- Teller User Guide

- Term Deposit Transactions

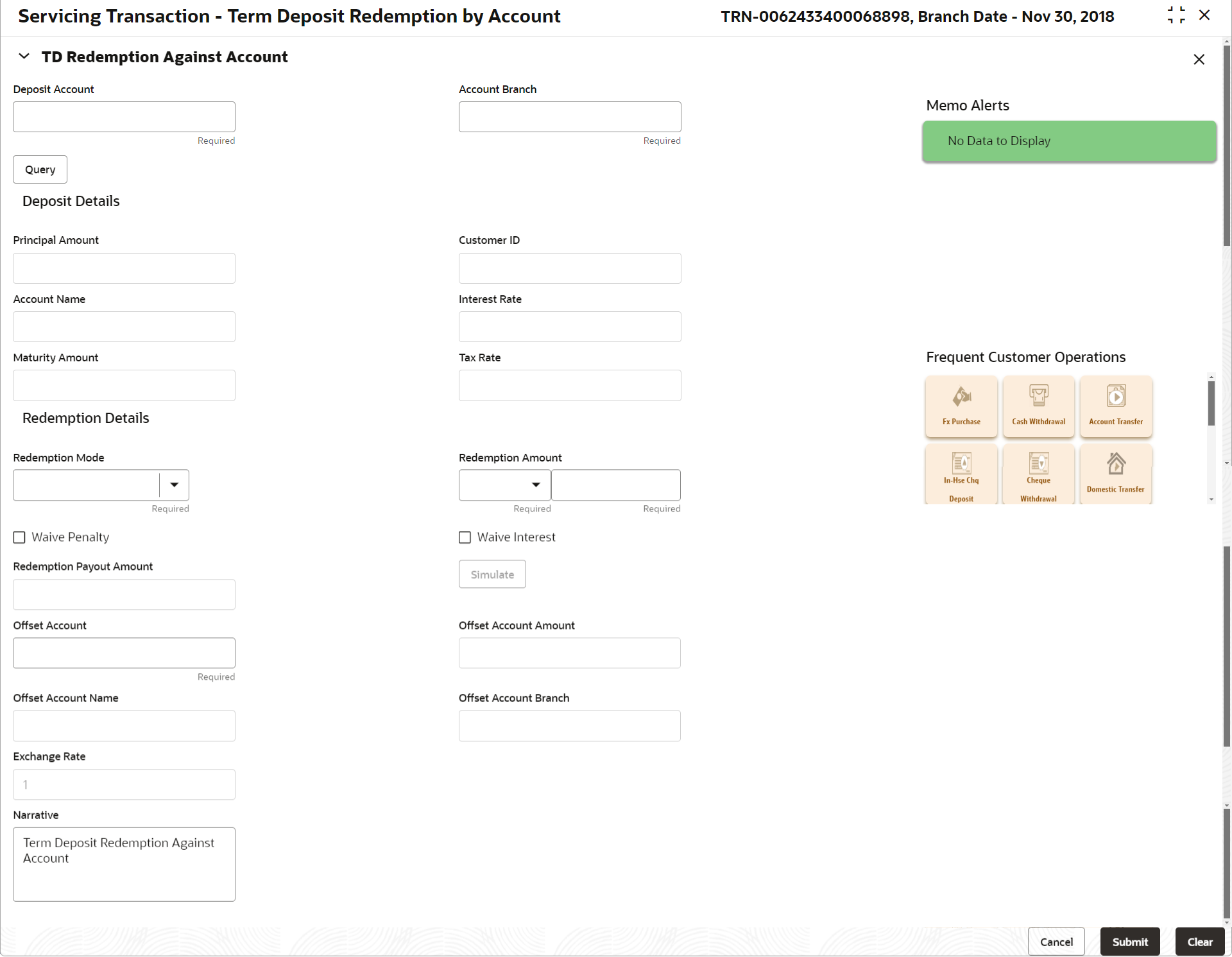

- TD Redemption Against Account

9.3 TD Redemption Against Account

The Teller can use the TD Redemption Against Account screen to initiate manual redemption of the cash from a term deposit account.

It is accomplished by the pre-mature redemption either in full or part, ahead of the maturity date or after the maturity date when TD is in grace days without maturing.

To perform TD redemption against account:

- On the Homepage, from Teller mega menu, under

Term Deposit, click TD Redemption -

Account or specify TD Redemption -

Account in the search icon bar and select the screen.The TD Redemption Against Account screen is displayed.

- On the TD Redemption Against Account screen, specify the

fields. For more information on fields, refer to the field description

table.

Note:

The fields marked as Required are mandatory.Table 9-8 TD Redemption Against Account - Field Description

Field Description Deposit Account

Specify the deposit account number.

Account Branch

Displays the branch of the deposit account.

Query

Click Query to fetch the deposit details.

Deposit Details

Specify the fields.

Customer ID

Displays the Customer ID of the deposit account number.

Account Name

Displays the account description of the deposit account.

Principal Amount

Click Compute to get the amount paid at the time of term deposit booking.

Interest Amount

Displays the default rate of interest at which the interest amount is calculated.

Tax Amount

Displays the amount to be deducted towards tax.

Interest Rate

Click Compute to get the current interest rate applicable after partial or full redemption.

Maturity Amount

Displays the current maturity amount after partial/full redemption.

Total Payout Amount

Displays the total payout amount.

Redemption Details

Specify the fields.

Redemption Mode

Select the redemption mode from the drop-down list (Partial Redemption or Full Redemption).

Redemption Amount

Specify as mentioned below:

-

If the Redemption Mode is selected as Partial Redemption, specify the redemption amount.

-

If the Redemption Mode is selected as Full Redemption, it displays the principal amount as redemption amount.

Waive Penalty

Check this box to waive the penalty for redeeming the term deposit.Note:

This is applicable only if the Redemption Mode is selected as Full Redemption.Waive Interest

Check this box to waive the interest for redeeming the term deposit.Note:

This is applicable only if the Redemption Mode is selected as Full Redemption.Redemption Payout Amount

The host determines and gives out the redemption payout amount, which is the sum of the redemption amount and interest, minus taxes. Simulate

Click Simulate. When you click the Simulate button, the system calculates the redemption payout amount.

Offset Account

Specify the offset account number to which the redeemed funds are to be paid.

Offset Account Amount

The system defaults the amount in the offset account number.

Offset Account Branch

The system defaults the branch of the offset account number.

Offset Account Name

The system defaults the description of the offset account number.

Exchange Rate

Displays the exchange rate applicable for the transaction based on the deposit currency and offset account currency.Note:

This field is displayed only ifMulti-Currency Configurationat Function Code Indicator level is set as Y.Narrative

Displays the default narrative as TD Redemption, and it can be modified.

-

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Charge Details.

- Click Submit.

A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any warning raised when the transaction saves. When you submit, the transaction details are handed off to the Term Deposit module in FLEXCUBE Universal Banking for the TD redemption process.

Parent topic: Term Deposit Transactions