4.12 Re-valuating Positions

Revaluation is performed for each open position under a CUSIP against the corresponding position identifier. For each combination of CUSIP and position identifier, the system generates a unique position contract reference number. The revaluation and reserve events along with the related accounting entries are passed for this position reference number.

The revaluation accounting entries are posted for the total position (settled + unsettled) as part of EOD batch program. These accounting entries posted are reversed during the BOD batch for the next working day.

Revaluation is performed using the market price details captured for the CUSIP. If the costing method defined for the portfolio is WAC, the system compares the market price with the WAC for the position. If the costing method is either LIFO or FIFO, then the system compares the trade price with the market price for each deal. A single set of accounting entries are posted for the position contract reference number, netting the revaluation entries for all deals under the CUSIP.

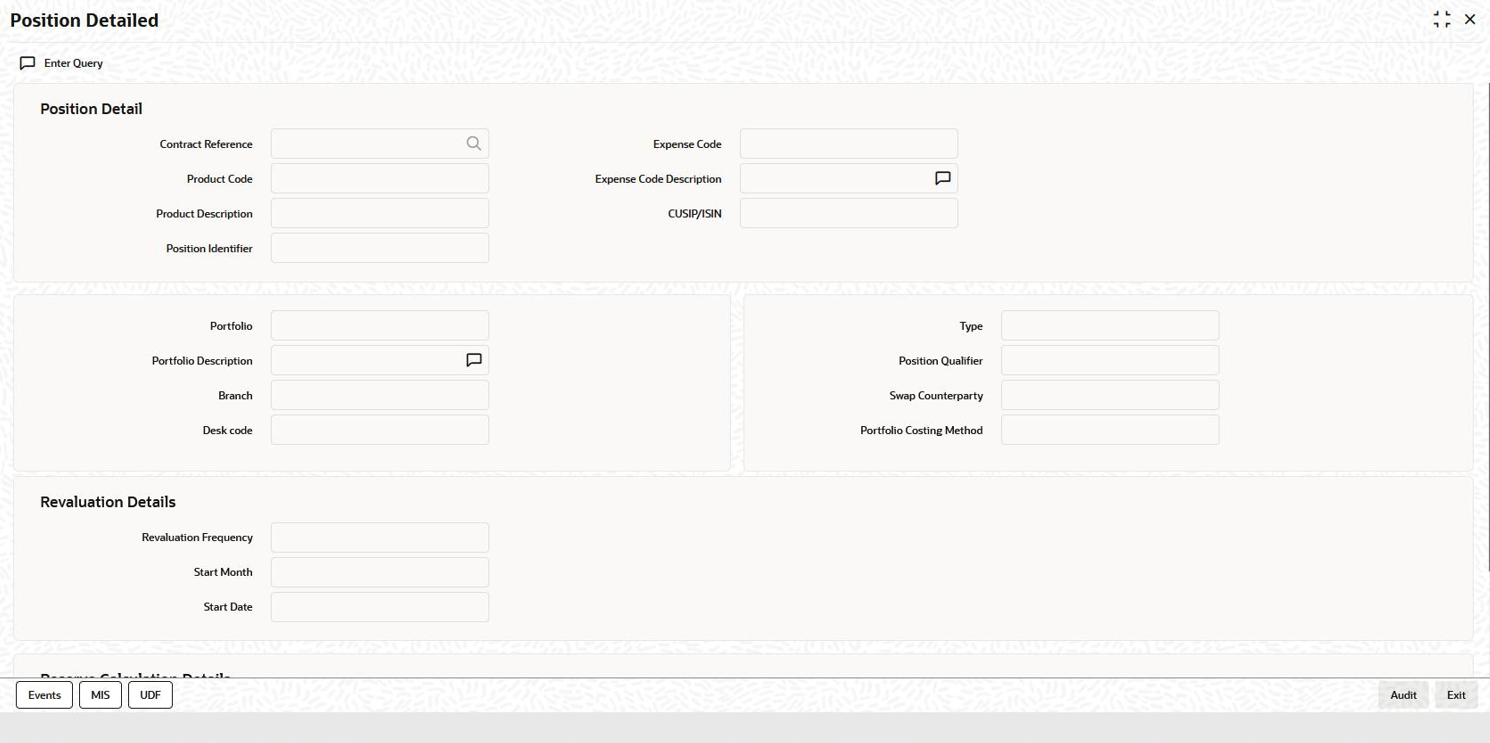

You can view the re-valuation preferences for a position contract in the Position Detailed screen. You can also view the revaluation accounting entries associated with the contract in this screen.

To capture details of position detailed screen

Specify the User ID and Password, and login to Homepage.

Parent topic: Processing an SLT Contract