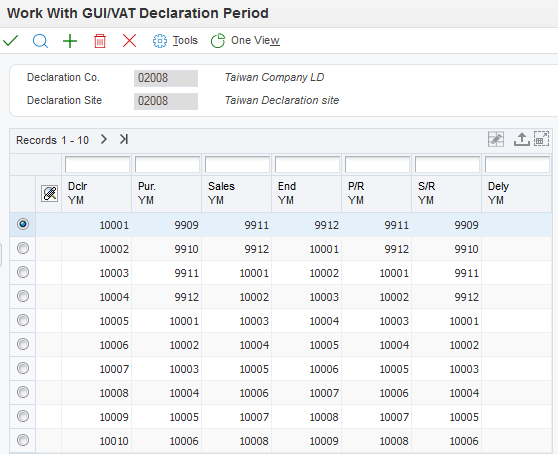

Setting Up Declaration Periods

Access the GUI/VAT Declaration Period Revisions form.

- Dclr YM (year and month of VAT declaration)

Enter the Taiwanese calendar year and month of the GUI/VAT declaration.

- Pur. YM (year and month for purchase documents)

Enter the year and month that begins the range of dates for the purchase documents.

- Sales YM (year and month for sales documents)

Enter the year and month that begins the range of dates for the sales documents.

- End YM (year and month end range of dates)

Enter the year and month that ends the range of dates for the sales or purchase documents.

- P/R YM (year and month for purchase returns)

Enter the year and month that begins the range of dates for the purchase return or allowance documents.

- S/R YM (year and month for sales returns)

Enter the year and month that begins the range of dates for the sales return or allowance documents.

- Delay YM (year and month of delayed declaration)

Enter the Taiwan calendar year and month of the delayed declaration for purchase tax.