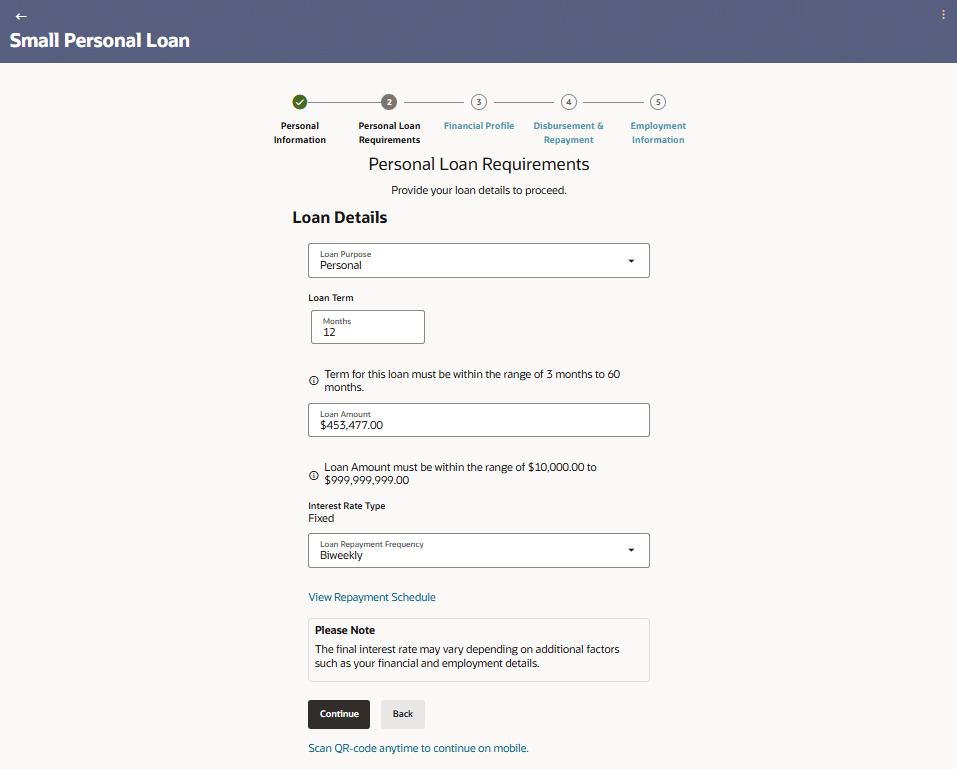

1.9 Personal Loan Requirements

This topic describes the section where you must provide loan-specific information, including the loan purpose, desired amount, and loan tenure.

Note:

The facility to initiate an application through the EMI calculator screen is available only for the existing customers of the bank.

Figure 1-14 Personal Loan Requirements

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-11 Personal Loan Requirements - Field Description

| Field Name | Description |

|---|---|

| Loan Purpose | The purpose for which the loan is being availed.

If this field is a dropdown, the options are:

Note: Depending on the maintenance in OBO, this field can be a drop-down or an input field. |

| Loan Term | The tenure of the loan in terms of years, months, and

days.

Note:

|

| Loan Amount | The loan amount that you would like to borrow.

Note: The loan amount must be within the minimum and maximum allowed range defined at the product level. |

| Interest Rate Type | The type of interest rate to be applied on the loan i.e. fixed

or floating.

Note: In the event that a single type of interest rate is defined for the loan product, this field will be designated as read-only, and the corresponding applicable interest rate type will be presented alongside it. |

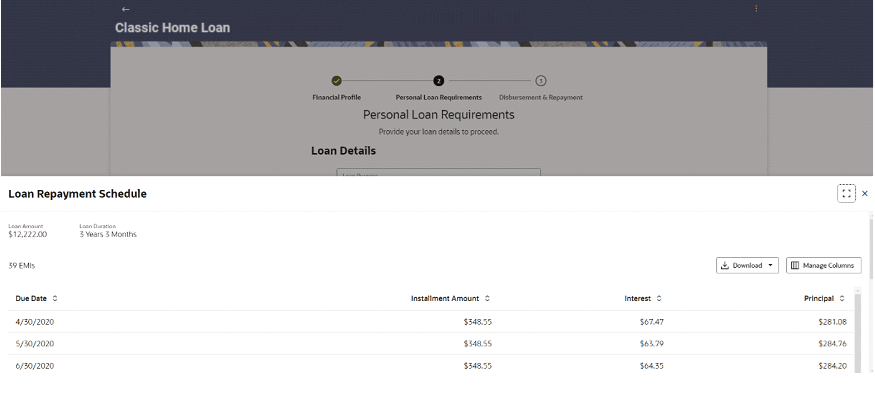

| Loan Repayment Schedule | The type of loan repayment schedule the user wants to opt for.

The following options are supported:

Standard – Regular equated monthly instalments to repay the loan. Personalized – A GenAI based intelligent loan repayment schedule in which the instalment amount is adjusted as per the expense predicted for a given month. If the expense is predicted to be high, the EMI will be lower and vice versa. Note: If the applicant opts for personalized loan repayment schedule, they will be required to upload past savings or checking account bank statements of a period defined by the bank. |

Parent topic: Unsecured Personal Loan Application