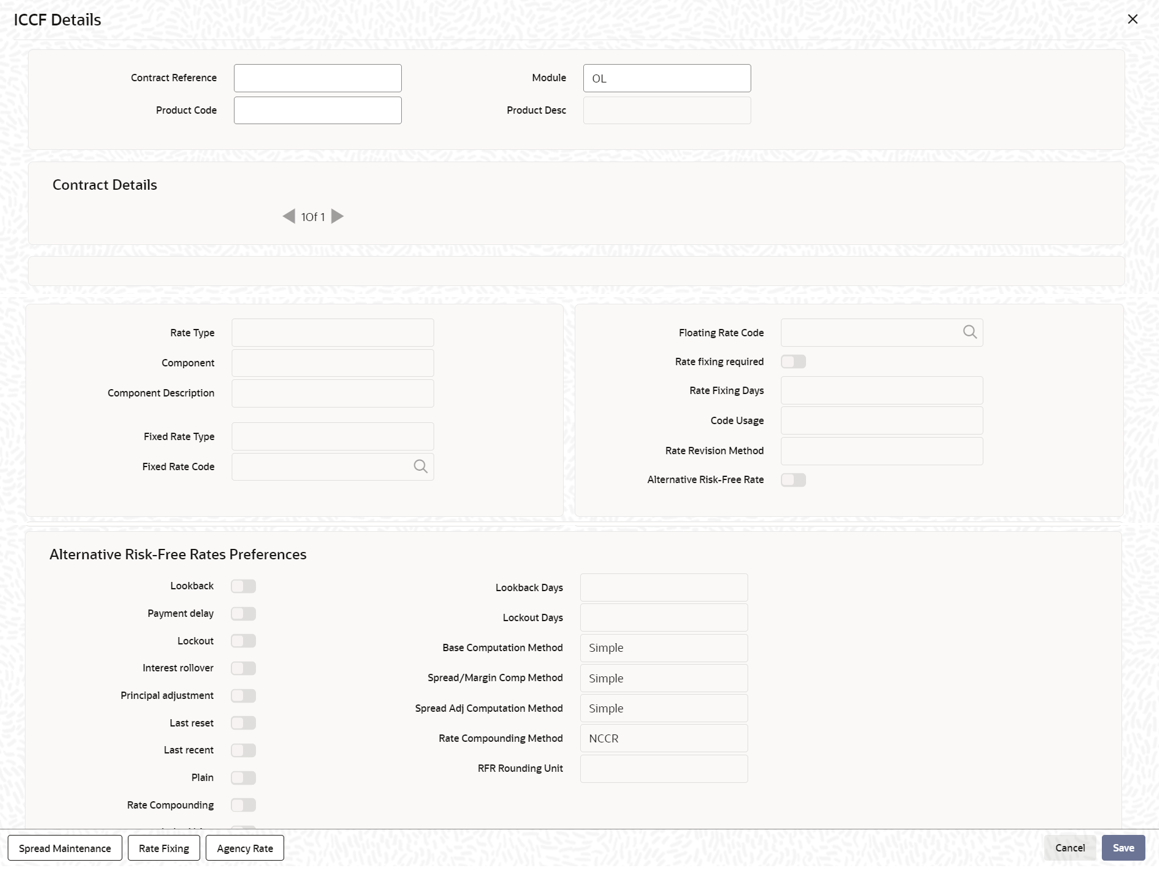

| Fixed Rate Type |

For a Fixed rate type, this indicates whether the rate is user specified or is picked up from the rate maintenance table. The options are:

- User Input (U) – This option indicates that the user specifies the rate of interest applicable on the contract.

- Standard (S) – This option indicates that the system picks-up the rate from the Standard Rate Maintenance screen. This rate is a combination of the Standard Rate and Tenor-wise Spread.

This specification is defaulted from the loan product involved in the contract and you cannot change it at the contract level.

|

| Special Rate Type |

System defaults the maintenance done for Special Rate Type in the Interest Limits Maintenance screen. However, you can edit this value and select the special rate type from the adjoining drop-down list. This list displays the following values.

|

| Fixed Rate Code |

If the Fixed Rate Type is Standard, this indicates the Standard Rate Code based on which the system pick ups the rate applicable on the contract.

This specification is defaulted from the product. However, you are allowed to change it at the time of contract processing.

|

| Penalty Rate Code |

If pre-payment penalty is allowed for the loan product, select the rate code based on which the system pick-ups the prepayment penalty rate for the contract.

This specification is also be defaulted from the product. However, you are allowed to select a different rate code at the contract level.

|

| Revision Method |

Select the revision method option for the periodic floating type of loans from the list of option provided:

|

| Alternative Risk-Free Rates |

For information on Alternative Risk-Free Rates, refer to Interest Class Maintenance in this User Manual.

|

| Interest Rate Rounding Components |

The Rate Rounding Rule, Rate Rounding Unit, and Rate Rounding Position values get defaulted from Interest Limits Detail screen. If required, you can change these values.

|

| Consider as Discount |

While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is to be considered for discount accrual on a constant yield basis.

The value for this field is defaulted from the Interest Definition and it can be changed here. If Accrual Required option is not selected then Consider as Discount option is disabled for Bearing Contracts.

If you select this option the interest received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Note: You are allowed to enable the Consider as Discount option for loans only when the payment method specified is Discounted or True Discounted and for the Discount operation for Export bills.

For bearing type of contracts, all future interest cash flows are considered for computation of constant yield. For discount type of contracts, only the interest amount received for the components with the Consider as Discount option enabled are considered for the computation of constant yield; subsequently the interest amount received in advance for these components is amortized over the tenor of the associated contract.

|

| Interest Component accrual |

While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is required to be accrued.

The value for this field is also defaulted from the Interest Class Maintenance screen. However, you can change it here.

Note: If both Consider as Discount and Accrual Required fields have not been enabled for the product, you cannot enable these for contracts.

If the Special Penalty Component check box is selected for a component, then system deselects the Accrual Required box for such components and disable it.

|

| Special Penalty Comp |

System automatically selects this box for late payment charge components (based on the maintenance done in Interest Class Maintenance screen) and you cannot modify it.

|

| Interest period basis |

You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of interest components applicable for the contract. This preference is inherited from the Interest Limits definition for the product used by the contract, and you can change the default option chosen.

You can choose any of the following options:

- Including the From Date

- Including the To Date

- Including both From and To Dates

- Excluding both From and To Dates

For details about the four options, refer the topic Specifying the Interest Basis under the head Building Interest Classes, in this User Manual.

|

| Waiving an Interest Rule |

You have the option of waiving those rules (defined for the product), which you do not wish to apply on a contract.

Example For a product, there can be one interest rule for the main interest (for example, 14%). You can have a tenor-based commission defined as an interest rule for the same product (for example, 3%). Both these apply to contracts involving the product. However, you can waive these rules for a specific contract. For instance, you can waive the 3% commission on the contract (by checking the Waive field.)

|

| Interest Amount |

System defaults the value maintained for Default Amount in the Interest Class Maintenance screen for a late payment component which has Rate Type as SPECIAL and Special Rate Type as Flat Amount. However, you can edit this value during contract input.

|

| Penal Compounding on Rate Revision |

The Penal Compounding on Rate Revision check box is available in the Contract ICCF sub-screen. It is read only and displays the value selected at product level.

The calculation for the basis amount based on the following:

- The date from which penalty is due (Min Due Date) and penalty amount paid.

- Accruing the penalty interest due from Min Due Date to the current schedule date.

- Modifying the basis amount for the current schedule as

- Basis Amount = Basis Amount + Penalty Due – Penalty Paid

|