1.10.1 Create IRA Product

This topic describes the systematic instructions to create IRA product. The maintenance screen allows the user to configure IRA product details.

Note:

The fields marked as Required are mandatory.- On Home screen, under Menu, click Retail Account Configurations. Under Retail Account Configurations, click IRA Product Configuration.

- Under IRA Product Configuration, click Create

IRA Product.The Create IRA Product screen displays.

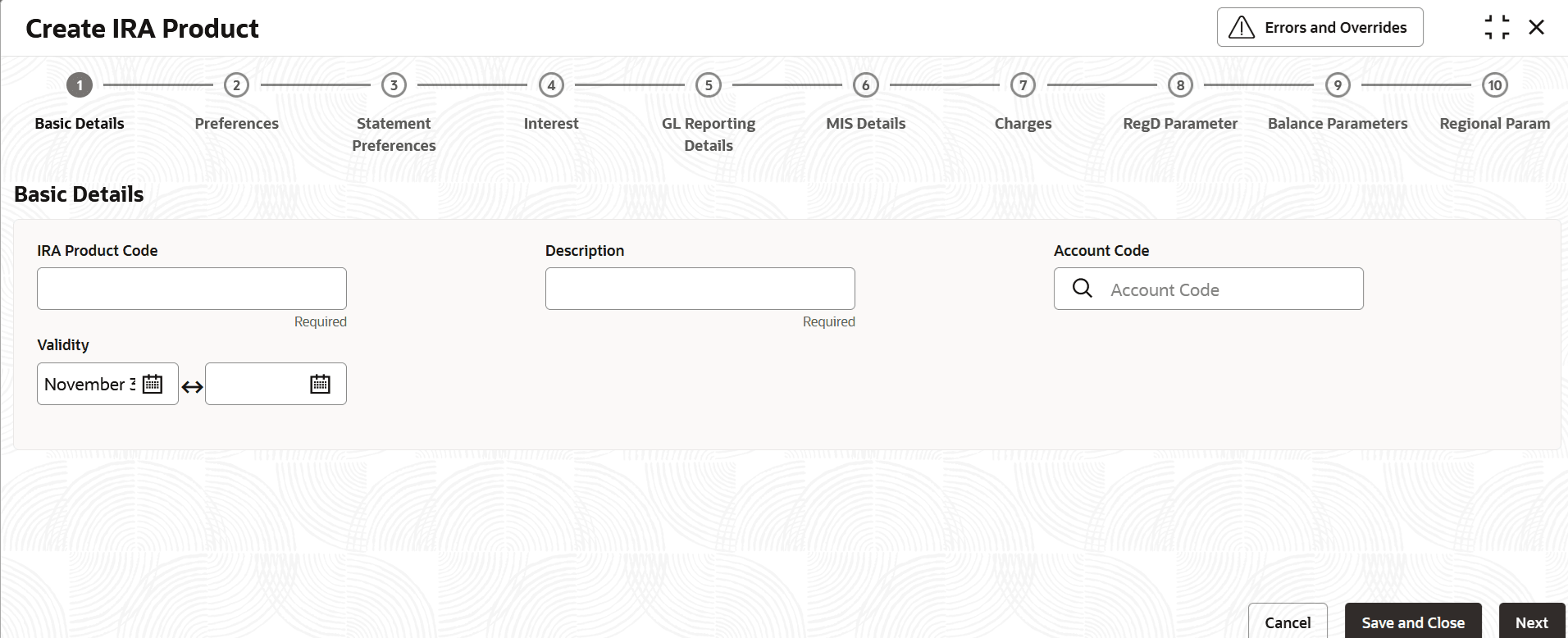

Figure 1-41 Create IRA Product - Basic Details

- Specify the fields on the Basic Details screen.

For more information on fields, refer to the field description table below.

Table 1-39 Basic Details - Field Description

Field Description IRA Product Code Specify the six digit alpha numeric unique product code for identifying the IRA product. Description Specify the brief description of the IRA product. Account Code As per your bank’s requirement, you can choose to classify IRA products into different account codes. The bank can decide the way the IRA products are to be assigned to different account codes. The IRA product or an account code can be part of the customer account mask.

If the customer account mask consists of an account code, the value in this field is replaced in the account number.Validity Specify the validity period of the IRA product by specifying the start date and the end date. The start date is mandatory and is defaulted to the current date.

End date is optional.

- After specifying the fields in the Basic Details screen,

click Next.The Preferences screen displays.

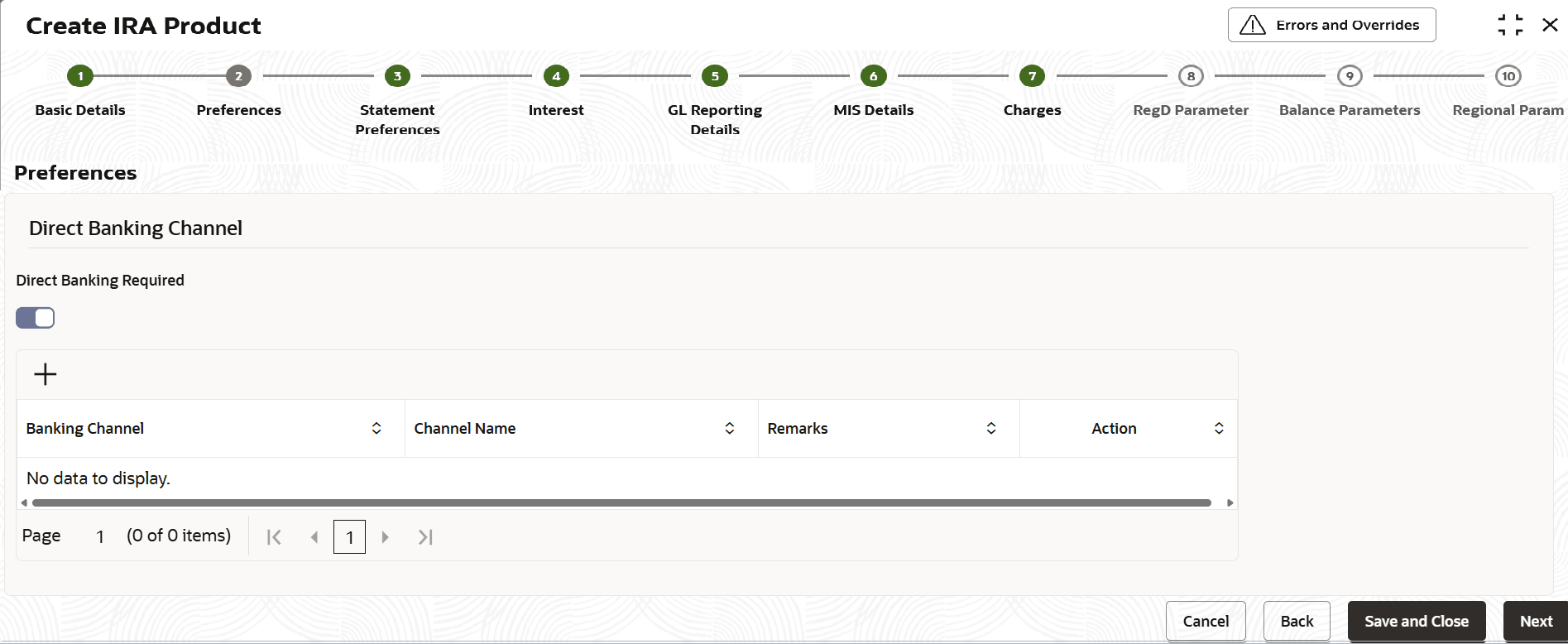

Figure 1-42 Create IRA Product - Preferences

- Specify the fields on Preferences screen.

For more information on fields, refer to the field description table below.

Table 1-40 Preferences - Field Description

Field Description Direct Banking Required Switch this toggle ON whether direct banking is required for accounts under the IRA product. The default value is OFF.

Once it is enabled, an Add icon and the related fields are displayed.

Click Add icon to add a direct banking channel details. A new row is added with the below fields.- Banking Channel - Banking channels maintained in Static Type Maintenance, are listed here as permissible channels for the IRA product. The channels include Internet Banking, Interactive Voice Response, Mobile, ATM, Credit Card and so on.

- Channel Name - This field indicates the name of the banking channel and it is auto-populated based on the banking channel code selected.

- Remarks - Capture if any remarks for the channel.

- Action - Click the Delete icon to delete the added details.

- After specifying the fields in the Preferences screen,

click Next.The Statement Preferences screen displays.

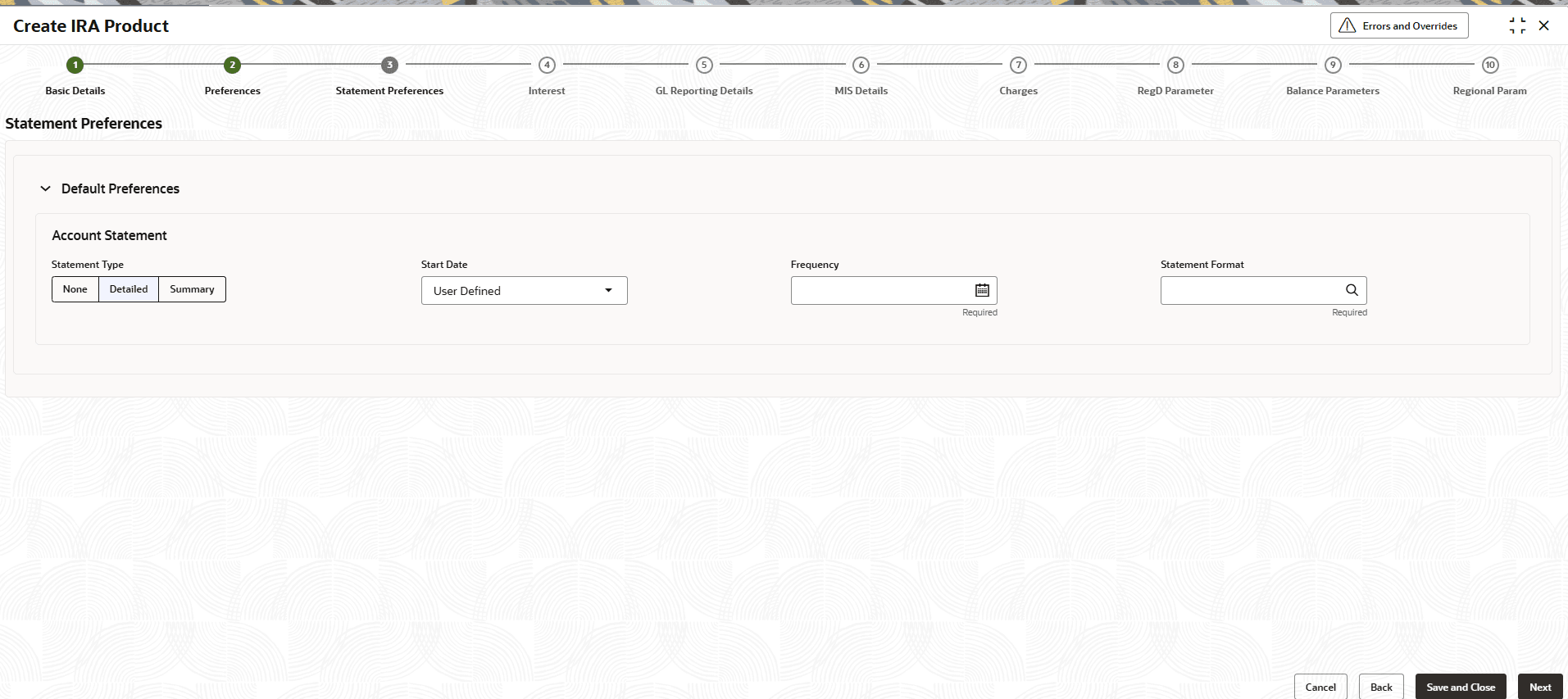

Figure 1-43 Create IRA Product - Statement Preferences

- Specify the fields on the Statement Preferences

screen.

For more information on fields, refer to the field description table below.

Table 1-41 Statement Preferences - Field Description

Field Description Statement Type Specify the type of account statement. The options are as follow: - None

- Summary

- Detailed

Start Date Select the start date of the account statement cycle begins. Frequency Select the frequency of an account statements are to be generated. Statement Format Specify the format in which the account statement should be generated. Click Search icon to view and select the required statement format. This field is available only when the Statement Type is selected as Summary or Detailed.

Validations

When the Cycle is selected as follows:

- Monthly - the list of value displays value from 1 to 31. This shows the day of the month for statement generation.

- Weekly - the list of value displays value from Sunday to Saturday.

- Fortnightly - the list of value displays value from Sunday to Saturday.

- Quarterly - the list of value displays value from January to December.

- Semi Annual - the list of value displays value from January to December.

- Annual - the list of value displays value from January to December.

- After specifying the fields in the Statement Preferences

screen, click Next.The Interest screen displays.

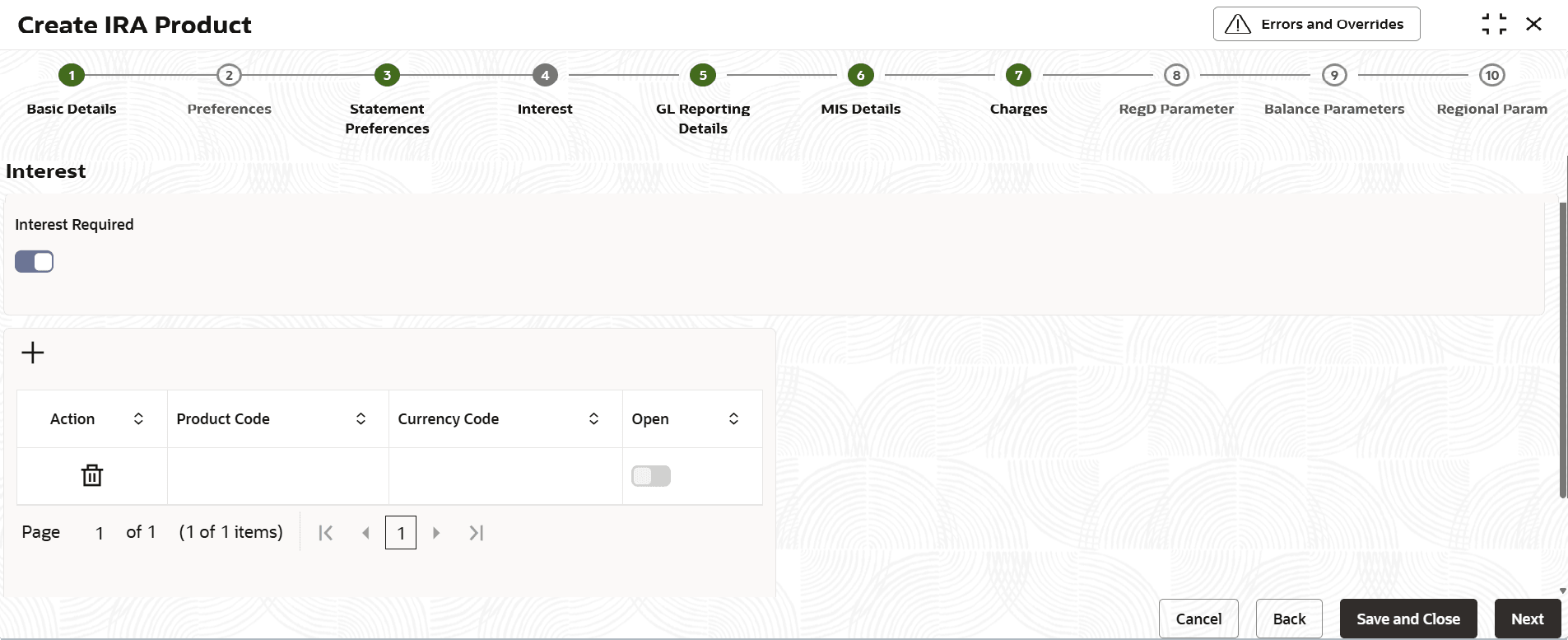

To calculate interest for an account, you must apply an interest product code on the account. To recall, every interest product code that you create is linked to an interest rule. The logic to calculate interest is built into an interest rule. When you apply an interest product code on the account, interest for the account will be calculated according to the interest rule definition.

The interest rule that is linked to the product(s) will determine the interest that is applied on the account. You may want to apply more than one interest product code on an account. For example, you may want to pay credit interest on the credit balance maintained in a current account and levy a debit interest if the account lapses into a debit balance. In order to achieve this, you would have to apply two product codes (one defined for credit interest and another defined for debit interest). In this screen, you can choose the interest product codes that you want to apply on the account.

- Specify the fields on Interest screen.

For more information on fields, refer to the field description table below.

Table 1-42 Interest - Field Description

Field Description Interest Required Switch this toggle ON to indicate that the interest is applicable for the accounts with this IRA product. The default value is ON.

Click the Add icon, a new row is added to update the details for the interest.

Action Click the Delete icon to delete the added row. Product Code The IC product code can be selected for the product (currency-wise) for the IRA product. This is applicable only if Interest Required flag is ON. Currency Code Click Search icon to view and select the applicable currency code. This is applicable only if Interest Required flag is ON. Open Switch this toggle ON to change the status of the product code to open. The default value is OFF.

For more information about Interest, refer to Interest and Charges User Guide

- After specifying the fields in the Interest screen,

click Next.The GL Reporting Details screen displays.

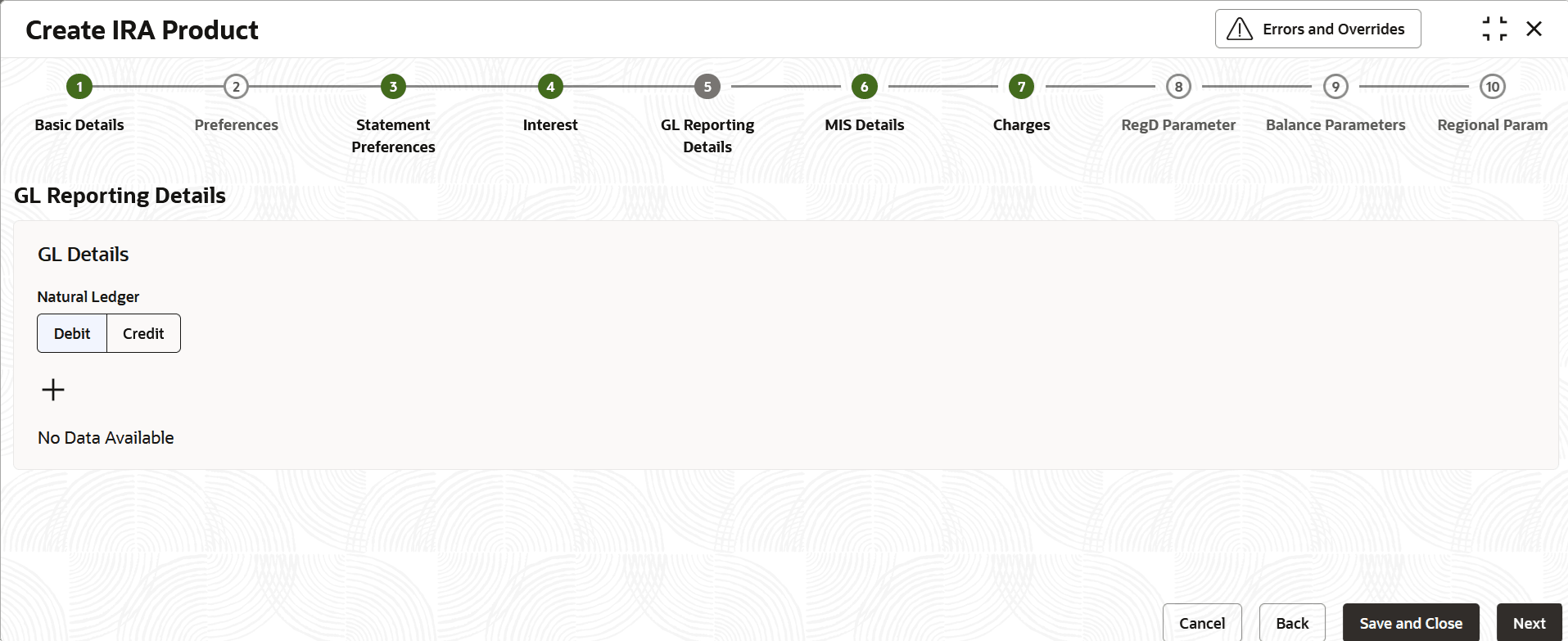

Figure 1-45 Create IRA Product - GL Reporting Details

- Specify the fields on GL Reporting Details screen.

For more information on fields, refer to the field description table below.

Table 1-43 GL Reporting Details - Field Description

Field Description Natural GL The following values are available for natural GL as follows: - Credit

- Debit

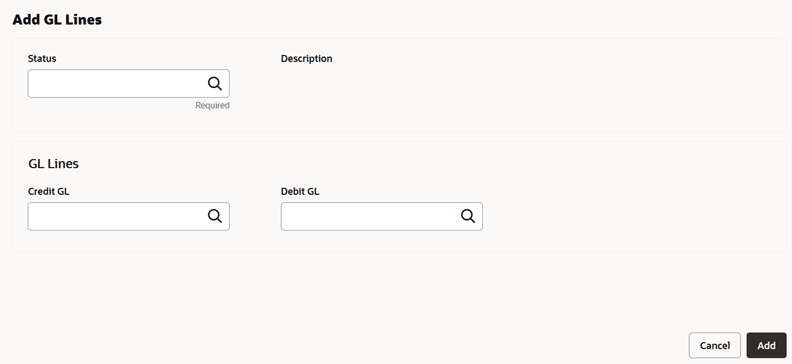

- Click the Add icon to add an entry for GL.The Add GL Lines screen displays.

- Specify the fields on Add GL Lines screen.

For more information on fields, refer to the field description table below.

Table 1-44 GL Reporting Details_Add GL Lines - Field Description

Field Description Status Specify the status. Click the search icon to open the Status list of values. Select the value to add the status. Description Based on the Status selected. The system displays the status description. Credit GL Specify the GL to which the account balance should belong. Click the Search icon to open the Credit GL list of values. Select the value to add the entry. Debit GL Specify the GL to which the account balance should belong. Click the Search icon to open the Debit GL list of values. Select the value to add the entry. - After specify the fields in the GL Reporting Details

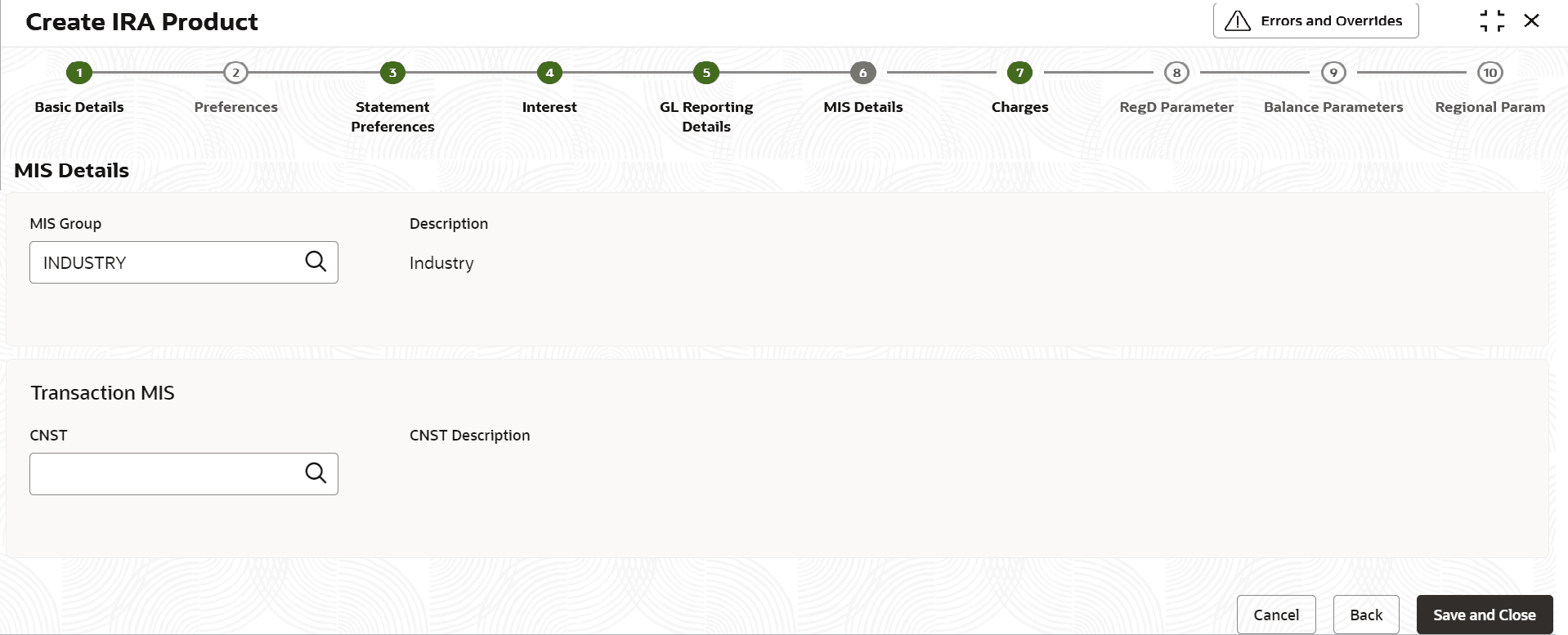

screen, click Next.The MIS Details screen displays.

Figure 1-47 Create IRA Product - MIS Details

- Specify the fields on MIS Details screen.

For more information on fields, refer to the field description table below.

Table 1-45 MIS Details - Field Description

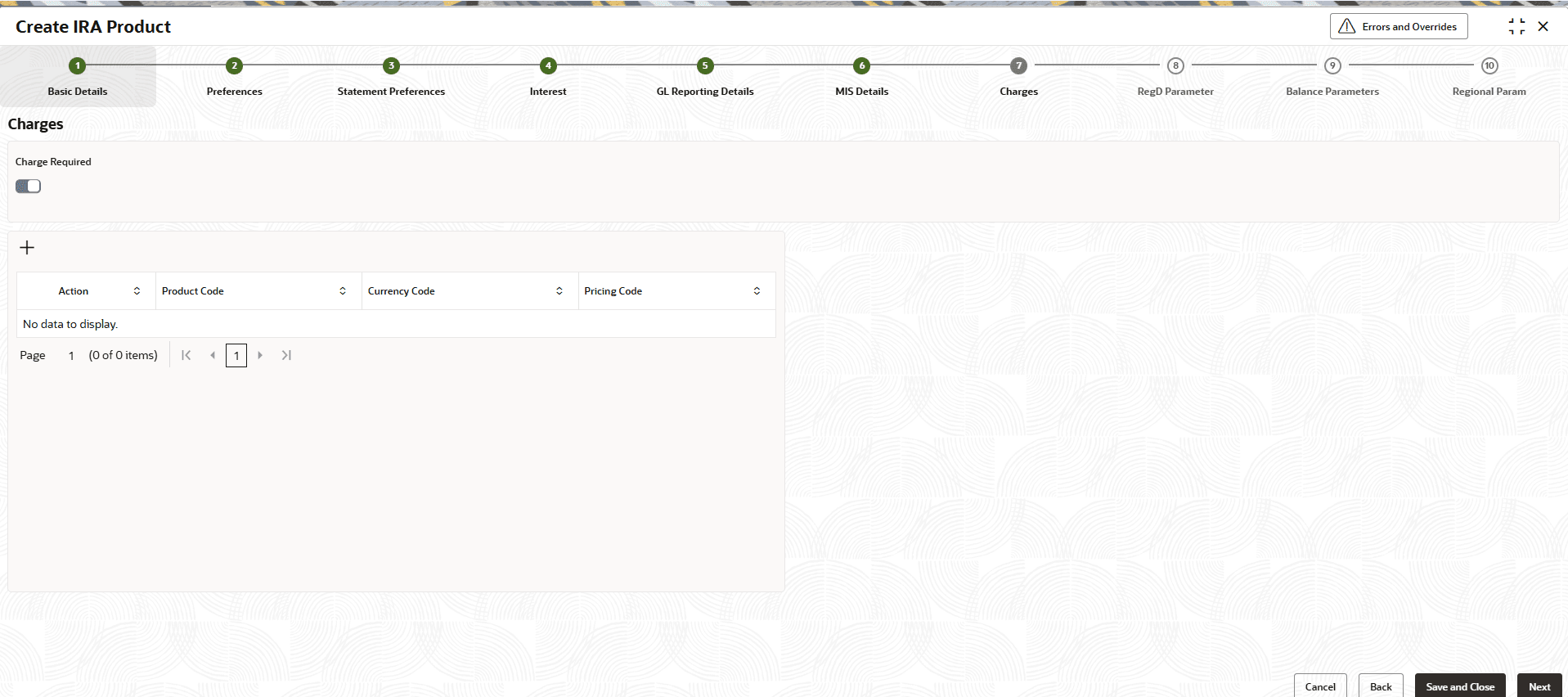

Field Description MIS Group Specify the MIS group associated with the IRA product. Description Based on the MIS Group selected. The system displays the description. - After specifying the fields in the MIS screen, click Next.The Charges screen displays.

- Specify the fields on Charges screen.

For more information on fields, refer to the field description table below.

Table 1-46 Charges - Field Description

Field Description Charges Required Switch this toggle ON to indicate that the charges are applicable for the accounts with this business product. The default value is OFF.

Click the Add icon, a new row is added to update the details for the charges.

For more information about Charges, refer to Interest and Charges User Guide

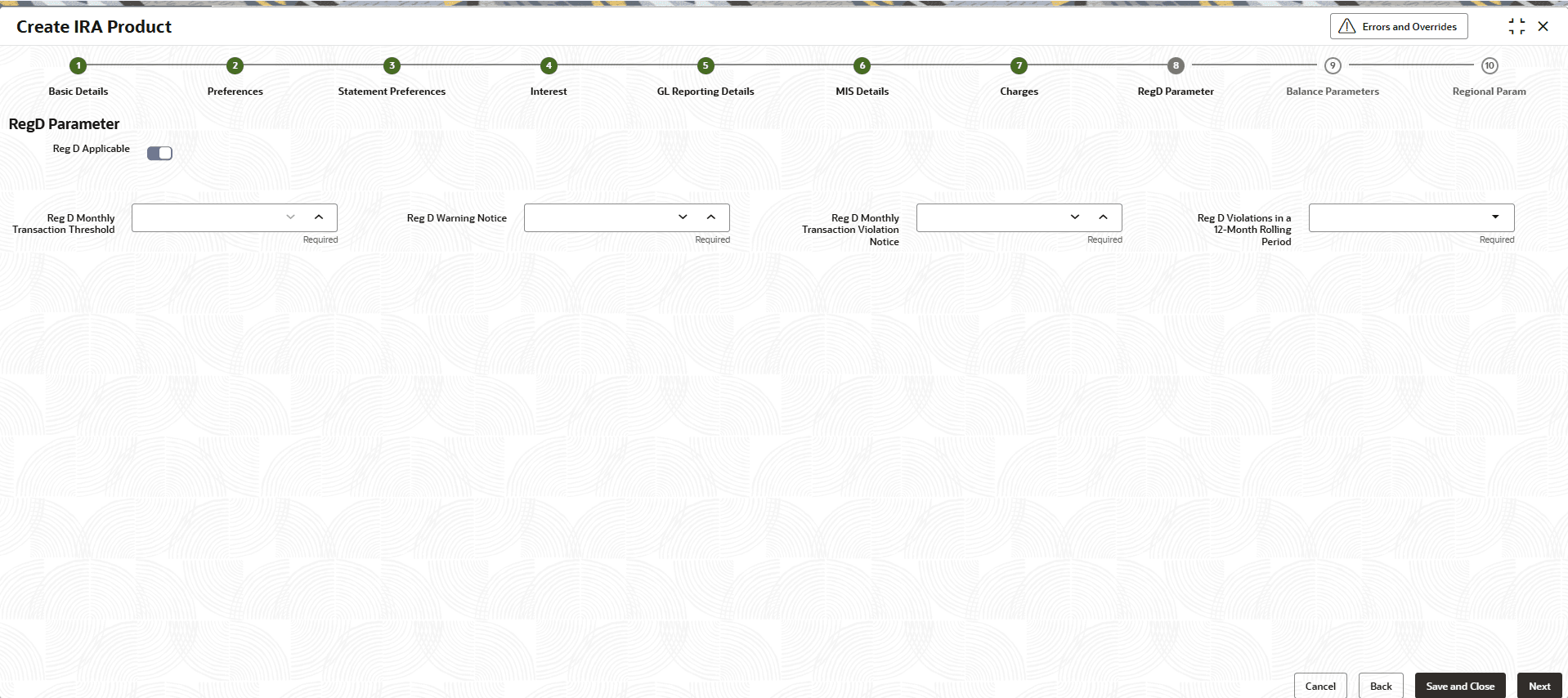

- After specifying the fields in the Charges screen, click Next.The RegD Parameter screen displays.

Figure 1-49 Create Business Product – RegD Parameter

- Specify the fields on RegD Parameter screen.

For more information on fields, refer to the field description table below.

Table 1-47 RegD Parameter - Field Description

Field Description Reg D Applicable Switch this toggle ON, then the business product is also applicable for Reg D. The below fields are displayed.

- Reg D Monthly Transaction Threshold

- Reg D Warning Notice

- Reg D Monthly Transaction Violation Notice

- Reg D Violation in a 12 Month Rolling Period

The default value is OFF.

Reg D Monthly Transaction Threshold It denotes the number of transactions threshold for Reg D in a calendar month. Reg D Warning Notice It denotes the number of transactions before a Reg D violation within the calendar month, at which a warning notice or disclosure needs to be sent to the customer. Reg D Monthly Transaction Violation Notice It denotes the number of transactions within a calendar month post violation of Reg D, where a notice or disclosure needs to be sent to customer (this notice also mentions switching the customer account from MMDA or Savings account to Checking). Reg D Violations in a 12-Month Rolling Period It denotes the minimum number of months in a 12-month rolling period, where if there is a violation of Reg D for these many months, a notice or disclosure will be sent to customer. - After specifying the fields in the RegD Parameter screen, click Next.The Balance Parameter screen displays.

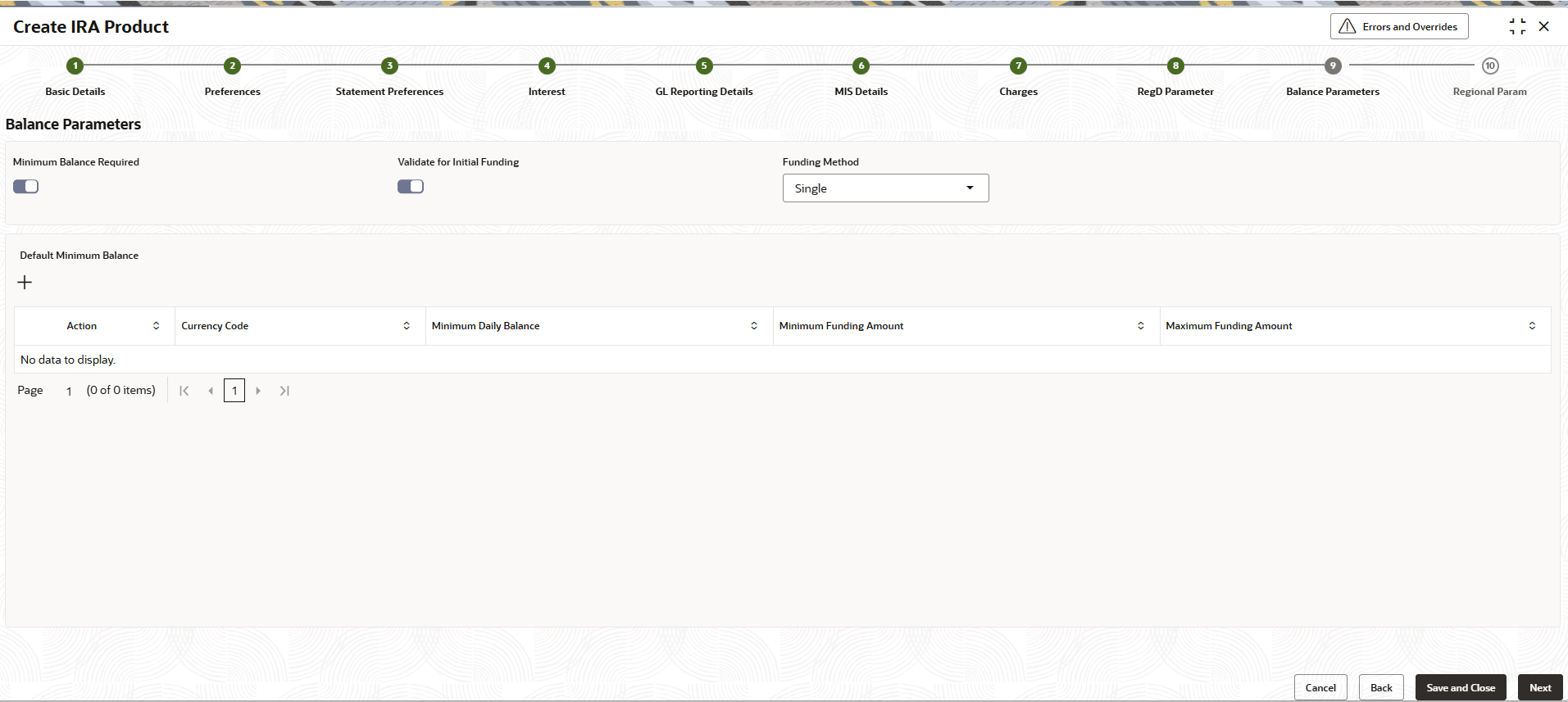

Figure 1-50 Create Business Product – Balance Parameter

- Specify the fields on Balance Parameter screen.

For more information on fields, refer to the field description table below.

Table 1-48 Balance Parameter - Field Description

Field Description Minimum Balance Required Switch this toggle ON, the user can able to define a currency-wise minimum and maximum opening amount. User can create the defined amounts as required by the financial institution. If this option is toggle ON, the below fileds are displayed.- Currency Code

- Minimum Daily Balance

- Minimum Opening Balance

The default value is OFF.

Click the Add icon, to add the details for the minimum balance.

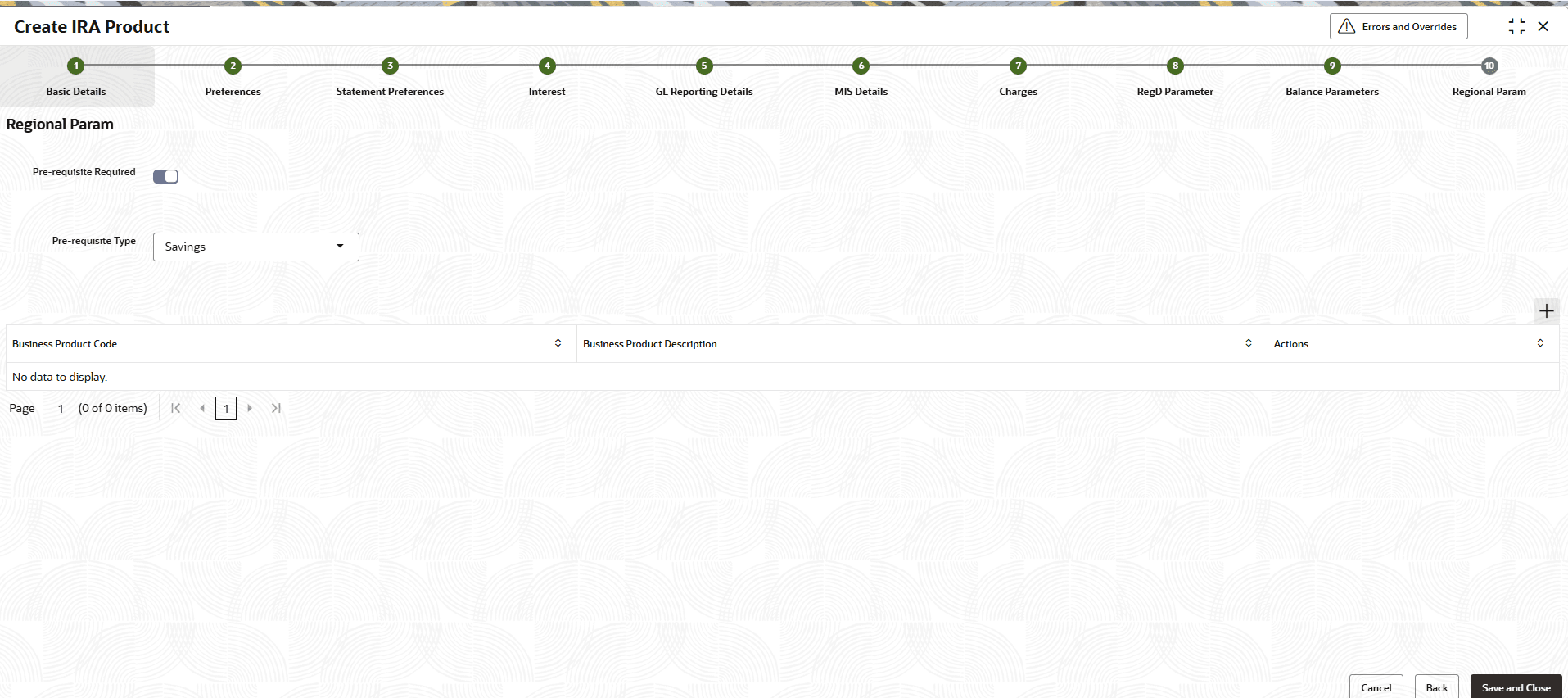

- After specifying the fields in the Balance Parameter screen, click Next.The Regional param screen displays.

Figure 1-51 Create Business Product – Regional param

- Specify the fields on Regional param screen.

For more information on fields, refer to the field description table below.

Table 1-49 Regional param - Field Description

Field Description Pre-requisite Required Switch this toggle ON, the user will be able to configure pre-requisite business products for a Money Market Savings Product.

Pre-requisite Type Select the pre-requisite type value. - After specifying all the details, click Save and Close to complete the steps or click Cancel to exit without saving.

Parent topic: IRA Product Configuration