French Degressive Depreciation

Use degressive depreciation to calculate the French tax depreciation. The French Degressive depreciation method is similar to the declining balance method. This method uses Acquisition/Pro-rata as its depreciation rule. The first year's depreciation amount is prorated based on the number of months left for the fiscal year.

Formula: PB * ((FC_RATE / AL)~(1 / (AL - CEIL(CP) + 1)))

Depreciation Period: Annually

FC_RATE is the Fiscal Coefficient Rate set by the French government. You must manually enter the rate and convert it to decimal format. A new Degressive depreciation method must be created for each new rate.

In the Tax Method, set the values in these fields as follows:

-

Depreciation Rules: Pro-rata

-

Depreciation Start Date: 1st day of the Month

The annual depreciation is computed as:

PB * MAX(Degressive Rate, Linear Rate)

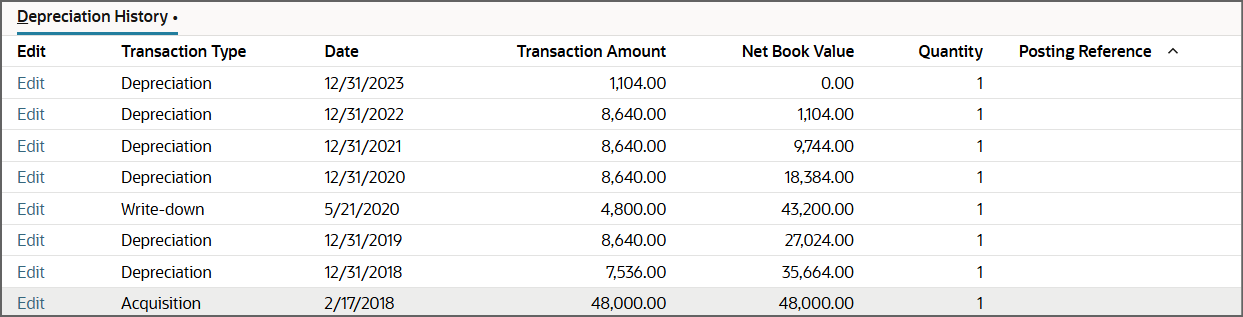

The following sample shows the expected depreciation values using the formula for degressive depreciation, with a Fiscal Coefficient Rate of 1.75.