8.3 Bill Settlement - Single - Charges and Taxes

This topic provides the systematic instructions to view the Charges and Taxes details in the application.

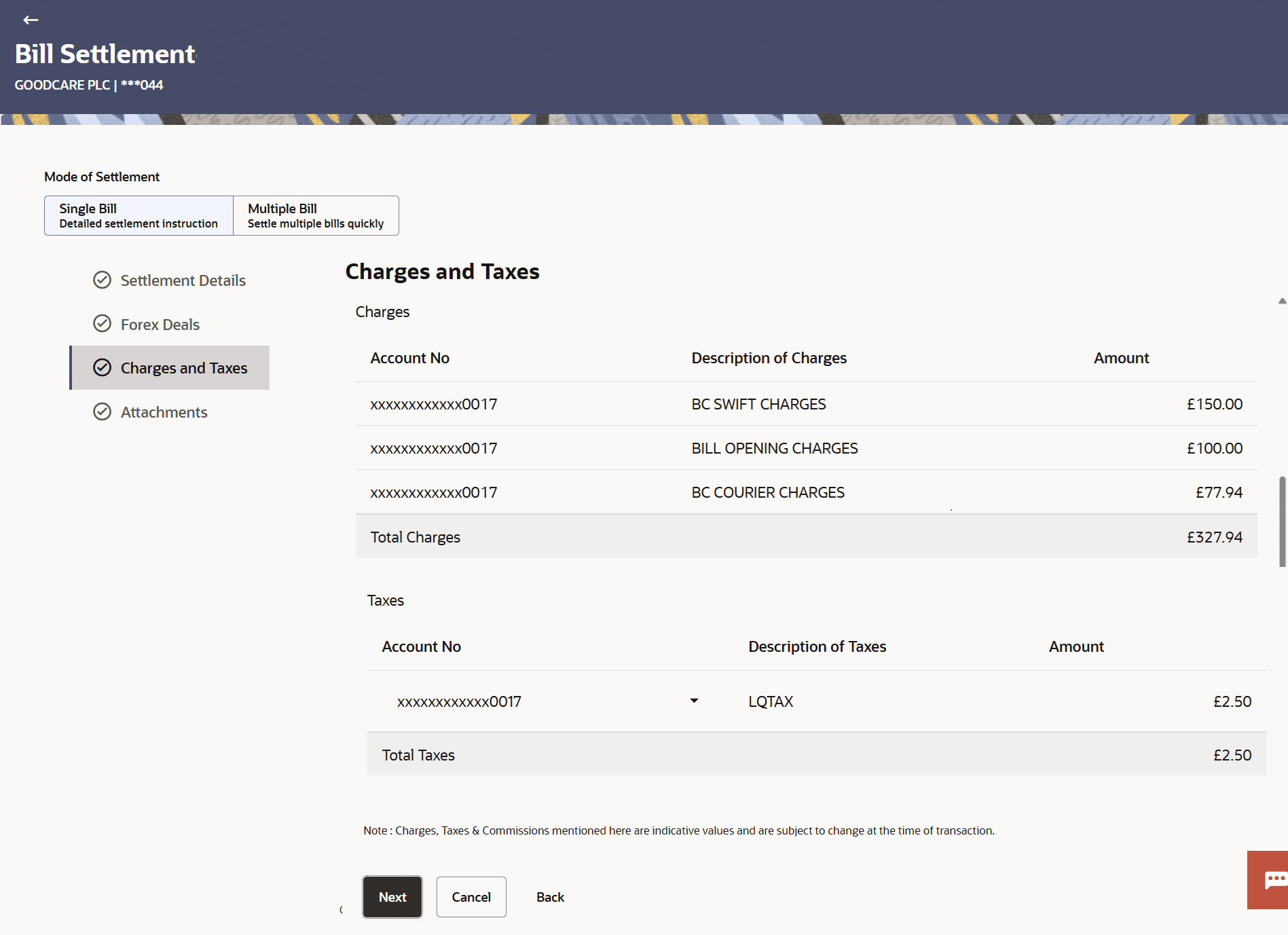

This tab captures the charges and taxes for the single bill settlement Instruction application process.

Parent topic: Bill Settlement