1.2 Features

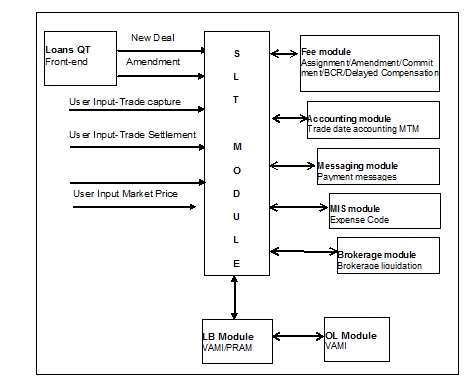

SLT module interfaces with Loans QT, which is an external front-end application used to book buy and sell deals. The details of new trade deals as well as amendments to the existing deals are exchanged between Loans QT and Oracle Banking Corporate Lending. SLT module also interfaces with other external systems like Hamper to get the market price details for the CUSIPs.

SLT module also allows you to capture new trade deals and amendments to existing deals, independent of Loans QT. The settlement of a deal can be initiated from the SLT Trade Settlement screen.

- Fee Module – for calculation of Assignment, Amendment, Line/Accommodation and Delayed Compensation Fees.

- Accounting Module – for passing all the accounting entries related to Fees, Trade Date Accounting & MTM entries.

- Messaging Module – for generation of Payment messages and Funding Memo.

- MIS Module – for passing the accounting entries with the relevant Expense Codes.

- Brokerage Module – for passing Brokerage entries into the Payable Account.

- Loans Syndication – trading details are passed on from SLT to LB module which in turn interfaces with the OL module.

The following diagram graphically represents the way in which SLT module interfaces with the external applications as well as other modules.

- Upload trades captured using external system into Oracle Banking Corporate Lending.

- Capture trades using the front-end provided in SLT.

- Maintain open and closed positions on facilities.

- Allow pairing or squaring off deals using WAC, FIFO, and LIFO methodologies.

- Calculate and pass unrealized P&L entries at EOD, using the market rate uploaded from external system.

- Support calculation and settlement of fees incurred in the process of each trade transaction.

- Support calculation of brokerage.

- Perform trade date accounting.

- Generate funding memo.

- Generate payment messages on settlement.

Parent topic: Secondary Loan Trading - An Overview