1.9.2 SME Loan Drawdown

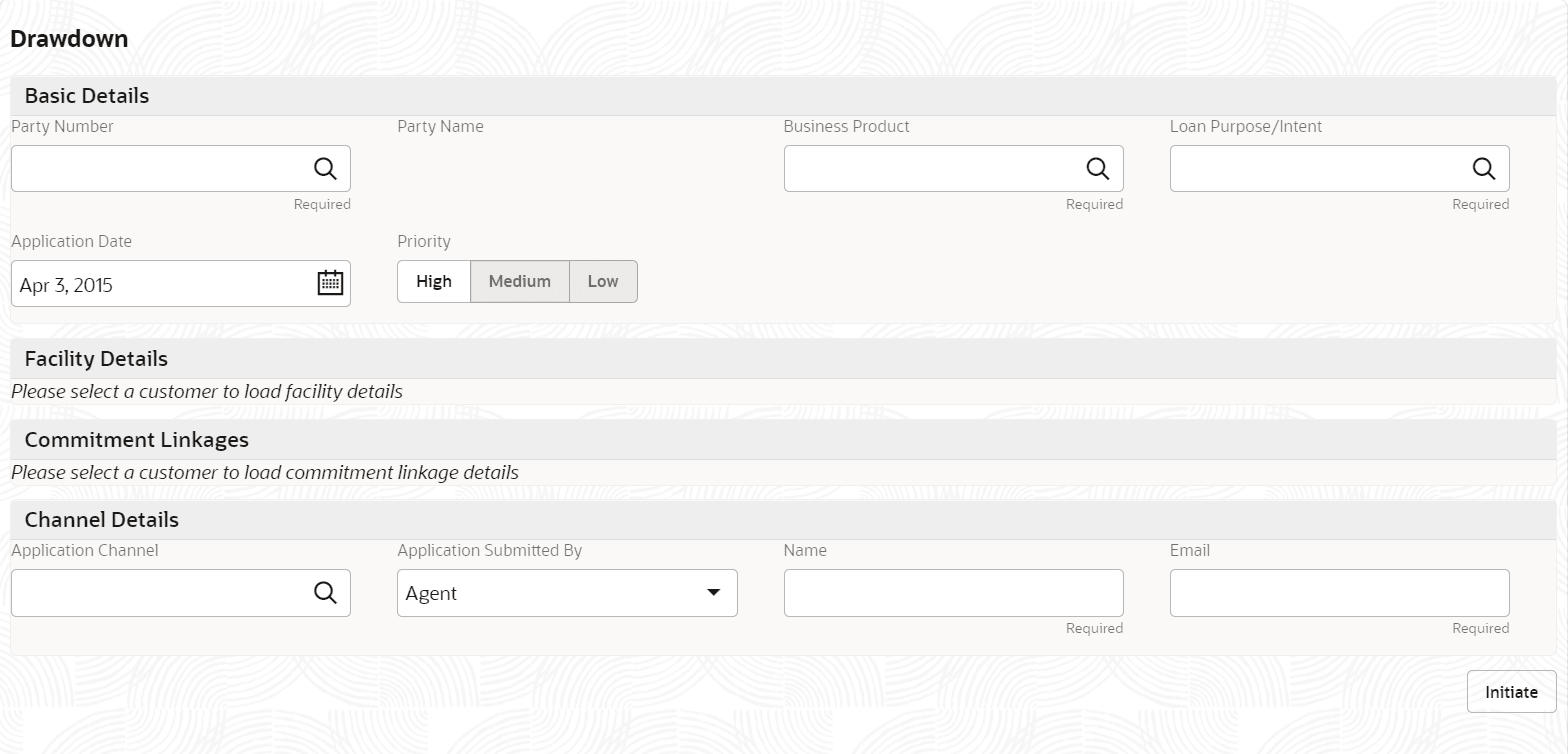

This topic describes about the SME Loan Drawdown feature. The Bank provides the SME loan drawdown feature to draw down the required loan amount for their existing customer.

The customer can facilitate the drawdown of required loan amount from their existing SME loan. After the facility is set up for a corporate customer by the bank, the customer can then receive the loan from the bank. The application initiates the business process flow through various stages, starting from drawdown initiation, and continuing with loan account creation/handoff and disbursement based on the application category.

The process flow pre-defined for SME Loan Origination is provided for quick reference:

- Application Enrichment

- Credit Approval

- Application Verification

- Loan Approval

- Customer Acceptance

- Application Enrichment

This topic describes about the Application Enrichment stage. - Credit Exception

This topic describes about the Credit Exception stage. - Application Verification

This topic describes the information about the Application Verification stage. - Loan Approval

This topic describes about the Loal Approval stage. - Customer Agreement

This topic describes about the Customer Acceptance stage.

Parent topic: SME Lending