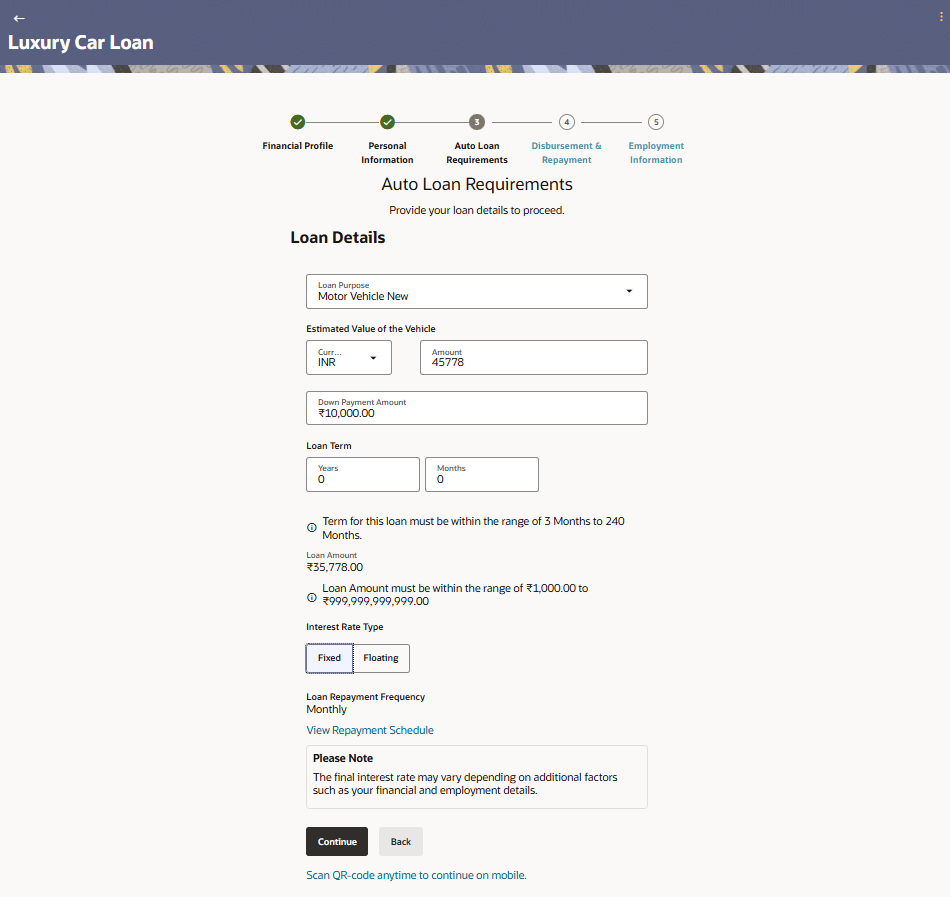

1.7 Auto Loan Requirements

This topic describes the section of the application form where applicants provide information about the vehicle being purchased and the loan itself.

In terms of loan information, in addition to the loan term, you will also be required to define the estimated value of the vehicle, and whether you wish to make any down payment or not which will enable the system to identify the expected loan amount.

- From Financial Profile, click

Continue.The Auto Loan Requirements screen is displayed.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-10 Loan Requirements - Field Description

Field Name Description Loan Purpose The purpose for which the loan is being availed. Note: Depending on the maintenance in OBO, this field can be a drop-down or an input field.

Estimated Value of the Vehicle The estimated market value of the vehicle. Down payment Amount The amount, if at all, you wish to make in payment towards the purchase of the vehicle. Loan Term The tenure of the loan in terms of years, months, and days. Note:- The loan term must be within the minimum and maximum allowed range defined at the product level.

- The loan term's duration depends on the product's maintenance in OBO.

Loan Amount Displays the loan amount based on the estimated value and down payment values provided by you. Note: The loan amount, as derived on the basis of the estimated value and down payment value entered, must be within the minimum and maximum allowed range defined at the product level.

Interest Rate Type The type of interest rate to be applied on the loan i.e. fixed or floating. The options are:- Fixed – The rate of interest will be fixed if this option is selected.

- Floating – If this option is selected the interest rate applicable on the loan will vary over time.

Note: In the event that a single type of interest rate is defined for the loan product, this field will be designated as read-only, and the corresponding applicable interest rate type will be presented alongside it.

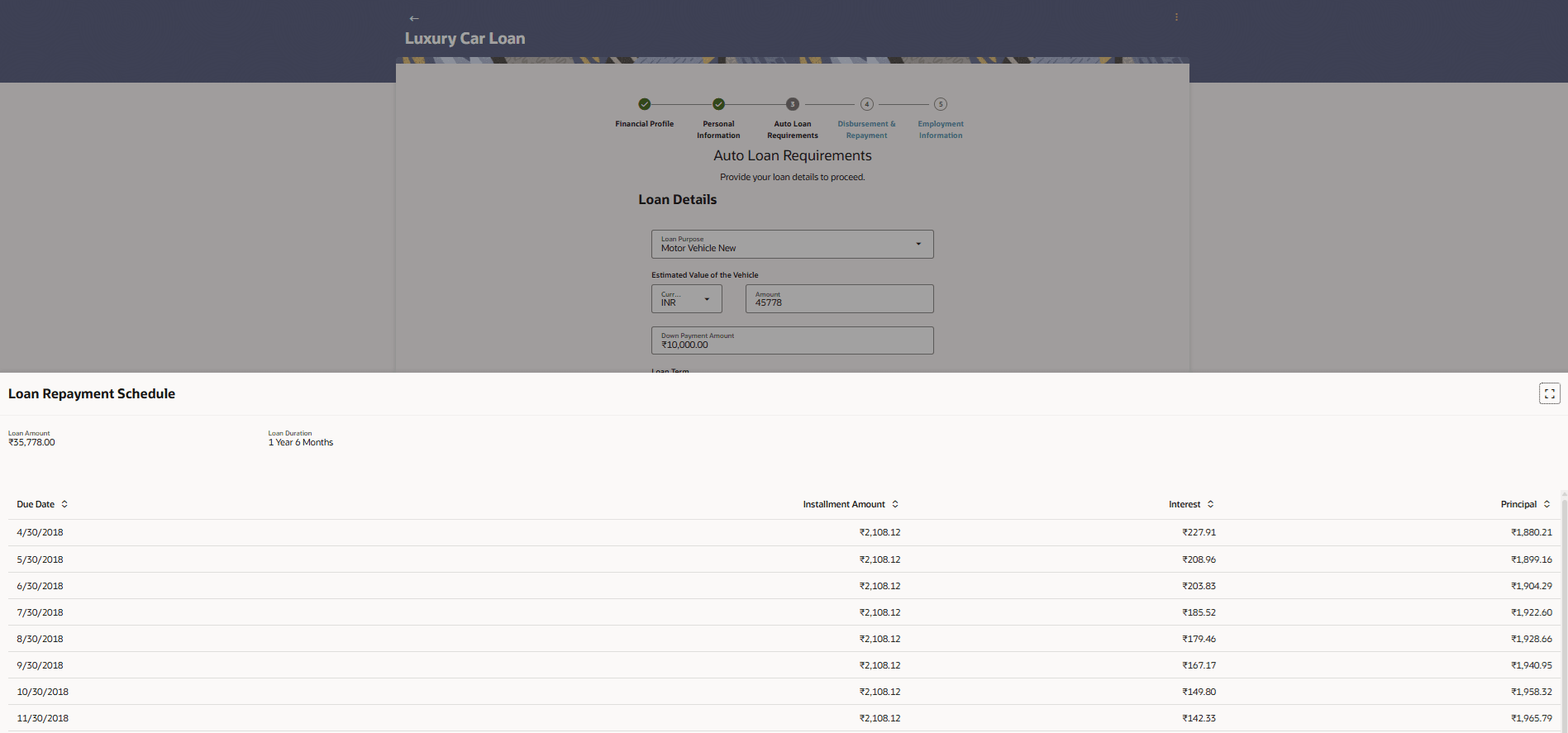

- Select the View Repayment Schedule to view the loan repayment

schedule in a detailed tabular form.

- Perform any of the following actions:

- Click Continue to proceed to the next step in the application.

- Click Back to navigate back to the previous step in the application.

- Click Scan QR-code anytime to continue on mobile link to continue the application on mobile or tablet device.

- Under the kebab menu, perform any of the following actions:

- Click Save and Continue Later to save the application.

- Click Continue on Mobile to continue the application on a mobile device.

Parent topic: Auto Loan Application