3.1.1 Account

This topic provides information on account.

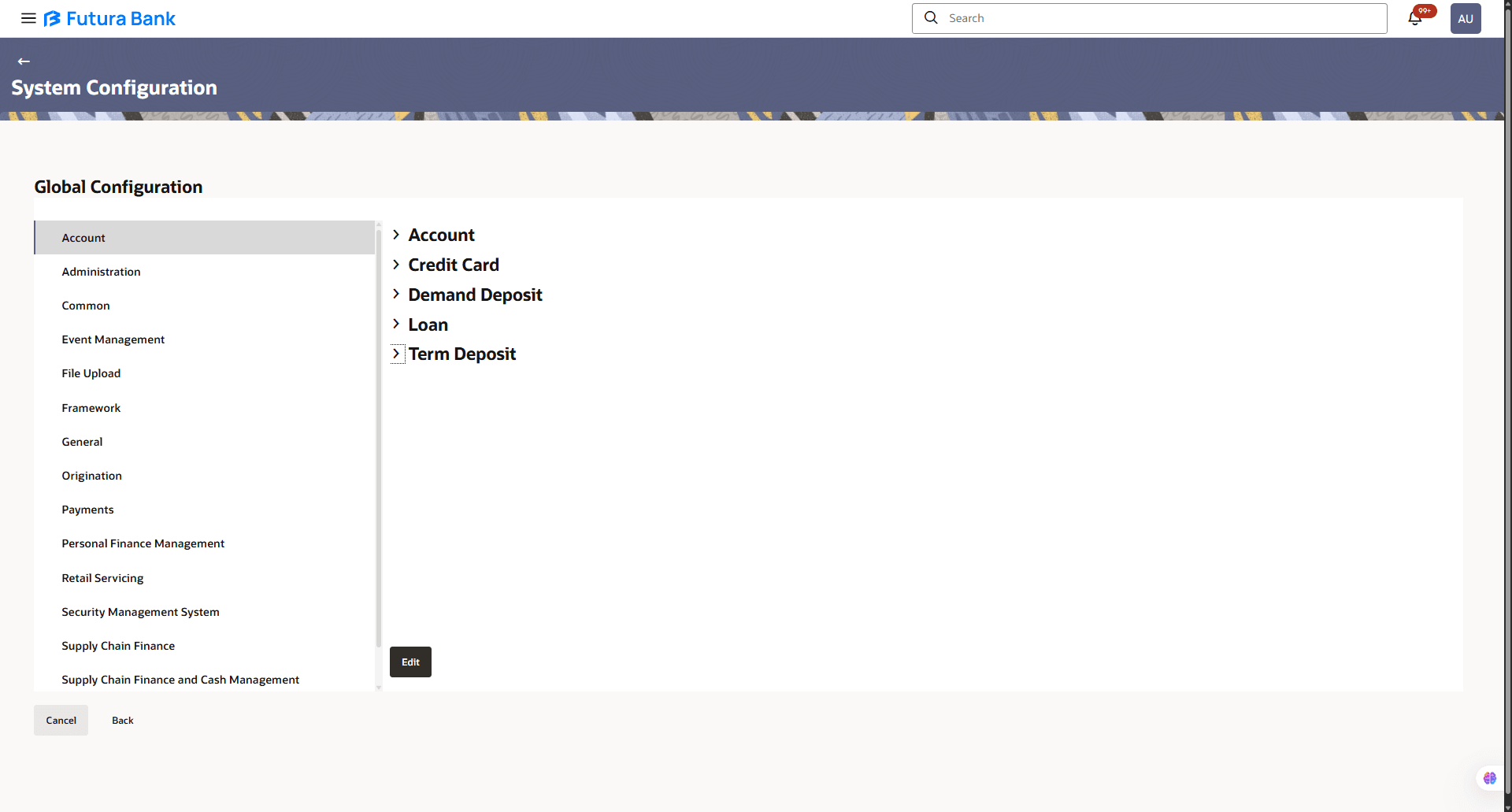

- In the Global Configuration screen, click

Account.The Account screen is displayed.

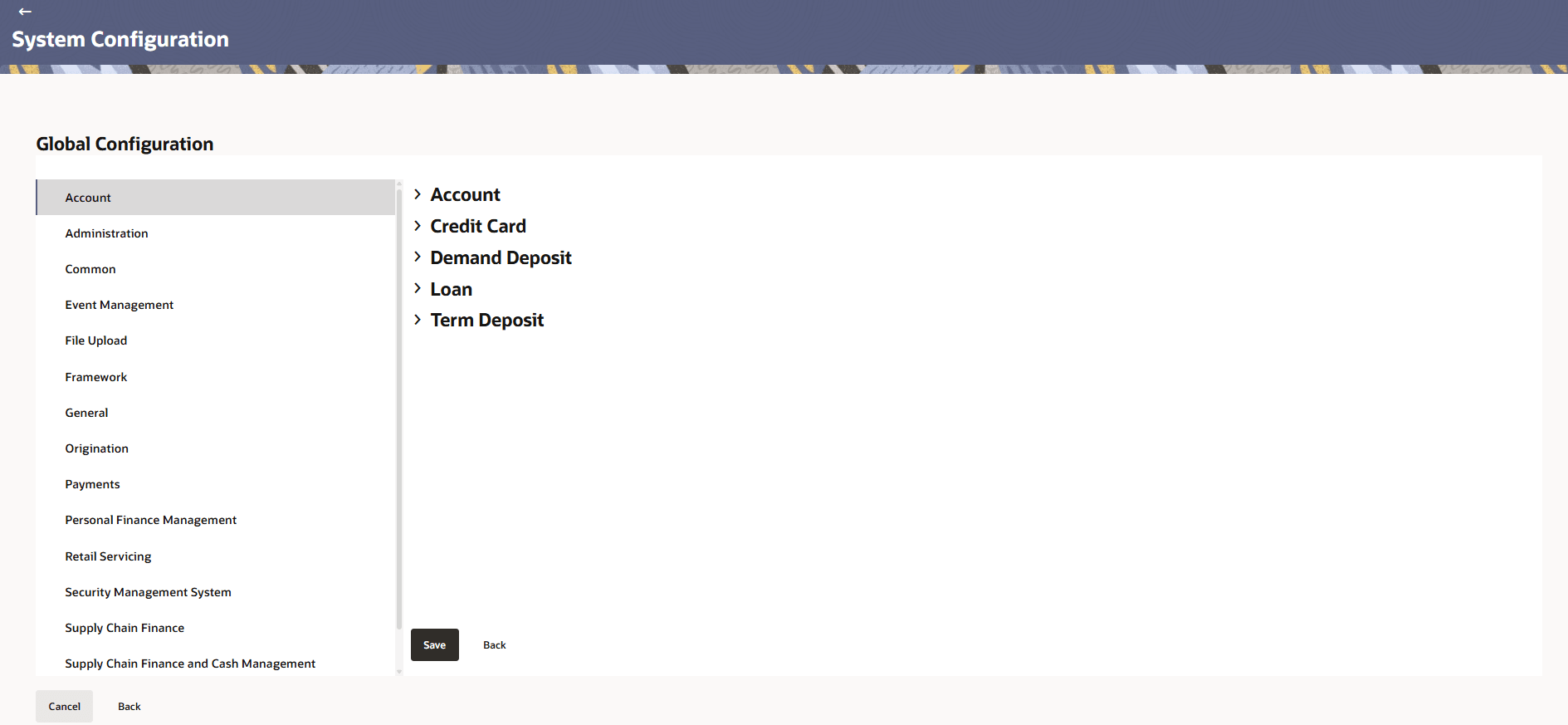

- Click Edit to specify the details under account.The Account - Edit screen is displayed.

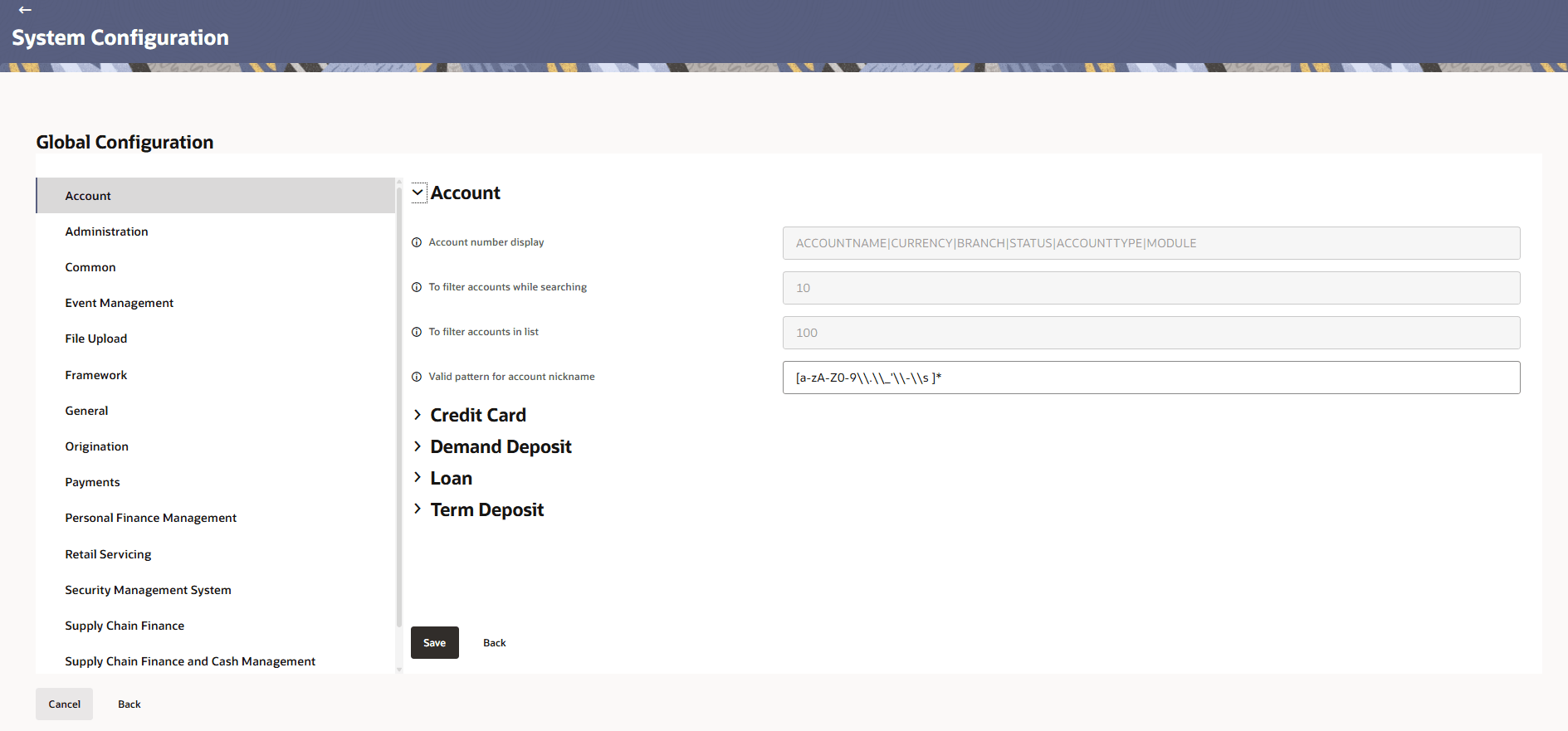

- Click expand and specify the details.

Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-1 Account - Field Description

Field Description Account number display Displays the unique account number associated with the customer’s account. To filter accounts while searching Allows users to refine search results by filtering accounts based on specific criteria. To filter accounts in list Enables users to apply filters to the displayed account list, helping narrow down the view to accounts Valid pattern for account nickname Specifies the acceptable format for account nicknames. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

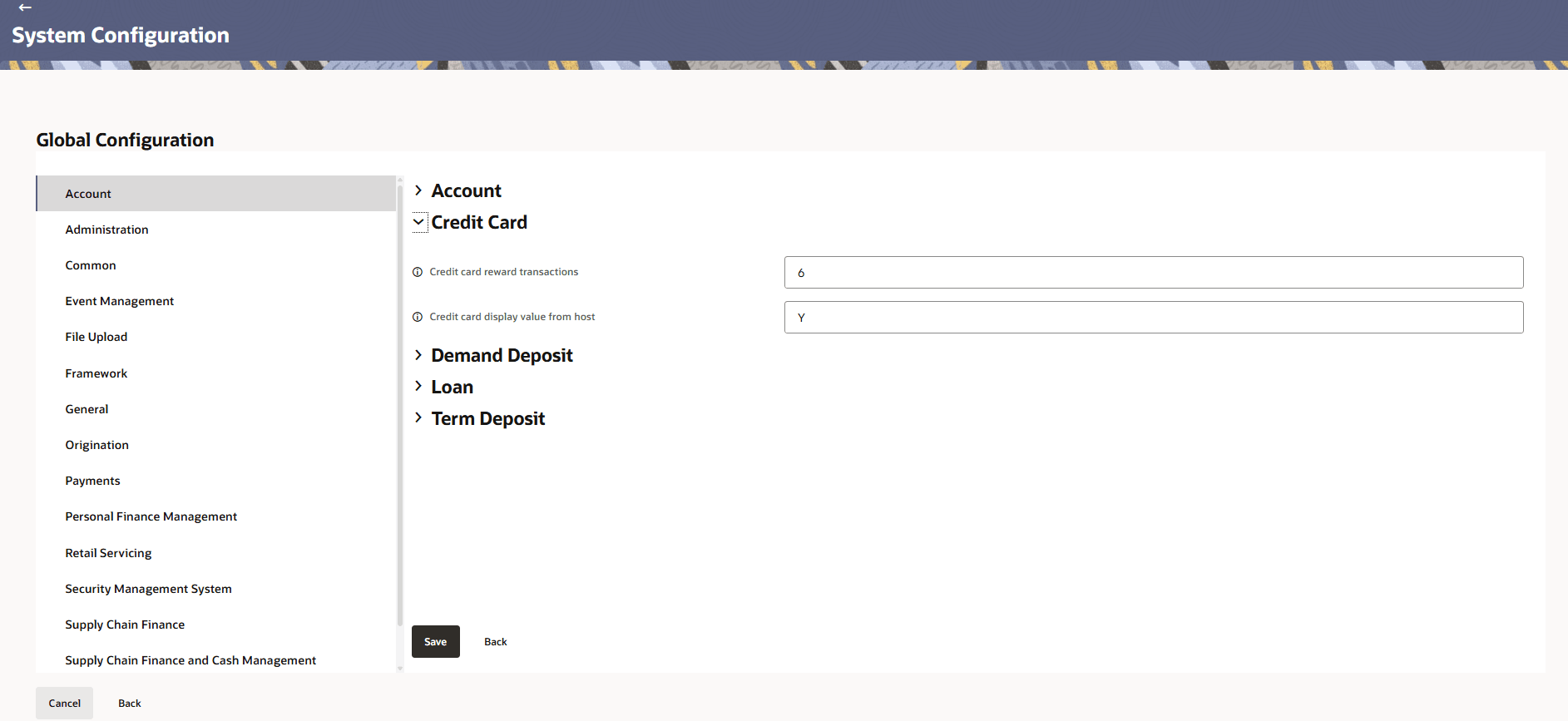

Table 3-2 Credit Card - Field Description

Field Description Credit card reward transactions Displays the list of transactions that have earned or redeemed reward points on the credit card. Credit card display value from host Displays the credit card details or values retrieved directly from the host system. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

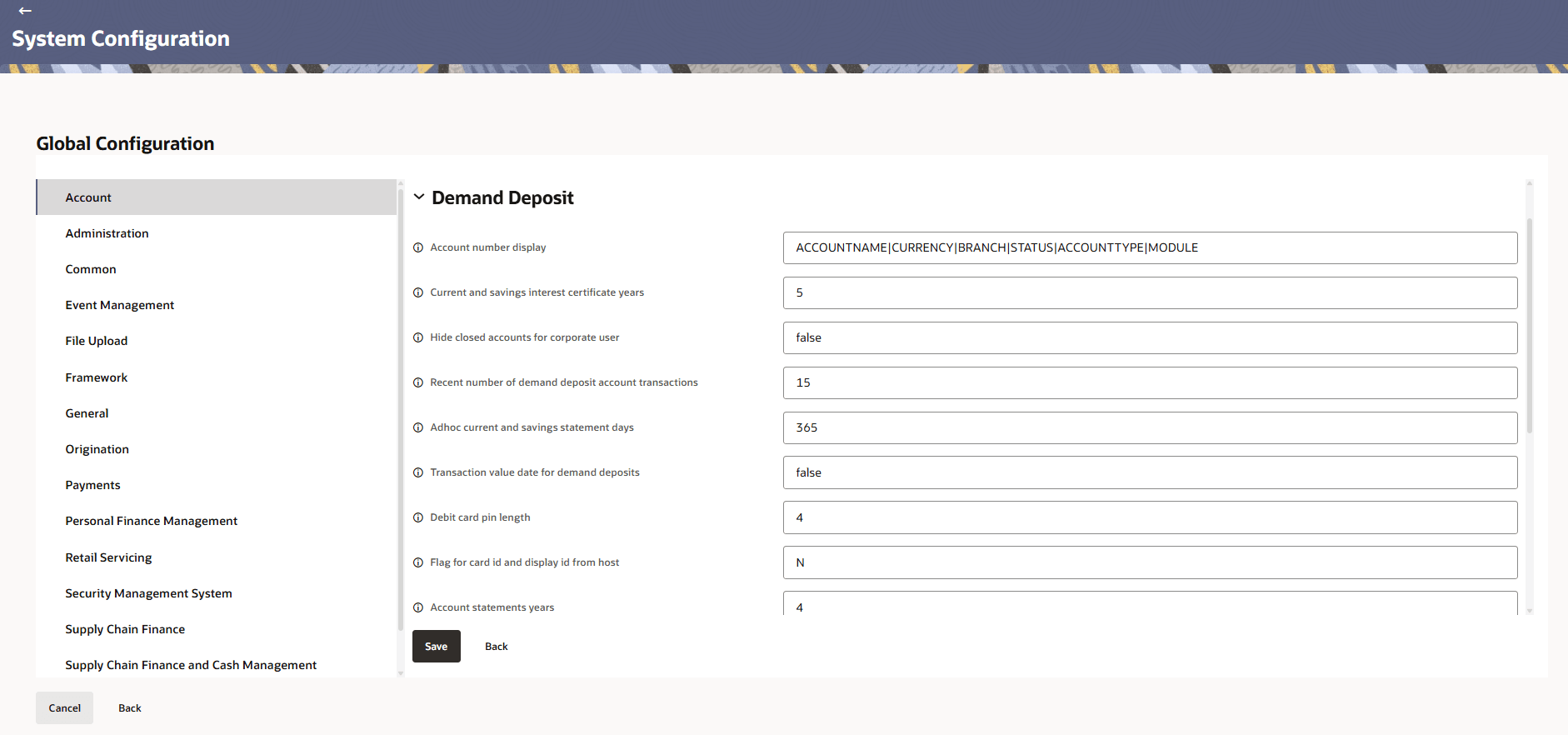

Table 3-3 Demand Deposit - Field Description

Field Description Account number display Displays the unique account number linked to the customer’s account for identification in transactions and statements. Current and savings interest certificate years Defines the range of years available for generating interest certificates for current and savings accounts. Hide closed accounts for corporate user Enables hiding of closed accounts from the account list view for corporate users to display only active accounts. Recent number of demand deposit account transactions Specifies the number of recent transactions to be displayed for demand deposit accounts. Adhoc current and savings statement days Sets the number of days for which ad-hoc statements can be generated for current and savings accounts. Transaction value date for demand deposits Determines the value date to be used when displaying or processing demand deposit transactions. Debit card pin length Defines the required length (number of digits) for the debit card Personal Identification Number (PIN). Flag for card id and display id from host Indicates whether the card ID and display ID should be fetched directly from the host system. Account statements years Specifies the range of years available for generating or viewing account statements. Days for fetching transactions Determines the time period (in days) for which transaction records can be retrieved and displayed. Enable IBAN Enables the option to display or use International Bank Account Numbers (IBAN) for applicable accounts. Days for listing Cheques Defines the number of past days for which cheque records should be displayed in the system. Maximum number of records Sets the upper limit on the number of records that can be retrieved or displayed in a single query or view. Demand deposits pre generated transactions Indicates whether pre-generated transactions for demand deposit accounts should be displayed or processed automatically. Filters account activity on the basis of transaction date Enables filtering of account activity records based on the selected transaction date range. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

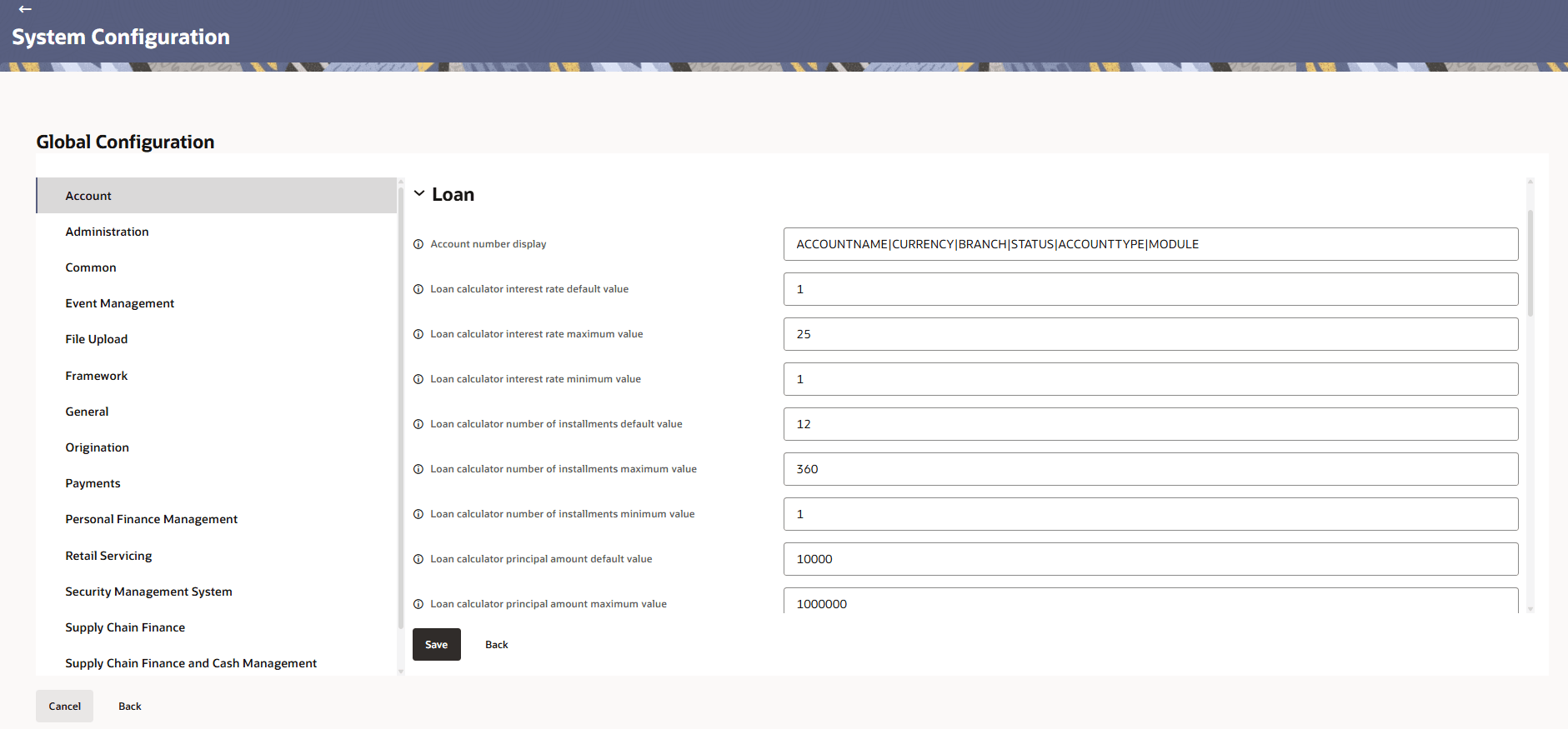

Table 3-4 Loan - Field Description

Field Name Description Account number display Displays the unique account number associated with the customer’s account for transaction and statement identification. Loan calculator interest rate default value Specifies the default interest rate (%) that appears automatically when using the loan calculator. Loan calculator interest rate maximum value Defines the highest permissible interest rate (%) that can be entered in the loan calculator. Loan calculator interest rate minimum value Defines the lowest permissible interest rate (%) that can be entered in the loan calculator. Loan calculator number of installments default value Sets the default number of installments (EMIs) pre-populated in the loan calculator. Loan calculator number of installments maximum value Specifies the maximum number of installments allowed in the loan calculator. Loan calculator number of installments minimum value Specifies the minimum number of installments required in the loan calculator. Loan calculator principal amount default value Indicates the default principal loan amount displayed in the loan calculator. Loan calculator principal amount maximum value Defines the upper limit of the loan amount that can be entered in the loan calculator. Loan calculator tenure default value Sets the default tenure value (in months or years) pre-populated in the loan calculator. Loan calculator tenure maximum value Defines the maximum tenure duration allowed for loan calculations. Loan calculator tenure minimum value Defines the minimum tenure duration allowed for loan calculations. Loan eligibility calculator gross monthly income default value Specifies the default gross monthly income amount displayed in the loan eligibility calculator. Loan eligibility calculator gross monthly income maximum value Defines the maximum gross monthly income value that can be entered in the loan eligibility calculator. Loan eligibility calculator gross monthly income minimum value Defines the minimum gross monthly income value required in the loan eligibility calculator. Loan eligibility calculator interest rate default value Sets the default interest rate (%) displayed in the loan eligibility calculator. Loan eligibility calculator interest rate maximum value Specifies the maximum permissible interest rate (%) in the loan eligibility calculator. Loan eligibility calculator interest rate minimum value Specifies the minimum permissible interest rate (%) in the loan eligibility calculator. Loan eligibility calculator monthly expenses default value Indicates the default monthly expenses value shown in the loan eligibility calculator. Loan eligibility calculator monthly expenses maximum value Defines the upper limit for monthly expenses that can be entered in the loan eligibility calculator. Loan eligibility calculator monthly expenses minimum value Defines the minimum monthly expenses value required in the loan eligibility calculator. Loan eligibility calculator tenure default value Sets the default loan tenure (in months or years) pre-filled in the loan eligibility calculator. Loan eligibility calculator tenure maximum value Defines the maximum loan tenure allowed in the loan eligibility calculator. Loan eligibility calculator tenure minimum value Defines the minimum loan tenure allowed in the loan eligibility calculator. Loan calculator rounding mode Specifies the rounding method (for example, up, down, nearest) used when calculating loan amounts and EMI values. Loan calculator rounding scale Determines the number of decimal places to which calculated loan values are rounded. Account statements years Specifies the range of years available for generating or viewing account statements. Loan transaction value date Defines the value date to be used for displaying or processing loan transactions. Loans interest certificate years Sets the range of financial years available for generating loan interest certificates. Recent number of loan account transactions Specifies the number of recent loan account transactions to be displayed in the transaction list. Loan adhoc statement days Determines the number of days for which ad-hoc statements can be generated for loan accounts. Loans pre-generated transactions Indicates whether pre-generated loan transactions should be displayed or processed automatically. Filters account activity on the basis of transaction date Enables filtering of loan or account activity records based on the selected transaction date range. Note:

The fields marked as Required are mandatory.For more information on fields, refer to the field description table.

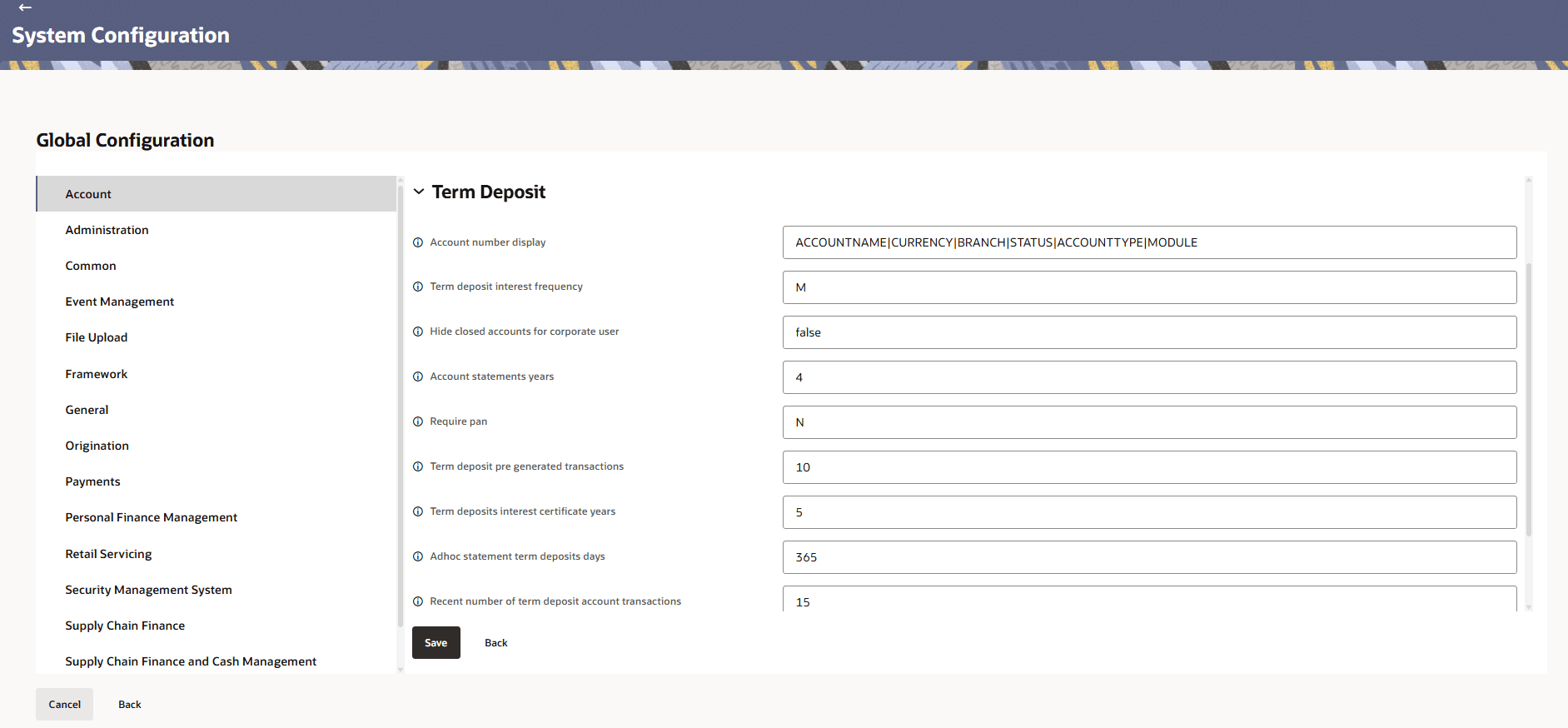

Table 3-5 Term Deposit - Field Description

Field Name Description Account number display Displays the unique account number associated with the customer’s account for transaction and statement identification. Term deposit interest frequency Specifies how often interest is calculated and credited for term deposit accounts (e.g., monthly, quarterly, annually). Hide closed accounts for corporate user Enables hiding of closed accounts from the account list view for corporate users to display only active accounts. Account statements years Specifies the range of years available for generating or viewing account statements. Require PAN Indicates whether the PAN (Permanent Account Number) is mandatory for term deposit account creation or transactions. Term deposit pre-generated transactions Indicates whether pre-generated transactions for term deposit accounts should be displayed or processed automatically. Term deposits interest certificate years Sets the range of financial years available for generating term deposit interest certificates. Adhoc statement term deposits days Determines the number of days for which ad-hoc statements can be generated for term deposit accounts. Recent number of term deposit account transactions Specifies the number of recent term deposit account transactions to be displayed in the transaction list. Term deposit calculation walk-in customer ID Specifies the customer ID to be used when calculating term deposits for walk-in customers. Filters account activity on the basis of transaction date Enables filtering of term deposit or account activity records based on the selected transaction date range. - Click Save to save the details.

- Click Back to navigate to previous page.

- Click Cancel to cancel the details.

Parent topic: Global Settings