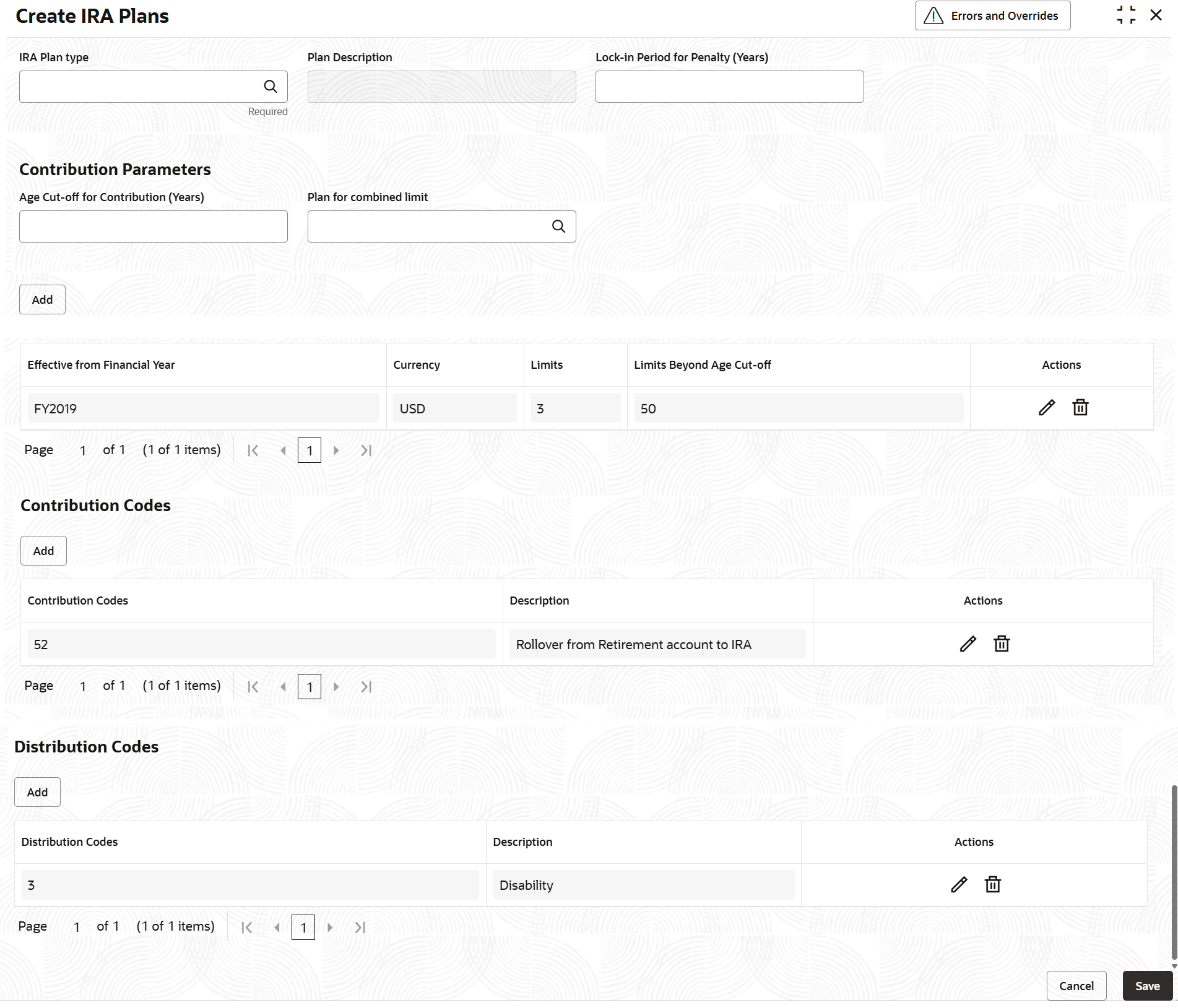

1.7.1 Create IRA Plans

This topic explains the systematic instructions to create IRA plans.

Note:

The fields marked as Required are mandatory.- On Home screen, under Menu, click Retail Account Configurations. Under Retail Account Configurations, click IRA Plans Configuration.

- Under IRA Plans Configuration, click Create

IRA Plans.The Create IRA Plans screen is displayed.

- Specify the fields on Create IRA Plans screen.

For more information on fields, refer to the field description table below.

Table 1-23 Create IRA Plans - Field Description

Field Description IRA Plan type Click the Search icon to select the value from the list. The values are as follow: - TRA – Traditional IRA

- ROT – Roth IRA

Plan Description Based on the selection of the IRA Plan Type, the plan description is displayed. Lock-in Period for Penalty (Years) This field captures the number of years before which, if a distribution is made on a ROTH IRA, the penalty will apply for distribution (withdrawals). This field is applicable only if the selected IRA type is ROT (Roth IRA).

Age Cut-off for Contribution (Years) This field specifies whether the age of the customer is to be taken into consideration while doing contribution transactions. The User can proceed to set up the contribution limits for the plan basis the customer age. For Example: If the value of this field is 50 years then separate contribution limits can be set for customers who are less than or equal to 50 years and greater than 50 years. The User can leave it blank if the contribution limit for a plan does not differ by age.

Plan for combined limit The user can select the plan from the list of values, for which the contribution limits below will be cumulatively applicable. In this case during IRA transaction, the system will check if there is a plan mapped in this field for combined limit check and if yes, the system will validate the cumulative contributions against the contribution limit defined for both the plans.

For Example:

It is to be noted that, currently the regulation requires combined limit validation across Traditional and Roth IRA plans for a customer. Therefore, in this case the user can select the plan for combined limit as "ROT" when setting up the contribution limits data for IRA plan "TRA" -Traditional. In which case, the system will consider the contribution limits set cumulatively for all IRA accounts under both Traditional and Roth plans of the customer.

Note: If combined limit check is applicable, that is, the plan details for combined limit is provided, then the system will validate that the contribution limits cannot be provided for the plan attached in the field Plan for combined limit when the plan-wise parameter maintenance is done for the same plan.

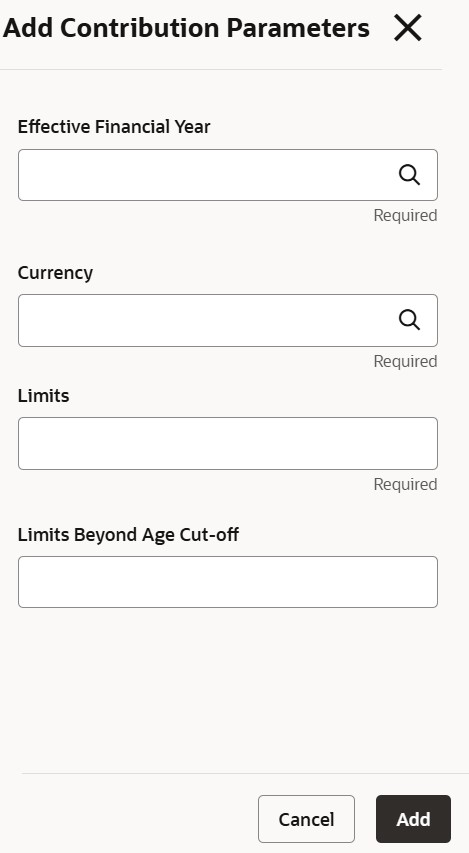

- Click Add button in the Contribution

Parameters section.The Add Contribution Parameters screen is displayed.

For more information on fields, refer to the field description table below.

Table 1-24 Create IRA Plans_Add Contribution Parameters - Field Description

Field Description Effective Financial Year The user can set Financial Year wise contribution limits in this screen. The user will select the value of the Financial Year (from the financial year list maintained as part of Interest and charges period code definition) to set the contribution limits for the mentioned financial year. If there are no contribution limits set for the current Financial Year, then the system will consider the latest set Financial Year limits as contribution limits for the IRA plan. Currency This field denotes the currency for defining the contribution limit amounts for the plan. This can always be USD for IRA plans. Limits This amount field defines the contribution limit for the plan. - If the field Age Cutoff for contribution is provided for the plan, then this value denotes the contribution limits for customers whose age is less than or equal to the configured Age Cut-off.

- If the field Age Cutoff for contribution is not provided for the plan, then this value denotes the generic contribution limits for all customer ages.

Limits Beyond Age Cut-off This amount field defines the contribution limit for the plan for customers whose age is greater than the configured Age Cut-off. This field is required only if an age value is provided for the Age Cutoff for contribution field. If no age value is given, this field does not need to be captured.

- Click Add button to add the contribution parameters detail in the main screen, or Click Cancel button to close the Add Contribution Parameters screen.

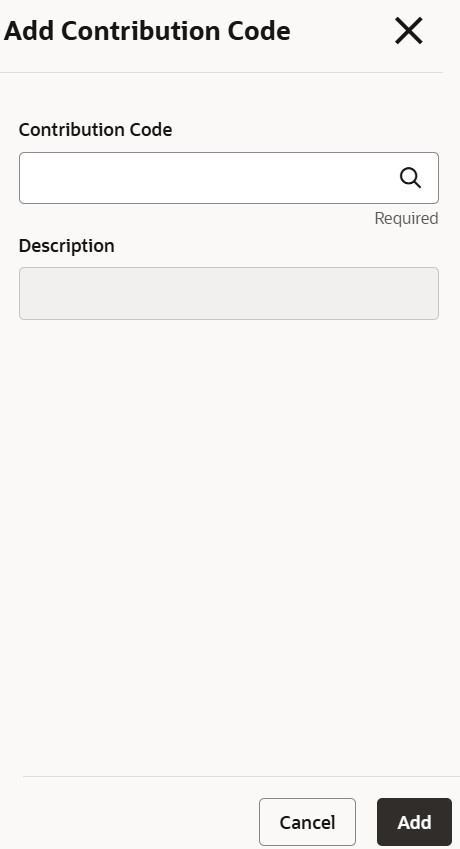

- Click Add button in the Contribution

Codes section.The Add Contribution Code screen is displayed.

For more information on fields, refer to the field description table below.

Table 1-25 Create IRA Plans_Add Contribution Parameters - Field Description

Field Description Contribution Code Click the Search icon to select the Contribution Code from the list of values available as part of static maintenance. Refer the Contribution Code Maintenance table for the codes list.

Description Based on the selection of Contribution Code, the description is displayed. Actions It allows the user to edit or delete the record. Table 1-26 Contribution Code Maintenance

Code IRS Description 50 Prior Year contribution 51 Current Year contribution 52 Rollover from Retirement account to IRA 53 Employer contribution prior year 54 Employer contribution current year 55 Direct Rollover 56 Late Rollover 57 Recharacterized rollover deposit 58 Trustee to Trustee Transfer 59 Roth Conversion - Click Add button to add the contribution code detail in the main screen, or Click Cancel button to close the Add Contribution Code screen.

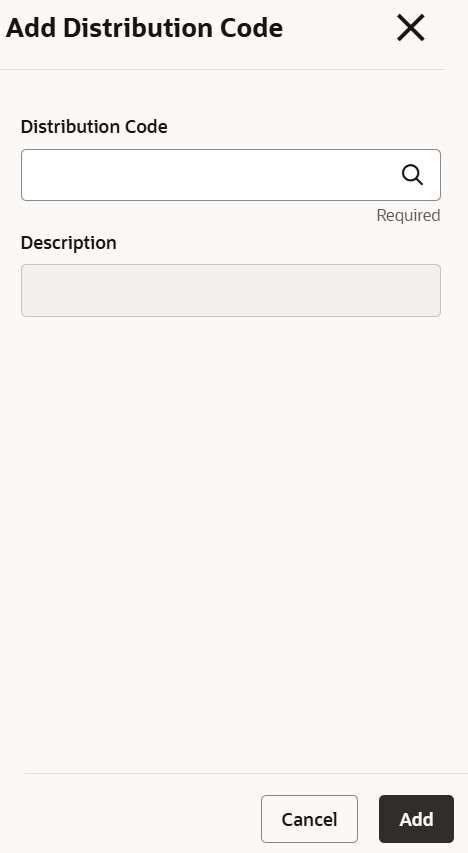

- Click Add button in the Distribution

Codes section.The Add Distribution Code screen is displayed.

For more information on fields, refer to the field description table below.

Table 1-27 Create IRA Plans_Add Distribution Parameters - Field Description

Field Description Distribution Code Click the Search icon to select the Distribution Code from the list of values available as part of static maintenance. Refer the Distribution Code Maintenance table for the codes list.

Description Based on the selection of Distribution Code, the description is displayed. Actions It allows the user to edit or delete the record. Table 1-28 Distribution Code Maintenance

Code IRS Description 1 Early distribution, no known exception (in most cases, under age 59½). 2 Early distribution, exception applies (under age 59½). 3 Disability 4 Death 5 Prohibited Transaction (this generally means the account is no longer an IRA). 6 Section 1035 exchange (a tax-free exchange of life insurance, annuity, qualified long-term care insurance, or endowment contracts). 7 Normal distribution 8 Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in current year. 9 Cost of current life insurance protection. A May be eligible for 10-year tax option. B Designated Roth account distribution. C Reportable death benefits under section 6050Y. D Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411. E Distributions under Employee Plans Compliance Resolution System (EPCRS). F Charitable gift annuity. G Direct rollover and direct payment (distribution to a qualified plan, a section 403(b) plan, a governmental section 457(b) plan, or an IRA). H Direct rollover of a designated Roth account distribution to a Roth IRA. J Early distribution from a Roth IRA, no known exception (in most cases, under age 59½). K Distribution of traditional IRA assets not having a readily available FMV (fair market value). L Loans treated as deemed distributions under section 72(p). M Qualified plan loan offset. N Recharacterized IRA contribution made for current year. P Excess contributions plus earnings/excess deferrals taxable in previous year. Q Qualified distribution from a Roth IRA. R Recharacterized IRA contribution made for previous year and recharacterized in current year. S Early distribution from a SIMPLE IRA in first 2 years, no known exception (under age 59½). T Roth IRA distribution, exception applies. U Dividend distribution from ESOP under section 404(k). (this distribution isn't eligible for rollover). W Charges or payment for purchasing qualified long-term care insurance contracts under combined arrangements. Note:

Joint holders can never be associated to an IRA account. Therefore, system to validate and do not allow joint accounts to be opened for IRA plans. While joint accounts are not allowed, it is important to note that custodian and guardians can still be attached to an IRA account.

- Click Add button to add the distribution code detail in

the main screen, or Click Cancel button to close the

Add Distribution Code screen.

Note:

For distribution transaction where exception is applicable, the list of below exception codes and descriptions will be applicable. This is a common list of codes for all IRA plan types.Table 1-29 Exception Codes for Distribution Transaction

Code Exception 1 First Time Home Buyer 2 Closing of account within 7 days of opening 3 Terminally ill patient 4 SCRA on active duty 5 Divorce 6 Disaster recovery distribution upto $22,000 to qualified individuals 7 Emergency Personal Expense 8 Medical Expenses - After specifying all the details, click Save to complete the steps. Or, click Cancel to exit without saving.

Parent topic: IRA Plans Configuration