- Secondary Loan Trading

- Defining Attributes of an SLT Product

- Introduction

- Specifying Fee Details

3.1.2 Specifying Fee Details

To capture details of SLT product fees details

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Secondary Loan Trade - Product Definition screen.

- From the Secondary Loan Trade - Product Definition

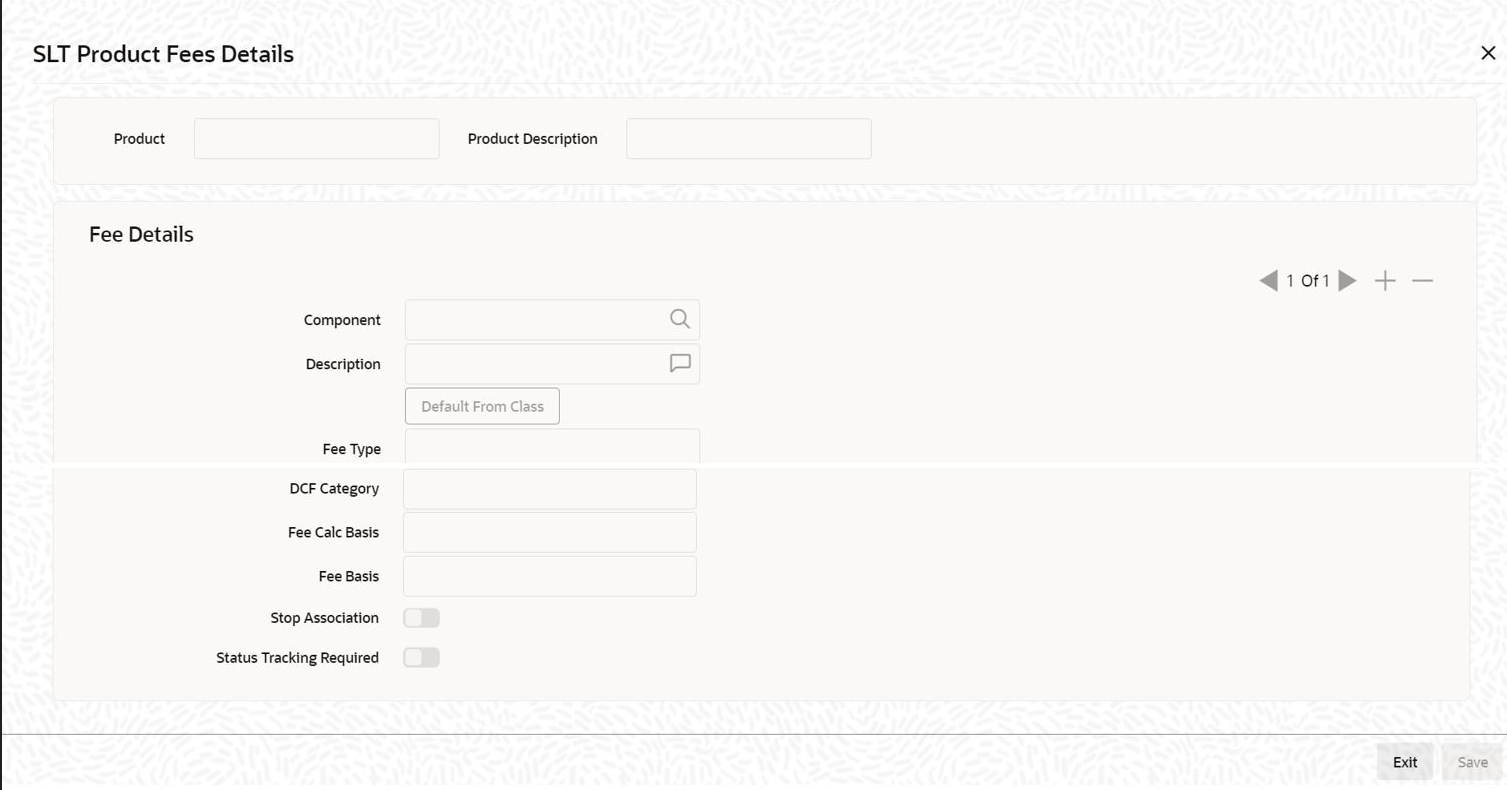

screen, click on Fees.The SLT Product Fees Details screen is displayed.

Figure 3-3 SLT Product Fees Details

- You can enter below details in SLT Product Fees Details

screen. For information on fields, refer to the field description table.

Table 3-7 SLT Product Fees Details

Field Description Component Specify the name of the fee component for which you are maintaining the details. Description Specify a suitable description for the fee component. Fee Type Select the type of the fee from the drop-down list. The following options are provided: - Broker Fee

- Break-fund Fee

- Waiver Fee

- Assignment Fee

- Amendment Fee

- Adhoc Buyer Fee

- Adhoc Seller Fee

- Line/Accommodation Fee

- DCF or Delayed Compensation Fee

DCF Category Select the sub category associated with the delayed compensation fee from the drop-down list. The following options are provided: - DCF_FIX_INT – all-in-rate interest for fixed type drawdowns

- DCF_FIX_MARGIN – interest using margin for fixed type drawdowns

- DCF_FLT_INT – all-in-rate interest for floating type drawdowns

- DCF_FLT_COF – cost of funds for floating type drawdowns

- DCF_COC - calculates COC for all type of funded amounts together.

- DCFUTILIZ – utilization fee

- DCFFACILITY – facility fee

- DCFSTBYLC – standby LC fee

- DCFCOMMLC – commercial LC fee

- DCFCOMM – commitment fee

The formula to calculate COC is given below;[(Fund*Price– (Unfunded + Commitment Reduction)*(1–Price)] as of T+20 (Expected Settlement Date)- (Funded Amount * Price - (Unfunded Amount + Commitment Reduction) * (1-Price)) * (Average LIBOR Rate) * (No of Days) / Denominator basis.

Rule-25-factor on T+20 = -------------

[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of Trade Date[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of T+21

Rule-25-factor on T+21 = -------------

[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of Trade Date

Note:

- For distress trades, the Rule-25 factor is computed starting from the Expected settlement date (T+20) till the actual settlement date.

- DCF category is applicable only for distress type of desk.

- If Rule of 25 becomes Yes for the current application date, then it remains Yes for all the subsequent dates, even if the variance changes to less than 25% for the same date due to some Back valued activities entered in the subsequent date.

- If Rule of 25 remain No from the Expected settlement date till the previous application date and if it becomes Yes while computing the factor on the current application date due to some back valued activities, then the Rule of 25 is applicable from the current application date only, not from the past dates.

- DCF COC value remains positive during the computation period.

- Till the Rule of 25 is No, the basis amount for DCF-COC computation is the COC basis amounts as on Expected Settlement Date (T+20). From the date Rule of 25 is Yes, basis amount for DCF-COC computation is derived on daily basis.

- Once the Rule of 25 becomes Yes, the daily balances are considered for the COC even if the Rule of 25 factors is No on any subsequent date. In other words, once COC catches Rule of 25, it remain with Rule of 25 for the rest of the delayed period.

- If the variance of the Rule-25-factor is greater than or equal to 25% (i.e. Rule-25- factor <= 0.75 OR Rule-25-factor >= 1.25) then Rule-of-25 is applicable for the computation. Otherwise Rule-of-25 is not applicable.

- If Rule-of-25 is applicable then the system computes DCF COC on daily basis from the Expected Settlement Date to the Actual Settlement Date, as per the below formula.

- (Fund * Price – ( Unfunded + Commitment Reduction) * (1-Price) ) * Average LIBOR * Days / Denominator basis

- (Fund * Price) * Average LIBOR * Days / Denominator basis

- If Rule-of-25 is not applicable then system computes DCF COC as the balance available on Expected Settlement Date as per the below formula;

- (Fund amount as of Expected Settlement Date * Price – ( Unfunded amount as of Expected Settlement Date + Commitment Reduction amount as of Expected Settlement Date) * (1-Price) ) * Average LIBOR * Days / Denominator basis

- (Fund amount as of Expected Settlement Date * Price) * Average LIBOR * Days / Denominator basis

- Funded amount * (Actual Settlement Date – Expected Settlement Date) * All-in Rate / Denominator basis

Fee Calc Basis Select the source for deriving the Fee Basis for calculating the fee amount, from the dropdown list. The following options are provided: - Agency - Fee Basis is arrived from LB Module for the respective component

- SLT – Fee Basis needs to be manually specified at the SLT product or contract level

Fee Basis The Fee Basis indicates the method in which a given fee amount has to be calculated. The values in the drop-down list are: - 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

Stop Association Select this check box to indicate the fee component should not be associated with the product henceforth. Note:

There are no fee components associated with internal deal type of products.Status Tracking Required Select this check box to allow the system to start and restart accrual of DCF components. Note:

You can select this check box only for the following type of DCF components:- DCF FUNDED FLOATING COF

- DCF FUNDED FLOATING INT

- DCF FUNDED FIXED INTEREST

- DCF FUNDED FIXED MARGIN

- DCF UNFUNDED COMMLC

- DCF UNFUNDED COMM

- DCF UNFUNDED FACILITY

- DCF UNFUNDED STANDBYLC

- DCF UNFUNDED UTILIZED

Parent topic: Introduction