10.1 Introduction

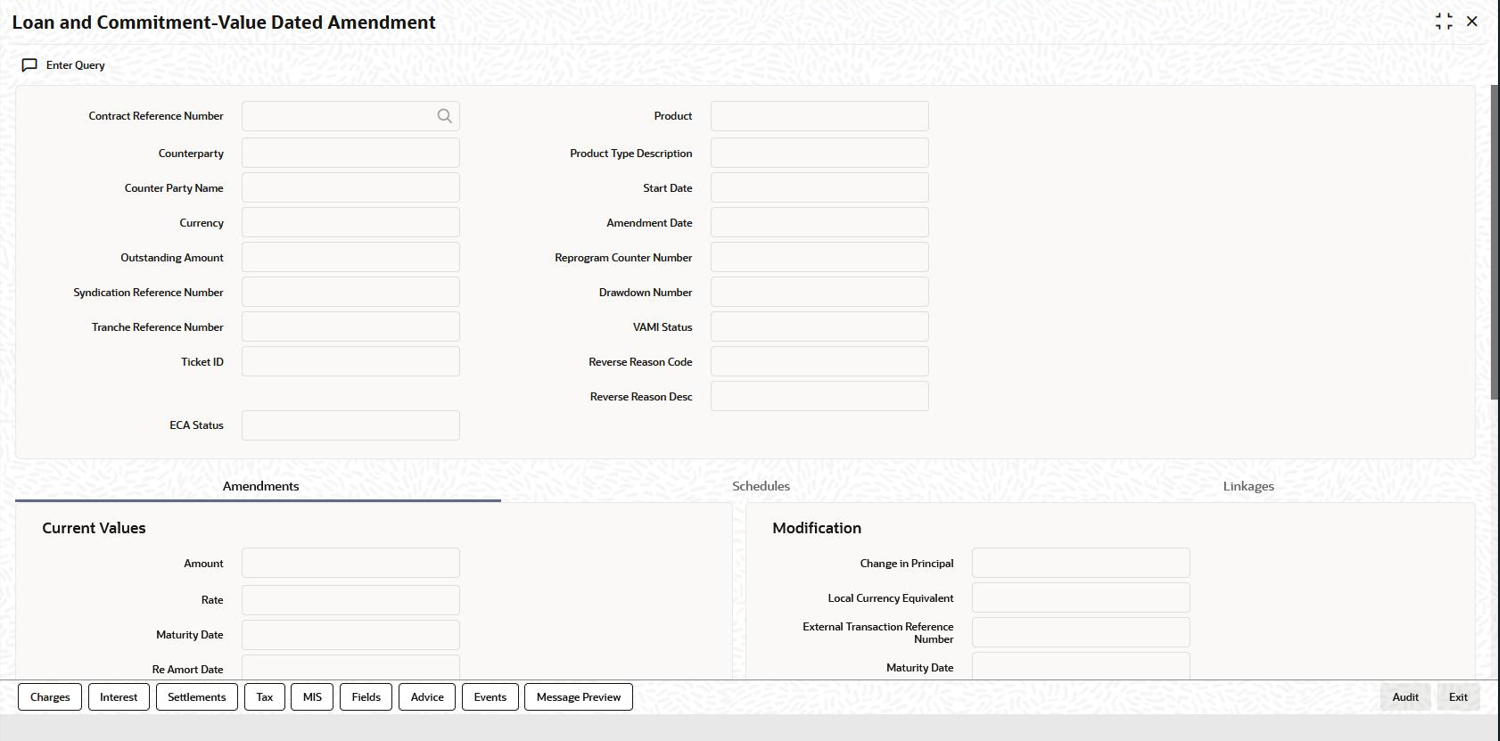

Any change to the terms of a loan, which affects its financial details and the

accounting entries, can be made through the Value Dated Amendment function of Oracle

Lending. Through this function you can make changes to authorized loans on any day

before the Maturity Date of the loan.

The changes to the terms of a loan, notified through this function, take effect on a date referred to as the Value Date. That is why the changes brought about by this function are called Value Dated Amendment.

A Value Date could be:- Today

- A date in the future

- A date in the past

Using the Value Dated Amendment function, you can make changes to the various

components of a loan such as:

If the value date is a date in the past, it should

not be beyond the last payment date for any component.

- Additional disbursement of Principal

- The interest rate or amount

- The fees

- The Maturity Date

You should ensure that a contract - on which you plan to make backdated changes - does not have amortized schedules.

In addition, a value date in the future cannot be beyond the Maturity Date of the loan. If it has to be beyond the Maturity Date of the loan, you have to first postpone the Maturity Date of the loan so that your proposed future value date falls before the new maturity date. Only after this change is authorized can you fix a value date in the future for the loan.The system defaults to today’s date.

Note:

If a contract is pending for authorization in any screen and if you try to unlock in OLDVAMND to do changes, then an error message Unauthorized amendments exist for contract in function id appears.Specify the User ID and Password, and

login to Homepage.