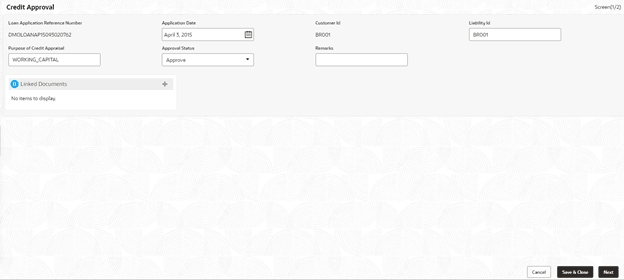

2.10.1.4 Credit Approval

This topic describes the systematic instructions to Credit Approval screen. This screen is used for any exemption raised as part of Facility/Collateral data segment due to insufficient credit lines. Then, the loan application is marked for credit approval.

This data segment helps the credit committee to verify the credit lines and

collaterals furnished by the applicant and take prompt action based on the

evaluation.

Parent topic: Cash Flow