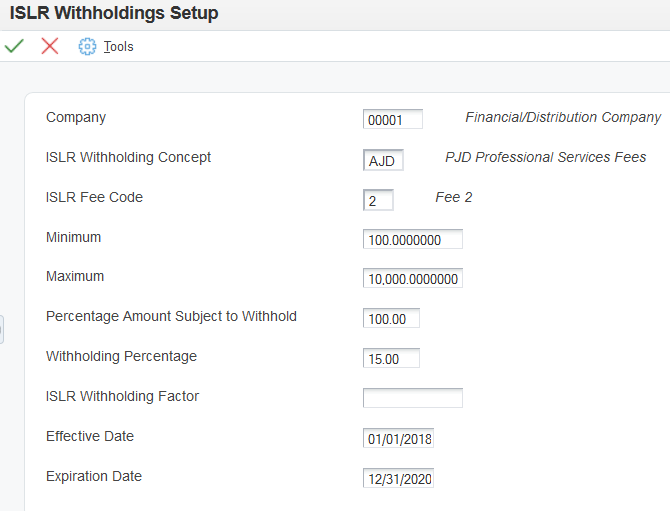

Entering Withholding Amount Information

Access the ISLR Withholding Setup form. You must complete all fields on the form.

- ISLR Withholding Concept

Enter a value from the ISLR Withholding Concept (76V/IS) UDC table to identify the type of tax.

- ISLR Fee Code

Enter a value from the Fee Codes (76V/CT) UDC table to identify the type of fee.

- Minimum Amount

Enter 0 to indicate the minimum amount on which the tax is calculated.

- Maximum Amount

Enter the maximum amount on which the tax is calculated. To specify an infinite amount, enter 999.999.999.99.

Enter the amount after converting it to tributary units.

- Percent Amount Subject to Withholding

Enter the percentage of the amount that is subject to withholding. For example, if the entire amount is subject to withholding, enter 100.

- Withholding Percentage

Enter the amount by which the system multiplies the amount subject to withholding to determine the amount to withhold.

- ICMS Reduced Taxable Amount

Enter the amount on which ICMS taxes are assessed.