Allow manual override of Canadian taxes on Expense report export

Check this box to export the tax amounts entered manually on receipts on SuiteProjects Pro instead of using the tax location to determine tax amount when exporting Canadian expense report tax from SuiteProjects Pro to NetSuite. In NetSuite, the exported expense report includes custom fields showing the tax amounts entered manually both at the expense line level and at the expense report level.

Additional setup is required before you can use this feature:

-

In NetSuite, go to Setup > Company > General Preferences.

-

On the Custom Preferences subtab, under the SuiteProjects Pro SRP Integration section, check the Enable Canadian Expense Tax Override box.

The following custom transaction body fields and transaction line fields are created when you install the SuiteProjects Pro SRP Integration bundle - Bundle ID 369637 (previously 2851) 1.23 or later version. These fields are used to display information - the field values are not used in any calculations.

-

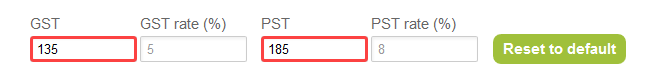

SuiteProjects Pro: GST/HST Amount [

custbody_oa_gst_override] - Transaction body field on expense reports and vendor bills holding the calculated sum of Goods and Services Tax (GST) or Harmonized Sales Tax (HST) across all expense lines. -

SuiteProjects Pro: PST Amount [

custbody_oa_pst_override] - Transaction body field on expense reports and vendor bills holding the calculated sum of Provincial Sales Tax (PST) across all expense lines. -

SuiteProjects Pro: GST/HST [

custcol_oa_gst_override] - Transaction line field on expense reports and vendor bills holding the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) entered manually on the SuiteProjects Pro receipt. -

SuiteProjects Pro: PST [

custcol_oa_pst_override] - Transaction line field on expense reports and vendor bills holding the calculated sum of Provincial Sales Tax (PST) entered manually on the SuiteProjects Pro receipt.

Best Practice Guidelines

Review the following guidelines:

-

Before you enable this feature, first enable and set up expense report tax export. See Enable tax export on expense reports.

-

The Canadian tax location used on SuiteProjects Pro receipts must have a corresponding tax code or tax group in NetSuite. The NetSuite Tax Code ID [

netsuite_tax_rate_id] on the tax location entity form holds the internal ID of the corresponding tax code or tax group record in NetSuite. -

The employee must be associated with a Canadian tax nexus in NetSuite. The subsidiary country or the shipping address determines the applicable tax nexus for employees. To verify the nexus associated with an employee in NetSuite, go to Transactions > Employees > Enter Expense Reports, select the Employee and click the expenses subtab. The field displayed at the expense line level are different depending on the applicable nexus.

-

Expense lines in NetSuite Tax amount on each expense line is not displayed. This is a system limitation.

-

For tax reporting, the tax on each expense line may not match the tax amounts entered manually on the SuiteProjects Pro receipts, especially when multiple tax codes are involved.

-

If there are rounding discrepancies in the total tax amount for the expense report in SuiteProjects Pro and NetSuite, the total GST amount is adjusted to keep the total amount to be reimbursed to the employee consistent across the two applications.