3.9 Multi-Currency Accounts

The multi-currency accounts functionality helps the customer to improve customer experience and operational efficiency. This kind of account is useful for the customer's dealing with international payments or perform transactions in different currencies.

The following are the financial screens, where multi-currency functionality is supported:

- Account 360

- Overdraft Limit Summary

- Unsecured Overdraft Limit

- Temporary Overdraft Limit

- Advance Against Uncollected Funds

- Create Amount Block

- View and Modify

- Amount Block

- Account Transactions

- Account Balance Inquiry

- Secured Overdraft Limit

The following are the non-financial screens, where multi-currency functionality are supported:

- Account Address Update

- Joint Holder Maintenance

- Nominee/Beneficiary Details Update

- Account Preferences

- Customer Relationship Maintenance

- Account Statement Frequency

- Activate Dormant/Inactive Account

- Account Status Change

- Cheque Book Request

- Stop Cheque Payment

- Cheque Book Status

- View/Modify Stop Cheque

- Account Closure Inquiry

- Memo Maintenance

The following are the screens, where multi-currency functionality is not supported:

- Courtesy Pay Maintenance

- Account Garnishment

- Online Account Sweep In

- Online Account Sweep History

- Regulation D Transaction Inquiry

- Account Closure

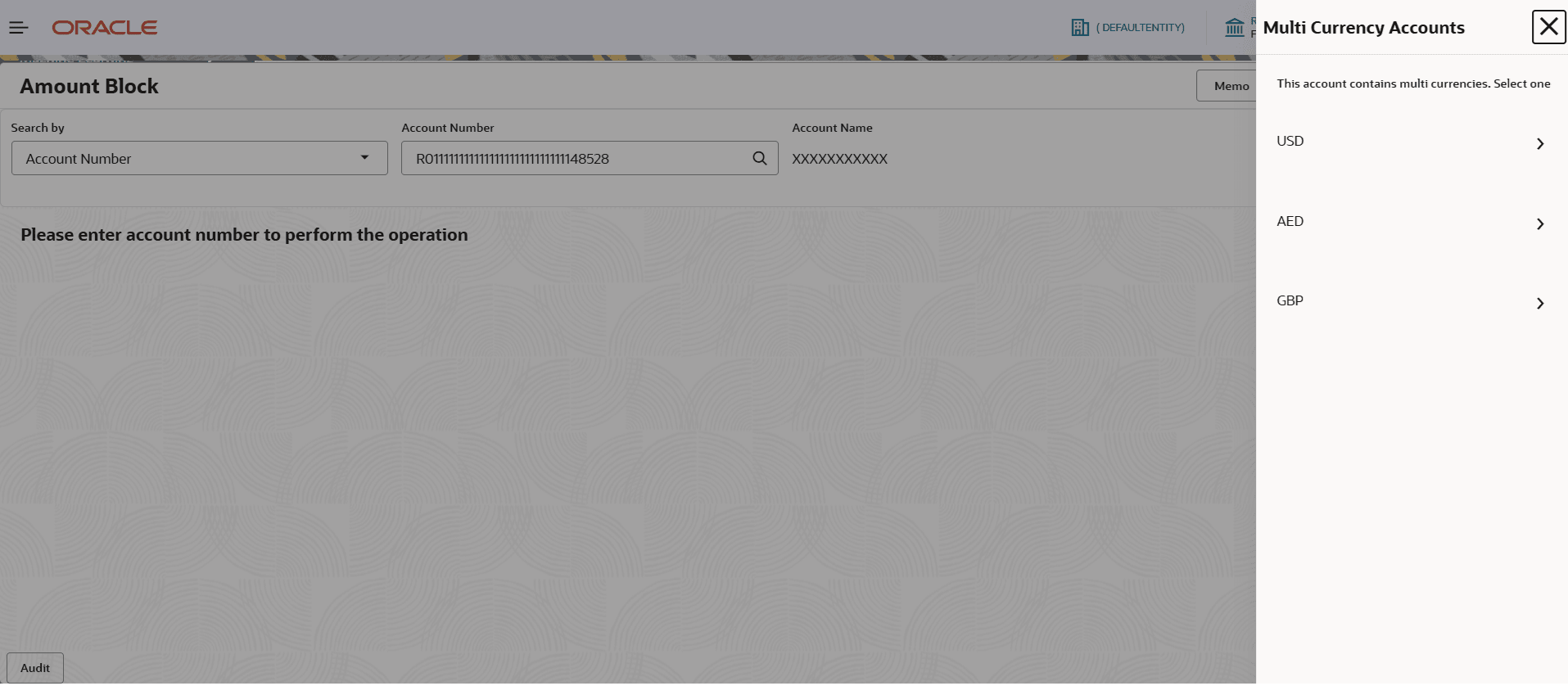

To set currency from multi-currency:

- Specify the account number in the financial screens.

The following screens is displayed.

- In the Multi Currency Accounts section, select the currency.

- The currency gets defaulted, for the specific screen.

Parent topic: Operations