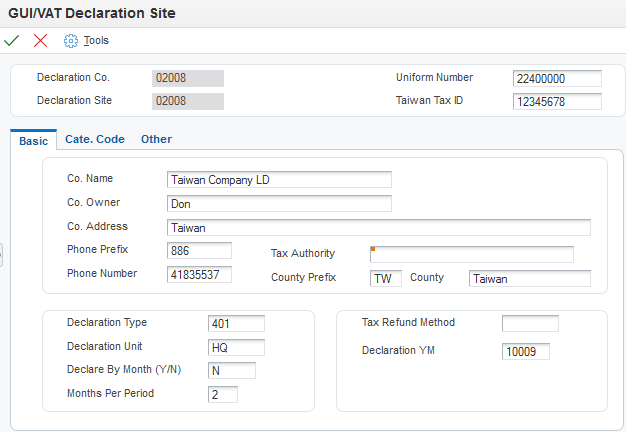

Basic

Access the Basic tab.

- Declaration Co. (declaration company)

Enter the company code of the reporting company. The company code must exist in the Company Constants table (F0010).

- Declaration Site

Enter a code that exists in the GUI/VAT Declaration Site (75T/DS) UDC table to identify the site for which the VAT is declared.

- Uniform Number

Enter the Uniform Number of the Taiwanese company.

- Taiwan Tax ID

Enter the tax ID of the company.

- Co. Name (company name)

Enter the name of the reporting company as you want it to appear on reports. You can enter up to 40 characters.

You must complete this field.

- Co. Owner (company owner)

Enter the company or person to whom billing or correspondence is addressed.

You must complete this field.

- Co. Address (company address)

Enter the address of the reporting company. You can enter up to 80 characters.

- Phone Prefix

Enter the first segment of a telephone number.

- Phone Number

Enter a number without the prefix or special characters, such as hyphens or periods, that makes up the telephone number for an entity.

- Tax Authorities

Enter the address book number of the tax authority to whom you send tax payments.

- County Prefix

Enter the prefix for the county in which the declaration site exists.

- County

Enter the county in which the declaration site exists.

- Declaration Type

Enter a value that exists in the GUI/VAT Declaration Type (75T/DL) UDC table to identify the declaration type of a GUI/VAT. Values are:

401: Taxable only

403: Taxable, tax-exempt, or special tax

You must complete this field.

- Declaration Unit

Enter a value that exists in the GUI/VAT Declaration Unit (75T/DU) UDC table to specify the type of declaration unit. Values are:

HQ: Headquarters

IU: Individual unit

You must complete this field.

- Declare By Month (Y/N)

Enter a value to specify whether the VAT declaration is by month. Values are:

Y: Month.

N: Period.

You must complete this field.

- Months Per Period

Enter the number of months in a declaration period.

If you entered N in the Declare By Month field, you must complete this field.

- Tax Refund Method

Enter a value that exists in the Tax Refund Method (75T/TR) UDC table to specify the tax refund method. Values are:

BK: Deposit in bank

CH: Check

- Declaration YM (declaration year and month)

Enter the Taiwanese calendar year and month of the GUI/VAT declaration.

You must set up declaration periods before completing the Declaration YM field. After creating a declaration site record, set up declaration periods for that declaration site, and then return to the GUI/VAT Declaration Site form and specify the current declaration period in the Declaration YM field.