A commitment is initiated through the Contract On-line screens. Through the Contract Details screen, you have to specify the following:

- Counterparty (customer)

- Currency

- Credit line

- Amount

- Settlement Account

- Maturity Date (fixed)

- Tenor

While booking or amending a commitment, if the UDF

RATE-VARIANCE is maintained as a non-zero value for the commitment contract, dual authorization is required.

For more information about dual authorization, refer to Dual Authorization topic in this manual.

Through the Contract Schedules screen, you have to specify the type of the commitment. A commitment can be:

- Revolving or

- Non-revolving

Revolving

In a revolving type of commitment, the amount available is

reinstated whenever there is a payment against a loan linked to it.

Non Revolving

In a revolving type of commitment, the amount repaid

against a loan is not reinstated.

Through this screen, you can also indicate whether

the status movement (aging analysis) has to be done automatically or manually for

the commitment.

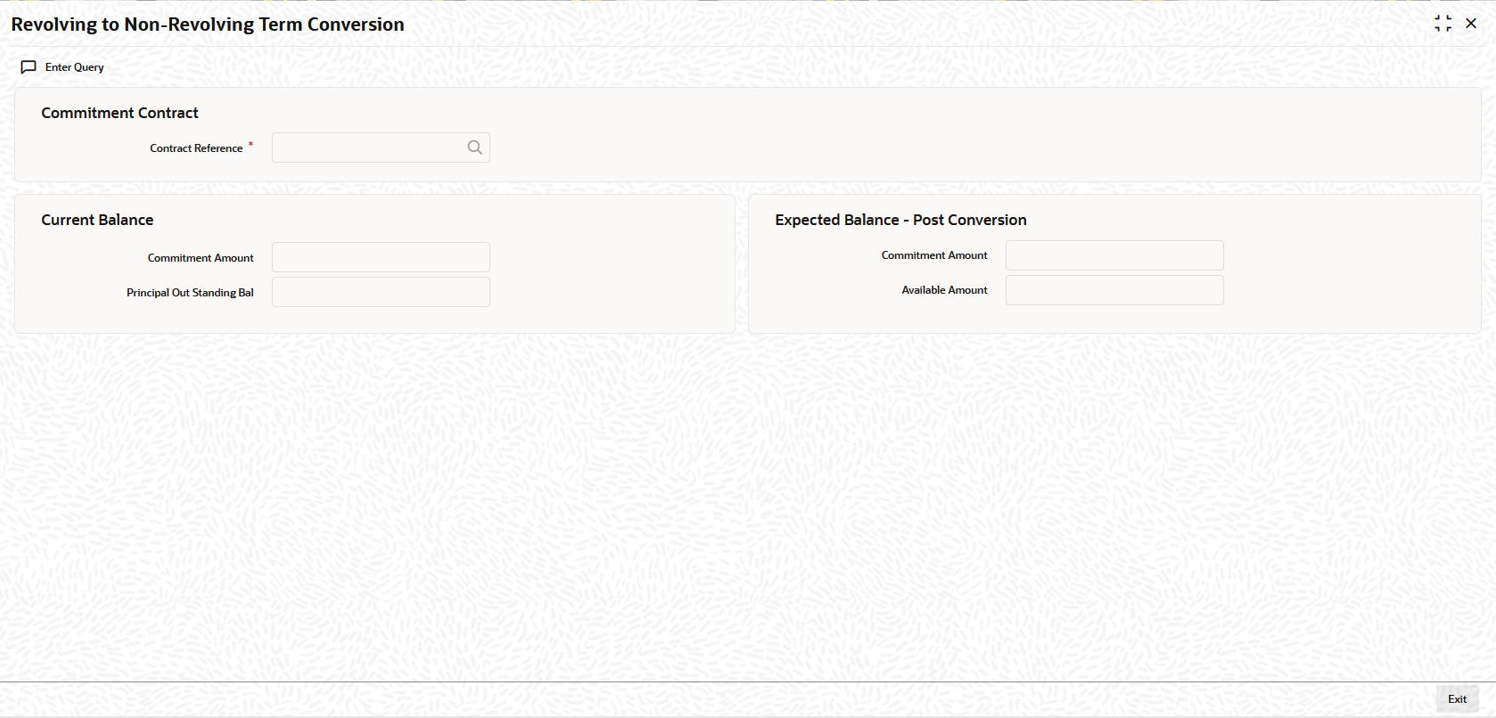

You can convert the existing revolving commitment contract to

non revolving commitment (Term commitment) contract using, Revolving to

Non-Revolving Term Conversion screen.

You can change the

contract preference from revolving to non-revolving in Revolving to Non-

Revolving Term Conversion screen.

Specify the User ID and Password, and

login to Homepage.

- On the homepage, type OLDTMCNV and click next

arrow.

The

Revolving to Non-Revolving Term Conversion

screen is displayed.

Note:

The fields which are marked in asterisk red are

mandatory fields.

- You can enter below details in this screen.

Current BalanceExpected Balance – Post Conversion

- Commitment Amount

The total commitment amount

after conversion is displayed in this field.

- Available Amount

The total unutilized amount of

a commitment contract after conversion is displayed in this

field.

The contract balances are not rebuilt by the system while

converting the commitment from Revolving to Non-Revolving. You should

handle any balance changes during the conversion or subsequent to

conversions by means of Value dated amendments for the respective

commitments.

In the preferences screen, you have to indicate your

schedule preferences:

- Whether holidays are to be ignored when schedule dates are

calculated.

- Whether schedule dates are to be moved (backward or forward)

if a schedule date falls on a holiday.

- Whether a movement of the schedule date across the month is

allowed.

- Whether the mode of liquidation of the repayment schedules

has to be automatic.

For a commitment, the schedule you have defined for the product

is applied to the fee, by default. You can reverse these schedules

through the

Contract online screen, Schedules

tab by providing the following details.

- The start date

- The number of schedules

- The frequency and unit

- The amount if the fee is a flat amount

For the principal schedule defined to maturity, you have to

give the principal amount through this screen. You can also indicate

your preference for cost of credit valuation.

The fee and principal schedules can

be liquidated automatically or manually, through the Manual

Liquidation screen.

- Cost of Credit Valuation

The system displays

the option entered at the product level. If the option is deselected

at the product level, it is disabled in this screen and you cannot

select this option at the contract level. If this option is selected

at the product level, then you can deselect it. During contract

amendment, you can select it or deselect it based on its value in

the previous version.

The system performs cost of credit

valuation for the contract for both performing and nonperforming

contracts only if the Cost of Credit Valuation

Reqd check box is selected for the contract.

This topic contains following sub-topics: