- Bilateral Loans

- Defining Attributes Specific to Loan product

- Setting Product Preferences

- Specifying Additional Preference

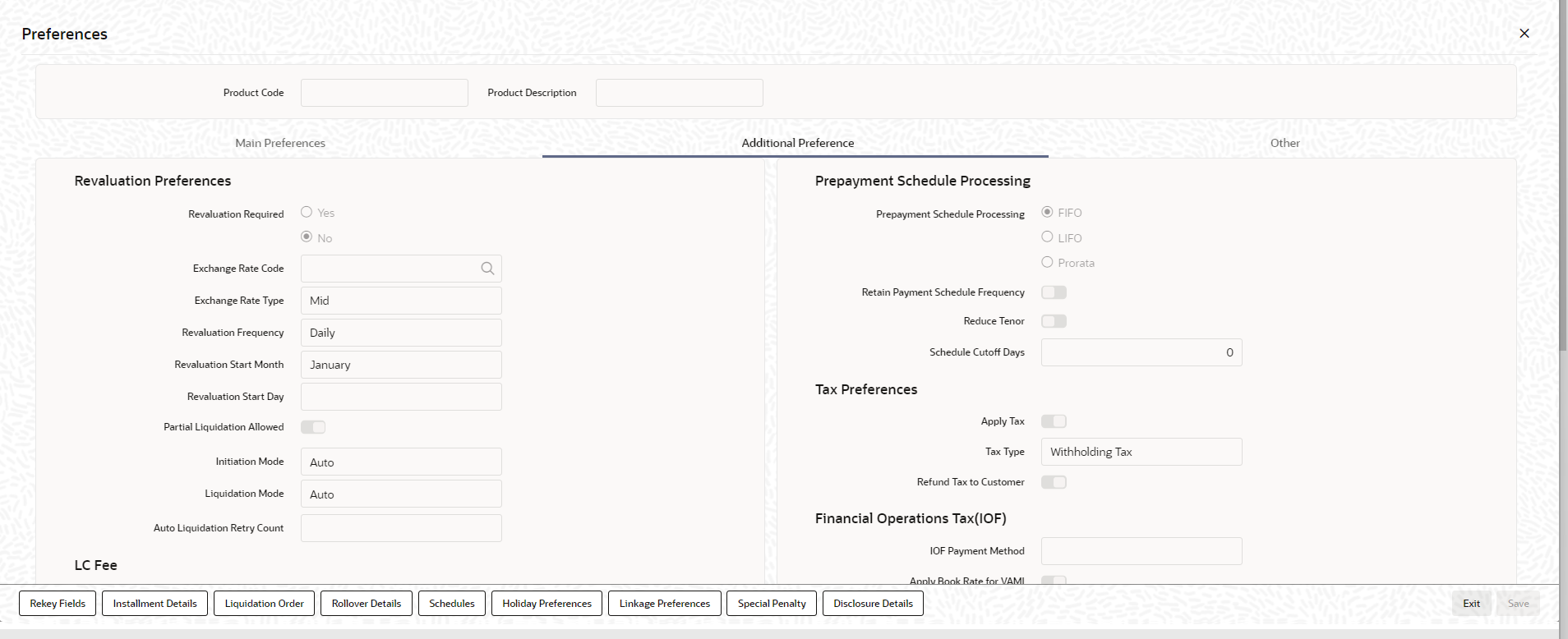

3.2.11 Specifying Additional Preference

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Bilateral Loans Product Definition screen.

From the Bilateral Loans Product Definition screen, click Preferences.

- From the Preferences screen, click Additional

Preferences tab.The Additional Preferences screen is displayed.

Note:

You can select rate fixing type as automatic or manual. By default, it is automatic For more information on rate fixing, refer to Interest User Manual. - You can enter below details in this screen. For information on fields, refer to

the field description table.

Table 3-5 Additional Preference

Field Description Liquidation Mode Components of a loan can be liquidated automatically or manually. You should indicate whether the mode of liquidation of repayment schedules is to be automatic or manual. You can also indicate that certain specific components must be liquidated automatically. If you opt for automatic liquidation, a schedule is automatically liquidated on the day it falls due, during beginning-of-day processing (by the Automatic Contract Update function). Specify Auto liquidation if you want all the components of a loan involving this product to be liquidated automatically.

If you opt for manual liquidation you have to give specific instructions for liquidation through the manual liquidation screen on the day you want to liquidate the schedule. Specify Manual liquidation if you want to perform a manual liquidation for all components of a loan involving this product.If you want some specific components to be liquidated automatically in a certain prioritized order, you can specify component liquidation. When you choose this option, you can select the components that must be liquidated automatically, and define the order in which they are liquidated automatically. In such a case, the components not selected must be liquidated manually, by entering the payment in the manual liquidation screen.

Note:

You can select components to be automatically liquidated only if the liquidation type chosen for the product is Component.Partial Liquidation Allowed Select the Partial Liquidation Allowed check box to allow partial payment of amounts due on a schedule date. For a contract, the value of partial liquidation allowed is defaulted from product and also you can change the value.If this box is deselected, then system does not allow partial settlement of components that are due. If the payment amount(s) is less than the amount(s) due, then system does not allow the payment to be saved and system displays the following error message: Partial payment not allowed.

This check box is also applicable in case of manual liquidation.Product Restrictions When you create a product, you can provide product restrictions. That is, you can specify the branches of your bank that can offer this product, the currencies that are allowed or disallowed and the customers who can avail the product. You can set preferences as Allowed/Disallowed in this screen and the same is defaulted to Bilateral Loan and Commitment Restrictions screen. Auto Liquidation Retry Counter You can enter the number of days in Auto Liquidation Retry Days field at the product level. During auto liquidation of a contract, the system initiates an ECA call, to validate account balance. If DDA system rejects the ECA request due to insufficient balance or any invalid status of the account, then on subsequent batch / day system re-triggers the ECA & tries to liquidate the schedule. This re-try is done up to the number days specified on this parameter. This number of days is on calendar days basis. When the CL batch is configured on both BOD and EOD, liquidation for the schedule is tried on both slots, however the number of days is considered as 1.

Example for Auto Liquidation Retry Counter

A loan with a value of USD 100,000 is value dated 1st January 2020 and matures on 1st May 2020 and CASA account having balance of zero. The payment schedules are on 1st February 2020, 1st March 2020 and 1st April 2020.Auto Liquidation Retry Counter is 3 and Schedule date is Feb 1 2020.

The system checks the amount in 1st, 2nd and 3rd Feb. From 4th Feb, the schedule gets skipped until next schedule.Table 3-6 Auto Liquidation Retry Counter

Schedule Processing date - 1 1st February 2020 Check the due amount in CASA 2 2nd February 2020 Check the due amount in CASA 3 3rd February 2020 Check the due amount in CASA 4 4th February 2020 Skip the schedule 5 1st March 2020 Check the due amount in CASA 6 2nd March 2020 Check the due amount 7 3rd March 2020 Check the due amount in CASA 8 4th March 2020 Skip the schedule 9 1st April 2020 Check the due amount in CASA This topic contains following sub-topics: