- Secondary Loan Trading

- Maintaining Details Specific to SLT

- Position Identifier Details Maintenance

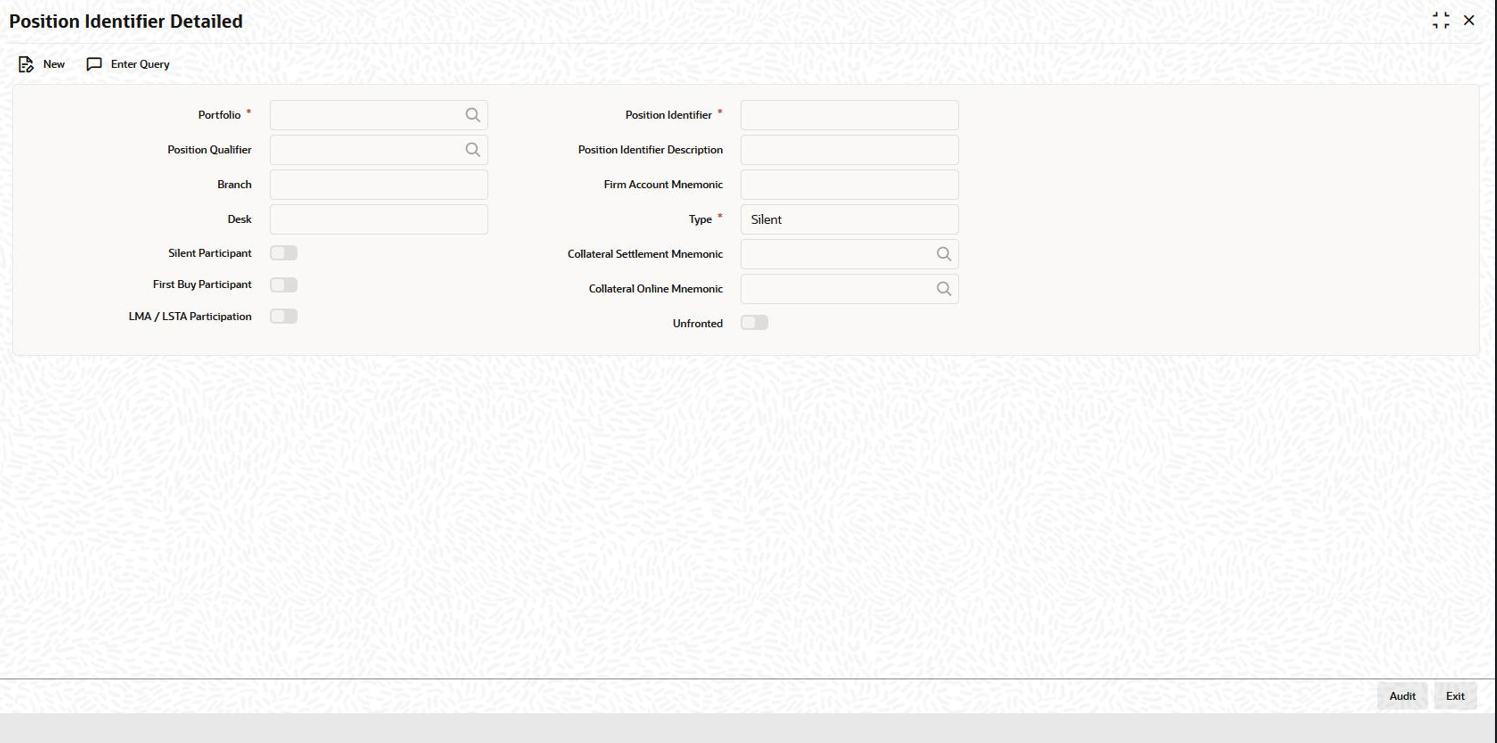

2.7 Position Identifier Details Maintenance

Position Identifier indicates the level at which position needs to be maintained for a portfolio. You can maintain settled and unsettled positions at position identifier level. You can maintain the details related to position identifier in Position Identifier Detail screen.

To capture details of position identifier screen

Specify the User ID and Password, and login to Homepage.

- On the homepage, type TLDPIMNT and click next

arrow.The Position Identifier Detailed screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can enter below details in Position Identifier

Detailed screen. For information on fields, refer to the field

description table.

Table 2-7 Position Identifier Details

Field Description Position Identifier Specify a unique identification for the position identifier to be used for tracking the position of the portfolio selected. Position Description You can also provide a description for the identifier in the adjoining column. Type Select the type of the position identifier from the drop-down list. The following options are provided: - Swap

- Silent

- Self

Note:

For TRS trades, you need to specify the type as Self in case of parent trades, and for corresponding swap trades the type gets defaulted as Swap.Portfolio The portfolio number specified in the Position Details screen gets displayed here. The branch, desk, and expense code details associated with this portfolio are also defaulted. Position Qualifier Select the position qualifier from the option list provided, for identifiers of type Silent. The option list displays the list of existing customers in Oracle Banking Corporate Lending. If type is Swap, the position qualifier indicates the Swap ID.

Note:

Position qualifier is disabled for Self identifier types.Branch Select the branch code associated with the position qualifier. Desk Select the desk code associated with the position qualifier from the list of options provided. All desk codes are maintained in Desk Maintenance are displayed. Firm Account Mnemonic The system displays the firm account mnemonic maintained in the Portfolio Maintenance screen. This displays only the valid CFPI firm account mnemonic uploaded through MCC and not the existing firm account mnemonic. Silent Participant Select this check box to indicate that the specific position identifier is a silent participant. If this option is selected, the position identifier type should be selected as Self and the desk type as Par or Distress. A single silent participant represents all the external participants who have bought the Participation from the bank. You can mark a specific position identifier as a silent participant across the branches and desk. If the position identifier for the Silent participant is not maintained, SLT-LB Handoff is in Failed status in SLT-LB Interface browser for Participation sell.

During SLT-LB handoff, a new wrapper contract is created for all the silent participation sold across the bank entities.Collateral Online Mnemonic Specify the collateral online mnemonic to the margin desk account. The adjoining option list displays all mnemonics that are maintained for the collateral online customer in the system. Collateral Settlement Mnemonic Specify the collateral settlement mnemonic to the margin desk account. The adjoining option list displays all mnemonics that are maintained for the collateral settlement customer in the system. First Buy Participant Check this box to indicate that the position identifier is a first time buy investor. Only one such position identifier can be marked as first time buy investor across branches and desks. This is applicable only for non-lead agency contracts. Tranche/DDs for the first-time buy trade CUSIP has to be created manually before the expected settlement date of trade with 100% participation from the first-time buy investor. When such tranche contracts are created, the delayed compensation fee (DCF) is calculated for the first-time buy trades between the committed settlement date and the actual settlement date.

Note:

- When a bank entity is selling the participation, and if the CUSIP exists in the system, during SLT to agency handoff, the external counterparty is replaced by the silent participant maintained in the Position Identifier Detail screen.

- As part of the Agency handoff, the bank position is reduced and the position of the Silent Participant position identifier which is representing all the External parties in the sell participation is increased to the extent of sell participation.

- System fires PRAM (Participant transfer) on the agency contract transferring the participant amount between bank entity and Silent participant.

- A new commitment contract is created to the extent of the trade amount in tranche currency, and Tranche maturity date as the commitment maturity date. This is done as part of STP to Originations for the Silent participant.

- The expense code of the bank entity who sold the Participation to the external party is used as the expense code for the new commitment contract.

- System STP further PRAM events from agency to newly created commitment for the silent participant, if there is subsequent sell of Participations by the same bank entity.

- For every Sell of Participations by another bank entity, another new commitment gets created for the silent participant to the extent of trade amount.

- System does not create loans for the underlying draw-down contracts for these silent participants.

Parent topic: Maintaining Details Specific to SLT