4.2.29 Interpolation

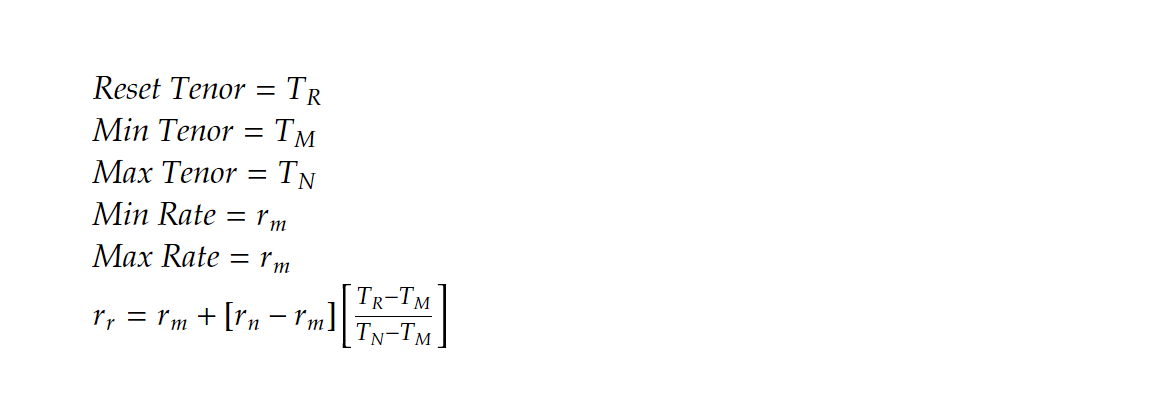

Interpolation is used to determine interest rates for a period of time that are not available.

In this case, the interest rate is the dependent variable, and the length of time is the independent variable. To interpolate an interest rate, you need the interest rate of a shorter period of time and a longer period of time.

In Corporate Lending, changes are made to standard interpolation formula so that the system picks the actual days for a month instead of directly picking the tenor available in the Floating Maintenance screen.

When the Rate Calculation Type is set to Interpolate, the system calculates the rate based on the rates of shorter and longer tenors. The periods used for interpolation are determined by the loan parameter INTERPOLATE_WITH_ACTUALDAYS, which has a default value of Y.

- When this field is set to Y (Default), the system will calculate the interpolation using the actual number of days in each month within the reset tenor. For example, if the reset tenor spans of one month has 30 days and another month has 31 days, the system uses actual calender days, which has 30 and 31 days in its interpolation calculation.

- When this field is set to N, the system uses the predefined tenor slabs from Floating Rate Maintenance (CFDFLTRI) screen instead of actual calendar days, even if the tenor days are multiples of 30.

Figure 4-7 Interpolation Formula

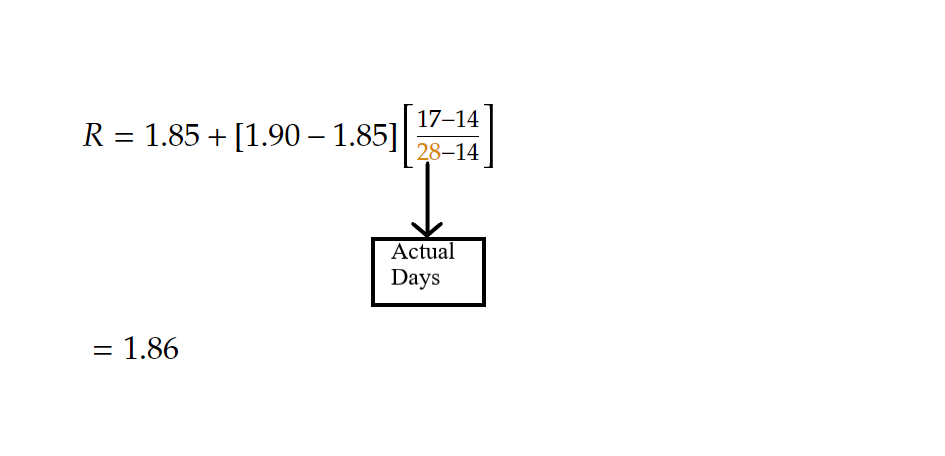

For example

Floating rates are maintained in the following format.

Currency - USD

| Tenor | Rate |

|---|---|

| 0 | 2.1 |

| 7 | 1.78 |

| 14 | 1.85 |

| 30 | 1.90 |

| 60 | 2.1 |

| 90 | 2.03 |

| 180 | 1.85 |

| 360 | 1.7 |

| 999 | 1.89 |

Schedule Date is 4-2-2015 and reset tenor is 17.

Parent topic: Loan Disbursement Details