deferred Payment Details Specify the details of Negotiation/ Deferred Payment. This field is enabled if the Negotiation/ Deferred Payment option is selected in the Credit Available By field.

Mixed Payment Details Specify the details of mixed payment. This field is enabled if the Mixed Payment option is selected in the Credit Available By field.

Credit Available With The option to select the details of Bank where credit would become available. It is captured by Bank’s SWIFT code. The options are:

- SWIFT Code

- Bank Address

Lookup SWIFT Code Select the SWIFT code of the issuing bank. This field is enabled if the SWIFT Code option is selected in the Credit Available With field.

SWIFT code Look up The following fields appear on a pop up window if the Lookup SWIFT Code link is clicked. Swift Code The facility to lookup bank details based on SWIFT code. Bank Name The facility to search for the SWIFT code based on the bank name. Country The facility to search for the SWIFT code based on the country. City The facility to search for the SWIFT code based on city. SWIFT Code Lookup Search Results This section displays the SWIFT Code lookup search results. Bank Name Displays the names of banks as fetched on the basis of the search criteria specified. Address Displays the complete address of each bank as fetched on the basis of the search criteria specified. Swift Code Displays the list of SWIFT codes as fetched on the basis of the search criteria specified. Bank Details Specify the name and address of the bank where credit would be available. This field is enabled if the Bank Address option is selected in the Credit Available With field.

Tenor (In Days) Specify the tenor of drafts to be drawn under the documentary credit. Credit Days From Specify the days from which the draft tenor is to be counted. Indicates the days from which the draft tenor is to be counted. Drawee Bank Select the drawee bank of the LC. The options are:- SWIFT Code

- Name and Address

SWIFT Code Specify the SWIFT code or click the Lookup SWIFT Code to search and select the SWIFT code. System fetches the SWIFT code details on the basis of the search criteria specified.

Draft Amount The various drafts amount for the LC application. Action The various drafts amount for the LC application.

- Pending Clarification

This topic provides the systematic instructions to search an view the transactions pending for clarifications.