- Bilateral Loans

- Automatic Processing

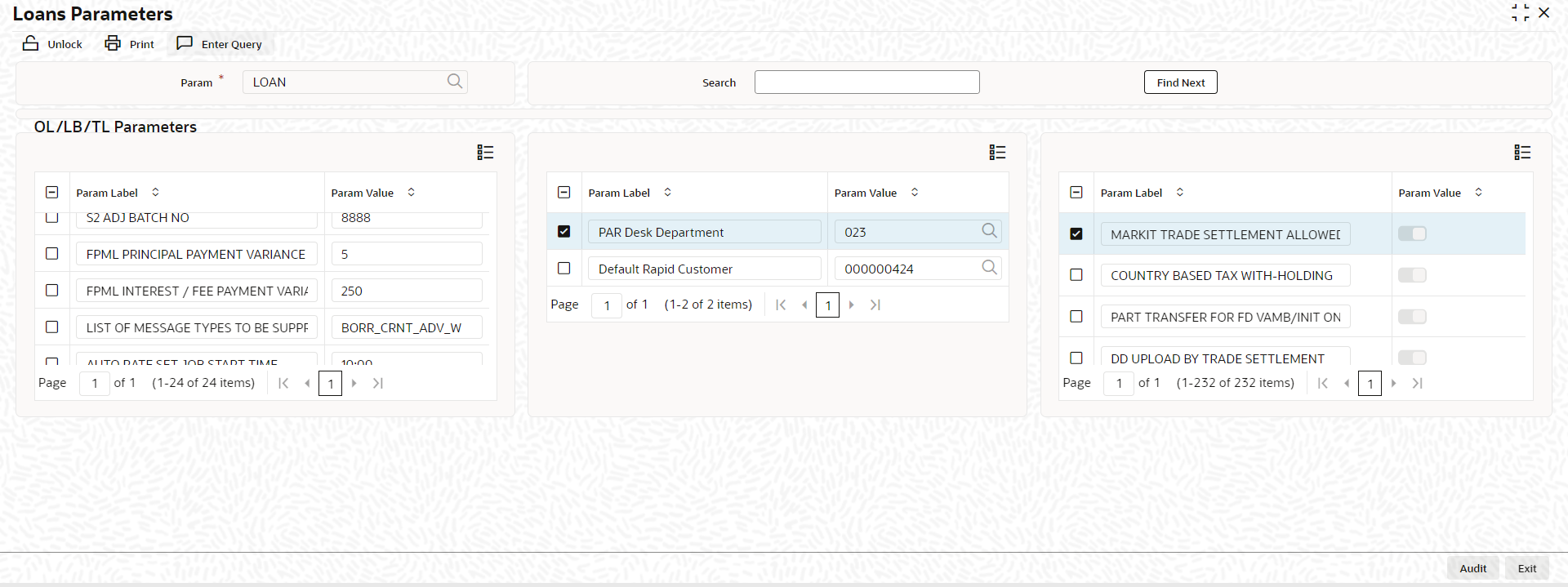

- Maintaining Loans Parameters Details

10.13 Maintaining Loans Parameters Details

You can maintain the generic parameters related to Loans, Loan Syndication and Secondary Loan Trading using

Loan parameter screen.- On the homepage, type OLDLNPRM and click next

arrow.The Loan parameter screen sceen is displayed.

- Through this screen you can view details of the following:

- OL/LB/TL Parameters, Param Label and Param Value

- Markit Trade Identifier

System displays the value of ‘Markit Trade Identifier’ as ‘MarkitClear’. However, you can edit this value

If the trade id from the incoming Markit message matches with the ‘Markit Identifier’, then the trade id value is the Markit Trade id and the other trade id is the LQT ticket id.

- S2 Adj Batch No

Specify the batch number for the S2 interface.

- FpML Principal Payment Variance

Specify the FpML Principal Payment Variance

- Swift Address

Specify the SWIFT address for for payment transaction. Multiple SWIFT address can be input here using a ‘~’ separated list.

The system checks for the Swift address before performing sanction check for a payment transaction.

- Archival Days

Specify the archival days for the payments which are not handed off from Oracle FLEXCUBE.

- PAR Desk Department

Select the Par desk department code from the adjoining option list. This list displays all the valid department codes maintained in the system. You can select the appropriate one. This code is used for par desk line trade (Par buying/selling from Origination – PL Trade) booked in the system through the external system Loans QT and is applicable throughout the life cycle of the trade.

For trades uploaded from the Loans QT, the department code is resolved based on the ‘PAR Desk Department’ code you have maintained here. If the ‘PAR Desk Department’ code is not maintained here, then the generic department code is defaulted for the trade. This defaulted department code is applicable throughout the life cycle of the trade.

For trades input manually through the ‘Secondary Loan Trading – Draft Trade’ screen, system validates to check that you have booked a Par desk line trade (PL trade) only with the default department code. Else, system displays the following error message:

‘User input department code not matching with the ‘PAR Desk Department Code’ along with the indication of the value maintained for the parameter’.

The Par desk department code, which is used as the department code for trades uploaded from external system Loans QT, is used for this validation.

This validation is carried out only if ‘PAR Desk Department’ is maintained here.

- Default Rapid Customer

Select a valid customer from the adjoining option list. The list displays all the valid customers maintained in the system.

- Markit Trade Settlement Allowed

Check this box to indicate that Markit messages should be processed in Oracle FLEXCUBE. If this box is checked, then system triggers to process to populate all the Markit messages into a system staging table.

- Country based Tax With-Holding

Check this box to indicate that tax withholding should be based on the investor’s country. If this box is checked, then system considers the country (domicile) of the investor as maintained in the ‘Customer Maintenance’ screen. If this box is unchecked, then tax withholding is based on the investor’s currency maintained in the ‘Currency Maintenance’ screen.

For more details on currency based tax withholding and waiver logic, refer the ‘Tax’ User Manual.

For details on Tax Rule Maintenance, refer section ‘Defining Tax Rules’ in the ‘Tax’ User Manual.

- Part Transfer for FD VAMB/INIT on SF DD

Check this box in indicate that future dated participant transfer is allowed for sighting funds enabled tranches involving participants who are:

- Completely funded for all the past events, and

- Unfunded for future events for all underlying drawdowns for

which ‘Cascade Participation’ is checked for a tranche

If this box is unchecked, then system does not allow future dated participant transfer for sighting funds enabled contracts.

For more details on participant transfer, refer section ‘Transferring Participant Assets’ in chapter ‘Loan Syndication Contracts’ in the Loan Syndication User Manual.

- DD Upload by Trade Settlement

Check this box to indicate that the Drawdown should be automatically created as part of Trade/ Ticket Settlement. You can specify the new drawdown details in ‘Agency Input Detail’ screen only if you have selected this check box.

For more details on agency input, refer section ‘Capturing Agency Details’ in chapter ‘Processing an SLT Contract’ in the Secondary Loan Trade User Manual.

- Allow all accounts in Overwrite SSI

Check this box to indicate that all the accounts should be displayed in the ‘Overwrite Settlement Instruction Details’ screen. If you have not checked this box, only GL accounts will be displayed.

For more information on ‘Overwrite Settlement Instruction Details’ screen, refer the chapter of ‘Disbursing a Loan, in the Loan and Deposits User Manual.

- Allow Fee End Date Reduction

Check this box to indicate that the fee end date reduction should be allowed.

Once the Agency Fee component(at facility) end date is changed to a back valued date, then all the accruals that have happened for the Agency Fee from the new Fee End date till the Current business date will be reversed online. On change of the fee end date to back valued date and fee is completely amortized, the component status will be updated as Liquidated.

The system will post the consolidated accrual entry for the adjustment accrual which will have the value date as current business date.

- Sanction Check Required

Check this box to indicate that the sanction check is required for LS, SLT, LD, Adhoc Fee and FT payments. If this box is checked, the existing payment messages that are already generated will not be sent to Sanction Check system. Further payments which will be generated in future will undergo the Sanction Check process.

If you have not checked this box, then you need to manually release all the pending payments for which confirmation is required from Sanction Check System.

- Populate FT to Payment Browser

Check this box to indicate that the FT payments should be displayed in Forward payment browser. If you have checked this box, the system will display the FT payment messages into forward processing browser.

- Populate Adhoc Fee (LD/LS) to Payment Browser

Check this box to indicate that the Adhoc fee payment should be displayed in Forward payment browser. If you have checked this box, the system will display the Adhoc fee payment messages into forward processing browser.

- Chapter3 or FATCA Rule Applicable

Check this box to indicate that the Chapter3 or FATCA rule is applicable. This will be used for storing history from ‘Tax Rule’ and ‘Customer Additional Tax Maintenance’ screen.

- Contract and Customer Mapping Required

Check this box to indicate that the contract and customer mapping is required. The contract reference number at the customer level will be generated only if this box is checked.

- Tax Rule Updation on customer modification

Check this box to indicate that the tax rule should be updated based on customer modification. The values from customer screen to Tax Group\Rule screen will be stored only if this box is checked.

- Toggle Rule of 25

Keep the check box selected if the toggling of Rule-of-25 is applicable. In this case, the system will allow toggling of Rule-of-25 from ‘No’ to ‘Yes’.

- LSTA Average LIBOR

Keep the check box selected for the system to calculate LSTA (Loan Syndication and Trading Association) average LIBOR (London InterBank Offered Rate) for DCF COC.

Uncheck this box if the LSTA average LIBOR calculation is not required to be done for DCF COC.

- DCF COC for FLAT

Keep the check box selected for the system to calculate DCF COC for FLAT quotation.

Uncheck this box if the DCF COC for FLAT calculation is not required to be done.

- Relaxing Dual Authorization

Check this box to indicate that the dual authorization is relaxed for contracts. Dual Auth Relaxation is applicable only for Non-Lead type of contracts.

- Forward Processing Required

Check this box to indicate that the forward processing can be applied for auto payments going out of the system.

- Include Ticket id in SLT ITR

Check this box to indicate that the ticket id should be included in the SLT ITR file for LS/LD records which are linked to LT.

- Include Ticket id in trade settl msg

Check this box to indicate that the ticket id should be included in the field 72 (line-1) of ticket/trade settlement payment message

These options are applicable for trades that are settled using Ticket Settlement and Trade Settlement screens. The changes are limited to only events that are STPed from LT to LS to LD

- Auto Commitment Reduction/PIK for new allocations

Keep the check box selected for the system to automatically perform commitment reduction/PIK (Pay in Kind) for subsequent new trade allocations.

Uncheck this box if automatic reduction/PIK is not required to be done for subsequent new trade allocations.

- Suppress Required for Participant

Check this flag to indicate that the suppress preference is available for the lenders. You can suppress borrower messages and send lender messages only or vice versa.

- Auto rate set Job start time

Specify the valid time maintained for the day, so the Auto Rate Set events will be processed automatically.

Note:

the Auto Rate Set events processes automatically only when valid time is maintained for the day, else events will not be processed and will be in unprocessed status. - Disallow Events to Intellect

Specify the events for which the system should not send an amend message to Intellect system. You need to maintain the events as a tilde-separated list. By default, the system will display ‘LIQD~ROLL’ in this field.

You can change it based on your bank’s requirement during implementation.

- Clearing Line GFRN Identifier

Specify the GFRN identifier that should be suffixed to the GFRN value coming from Rapid system in order for the clearing line to be used in Oracle FLEXCUBE.

- Bridge Account Departments

Specify the department codes for which you need to mandatorily maintain bridge customer accounts. You need to maintain the departments as a tilde-separated list.

- Amount change allowed during CUSIP\ISIN Amendment

Check this box to indicate that the system allows amendment of CUSIP/ISIN of a trade even if there is a trade amount mismatch between the original and amended trades.

- Automatic Rate Setting Allowed

Check this box to automatically process the interest rate fixing for the Drawdown contracts to fix the interest rate of main interest component having Rate Fixing Required.

If this flag is ‘No’, then you have to manually input rate and process rate fixing events.

- Auth Rate Fixing Events

Check this box to process the rate fixing events automatically. The system authorizes the Maker/Checker id as ‘SYSTEM’.

If this flag is ‘No’, then Rate fixing events should be manually authorized for those events.

- Buy-back for Zero Position Tranche

Check this box to buy back the zero position tranche. If this is unchecked the SLT-LS processing will fail for tranche with zero position.

- Autoauth Rapid Contracts

Check this box to automatically authorize the contracts.

Note:

Note the following- If the flag is checked then,

The Rapid details will be updated into ‘Draft Commitment’ screen after necessary validation with approval status as ‘Approved’ and

The commitment booking or Commitment amendment or Value Dated Amendment will be systematically processed and the corresponding commitment events will be auto authorized with maker/checker as ‘RAPIDUPLD’.

If you save the RAPID record after enriching few details in ‘Draft commitment’ Screen, then the Draft commitment Record will have to be manually authorized. The Auto authorization will not be done for such cases.

- If the flag is checked then,

- If the flag is not checked then,

The Rapid details will be auto populated into ‘Draft Commitment’ screen with approval status as ‘Unapproved’ and draft commitment will not be auto authorized.

The system will allow enriching the fields that are allowed to enrich currently. You need to manually approve and authorize the draft commitment details to create or amend commitment contracts.

For further more information on the ‘Draft commitment’ screen refer the section ‘Capturing Commitment Draft Details’ in the Loans Module.

- SLT Borrower Reclass Required

Check this box to indicate that reclassification functionality is required. If this box is unchecked, the system will always pass the accounting entries with related customer as trade counterparty even if associated tranche exists in agency module.

- HFS Transfer and Sale

Check this box to indicate that the system should allow transfer and sale of portfolios held for sale (HFS).

- Margin for Lender

Check this box to indicate that the system should allow you to capture margin rates for lender participants in a tranche.

- Allow CUSIP/ISIN SwingCheck this box to indicate that CUSIP swing should be allowed in the following tranche operations:

- Associating a new CUSIP on the existing tranche (Re-Allocation)

- Existing CUSIP to be linked by creating a new Tranche (Re-build)

- Distributing one tranche position by creating multiple new tranches (Split)

- Consolidating multiple tranche positions on a new tranche (Consol)

If you check this box, the following options will be available:- You can maintain records in the ‘CUSIP-Tranche Linkage’ screen and the system will accrue DCF based on these records.

- You will also be able to liquidate a tranche even if it has interest due on associated drawdown contracts and fee is due on the linked commitment/facility contracts.

- You can perform CUSIP reclass for the commitment and loan contracts

Refer the section ‘Maintaining CUSIP-Tranche Linkage’ in the chapter ‘Processing an SLT Contract’ in the Secondary Loan Trading User Manual.

- Enable Rapid Limit

Check this box to indicate that facilities of clearing line type can be utilized by transactions in Oracle FLEXCUBE.

- NAM Limit Confirmation

Check this box to indicate that the system should perform clearing line association validation and amount availability validation for Tranche and Drawdown events.

- Mnemonic Mapping for New Participant

Check this box to indicate that the system should pick up the applicable default mnemonic for the following entities:

- For a new self participant introduced to the non lead tranche through trade settlement in SLT module, the system should pick up the SSI mnemonic from the internal translation maintenance for currency, branch and department. If internal translation maintenance is not available, the system should pick up mnemonic based on ‘All’ department code. If no maintenance is available, the system should pick up the SSI mnemonic based on the customer, branch, currency, product and settlement sequence number as zero.

- For an external participant introduced to the non lead tranche (wrapper tranche) or the lead tranche, through settlement of a participation deal type sell trade, the system should pick up the mnemonic based on the ‘External Counterparty Mnemonic Details’ screen.

- For a silent participant introduced to the lead tranche through participation sell trade settlement, the system should pick up the SSI mnemonic based on the position identifier of the sell trade.

- Intellect Feed for UDF Change

Check this box to indicate that the system should send an amendment feed to Intellect system if the following UDF values are changed for a loan contract:

- CUSTOMER RATE

- DEALER LIBOR RATE

- LATE TRADE

- RA COST

- Allow Combined Ticket Settlement

Check this box to indicate that the combined ticket settlement is allowed for multiple tickets together with buy and sell trades across CUSIPs with multiple counterparty and currency combination.

- DCF Flat Unrealized LIQD Advice

The factory shipped value ‘DCF_FLAT_UNRLZ’ gets displayed here.

- Allow Negative Rate Processing

Check this box to indicate that the negative rate processing is allowed for the Loans.

- Disallow Negative Base Rate Processing

Check this box to indicate that the negative base rate processing is not allowed for the Loans. The base rate cannot be captured or processed in negative in both drawdown or loan contracts if this option is selected.

You can check this box only if the ‘Allow Negative Rate Processing’ option is selected. The system displays the below error if this validation fails:

Disallow Negative Base Rate Processing cannot be checked if Allow Negative Base Rate Processing is Unchecked

The maintenance and processing functionality of negative rates based on the maintenance of the above fields are handled by the system as follows:Table 10-3 Maintenance and processing functionality of negative rates

Allow Negative Rate Processing Disallow Negative Base Rate Processing Screen functionality Selected Not Selected Both Base Rate and Margin rate can be in negative. All in rate will be 0 if Base Rate + Margin is negative, in LS module

All in rate will be 0 if Base Rate + Spread is negative, in LD module

Selected Not Selected If Base Rate is negative, then base rate will be considered as 0. Margin can be negative.

All in rate will be 0 if Base Rate + Margin is negative, in LS module.

All in rate will be 0 if Base Rate + Spread is negative, in LD module.

Not Selected NA Below listed existing functionalities will continue to work. Both Base Rate and Margin should be positive in LS module.

Both Base Rate and Spread should be 2-32 positive in LD module

For more information on reclassification, refer the section ’Reclassification’ in the chapter ‘Processing an SLT Contract’ of the Secondary Loan Trading User Manual.

- CD Integration Source

Source code used for CD integration

- Trade Integration

Trade integration enabled or not

- Proceed with Previous Rate Available

If Yes - EOD to proceed with latest rate available. If rate for current day isn't available, apply the latest available. Else, EOD to abort.

- Inactive Cust status

If this value is "Y", then the UBS integration to handoff the inactive customers will be enabled.

- Reset Netrate

- If Param value - Y : If Min or Max rate is not null system will reset the Net Rate either to Min/Max if it is not in the given min/max range

- If Param value - N : If Min or Max rate is not null system will validate the Net Rate with Min/Max rate and system throws error "Rate must be more than minimum defined at product level".

- Consider Prev Sch Compound amt

Used when schedule type is selected as "Compounding".

- If this flag is Yes, then System will add the compounded amount for the previous schedule with the basis amout of the next schedule.

- If this flag is No, then System will not add the compounded amount with the basis amount of next schedule.

- Enable ELCM Blocking During Booking

If this flag is Yes, then system would send a block request for future dated disbursement to ELCM to block the facility/line.

- Enable Transaction Beyond Previous Month

- If this value is ”Y”, then system would allow posting of back dated transactions for any period.

- If this value is “N”, then system would allow posting of back dated.

- De Accelartion Allowed

If Yes - then, De-acceleration will be allowed already credit accelerated loan.

- Bulk Processing Limit

This value determines the number of records to be committed in a bulk transaction during penalty processing batch.

- Revision on rate fixing Date

If Yes - For FPA drawdowns fire revision event on rate fixing date itself if rate is available on BOD.

- Stop payment delay for PRINCIPAL

If Yes - then Payment Delay to be allowed only for Interest components.

Pay by date is not applicable for Principal, instead should liquidate on due date.

- Proceed with child contract processing

If Yes child contracts will be created via job when rollover details are captured before maturity date of contract or if split reprice value date lies in future

- Include Duplicate to Non-Primary Entities

If borrower/participants have multiple entities system generates original advice to primary entities. For non-primary entities system will add COPY - Avoid Duplication to the first line of advice generated.

Parent topic: Automatic Processing