5.7.1 Bulk Upload Transactions

Bulk uploading transactions involves preparing the transaction records in a structured format, validating the data, and uploading the file. This topic describes the systematic instructions to bulk upload transactions using CSV files.

- Prepare the transaction records in a comma-separated value (CSV) file as described in the table.

Note:

You can post a minimum of one transaction and a maximum of ninety nine transactions in a CSV file. Each transaction can have multiple Credit or Debit legs. You can upload multiple CSV files at a time.The general framework of the file has a parent component followed by one or more child components that mimic the hierarchical relationship between the elements of the transaction data. The parent component carries the header details of an entire transaction batch, including the transaction reference number and initialization date. Each child component represents a single Credit or Debit leg of a transaction in the batch.

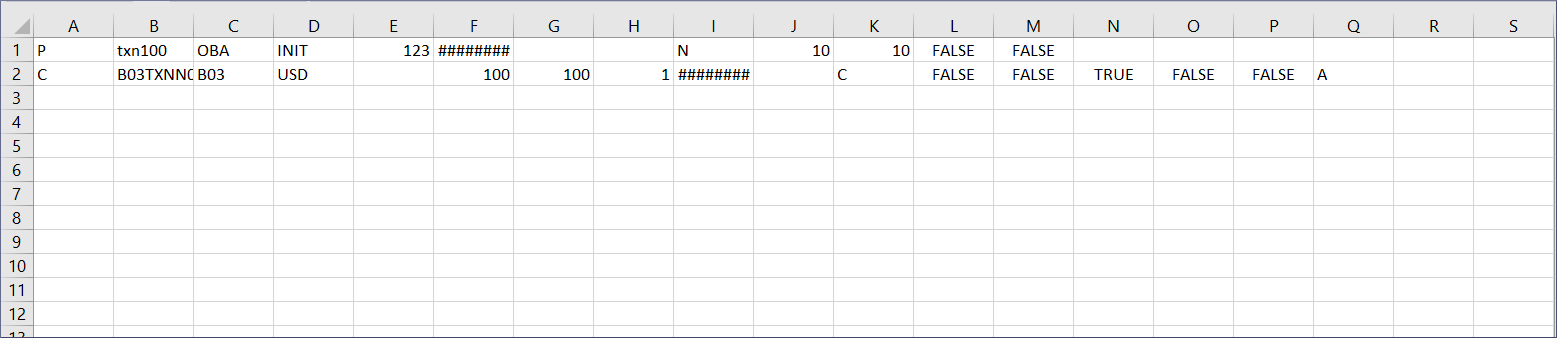

The following tables display the parent and the child component frameworks. Create the CSV files using the same field sequence number the tables specify for the parent and child records.

Table 5-15 Transaction Record - Parent Component

Field Name Field Sequence Field Description discriminator 1 This field determines the parent and child component. Specify P to represent the parent component containing the header details of the transaction. txnRefNo 2 Specify a unique identifier for the transaction. source 3 Specify the system that initiated the transaction. event 4 Specify the event associated with the transaction at this stage of the transaction. eventSrNo 5 Specify the sequential order of the event at this stage of the transaction in the transaction lifecycle. txnInitDate 6 Specify the date and time when the transaction was initiated. externalMaker 7 Specify the external entity or user who created the transaction. externalChecker 8 Specify the external entity or user who validated the transaction. referralAllowed 9 Specify TRUE to escalate the transaction to the review team for approval or other actions if it is necessary. Specify false otherwise. suppressAccOverridesUptoSeverityLevel 10 Specify the threshold level of severity to suppress or restrict account overrides. Note:

Provide a value from one to ten, where one is the lowest level of severity and ten is the highest.suppressBalanceOverridesUptoSeverityLevel 11 Specify the threshold level of severity to suppress or restrict balance overrides. Note:

Provide a value from one to ten, where one is the lowest level of severity and ten is the highest.triggerSuspenseEntry 12 Specify true for the system to create a suspense entry if the transaction meets specific conditions. Specify false otherwise. Note:

The system temporarily holds the transactions that require additional scrutiny in a suspense entry.deferredResponse 13 Specify true to defer a response to a transaction processing for a period. Specify false otherwise. Note:

The system holds the transactions under deferred response for a specified period before final processing or responding.fileName 14 Specify the name of the file containing this transaction. originalSource 15 Specify the primary source system the transaction originated from. balancedEntry 16 Specify if this transaction requires a balanced double-entry accounting. The following image shows a sample CSV file with a parent and child record.Table 5-16 Transaction Record - Child Component

Field Name Field Sequence Field Description discriminator 1 This field determines the parent and child component. Specify C to represents the child component containing the details of the Credit or Debit leg of a transaction. There can be multiple child components for a parent component. accNo 2 Specify the Account Number of the Account involved in this leg of the transaction. accBranch 3 Specify the Account Branch where the transaction occurred. accCcy 4 Specify the currency of the account. blockRefNo 5 Specify the Block Reference Number assigned to this block of transactions. accountCcyAmt 6 Specify the transaction amount in the currency of the account. branchLcyAmt 7 Specify the transaction amount in the local currency of the branch where the transaction occurs. exchRate 8 Specify the exchange rate to convert the transaction currency amount to the local currency of the branch. valueDate 9 Specify the date on which the transaction is considered effective for processing. instrumentCode 10 Specify the identifier that represents the product within the system. drCrInd 11 Specify if this is the Credit (C) leg or Debit leg of the transaction. Enter C for Credit or D for Debit. forcePost 12 Specify if this transaction posting bypasses validations and restrictions. Enter TRUE or FALSE. rtlAllowed 13 Specify if real time limits are applied for this transaction. Enter TRUE or FALSE. limitRequired 14 Specify if a transaction requires a limit to be set. Enter TRUE or FALSE. reversal 15 Specify if the transaction can be reversed. Enter TRUE or FALSE. reval 16 Specify if revaluation of the transaction is required. Enter TRUE or FALSE. accountEntryType 17 Specify the account entry type of the transaction from the following: txnCode 18 Specify the transaction code that identifies the transaction type. txnDescription 19 Provide a description of the transaction. availableDays 20 Specify the number of days the funds for a transaction are available to the account holder. availabilityInfo 21 Specify the availability of funds resulting from the transaction. autoRelease 22 Specify if the transaction is automatically released or completed without manual intervention. Enter TRUE or FALSE. module 23 Specify the module through which the transaction is processed. rtlRefNo 24 Specify the real time limit reference number applicable to the transaction. revalRequired 25 Specify if the transaction requires revaluation. Enter TRUE or FALSE. revalCode 26 Specify the revaluation code associated with the revaluation process applied to the transaction. revalRate 27 Specify the conversion or exchange rate used for the revaluation process. revalRateCode 28 Specify the rate code used for exchange rate or conversion rate for the revaluation process. revalProfitGl 29 Specify the general ledger code used to record the profit resulting from the revaluation process. revalLossGl 30 Specify the general ledger code used to record the loss resulting from the revaluation process. revalTxnCode 31 Specify the transaction code associated with the revaluation process applied to the transaction. considerForTurnOver 32 Specify if the transaction should be considered for turnover calculations. Enter TRUE or FALSE. considerForAccActivity 33 Specify if the transaction is considered as part of the associated account's activity. Enter TRUE or FALSE. product 34 Specify the financial product or service associated with the transaction. relatedAccount 35 Specify the account that is linked with the transaction. relatedReferrence 36 Specify the reference code of a related transaction that links to this transaction. relatedCustomer 37 Specify the customers who are directly associated or effected by the transaction. amtTag 38 Specify the label used to classify the type of the monetary amount in the transaction. accountingRefNoToBeReversed 39 Specify the reference number of a previous transaction to be reversed. statementNarrative 40 Provide a description of the transaction that provides additional context or details about the transaction. tag61SupportInfo 41 Provide supplementary information relating to :61: field of a SWIFT MT940 or MT942 message. userRefNo 42 Specify unique identifier assigned to the transaction by the external system to reference the transaction. bankRefNo 43 Specify the reference number assigned to the transaction by the bank initiating the transaction. productProcessor 44 Specify the system responsible for handling this transaction. fileName 45 Specify the name of the file containing this transaction data. requestTrackId 46 Specify the unique identifier to track and manage the transaction in the system. courtesyPaySource 47 Specify the funding source that covers the transaction if the account does not have sufficient funds. regdApplicable 48 Specify if the transaction has to comply with regulatory requirements. Enter TRUE or FALSE. originalTransactionAmount 49 Specify the amount involved in the transaction when it was initially processed or recorded. originalTransactionCurrency 50 Specify the currency of the amount involved in the transaction when it was initially processed or recorded. extAccountingRefNo 51 Specify the unique reference number assigned to this transaction by the external accounting or banking system. regEApplicable 52 Specify if the transaction is subject to Regulation E. The Electronic Fund Transfer Act (EFTA) in the United States regulates transactions through Regulation E. sweepApplicable 53 Specify if the transaction qualifies for the sweeping services provided by the system. Note:

The sweeping service transfers funds between accounts to optimize balances, update interest earnings, or manage liquidity. - Name the file in the following format: CDDATransactionPosting_<Unique Identifier>.For example, CDDATransactionPosting_16042024.

- Validate the file and then upload it.

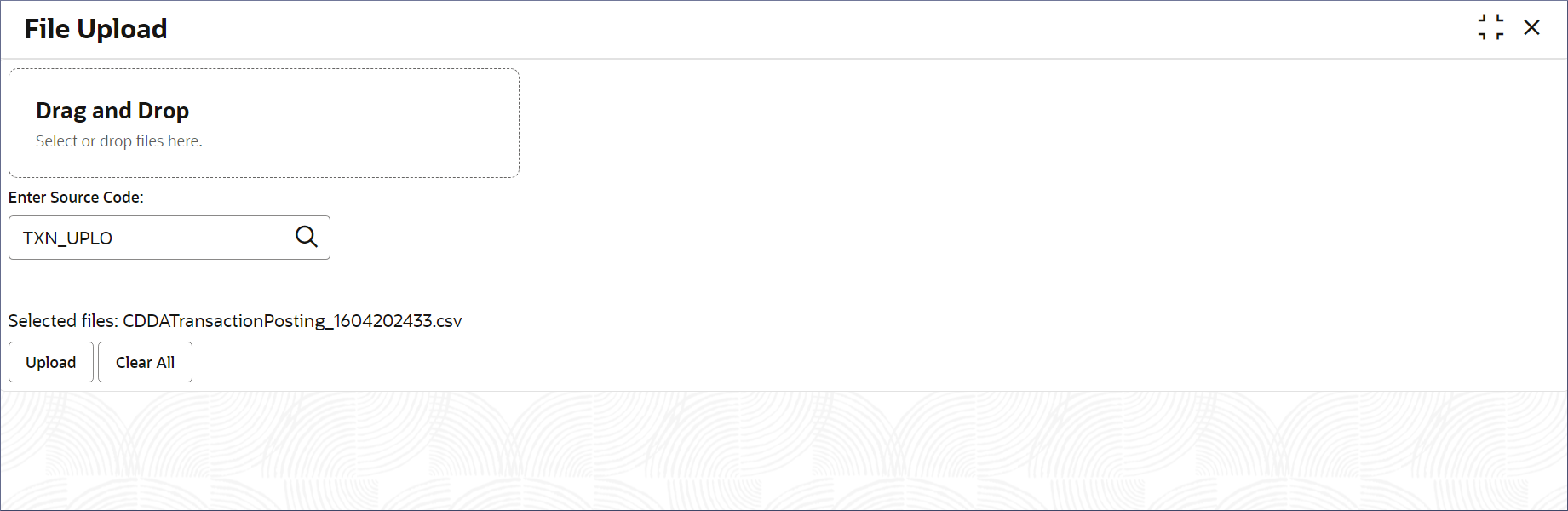

- Click File Management, and under File Management, click File Upload.The File Upload page displays.

- Drag and drop the required CSV file(s) into the Drag and Drop field. Alternatively, click the field, navigate to and open the selected file(s).The message Selected files: <filename.csv> displays above the Upload button.

- Click Enter Source Code field and select TXN_UPLOAD from the list of values.For more information, see Upload Source in the Oracle Banking Common Core User Guide.

- Click Upload.The File Upload Status dialog displays the file upload initiation message.

Note:

At this point the uploaded file(s) and the transaction records in them are not processed. - Click Clear ALL.The system clears the uploaded file and Source Code fields, and the page is ready to upload more files.

- Click File Management, and under File Management, click File Upload.

- Authorize and approve the uploaded file and the transaction records.To view the status of uploaded files and transaction records and approve the records, see View File Upload Status in the Oracle Banking Microservices Platform Foundation User Guide.

Note:

As a Maker of these transaction records, you cannot authorize and approve the files and the records. They have to be approved by another user (Checker) with a Supervisor role.

Parent topic: Upload Transactions