This topic describes the systematic instructions to View or Modify the Bulletin Message.

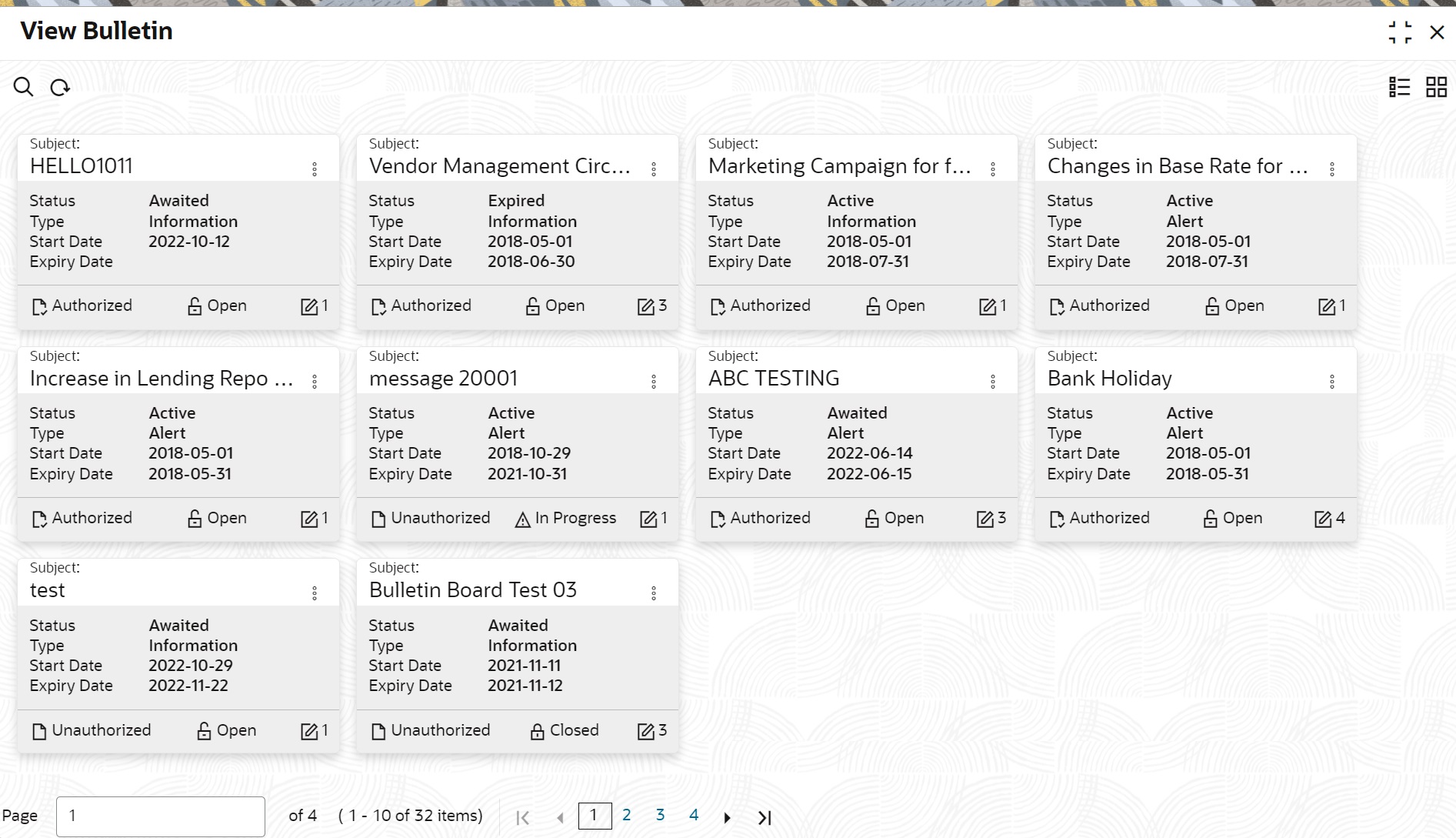

- On the Home screen, from Interaction

Services, under Maintenance,

Bulletin, click View Bulletin,

or specify the View Bulletin in the Search icon

bar.View Bulletinscreen is displayed.

- On View Bulletin screen, the system displays all the

bulletin messages with status:

- Awaited

- Active

- Paused

- Expired

- On the View Bulletin screen, user can search for specific bulletin using the Search icon. user can use any of the following options to search:

- Message Type

- Message Status

- Message Reference Number

- Subject

- Start Date

- Expiry Date

- Authorization Status

- Record Status

- After the input of any options mentioned above, click the Search button.

- Click the Action icon to display the following

options:

- Unlock

- Authorize

- Delete

- Close

- Copy

- View

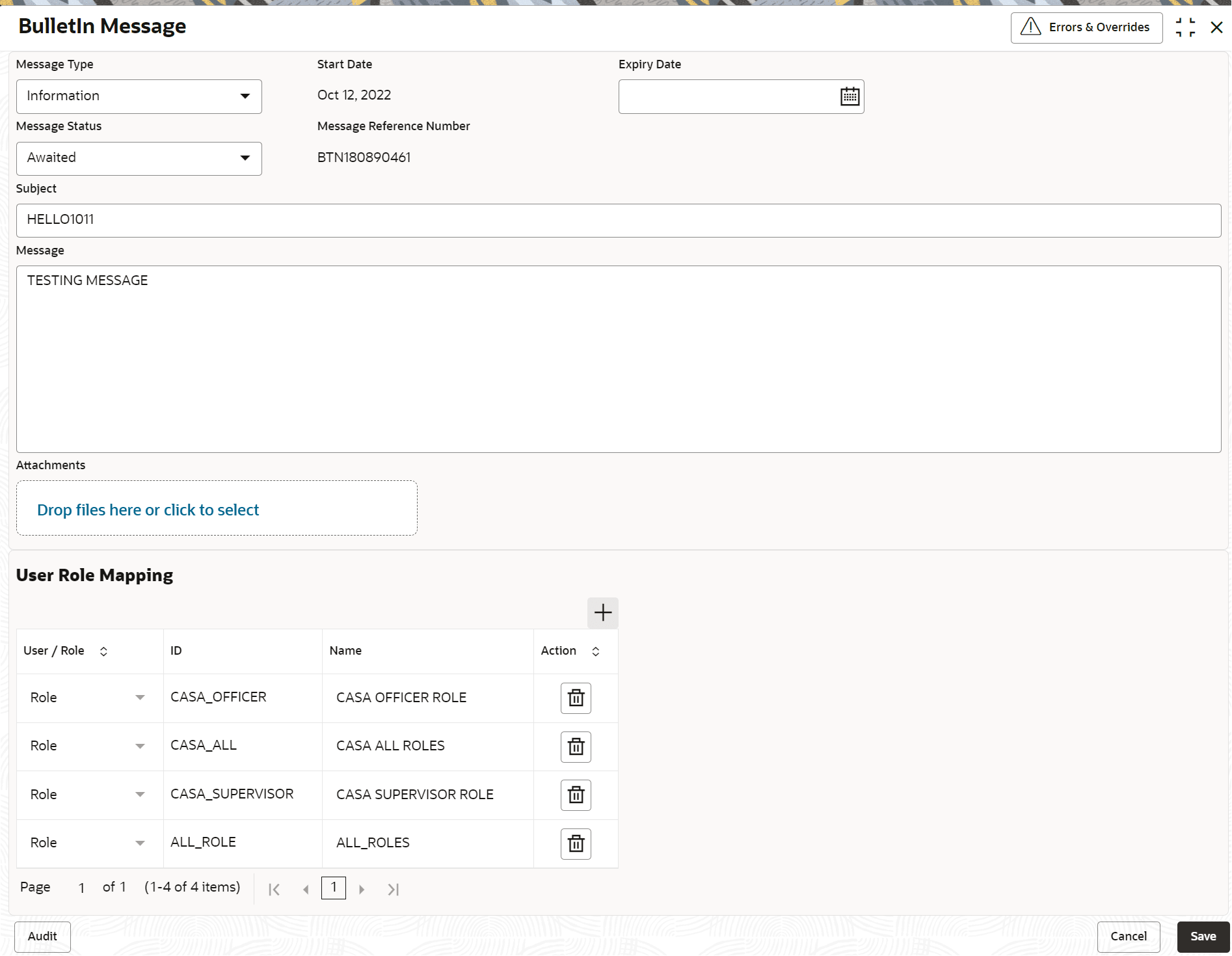

- To modify an existing bulletin message, click the Unlock

option from the Action icon.The BulletIn Message screen is displayed.

- To view the bulletin message, click the View option from

the Action icon.Create Bulletin screen is displayed.

Note:

On the create bulletin screen, all the fields are non-editable. - To replicate an existing bulletin, click the Copy option from the Action icon.

- To permanently delete the existing bulletin, click the Delete option from the Action icon.

- On View Bulletin screen, the system displays all the bulletin messages with status

Note:

For more information on fields, refer to the field description table.Table 2-17 Tax Deducted at Source Inquiry - Field Description

Field Description Customer ID Enter the Customer ID or click the search icon to view the Customer ID pop-up window. By default, this window lists all the Customer ID’s present in the system. User can search for a specific Customer ID by providing Customer Number or Customer Name and click on the Fetch button. Customer Name Customer Name is displayed based on the Customer ID selected. Account Number User can enter a specific account number of the customer and search Tax Deducted at Source details or click the drop-down list to select the available account numbers listed for the customer id to search the Tax Deducted at Source details. Note:This is an optional field.

Financial Year By default, the current financial year is displayed in this field. User can select the previous financial years from the drop-down. The system displays the Tax Deducted at Source details financial year-wise. Branch The system displays the Branch Code based on the account number. Account Number The system displays the Account Number. Account Name The system displays the Account Name. Interest Amount The system displays the Credit interest on the account. Taxation Date The system displays the date of the tax application on the account. Tax Amount The system displays the Tax amount calculated on the credit interest.