5.1 Introduction

A fee is a payment that you levy on your customer in exchange for advices or services rendered by your bank. While processing contracts in Oracle Lending, you can choose to accrue fee components at the time of booking the contract. The upfront fee involved in a contract is accrued by the system over the tenor of the contract.

- Straight Line Method

In this method of fee accrual, the fee amount is equally spread over the tenor from the fee calculation start date to the fee calculation end date of the loan or commitment.

The example given below illustrates the Straight Line method of calculating accruals wherein the fee amount is equally spread across between the Start and End date for fee calculation.

Exampe

Consider a loan with the following details:- Value Date: 01-Jan-2002

- Accrual Start Date: 01-Jan-2002

- Fee Amount: USD 365,000

- Accrual Frequency: Monthly

Therefore, the previous accrual date is 31st January 2002 as the accrual frequency is Monthly.

The fee accrual amount as of 01-Jan-2002 (which is the previous accrual date) = USD 31,000 (for 31 days between 1st January 2002 and 31st January 2002).On 28th February 2002 (which we have assumed as the current working date of your bank), the system calculates the gross fee amount that has to be accrued as: USD 31,000 (previous accrued amount) + USD 28,000 (fee amount accrued for 28 days for the month of February) = USD 59,000.

Note:

For contracts where a Principal amount has not been specified the Upfront Fee details can be maintained. Accruals takes place only on straight line basis. - Yield Basis Method

In the Yield Basis method of fee accrual, accruals are done based on the balance and the repayment schedules of the contract.

Exampe

Case1: Yield Basis method of accrual for loan contracts

Assume that your bank has disbursed a loan with the following details:- Value Date: 1-Jan-2002

- Maturity Date: 1-Jan-2003

- Principal: 1,000,000.00

- Currency: USD

- Fee Amount: 2000

- Fee Currency: USD

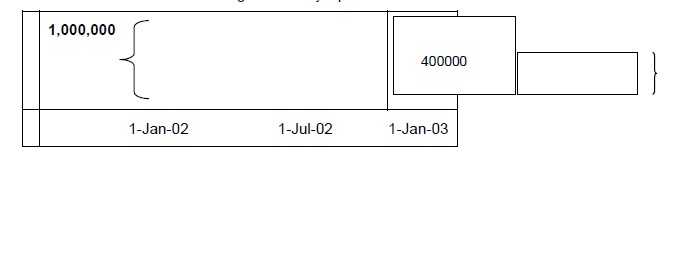

The detail of the loan contract is diagrammatically represented as shown:

According to the above illustration, the loan contract has a repayment schedule on 1st July 2002 and we are assuming that the customer has repaid USD 6,00,000 of the loan amount and therefore the outstanding balance is USD 4,00000.

Oracle Lending calculates the fee accrual amount for the above loan contract as follows:Start Date End Date Basis Amount No of Days Total Accrual Amount Daily Avg Accrual Amount 1-Jan-02 1-Jul-02 1000000 For loans, the basis amount is always the expected principal balance.

181 2000x[181x1, 000,000][181x1, 000,000 + 184x400000] = 1,421.84 The denominator is called the Yield Factor and is always the sum of (No of Days x Basis Amount) for both loans and commitments.

1,421.84/181= 7.85549544 1-Jul-02 1-Jan-03 400000 This is the expected balance as we are assuming that the customer has paid back USD 600000.

184 2000x [184x1, 000,000] [181x1, 000,000 + 184x400000] =578.16 578.16/184= 3.142183818 Case 2: Yield Basis method of accrual for revolving type of commitments with utilized facility amount

Let us assume that your bank has processed a revolving commitment with the following details:- Value Date: 1-Jan-2002

- Maturity Date: 1-Jan-2003

- Commitment Amount: 1,800,000.00

- Currency: USD

- Fee Amount: 2,000

- Fee Currency: USD

- Value Date: 1-Mar-2002

- Maturity Date: 1-Sep-2002

- Principal Amount: 1,000,000.00

- Currency: USD

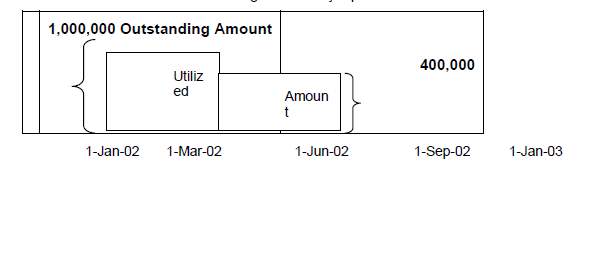

The details of the commitment are diagrammatically represented below:

In the above representation, the shaded area represents the outstanding amount of the commitment and non-shaded area represents the amount utilized by the customer.

With reference to the above illustration, we are assuming that the schedules for the commitment are on 1st march 2002, 1st June 2002 and 1st September 2002. Further, we assume that the utilized amount between 1st September 2002 and 1st January 2003 is USD 400,000.Keeping these details in view, system calculates the fee accrual amount as shown below:Start Date End Date Basis Amount No of Days Total Accrual Amount Daily Avg Accrual Amount 1-Jan-02 1-Mar-02 0.00 Basis Amount = Utilized Amount

59 0.0 0.0 1-Mar-02 1-Jun-02 1,000,000.00 92 2,000x[1,000,000x92] [92x1, 000,000 + 92x400, 000] = 1,428.57 1,428.57/92 =15.52795031 1-Jun-02 1-Sep-02 400,000.00 (We are assuming that this is the utilized amount)

92 2,000 x [400,00x92] [92x1,000,000+92x400,0 0] =571.43 571.43/92= 6.211180124 1-Sep-02 1-Jan-03 0.00 122 0.0 0.0

Parent topic: Processing Upfront Fee Accruals