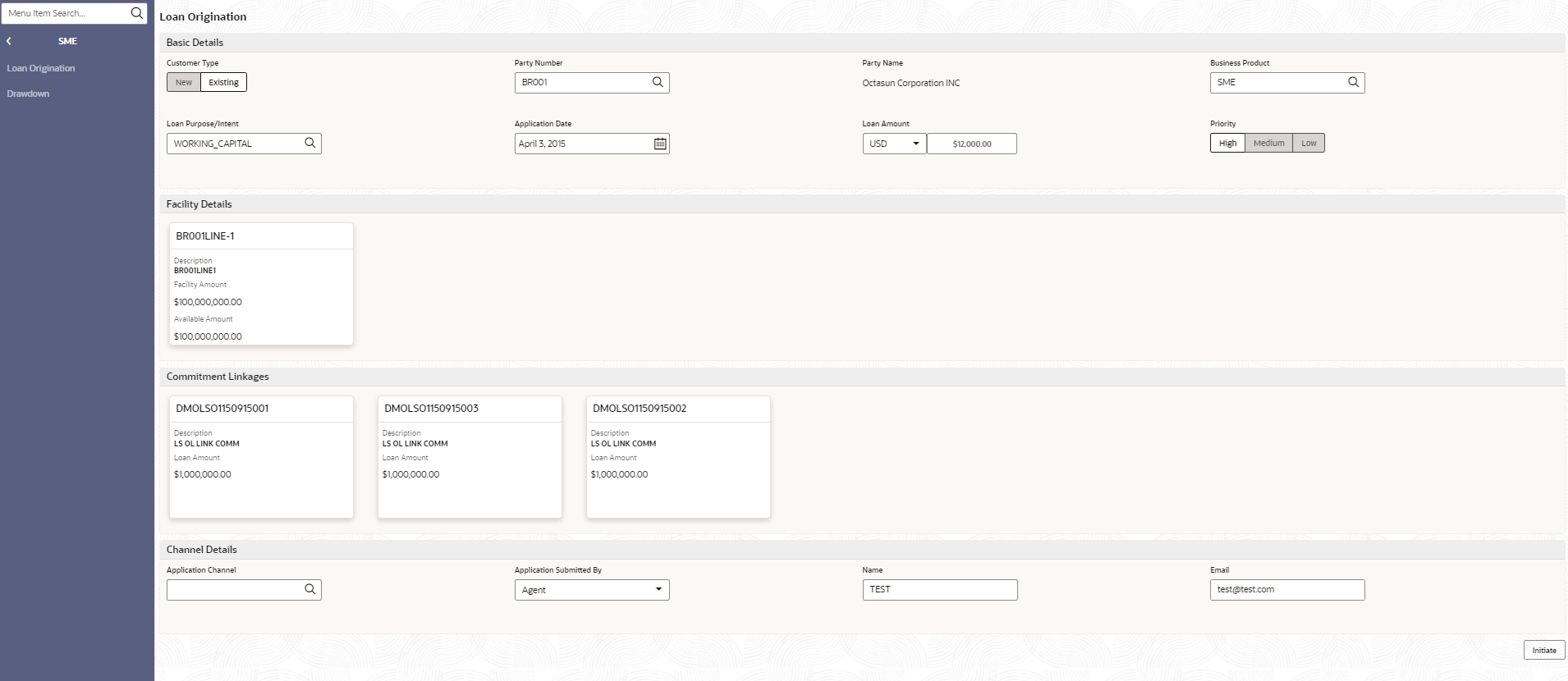

| Customer Type |

Select one of the options:

|

| Lead/Prospect Number |

Click Search to view and select the required Lead/Prospect Number. The loan administration helps determine if any loans are given under back-door schemes.

|

| Proposal Number |

Click Search to view and select the required proposal number. The Draft Proposal Process presents a list of proposals to the customer. When you select a completed application, the draft proposal is displayed and you can choose one application. Once selected, the data segments applicable to the current application default to the values from the draft proposal.

|

| Business Product |

Click Search to view and select the required business product. Based on the business product system derives the following details to process the loan application

- Applicable stages and its data segments

- Required documents and checklists

- Stage level advices

|

| Customer Number |

Click Search to view and select the required Customer Identification number or you can also type the Customer Number. This field is applicable only when the Customer Type is selected as Existing.

|

| Customer Name |

Based on the Customer Number selected, the information is auto populated.

|

| Loan Purpose/Intent |

Click Search to view and select the required loan purpose/intent.

|

| Application Date |

Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date. |

| Loan Amount |

Select a currency from the drop-down list and specify the loan amount. |

| Priority |

Select a priority from the drop-down list. |

| Facility Details |

Displays the list of all facilities that are created for the Customer Number. You can select the appropriate Facility ID which requires to be linked for the loan.

|

| Commitment linkages |

Displays the list of all commitment linkages that are created to the loan amount. In case of existing customer, you can select the already added commitment (available in OBCL). You cannot delete the commitment linkage once added. |

| Application Channel |

Click Search to view and select the required application channel

|

| Application Submitted By |

Select the details of the Agent/Customer who has submitted the application from the drop-down list. |

| Name |

Enter the name of the Agent/Customer who has submitted the application. |

| Email |

Enter the Email ID of the Agent/Customer who has submitted the application. |