9.2.2 Making Changes in Interest

Through the Value Dated Amendment function, you can make changes to the maturity

date, the principal and specify a new value date for the loan.

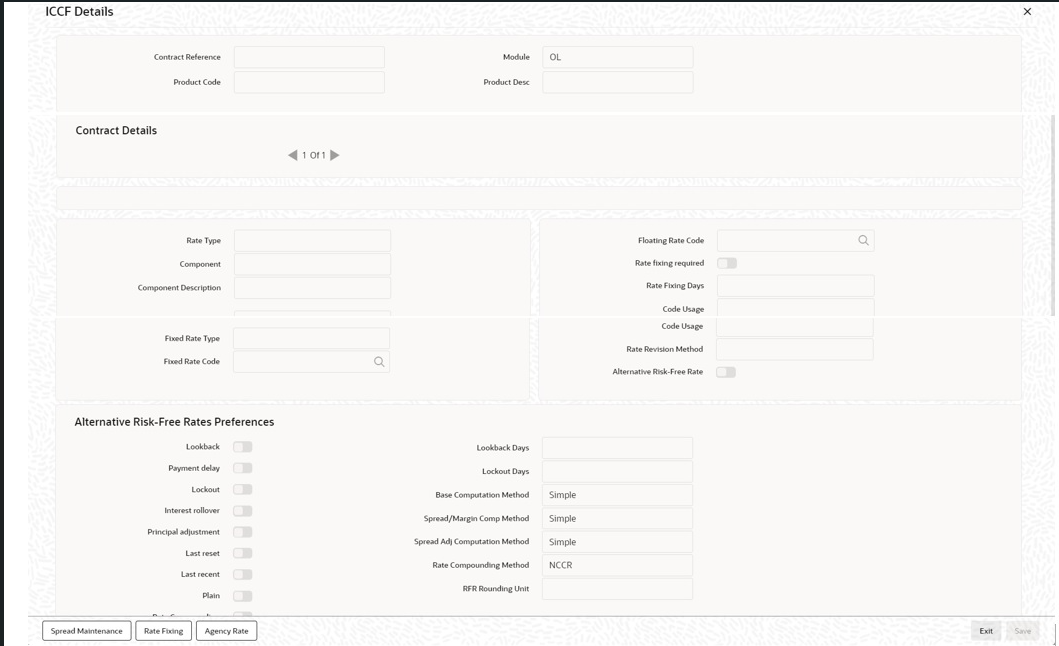

However, if you want to change the interest rate, the rate code, the spread or the interest amount, you have to invoke the Contract ICCF Detailsscreen of the ICCF module through the Loan and Commitment Value Dated Amendments screen.

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Loan and Commitment Value Dated Amendments screen.