4.2.29 Interpolation

Interpolation is used to determine interest rates for a period of time that are not available.

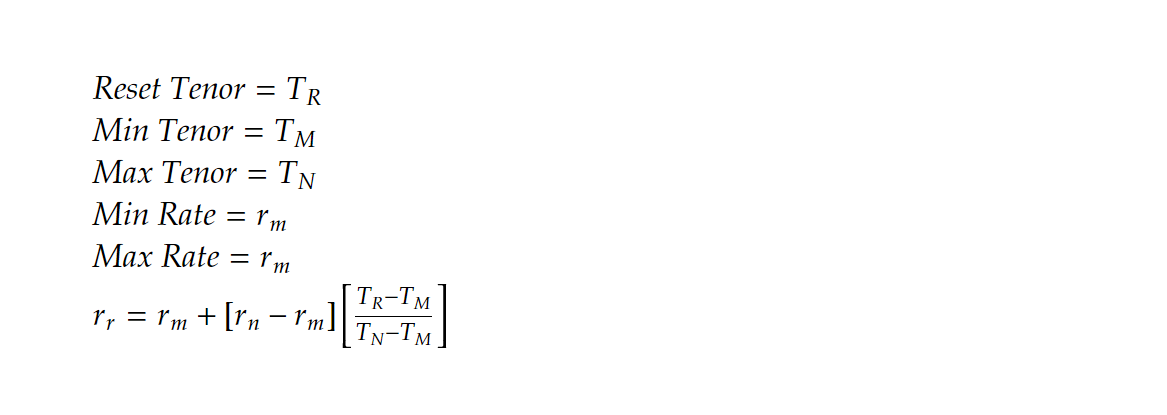

In this case, the interest rate is the dependent variable, and the length of time is the independent variable. To interpolate an interest rate, you need the interest rate of a shorter period of time and a longer period of time.

In Corporate Lending, changes are made to standard interpolation formula so that the system picks the actual days for a month instead of directly picking the tenor available in the Floating Maintenance screen.

Figure 4-7 Interpolation Formula

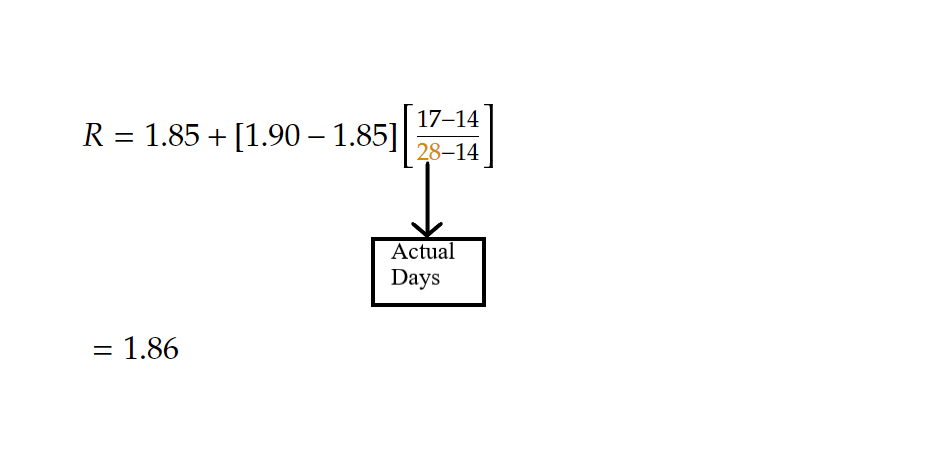

For example

Floating rates are maintained in the following format.

Currency - USD

| Tenor | Rate |

|---|---|

| 0 | 2.1 |

| 7 | 1.78 |

| 14 | 1.85 |

| 30 | 1.90 |

| 60 | 2.1 |

| 90 | 2.03 |

| 180 | 1.85 |

| 360 | 1.7 |

| 999 | 1.89 |

Schedule Date is 4-2-2015 and reset tenor is 17.

Parent topic: Loan Disbursement Details