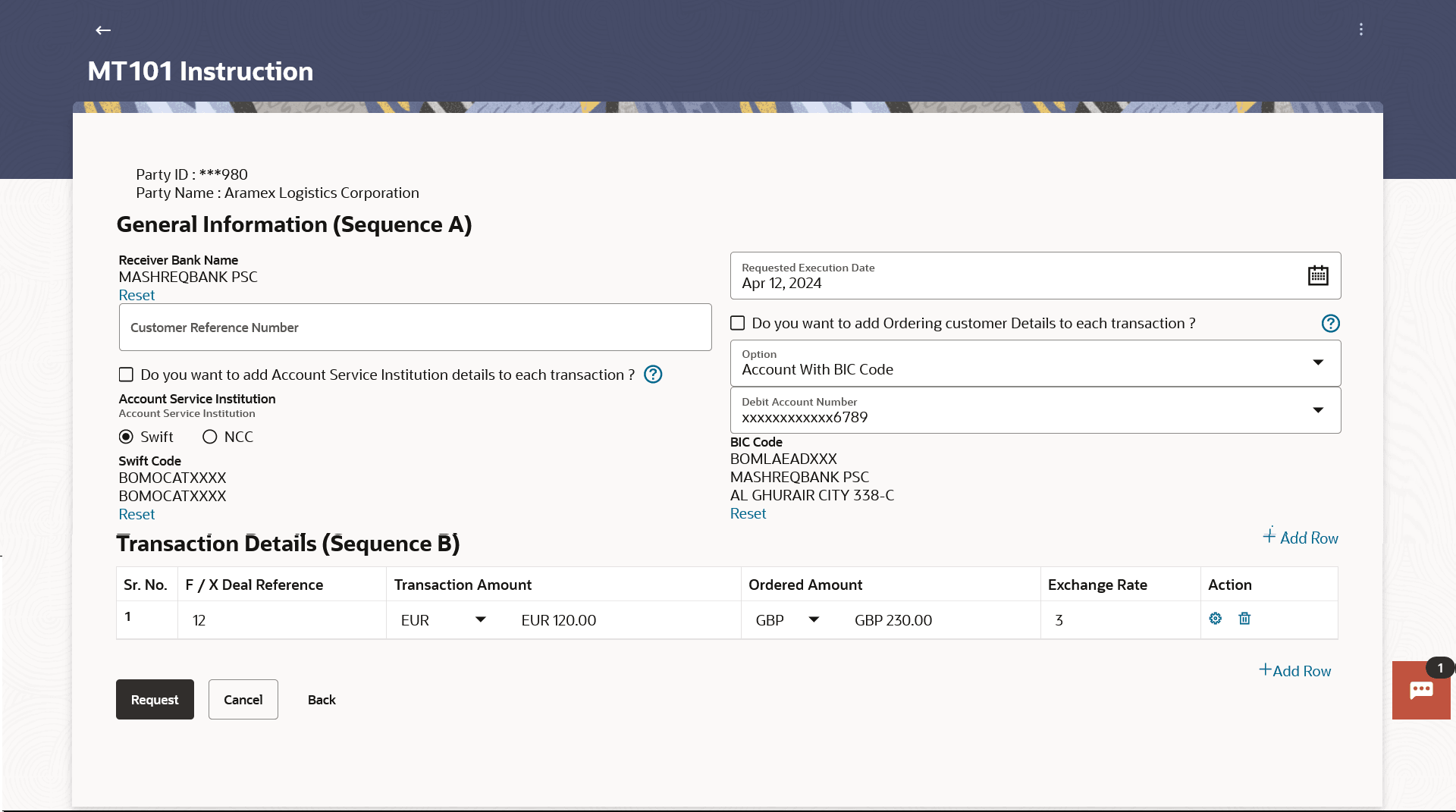

11 MT101 Instruction

This topic provides the systematic instructions for users to perform domestic and international fund transfers using the MT101 module and SWIFT MT101 instructions.

This allows users to debit funds from a single account and credit to multiple domestic and/or international accounts in a single transaction. On the MT101 Instruction screen, all tag option fields will be replaced with channels banking user friendly options. An MT101 Instruction consists of two parts:

- General Information (Sequence A): This is mandatory and contains debit party information like Sender’s Reference, Instructing Party and Requested Execution Date.

- Transaction Details (Sequence B): This component is repetitive and must be present at least once in the message.

Standard approval flow (Maker → Checker) is supported by the system, however, ‘Send To Modify’ feature is not supported. Bulk Uploads for MT101 Instructions is also not supported. Please note, this transaction will only be supported on desktop/laptop devices.

Pre-requisites:

- Transaction and account access are provided to the corporate user

- Approval rule set up for the corporate user to perform the actions

- Transaction working window is maintained

- Transaction limits are assigned to the user to perform the transaction

- External accounts to be added and mapped. Refer to section ’16 - External Account’

To initiate an MT101 instruction:

- Perform anyone of the following navigation to access the Create MT101

Instructions screen.

- From the Dashboard, click Toggle menu, click Menu, then click Payments . Under Payments , then click More Actions, and then select MT101 Instructions, then click Create MT101 Instructions.

- From the Search bar, type MT101 Instructions - Create MT101 Instructionsand press Enter.

The Create MT101 Instructions screen appears.

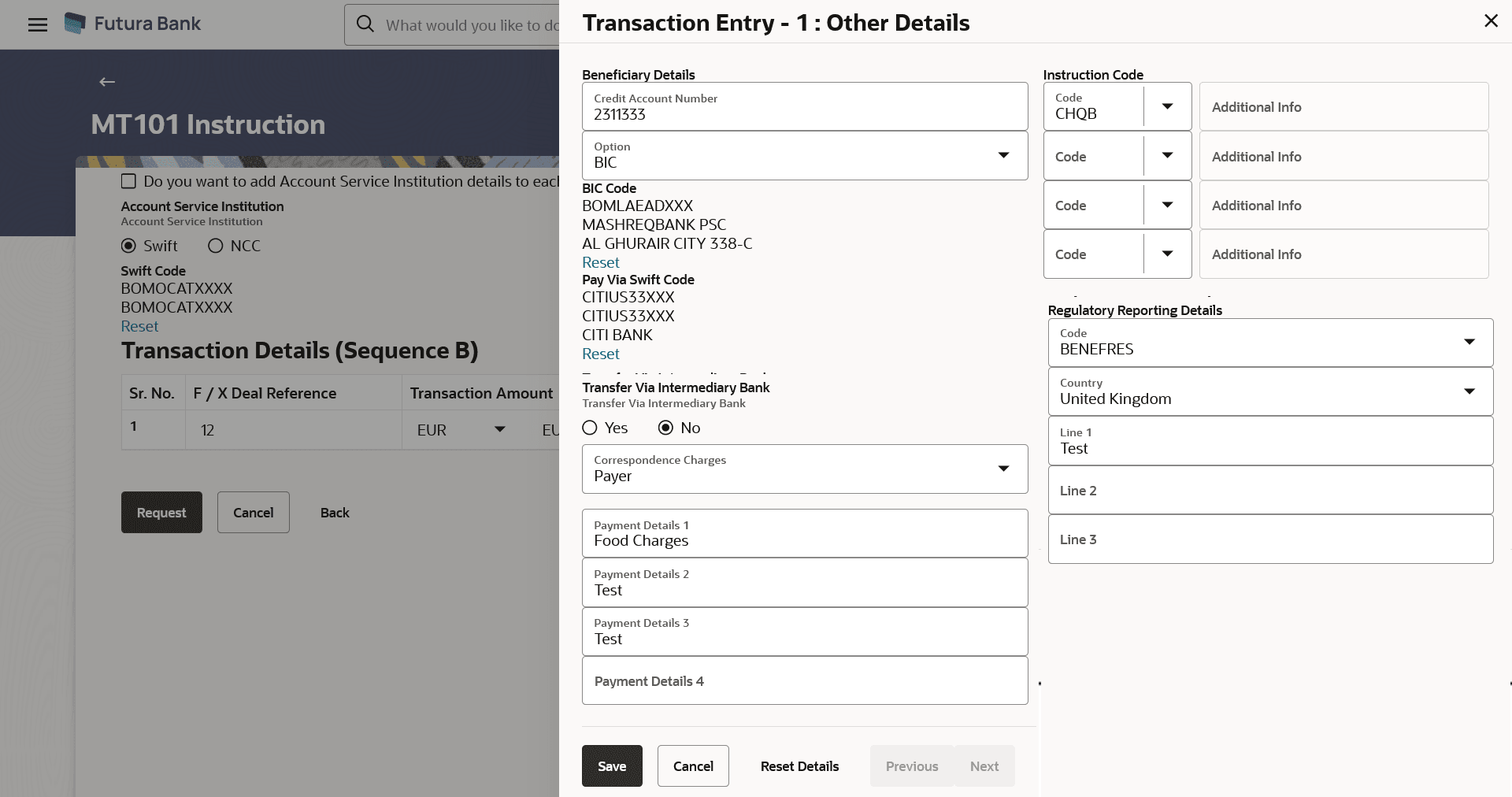

Figure 11-2 MT101 Instruction – Other Details Overlay screen

- Navigate to the screen.

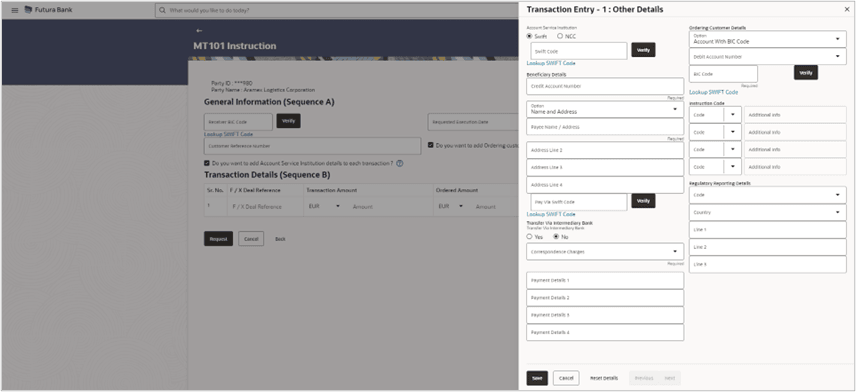

MT101 Instruction – Other Details Overlay screen (When Account Service Institution details and Ordering customer Details are added to each transaction)

Figure 11-3 MT101 Instruction – Other Details Overlay screen

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 11-1 MT101 Instruction – Other Details Overlay screen - Field Description

Field Name Description Party ID Displays the party ID of the user. Party Name Displays the party name of the user. The following fields are applicable for General Information (Sequence A) of MT101 Instruction: Receiver BIC Code The BIC code of the receiver’s bank. For more information, refer Lookups section.

Note:

Click Lookup Swift Code to search the Receiver Bank based on the BIC Code.OR

Click Reset to change the Receiver bank.

Receiver Bank Name Displays the receiver bank name. This field gets displayed on entering Receiver BIC Code.

Requested Execution Date Specify the date on which all subsequent transactions should be initiated by the executing bank. Customer Reference Number The reference to the entire message assigned by the user. Do you want to add Ordering customer Details to each transaction? Option to add Ordering customer details to each transaction. Note:

If there is only one debit account, the ordering customer must be identified in sequence A. Conversely, if multiple debit accounts are used, they must be identified for every transaction of Transaction Details (sequence B).Consequently, Ordering Customer details must be present in either sequence A or in each occurrence of Transaction Details(sequence B) , but must never be present in both sequences, nor be absent from both sequences.Option Select the option if you do not wish to add Ordering customer details to each transaction. The options are:

- Account with BIC Code

- Account with Address

This field is enabled if the user has not opted for the Do you want to add Ordering customer Details to each transaction? option.

BIC Code Enter the instructing party’s Business Identifier Code. This field is enabled if the Account With BIC Code option is selected in the Option field.

Debit Account Number The external account from which money will be debited. This field is enabled if the user has not opted for the Do you want to add Ordering customer Details to each transaction? option.

Name/Address Enter name and address of the instructing party. This field is enabled if the Account With Address option is selected in the Option field.

Address Line 1-4 The address of the instructing party. This field is enabled if the Account With Address option is selected in the Option field.

Do you want to add Account Service Institution details to each transaction ? Option to add an Account Service Institution details to each transaction. Note:

Account Service Institution may be present in either sequence A or in one or more occurrences of Transaction Details (sequence B), but must not be present in both sequences.Account Service Institution Option to select, if the account to be debited belongs to bank other than the receiver bank. The options are:

- Swift

- NCC

SWIFT Code Enter debtor bank details, if the account to be debited belongs to bank other than the receiver bank. This field is enabled if the Swift option is selected in the Account Service Institution field.

NCC Enter national clearing code details of debtor bank, if the account to be debited belongs to bank other than the receiver bank. This field is enabled if the NCC option is selected in the Account Service Institution field.

The following fields are applicable for Transaction Details (Sequence B) of MT101 Instruction. F/X Deal Reference The foreign exchange contract reference. Transaction Amount The amount and currency for the respective transaction. Ordered Amount This amount is to be entered for cross-currency transactions, where the user has a valid F/X deal reference number. The user is to enter the converted ordering amount and currency. Exchange Rate The Exchange Rate specified while converting the transaction amount to ordering amount. Action The settings  icon provisions the user to enter further details of the entry of

Transaction Details (Sequence B.)

icon provisions the user to enter further details of the entry of

Transaction Details (Sequence B.)

The delete

icon allows the user to delete the respective row.

icon allows the user to delete the respective row.

Transaction Entry- Other Details Below fields appears in the overlay window. Credit Account Number Account number of the creditor. Option User to select one of the following values: - Name and Address: Represents name and address of creditor.

- BIC: Business Identifier Code of the creditor.

Payee Name/Address Enter name and address of creditor. This field is enabled on selecting the Name and Address option.

Address Line 1-4 The address of creditor. BIC Code Enter Business Identifier Code of the creditor. This field is enabled on selecting the BIC option.

Pay Via Swift Code This field represents the BIC code of the creditor’s bank. Transfer Via Intermediary Bank Option to specify whether the fund transfer is to be done through intermediary bank or not. The options:

- Yes

- No

Swift Code The BIC code of the intermediary bank to be entered. This field is enabled if Yes option is selected in the Transfer Via Intermediary Bank field.

Payment Details The provisions the user to enter specific details about the transaction. Add up to 4 Payment Details, each of which must be no longer than 35.

Instruction Code The instructions to be used between the ordering customer and the account servicer. Add up to 4 fields, each of which must be no longer than 35.

Regulatory Reporting Details Code User to select BENEFRES, to enter Residence of the payee customer. Whereas, ORDERRES is to be selected to enter Residence of the ordering customer. Country User to enter address of payee or ordering customer based on the code selected. - In the Receiver BIC Code field, enter the BIC code of the

receiver’s bank. The system displays the receiver bank name.

- From the Requested Execution Date date picker list, select the date on which all subsequent transactions should be initiated by the executing bank.

- Perform one of the following actions:

- In the Do you want to add Ordering customer Details to each transaction?

field.

Select the checkbox if you wish to add Ordering customer Details to each transaction.

- In the Option field, select the option if you do not wish to

add Ordering customer details to each transaction.

- From the Debit Account Number list, select the external account from which money will be debited.

- If you select the Account With BIC Code

option;

- In the BIC Code field, enter the instructing party’s Business Identifier Code, and Click Verify.

- In the Do you want to add Ordering customer Details to each transaction?

field.

- In the Do you want to add Account Service Institution details to each transaction ? field, select the checkbox if you wish to add Account Service Institution details to each transaction.

- In the Account Service Institution field, select the desired

option if the account to be debited belongs to bank other than the receiver bank.Perform one of the following actions:

- f you select Swift

option;

In the Swift Code field, enter the debtor bank details, if the account to be debited belongs to bank other than the receiver bank, and click Verify.

- If you select NCC

option;

In the NCC field, enter the national clearing code details of debtor bank, if the account to be debited belongs to bank other than the receiver bank.

- f you select Swift

option;

- Enter required details in the Transaction Details (Sequence B)

section;

- In the F/X Deal Reference field, enter the foreign exchange contract reference number.

- In the Transaction Amount field, enter the amount and currency for the respective transaction.

- In the Ordered Amount field, enter the converted ordering amount and currency.

- In the Exchange Rate field, enter the exchange rate while converting the transaction amount to ordering amount.

- Click the setting

icon to enter further details of the entry of Transaction Details

(Sequence B). The Transaction Entry -1:Other Details overlay screen appears.

icon to enter further details of the entry of Transaction Details

(Sequence B). The Transaction Entry -1:Other Details overlay screen appears.- Enter all the required details.

- Perform one of the following actions:

- Click Save to save the details.

- Click Reset Details to clear all entered details.

- Click Cancel to navigate back to previous screen.

Note:

Perform one of the following actions:- Click +Add Row to add new row in the Transaction Details (Sequence B) section.

- Click

icon to delete the respective row.

icon to delete the respective row.

- Perform one of the following actions:

- Click on the Request to initiate the MT101

instruction.

TheReview screen appears.

- Click Cancel to cancel the transaction.

- Click Back to navigate back to previous page.

- Click on the Request to initiate the MT101

instruction.

- Perform one of the following actions:

- Verify the details, and click

Confirm.

The success message appears, along with the reference number.

- Click Cancel to cancel the transaction.

- Click Back to navigate back to previous page.

- Verify the details, and click

Confirm.

- Perform one of the following actions:

- Click Home to go to the Dashboard screen.

- Click Click View Other Transaction to view the entered other details for transaction.

- Click Request New MT101 Instruction to initiate new MT101 instrucon.

- MT101 Instructions Inquiry

This topic describes the MT101 Instructions Inquiry screen, which enables users to view all MT101 instructions that have been raised. - External Account

This topic describes external accounts as those belonging to customers who are initiating MT101 instructions. - MT101 Bilateral Agreement

This topic describes the MT101 module, which facilitates the transfer of funds, both domestically and internationally, through the transmission of SWIFT MT101 instructions to the user's bank.