Understanding the Deferred VAT Process

The system enables companies to defer paying VAT until they are able to do so. When you enter a voucher, the system calculates and displays VAT payable and accounts for the VAT in an interim account. After you make a payment for this voucher, the system transfers the VAT from the interim account to a definitive account and generates the appropriate accounting G/L transactions.

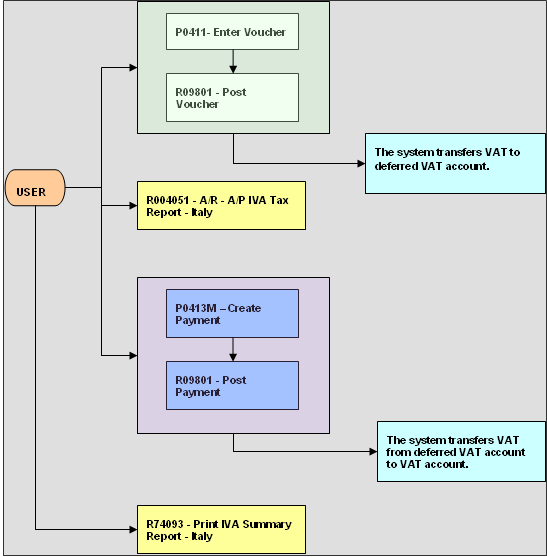

This diagram illustrates the deferred VAT process for Italy:

When you enter a voucher, the system creates a record in the Accounts Payable Ledger (F0411) and Accounts Ledger (F0911) tables. When you create a payment, the system creates records in the following tables:

Accounts Payable-Matching Document (F0413)

Accounts Payable-Matching Document Detail (F0414)

Accounts Ledger (F0911)

Taxes (F0018)

Suspended IVA Generation (F743B141)

The system updates the Suspended IVA Generation - Receipt/Rebate Control table (F743B14I) with AP information after successfully completing the G/L transaction.

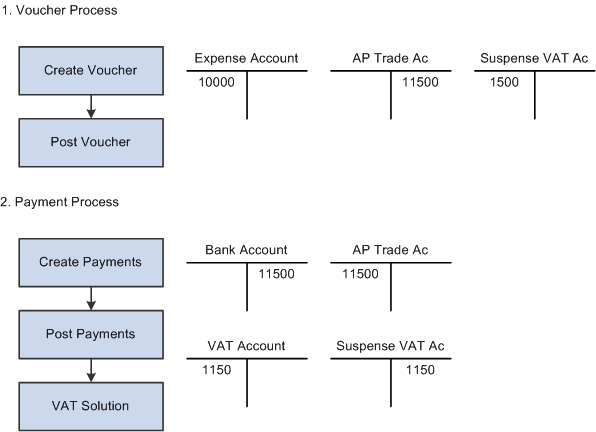

This diagram illustrates the effect of the Italy VAT process for vouchers on the general ledger: