- Retail Accounts User Guide

- Operations

- Limits

- Advance against Uncollected Funds

3.9.3 Advance against Uncollected Funds

This topic provides systematic instructions to capture details of limits granted to the account holder towards advance against uncollected funds and to update, modify or delete the existing limits.

Note:

The fields marked as Required are mandatory.Uncollected funds are the funds whose value date for the fund availability is in the future. Typically in a Retail banking scenario, cheques deposited into the account for collection represent an uncollected funds since the clearing process generally takes time.

To perform action on uncollected funds:

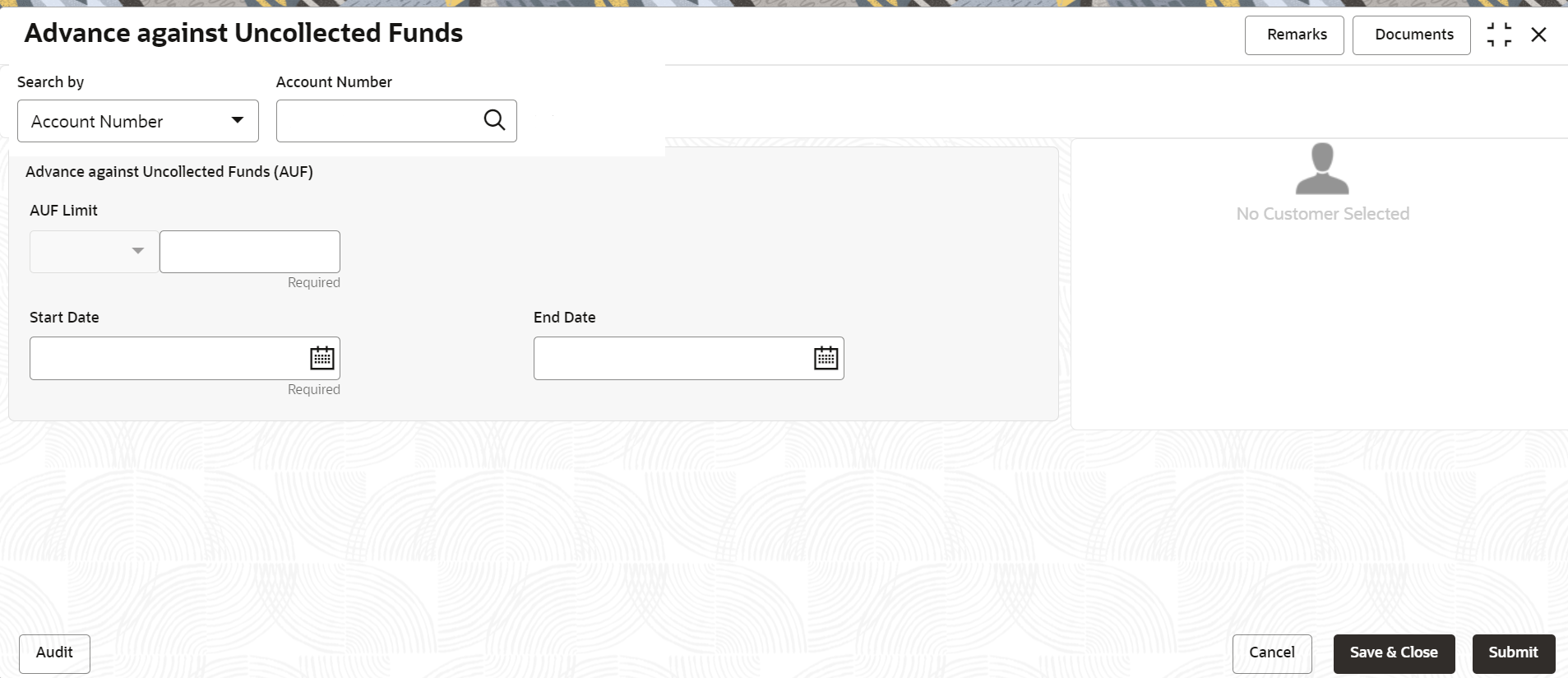

- On the Home screen, from Retail Account

Services, under Limits, click

Advance against Uncollected Funds, or specify the

Advance against Uncollected Funds in the Search icon

bar.Advance against Uncollected Fundsscreen is displayed.

Figure 3-59 Advance against Uncollected Funds

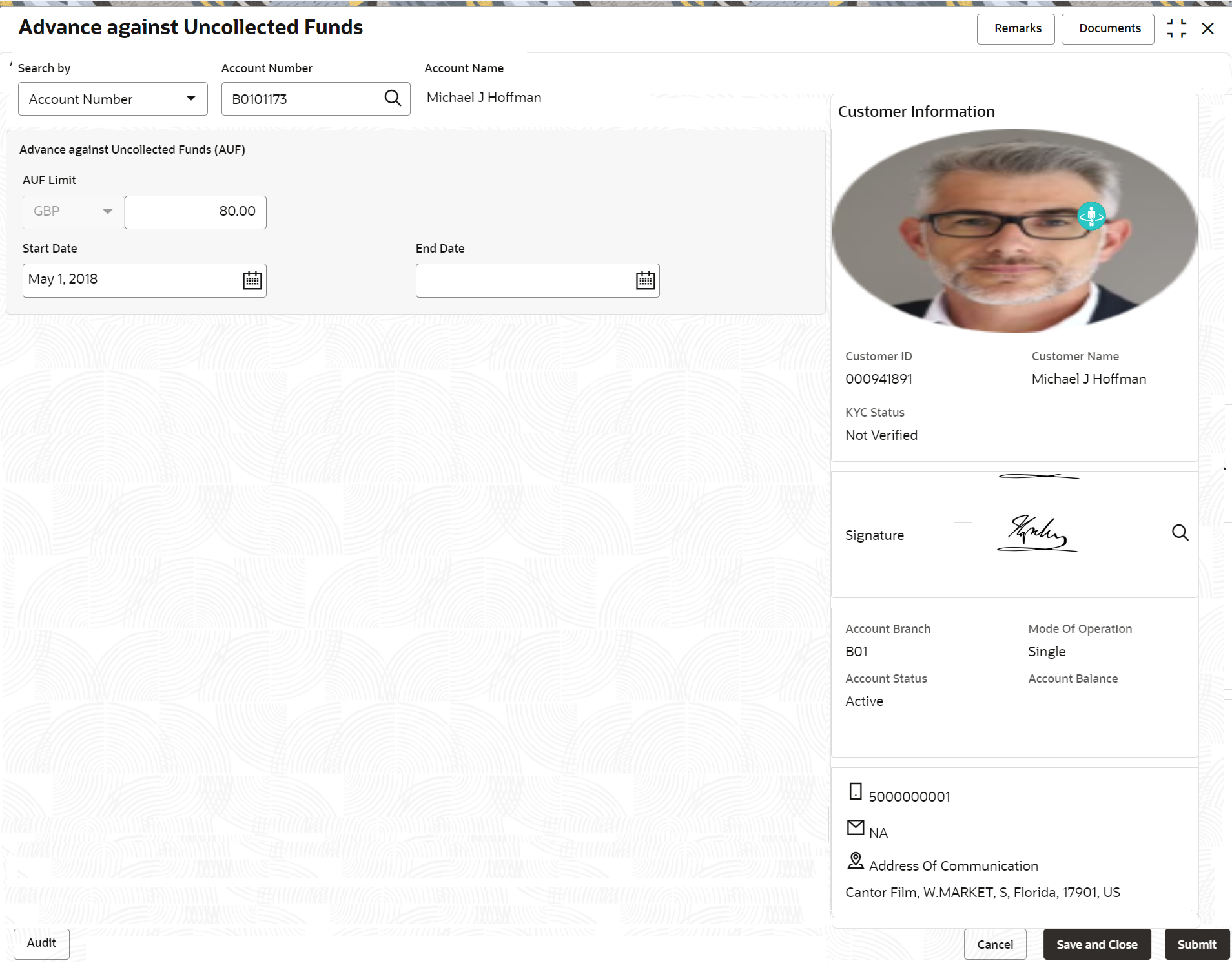

- On Advance against Uncollected Funds screen, specify the

account number. For more information on fields, refer to the field

description table below.

Table 3-35 Advance against Uncollected Funds - Field Description

Field Description Search By Users can search for an account number by using any of the available search criteria. The account number is set as the default search option. Users can specify the account number directly in the adjacent field or search for an account number by clicking the Search icon. Users can also search for the specific account number by providing customer ID, account number, or account name.

Other search options available in the Search by field are Customer ID, SSN, Mobile Number, and Email.

A specific customer ID can be searched by providing the customer name or customer ID. If SSN, mobile, or email IDs are chosen to find an account number, the respective IDs have to be input entirely in the adjacent field for the system to display the account number. For a given search criteria, multiple account numbers may be linked.

For example, two or more account numbers can be linked to a single mobile number. In such cases, the system displays all the account number matches and the user can select the relevant account number on which to perform a servicing operation.Note:

The label of the field adjacent to the Search by field changes dynamically. For example, if the Account number is chosen as the search criteria, the label of the adjacent field is displayed as the Account Number. If SSN is chosen as the search criteria, then the adjacent field would display the label as SSN.Account Name Account Name is displayed by default based on the account selected. If an existing AUF Limit is present for the account, the system displays the AUF Limit and if there are no records found, the message ‘Given account does not have any AUF limit' is displayed.

Customer Information is displayed for the entered Account Number.Figure 3-60 Customer Information - Advance against Uncollected Funds

Description of "Figure 3-60 Customer Information - Advance against Uncollected Funds" - On Advance against Uncollected Funds screen, specify the

fields. For more information on fields, refer to the field

description table below.

Table 3-36 Advance against Uncollected Funds - Field Description

Field Description AUF Limits Enter the AUF Limit amount. The withdrawable uncollected fund for an account will be either the AUF limit or the uncollected fund whichever is lesser. AUF Limit is always displayed in the account currency. Start Date The system defaults the Start Date as the current branch date. You can modify the start date to any future date using the adjoining calender button. Note:

Start Date cannot be backdated.End Date This is an optional field. Click the calendar icon and specify the expiry date. Note:

End Date cannot be less than Start Date. - Click Submit.The transaction is intiated successfully.

Parent topic: Limits