3.1 Introduction

In this topic, focuses on defining the attributes specific to a Loans product.

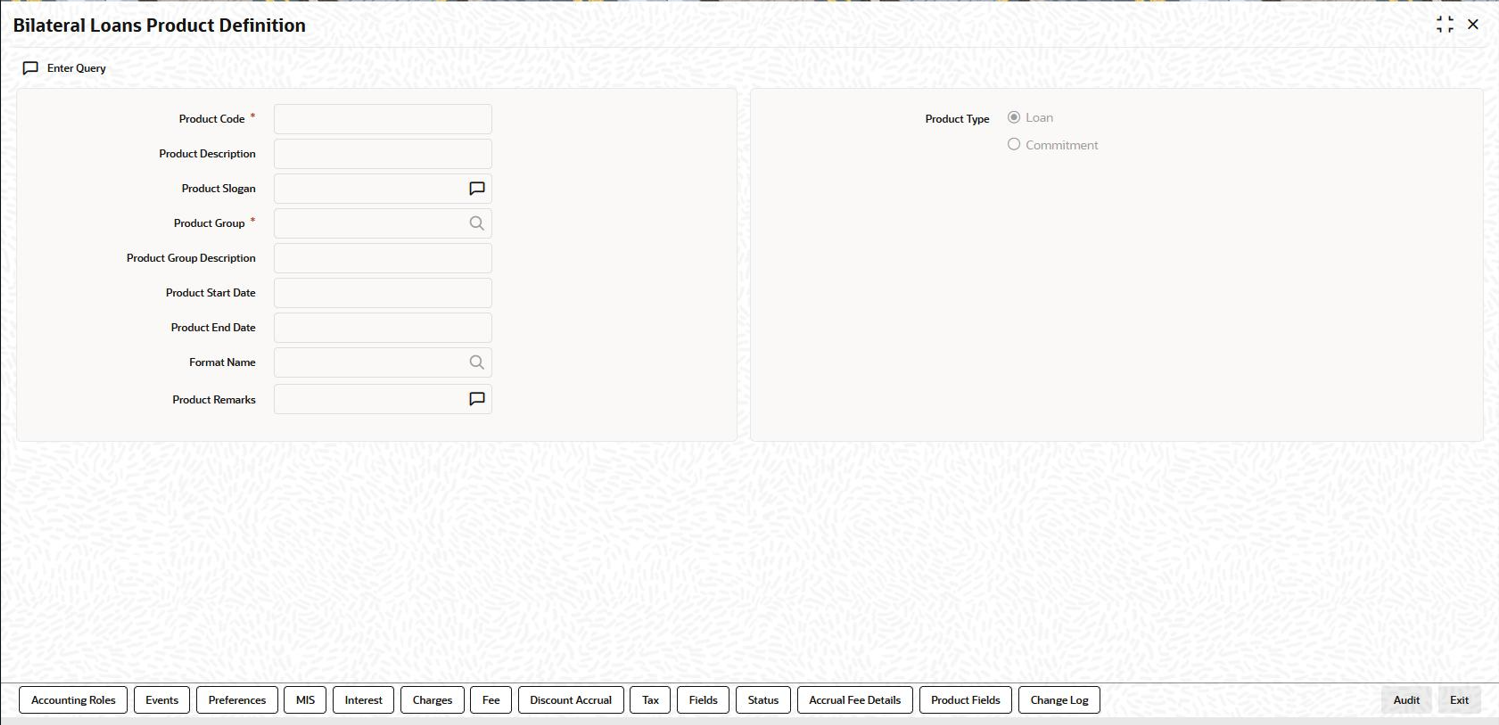

You can create a loans product in the Bilateral Loans Product

Definition screen.

Specify the User ID and Password,

and login to Homepage.

Parent topic: Defining Attributes Specific to Loan product