4.13.4 Add Predefined Details

You can add the F24 predefined details in the F24 Tax – By Cash data segment.

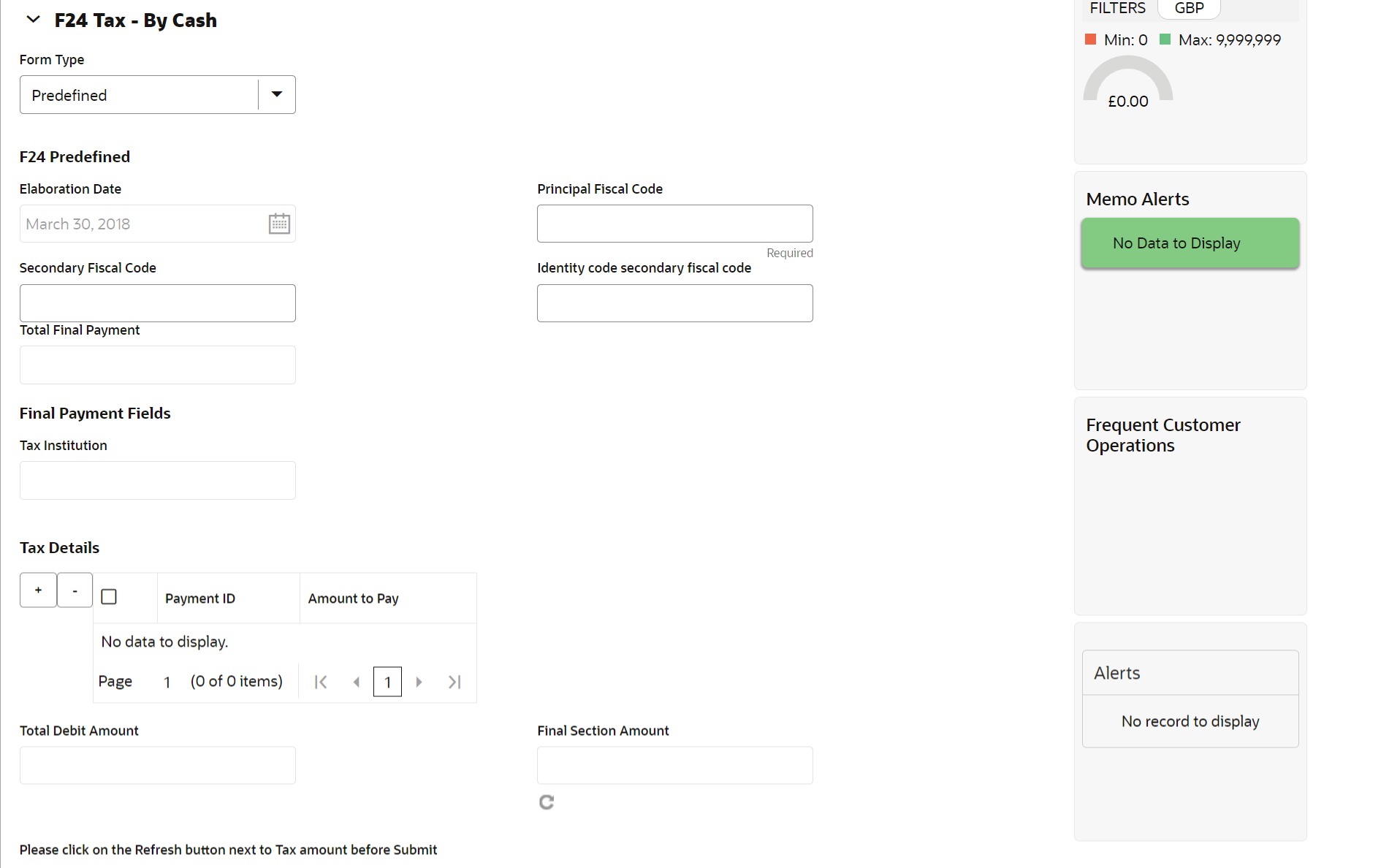

Figure 4-28 F24 Tax By Cash - F24 Predefined

On the F24 Tax – By Cash data segment, specify the fields. For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 4-36 F24 Predefined - Field Description

| Field | Description |

|---|---|

|

Form Type |

Select the Predefined tax category from the drop-down list. |

|

F24 Predefined |

Specify the fields. |

|

Elaboration Date |

Displays the elaboration date. |

|

Principal Fiscal Code |

Specify the debtor fiscal code.

Note: For Individual customers, the allowed principal fiscal code is 16 characters and for non-individual customers, this will be an 11-character VAT number. |

|

Secondary Fiscal Code |

Specify the secondary fiscal code.

Note: For Individual customers, the allowed secondary fiscal code is 16 characters and for non-individual customers, this will be an 11-character VAT number. |

|

Identity Code Secondary Fiscal Code |

Specify the identity code secondary fiscal code. |

|

Tax Institution |

Displays the tax Institution. |

|

Payment ID |

Specify the payment ID. |

|

Amount to Pay |

Specify the amount to be paid. |

|

Total Debit Amount |

Displays the total debit amount. |

|

Final Section Amount |

Displays the final section amount. |

Parent topic: F24C Tax Payment By Cash