- Deposit Services User Guide

- TD Transactions

- Redemption

3.4 Redemption

You can redeem a Term Deposit using this screen. The redemption proceeds can be credited to Current and Savings Account, New Term Deposit, Banker’s Cheque, Demand Draft, or Ledger. The Term Deposit can be redeemed in full or part.

Note:

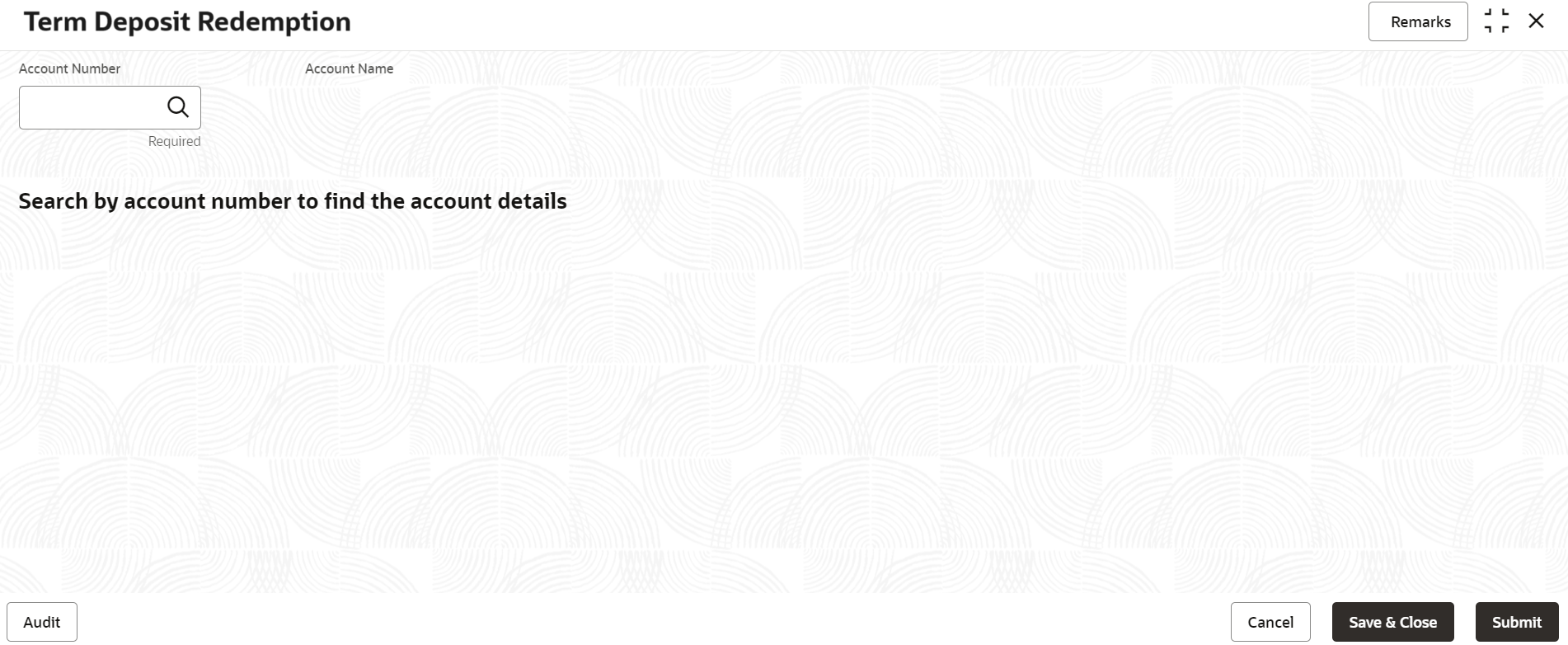

The fields marked as Required are mandatory.- On the Homepage, from the Retail Deposit

Services mega menu, under Term Deposits

and then Transactions, click

Redemption, or specify

Redemption in the search icon bar and select the

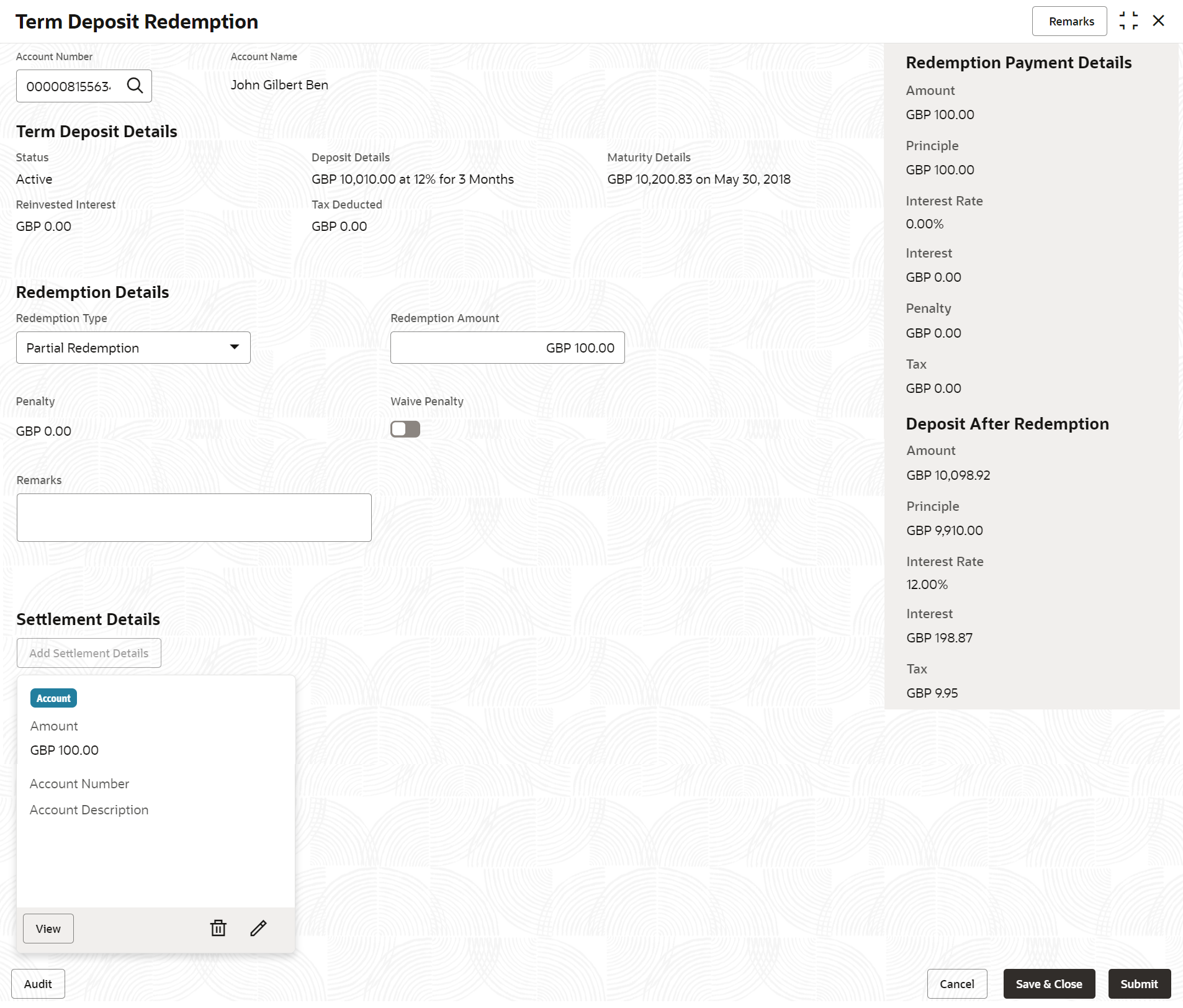

screen.The Term Deposit Redemption screen is displayed.

- On the Term Deposit Redemption screen, click the

icon or specify the account number in the Account

Number field, and press Enter or

Tab.The details are displayed in the Term Deposit Redemption screen.

icon or specify the account number in the Account

Number field, and press Enter or

Tab.The details are displayed in the Term Deposit Redemption screen.Figure 3-41 Term Deposit Redemption Details

- In the Term Deposit Redemption screen, perform the

required action. For more information on fields, refer to the field description

table.

Table 3-31 Term Deposit Redemption – Field Description

Field Description Account Number Click the icon and select the account number or specify

the account number to perform TD redemption.

icon and select the account number or specify

the account number to perform TD redemption.

Note:

The account holder name is displayed adjacent to this field.Status Displays the TD status. The possible options are: - Active

- Matured

- Closed

Deposit Details Displays the principal balance of the TD, the rate of interest, and the tenor of the TD. Maturity Details Displays the proceeds due to the customer on maturity and the maturity date. Reinvested Interest Displays the amount and currency for the reinvested or paid out interest. Note:

- If the interest if of reinvest type, then the field name is displayed as Reinvested Interest.

- If the interest if of paid out type, then the field name is displayed as Paid out Interest.

Tax Deducted Displays the actual tax deducted on reinvested or paid out interest till date. Redemption Type Select the type of redemption to be performed. The options are: - Partial Redemption

- Full Redemption

The default value is Full Redemption.

Note:

You can change the type to Partial Redemption and enter the amount in Redemption Amount field. The redemption amount should be not be greater than TD account balance.Redemption Amount Displays the full redemption amount. Note:

This field is enabled, if you select the Partial Redemption option from the Redemption Type field.Penalty Displays the penalty that will be charged for premature redemption. Waive Penalty Switch to

to waive the penalty amount charged on the

account.

to waive the penalty amount charged on the

account.

Switch to

to include the penalty amount charged on the

account.

to include the penalty amount charged on the

account.

Remarks You can specify the reason for TD redemption. - Based on the input data provided, the system simulates the details of TD and

displays them on the right side of the Term Deposit

Redemption screen.For more information on fields, refer to the field description table.

Table 3-32 Redemption Payment Details and Deposit After Redemption – Field Description

Field Description Redemption Payment Details This displays the details of the redemption payment to the customer. Amount This displays the final amount that will be paid out to the customer if the TD is redeemed today. Principal Displays the total principal of the TD. Interest Rate Displays the Interest rate applicable for the TD. Interest Displays the Net interest on the principal (Interest – Tax). Penalty Displays the penalty that will be charged for premature redemption and deducted from the proceeds due to the customer. Tax Displays the tax applicable on the recalculated interest and will be deducted from the proceeds due to the customer. Deposit After Redemption This displays the deposit amount in detail after redemption.

Amount Displays the maturity amount of the remaining term deposit.

Principal Displays the principal remaining after redemption.

Interest Rate Displays the interest rate applicable for the remaining principal.

Interest Displays the interest due to the customer on maturity.

Tax Displays the tax that will be deducted on maturity.

Note:

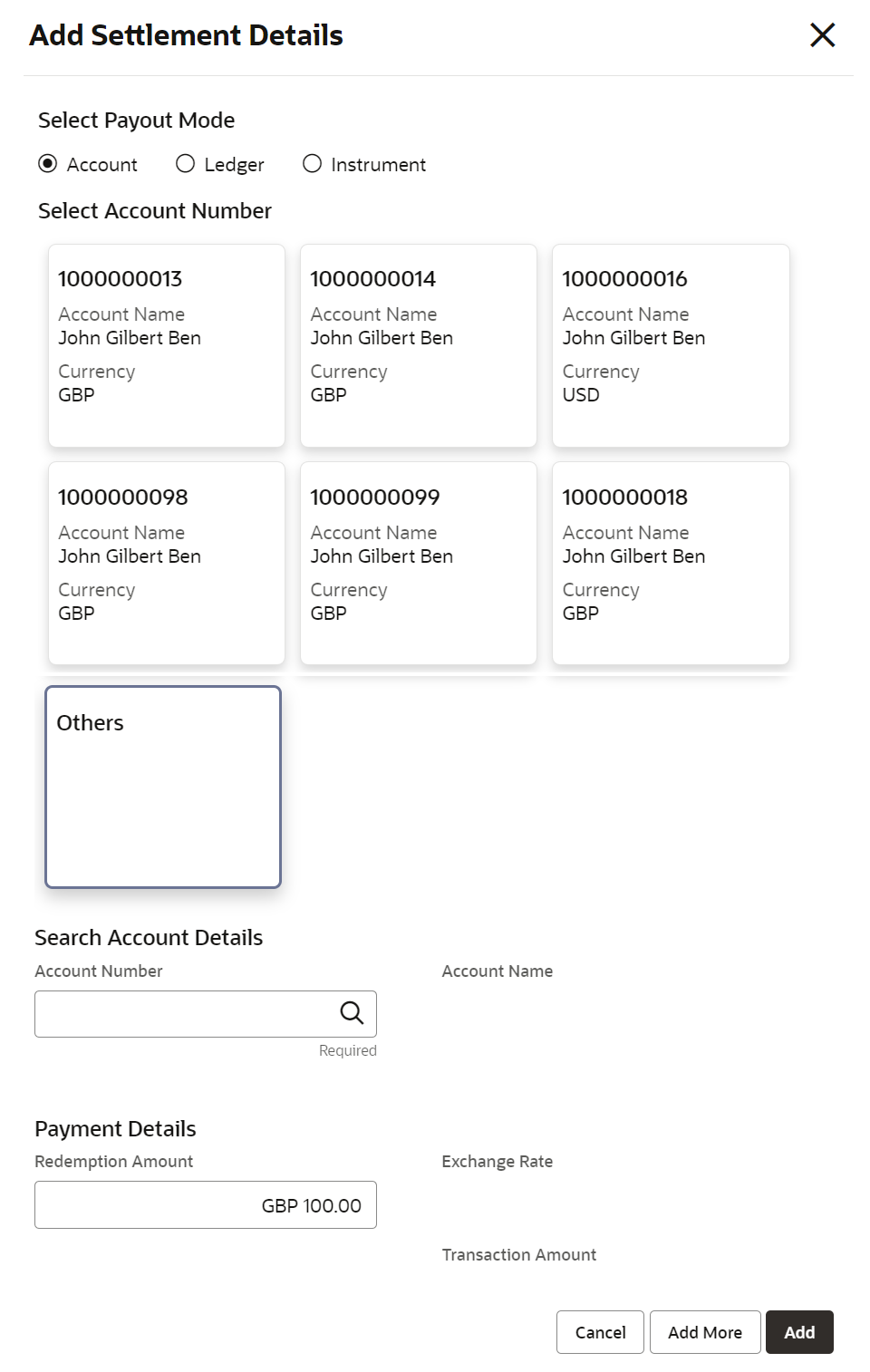

Once the deposit simulation is completed, you can provide the simulated details to the customer. - On Term Deposit Redemption screen, click Add

Settlement Details button.The Add Settlement Details screen is displayed with the default payout mode as Account.

Figure 3-42 Term Deposit Redemption - Account

For more information on fields, refer to the field description table.Table 3-33 Add Settlement Details - Account

Field Description Select Payout Mode The Account mode is selected with the default. Select Account Number The own accounts are displayed as widgets with the Account Number, Account Name, and Currency. You can select the account for TD payout. You can select Others from the widget to select any other accounts in the same bank for TD payout.

Search Account Details If you select Others from the widgets, the Account Number field is diplayed to specify the account number. click the

icon or specify the account number in the

Account Number field and

the Account Name is displayed

adjacent to the account number.

icon or specify the account number in the

Account Number field and

the Account Name is displayed

adjacent to the account number.

Redemption Amount Displays the amount and you can modify the amount in case the amount is payout by different modes or accounts. Exchange Rate Displays the exchange rate. Note:

This field is displayed only if there is cross currency transaction.Transaction Amount Displays the amount in payout account currency. Note:

This field is displayed only if there is cross currency transaction. - On Add Settlement Details screen, select

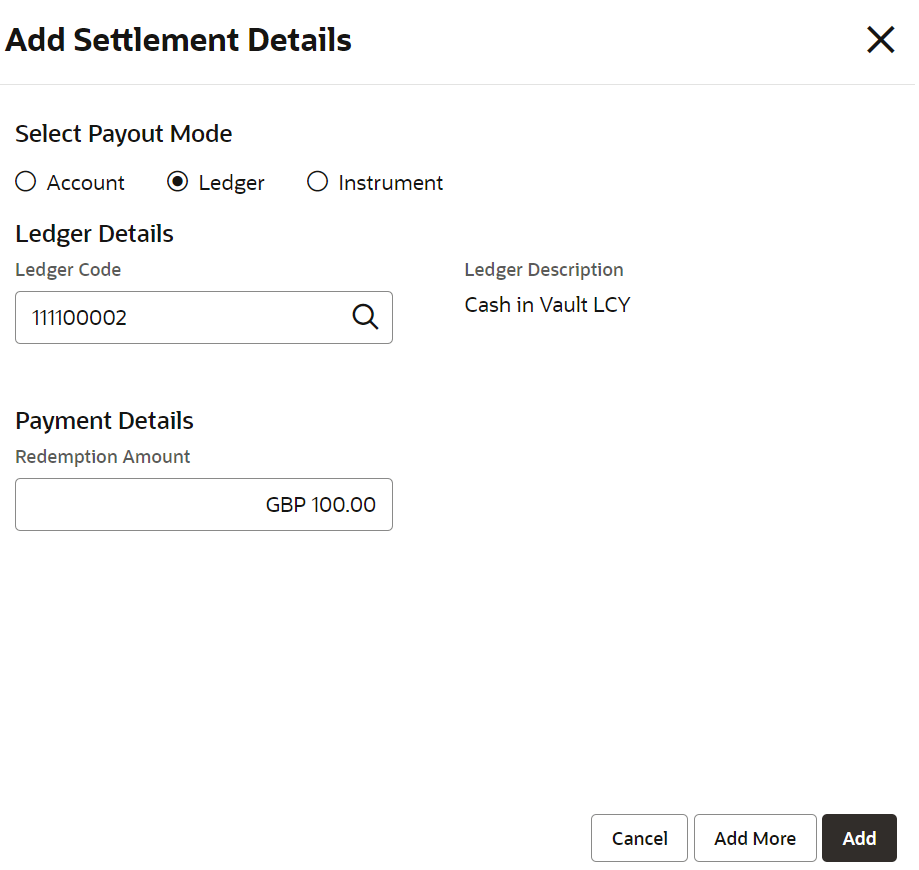

Ledger as the payment mode.The ledger details are displayed in the Add Settlement Details screen.

Figure 3-43 Term Deposit Redemption - Ledger

For more information on fields, refer to the field description table.Table 3-34 Add Settlement Details - Ledger

Field Description Ledger Code Specify the ledger code or click the  icon and specify the ledger code in the

Ledger Code field.

icon and specify the ledger code in the

Ledger Code field.

Ledger Description Displays the description once the ledger code is specified. Redemption Amount Displays the amount and you can modify the amount in case the amount is payout by different modes or accounts. - On Add Settlement Details screen, select

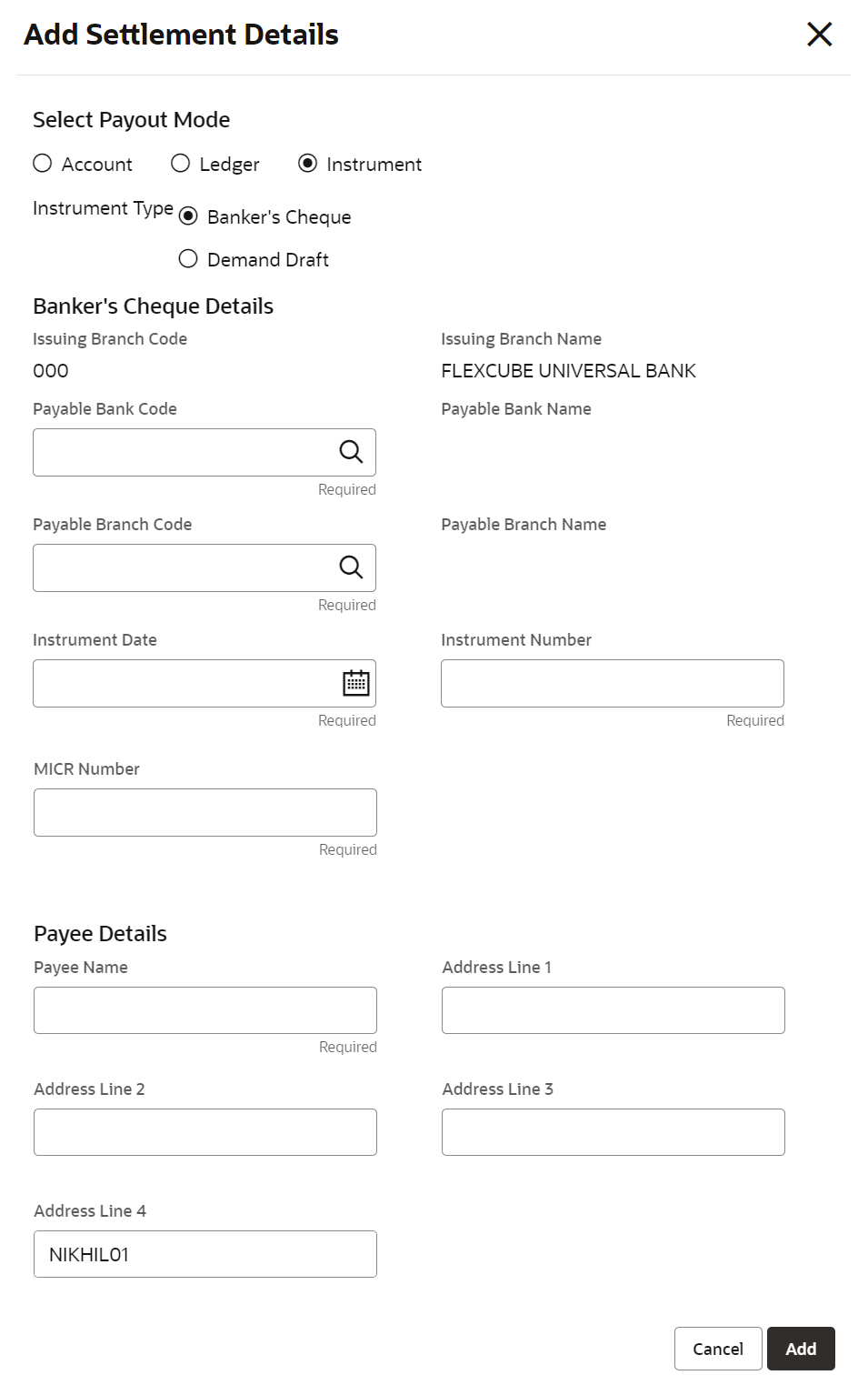

Instrument as the payment mode.The instrument details are displayed in the Add Settlement Details screen.

Figure 3-44 Term Deposit Redemption - Instrument

For more information on fields, refer to the field description table.Table 3-35 Add Settlement Details - Instrument

Field Description Instrument Type Select the type of instrument for payout. The options are: - Banker's Cheque

- Demand Draft

Issuing Branch Code Displays the branch code issuing the instrument. Issuing Branch Name Displays the branch name issuing the instrument. Payable Bank Code Specify the bank code at which the TD is payable. Payable Bank Name Displays the payable bank name once the payable bank code is specified. Payable Branch Code Specify the branch at which the BC or DD is payable. Payable Branch Name Displays the payable branch name once the payable branch code is specified. Instrument Date Specify the instrument date. Instrument Number Specify the instrument number. MICR Number Specify the MICR number. Payee Name Specify the payee name for the payout. Payee Address Specify the payee address for the payout. - Click Cancel button, to close the Add Settlement Details screen without adding the settlement details.

- Click Add More button, the system add the settlement details to the main screen and refreshes the Add settlement details screen with default values, and the payout amount is updated for the remaining settlement amount.

- Click Add button to add the settlement details in

Term Deposit Redemption screen.The settlement details are displayed in the Term Deposit Redemption screen.

Figure 3-45 Term Deposit Redemption - Settltment Details

For more information on fields, refer to the field description table.Table 3-36 Term Deposit Redemption - Settlement Details

Field Description Settlement Details For the Account, the system displays the below details.- Currency and Amount

- Account Number

- Account Description

For the Ledger, the system displays the below details.- Currency and Amount

- Ledger Code

- Ledger Description

Note:

Exchange rate is displayed only if there is a cross currency transaction.Click the View button to view the settlement details.

Click the

icon to edit the redemption amount in the

settlement details.

icon to edit the redemption amount in the

settlement details.

Click the

icon to delete the settlement details.

icon to delete the settlement details.

- Click Submit.The screen is successfully submitted for authorization.

Parent topic: TD Transactions