7.10.4 Handling Prepayments

When a prepayment is made for the principal, it constitutes a schedule violation of the contract. In such cases, a penalty in the form of a penalty amount for loans is charged.

The penalty amount that is entered by you are added to the liquidation amount in case of loans. The penalty amount is also reversed in case of a reversal of prepayment with penalty.

You are allowed to enter a prepayment penalty, only if the principal is prepaid. The other components are automatically liquidated. If prepayment of a component is done, then the schedules of the components for which this component is the basis are recomputed automatically. This is illustrated in the table below.

| Component | Basis Amount | Category |

|---|---|---|

| Interest | Principal | Expected |

If principal, which is the basis for interest (which is calculated on the Expected amount of the basis component) is prepaid, then the interest (which is a component based on principal) for the future schedules are recomputed automatically.

The prepayment penalty amount does not affect any schedules of the contract.

Table 7-2 Handling Prepayments

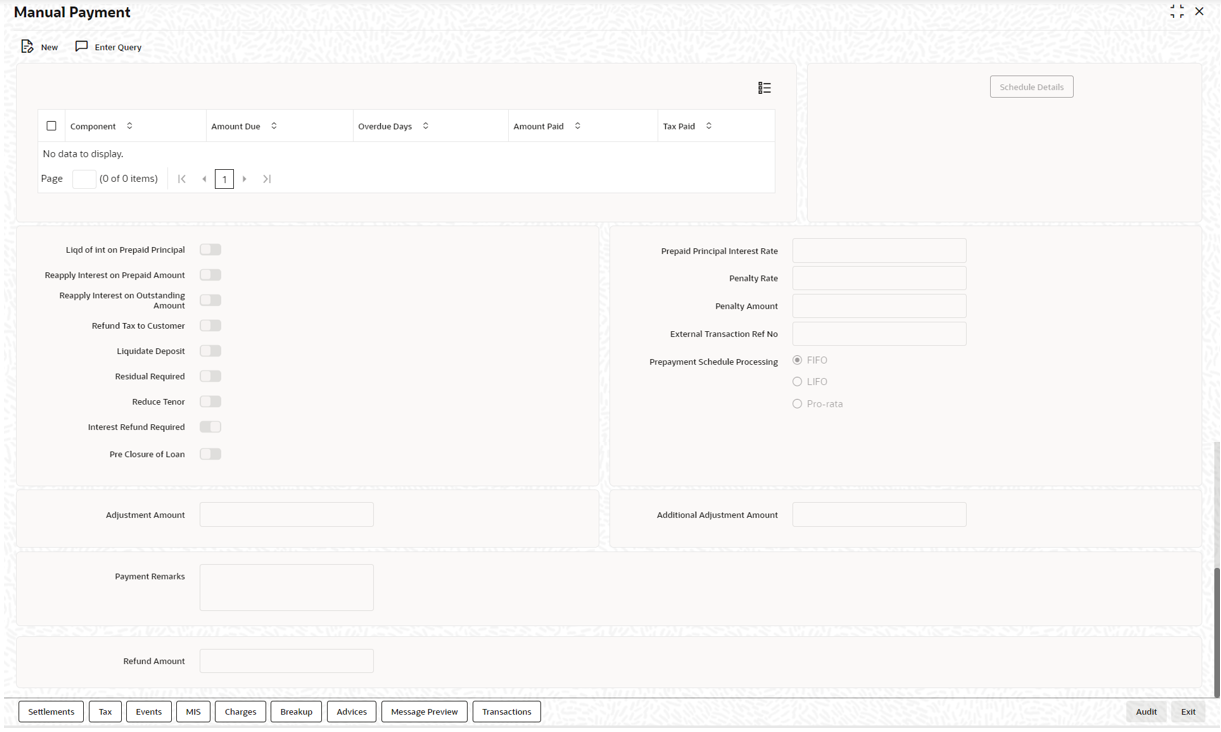

| Field | Description |

|---|---|

| Liqd. of Int. on Prepaid Principal | This check box is selected if you have selected the same in the Loans and Deposits Product – Preferences screen. You can change the preference you have specified in the Contract Payment screen. If you have selected this box, you are not allowed to enter the Amount for interest liquidation. The amount is computed and liquidated by the system. In addition, in case of prepayment, the rate is recomputed based on the contract currency, tenor, and amount. |

| Reapply Interest on Prepaid Amount | This check box is selected if you have selected the same in the Loans and Deposits Product – Preferences screen. You can change the preference you have specified in the Contract Payment screen. If you have selected this option, the interest on the prepaid amount is recalculated during prepayment, based on the rate applicable for the current tenor of the deposit. |

| Reapply Interest on Outstanding Amount | This check box is selected if you have selected the same in the Loans and Deposits Product – Preferences screen. You can change the preference you have specified in the Contract Payment screen. If you have selected this box, the interest on the outstanding amount is recalculated during prepayment. The repayment is based on the current amount spread applicable for the outstanding amount of the deposit. |

| Refund Tax to Customer | Select this check box if you want to refund the excess tax amount

collected from the customer. The system generates the amount tags

for reimbursing the excess tax deducted. If you leave this box

deselected, the amount is not refunded to the customer.

In case of an agency contract, if you make a full prepayment on the value date of the contract, the system triggers a contract reversal operation. This reversal is not sent to the Originations module through STP. The corresponding contract have to be manually reversed in the Originations module. This reversal is then be sent as a feed to the Intellect system. In case the contract is not linked to an agency, the system sends a cancel message to the Intellect system. |

| Reduce Tenor | This option gets defaulted if it is selected at the product level. You can select this option in Manual payment screen. This option works only with LIFO payment schedule processing type. |

| Prepaid Principal Interest Rate | This is the interest rate that is applied on the prepaid principal. If the final rate computed (after penalty deductions) during payment is less than 0, the rate for the payment is set to 0. For account linked deposits, the rate is recomputed based on the contract currency, tenor and amount. For interest reapplication, full rate re-computation (of Rate + Tenor Spread + Amount Spread) is done for the prepaid amount whereas for the outstanding balance, only the amount spread would be reapplied. |

| Adjustment Amount | You can collect an additional interest amount over and above the regular interest that you have charged the customer. You can enter the same in this field. |

| Additional Adjustment Amount | You can reimburse an additional interest amount, in case you have

collected excess interest from the customer. You can enter the

amount to be reimbursed in this field.

These adjustment amounts does not affect any schedules of the contract. |

| Pre Closure of Loan | This check box value gets defaulted from the Bilateral Loans Product Definition screen. Select this check box to close the loan manually if the loan is not required by the customer. Automatic closure happens only if maturity date is reached and automatic liquidation is set. |