1.1 Loan Origination

Use loan origination process to create corporate loans, that is, starting from loan account creation to disbursement.

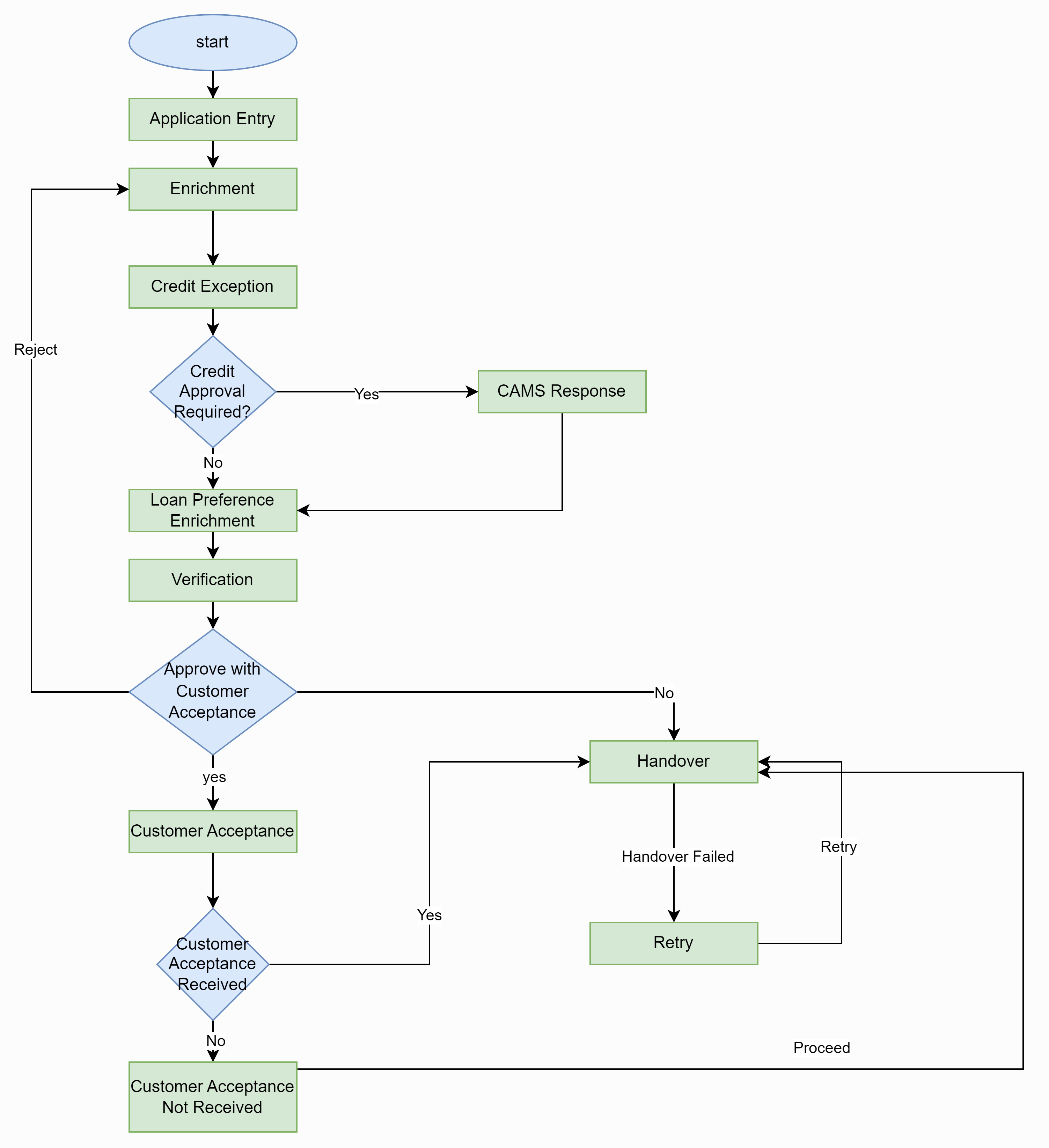

Loan Origination process provides a facility to create corporate loan taking the application through various stages of the business process flow commencing from loan request initiation till loan account creation/handoff and disbursement based on the Application Category.

The process of corporate loan origination is initiated by the Relationship Manager (RM) (or users with relevant rights) on behalf of an existing or a prospective customer. Based on the nature of the financing requirement the system can be configured to initiate the relevant Business process flow. For instance the Corporate Customer/Company may approach the bank for its credit needs related to working capital, expansion or for Trade financing through various channels like branch, mail or through external agents. The platform also enables the initiation of a Loan Request through Customer direct Banking channel through the REST based service APIs. The Platform has a predefined Netflix Conductor process flow following a typical corporate loan initiation process. However, this can be modified to suite the Bank's requirements.

The list of stages that are required for a Loan origination process are pre-defined in Netflix Conductor process and the data segments that are applicable for every stage can be configured in Application Category maintenance. Based on this setup, system derives the process flow for every loan application.

- Application Entry

- Application Enrichment

- Credit Exception

- Price Negotiation

- Application Verification

- Legal Verification

- Loan Approval

- Customer Acceptance

- KYC Required

- CAMS Initiation Required

- Credit Appraisal Required

- Facility Creation Required

- Price Negotiation Required

- Legal Approval Required

- Customer Acceptance Required

- Loan Amount

- Loan Currency

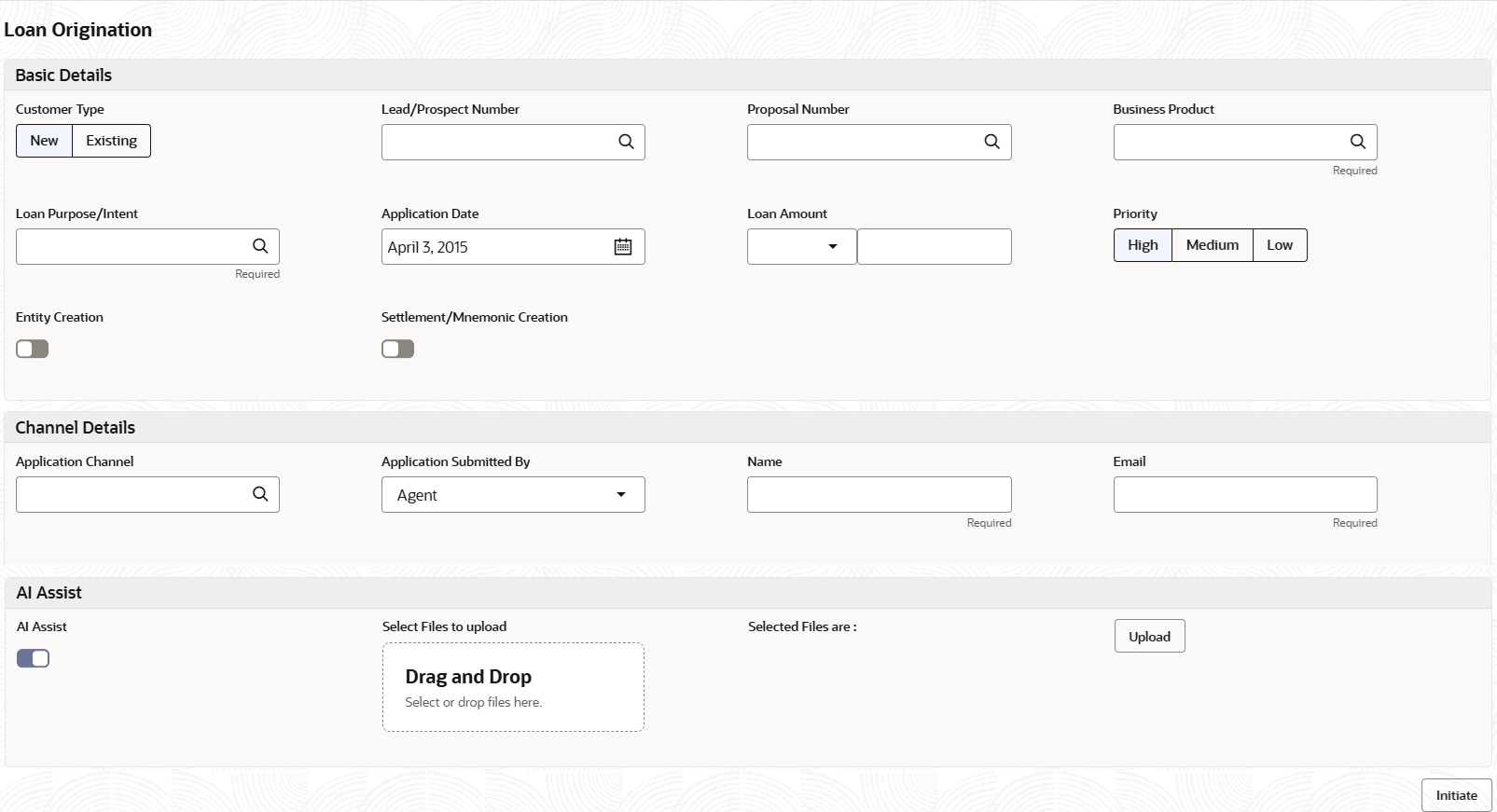

The basic registration details to create a corporate loan for a prospective borrower can be initiated using this initiation screen, provided the user has the required access rights.

For initiating a loan in the application, the maker needs to gather required data by going through multiple documents like Loan Agreement, Sanction Letter, Credit Memo etc. Once the required information is collected, user needs to manually input this data in the system. If maker enable the AI assist in system, then maker can upload the required documents in the loan initiation screen. On initiation, GEN AI pulls all the required data from these documents and populates them against the pre-decided parameters based on the specified prompts.

To initiate Loan Origination

On submit of the screen, a unique Application Registration number is auto generated by the system, which are used throughout the process and for further tracking. For an application, based on application category namely, Term Loan, Pre-shipment Finance, Post-shipment Finance, Project Financing, Working Capital and so on. The system derives the process flow for Loan Origination and the process gets instantiated. Based on the user rights the system navigates the first manual stage of the process flow.

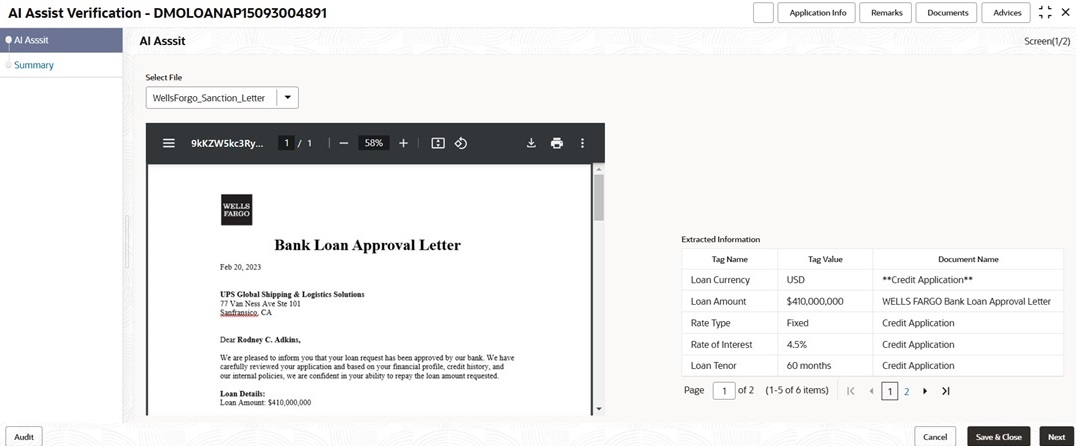

In case AI assist was enabled, then after initiation on the AI Assist details stage, the extracted data and the uploaded documents are displayed side by side. If required, the maker can verify the data with these scanned documents displayed. The parameter name, value and from which document the data is extracted from are shown in the table. The Maker can make any changes to the data on need basis.

Table 1-2 AI Assist Verification

| Field | Description |

|---|---|

| Select File | Displays the uploaded files in the drop down, select the required file for preview. |

| Extracted Information | Data extracted from the documents with our predefined questions, |

| Tag Name | Displays the predefined parameters for which data is extracted. |

| Tag Value | Displays the value extracted from the documents with predefined prompts. |

| Document Name | Displays the source document name from where the data is extracted. |

This topic contains the following sub-topics: