Understanding the Error List Report

The objective of this report is to show the list of errors from the Tax Invoice summary by customer and supplier reports. This report displays records in the Taxes table (F0018) that have errors. Note that this is an additional report, which is not legally required by South Korean authorities. If errors exist in the records that you need to report, then you must correct the errors and reprocess the supplier and customer records to generate the Tax Invoice Summary by Customer and the Tax Invoice Summary by Supplier reports.

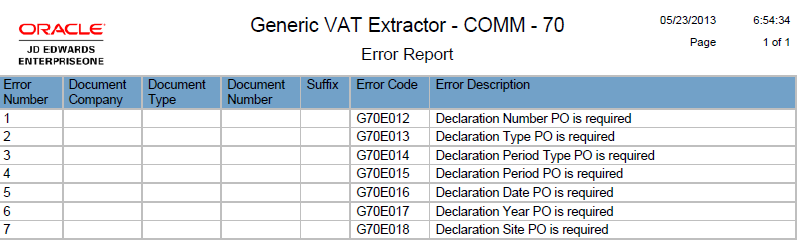

This image shows an example of the Error List report:

The Error List report includes an error ID and brief description of the error. The system writes a more detailed description of errors that occurred to the Work Center. You must fix the errors and generate the VAT reports if you receive error messages.